Nippon Steel's U.S. Acquisition: Trump Administration's Decision And Its Implications

Table of Contents

The Trump Administration's Stance on Foreign Acquisitions

National Security Concerns

The Committee on Foreign Investment in the United States (CFIUS) plays a crucial role in reviewing foreign investments for potential threats to national security. The CFIUS review process involves a rigorous assessment of various factors, aiming to prevent acquisitions that could compromise U.S. interests. In the case of Nippon Steel's attempted acquisitions, national security concerns were central to the Trump administration's deliberations.

- Critical Infrastructure: Concerns existed that foreign control of key steel production facilities could compromise the supply chain for critical infrastructure projects.

- Technology Transfer: The potential for advanced steelmaking technologies to be transferred to a foreign entity raised concerns about maintaining a technological edge.

- Job Displacement: The administration considered the potential for job losses in the U.S. steel industry if domestic companies were acquired by foreign entities. Specific examples might include concerns about the loss of skilled labor and potential negative impacts on local communities.

These national security risks, amplified by the "America First" policy, heavily influenced the CFIUS review and the ultimate decisions regarding Nippon Steel's bids. The steel industry, being a strategically vital sector, was subject to especially careful scrutiny regarding foreign investment.

"America First" Policy and its Influence

The Trump administration's "America First" policy significantly impacted its approach to foreign acquisitions. This protectionist trade policy prioritized domestic industries and aimed to curb foreign influence in key sectors of the U.S. economy.

- Political Motivations: The administration sought to demonstrate its commitment to protecting American jobs and bolstering domestic industries. This was a key element of its appeal to its base.

- Economic Motivations: The policy aimed to reduce reliance on foreign suppliers and strengthen the U.S.'s economic independence. This included prioritizing domestic steel production and reducing trade deficits.

This protectionist stance led to a more stringent review process for foreign acquisitions, particularly in strategically sensitive sectors such as steel, reflecting the administration's economic nationalism.

Nippon Steel's Acquisition Attempts and CFIUS Scrutiny

Specific Acquisition Targets

Nippon Steel's acquisition attempts targeted several U.S. steel companies. While specific names are not publicly available in all cases due to the confidential nature of CFIUS reviews, the acquisitions likely focused on companies with significant market share or access to specialized technologies.

- Target Company Size and Significance: The acquisitions aimed for companies with significant production capacity and market share within specific steel product segments, enabling Nippon Steel to expand its global reach and potentially influence pricing within the US market. These acquisitions were of vital importance to the overall growth strategy of Nippon Steel.

Further details about the specific targets remain largely undisclosed due to the confidential nature of the CFIUS review process.

The CFIUS Review Process and its Outcome

The CFIUS review process for each of Nippon Steel's acquisition attempts was extensive. Both Nippon Steel and those opposing the acquisitions presented their arguments, highlighting the economic benefits versus the potential national security risks.

- Arguments Presented: Nippon Steel likely emphasized economic benefits such as increased investment and modernization of U.S. steel plants. Opponents likely highlighted concerns about job losses, potential technology transfer, and the overall impact on the competitiveness of the U.S. steel industry.

The Trump administration's decisions, in several instances, blocked or significantly delayed Nippon Steel's acquisition attempts, prioritizing national security concerns and the goals of the "America First" policy over purely economic considerations. This resulted in a series of acquisition denials or significant regulatory hurdles.

Implications of the Trump Administration's Decisions

Impact on the U.S. Steel Industry

The Trump administration's decisions had a multifaceted impact on the U.S. steel industry.

- Market Competition: The decisions to block acquisitions may have prevented a significant shift in market power, potentially preserving some level of domestic competition within certain steel product segments.

- Domestic Production: By prioritizing domestic steel production, the administration aimed to enhance national security and strengthen the domestic steel industry. The long-term success of this objective remains a subject of ongoing debate.

- Job Security and Steel Prices: While aiming to safeguard jobs, the impact on long-term job security and the impact on steel prices for US consumers remain complex and require further analysis.

The long-term effects on the competitiveness and consolidation of the U.S. steel industry are still unfolding and require further study.

Geopolitical Ramifications

The Trump administration's decisions had broader geopolitical implications.

- US-Japan Relations: The decisions created some tension in the U.S.-Japan relationship, highlighting the complexities of balancing economic cooperation with national security concerns.

- Global Steel Market: The actions influenced the global steel market dynamics, potentially affecting trade negotiations and the competitive landscape within the international steel industry. The impact on broader trade agreements remains a subject of ongoing scrutiny and evaluation.

Conclusion: Understanding Nippon Steel's U.S. Acquisition Attempts and the Trump Administration's Legacy

The Trump administration's approach to Nippon Steel's U.S. acquisition attempts showcases the delicate balance between economic considerations and national security in the context of foreign investment. The emphasis on the "America First" policy resulted in a more protectionist approach, leading to significant scrutiny of foreign acquisitions in strategically vital sectors like steel. The long-term effects on the U.S. steel industry, U.S.-Japan relations, and the global steel market require further analysis and evaluation. To gain a deeper understanding of this complex issue, we encourage you to explore CFIUS reports and relevant government websites to better comprehend the intricacies of national security reviews and foreign investment policies. Understanding the impact of Nippon Steel's U.S. acquisition attempts and similar cases remains crucial to shaping the future of the U.S. steel industry and foreign investment policy.

Featured Posts

-

Traffic Alert M62 Westbound Closure For Resurfacing Manchester To Warrington

May 25, 2025

Traffic Alert M62 Westbound Closure For Resurfacing Manchester To Warrington

May 25, 2025 -

Giant Rubber Duck Arrives In Myrtle Beach Promoting Water Safety

May 25, 2025

Giant Rubber Duck Arrives In Myrtle Beach Promoting Water Safety

May 25, 2025 -

Nemecky Pracovny Trh V Krize Rozsiahle Prepustanie V Najvaecsich Firmach

May 25, 2025

Nemecky Pracovny Trh V Krize Rozsiahle Prepustanie V Najvaecsich Firmach

May 25, 2025 -

Apple Stock Aapl Key Price Levels To Watch

May 25, 2025

Apple Stock Aapl Key Price Levels To Watch

May 25, 2025 -

Canada Post Struggles Fuel Alternative Delivery Service Growth

May 25, 2025

Canada Post Struggles Fuel Alternative Delivery Service Growth

May 25, 2025

Latest Posts

-

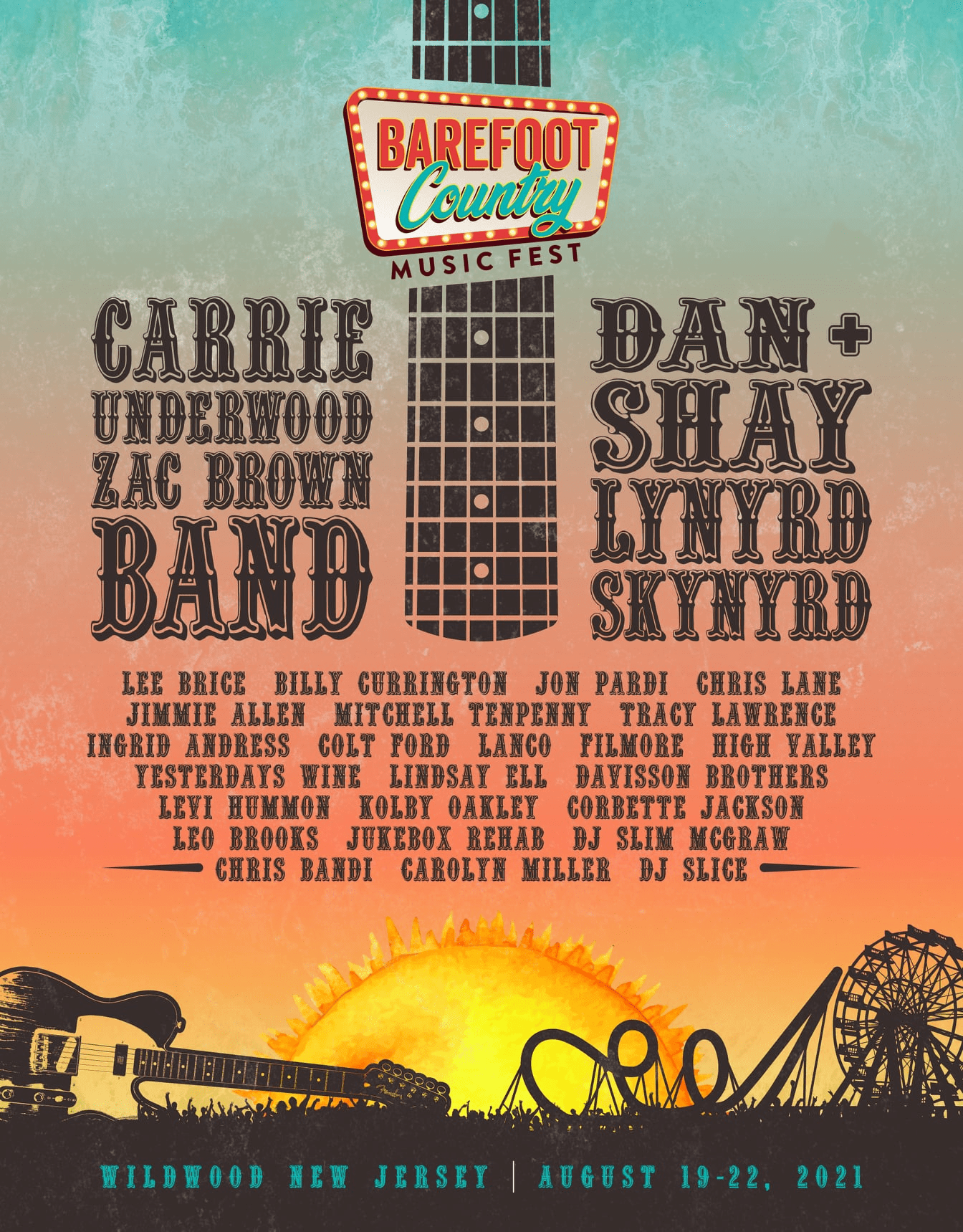

Ccmf 2025 Sold Out What To Expect Next Year

May 25, 2025

Ccmf 2025 Sold Out What To Expect Next Year

May 25, 2025 -

Southern Vacation Hotspots Safety Record Questioned After Shooting Incident

May 25, 2025

Southern Vacation Hotspots Safety Record Questioned After Shooting Incident

May 25, 2025 -

Kazni Za Mertsedes Vo Bakhrein Pred Pochetokot Na Trkata

May 25, 2025

Kazni Za Mertsedes Vo Bakhrein Pred Pochetokot Na Trkata

May 25, 2025 -

Tickets For Carolina Country Music Fest 2025 Sold Out

May 25, 2025

Tickets For Carolina Country Music Fest 2025 Sold Out

May 25, 2025 -

Recent Shooting Sparks Safety Debate At Beloved Southern Vacation Location

May 25, 2025

Recent Shooting Sparks Safety Debate At Beloved Southern Vacation Location

May 25, 2025