Market Analysis: 8% Stock Increase On Euronext Amsterdam After Trump's Tariff Decision

Table of Contents

Understanding the Trump Tariff Decision and its Global Impact

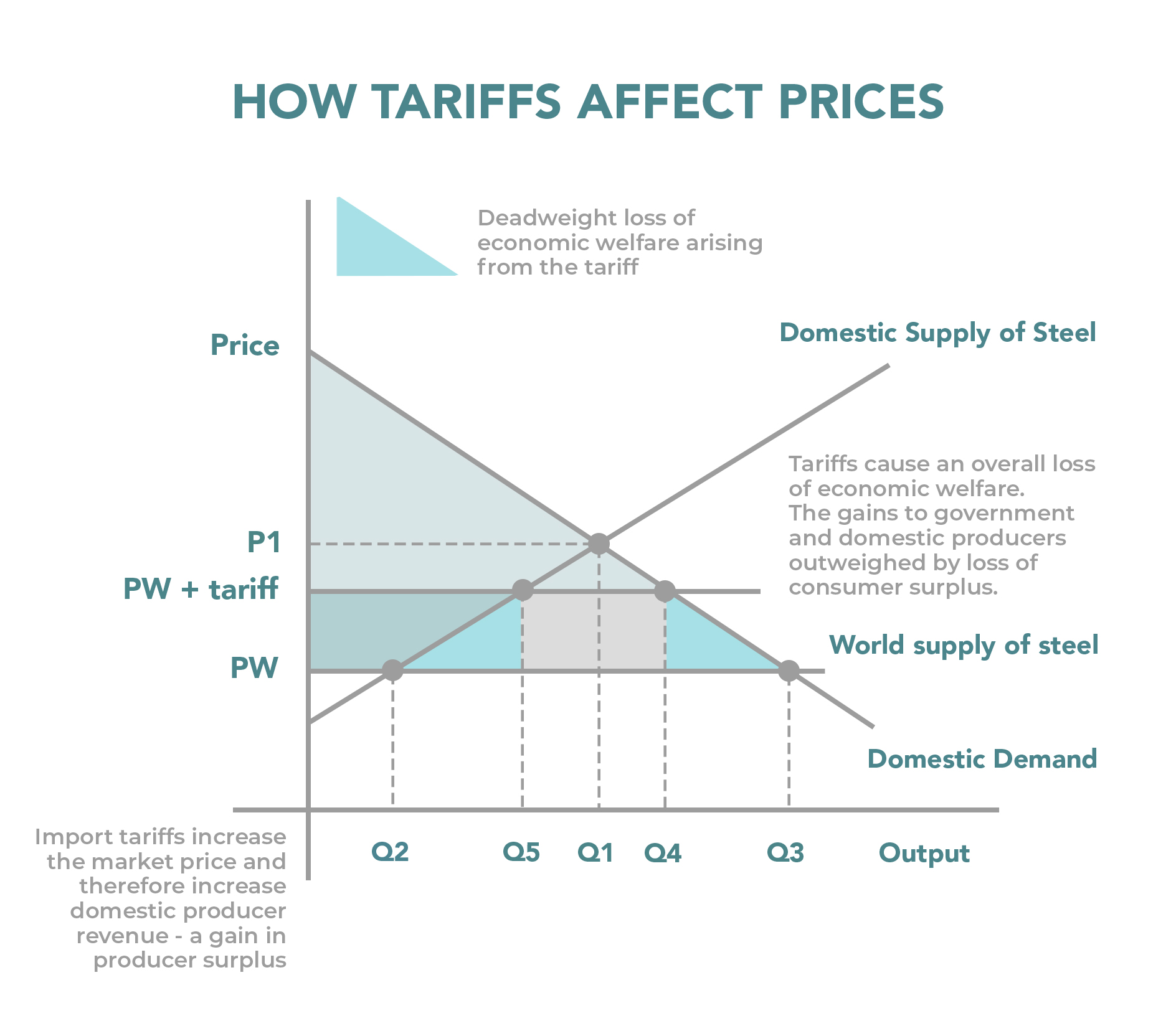

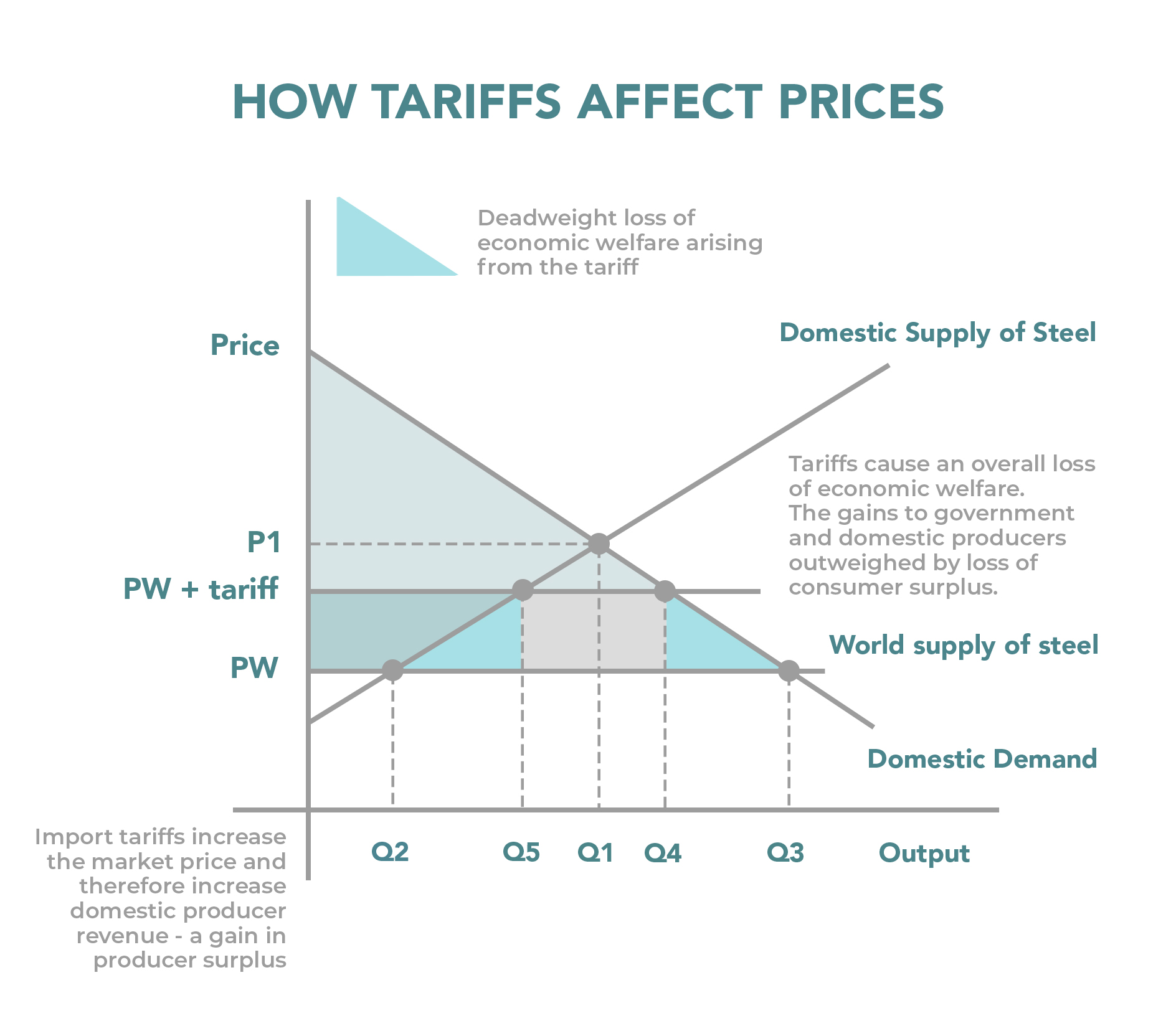

Donald Trump's administration implemented a series of tariffs, primarily targeting specific goods from certain countries. While the exact details varied, the core aim was to protect American industries and potentially renegotiate trade agreements. The initial global market reactions were mixed, with some sectors experiencing declines while others saw unexpected gains. The potential consequences of this decision were far-reaching, encompassing both short-term volatility and longer-term structural shifts in global trade patterns.

- Specific details of the tariff: The tariffs varied widely, affecting goods ranging from steel and aluminum to specific agricultural products. Countries such as China and the European Union were significantly impacted.

- Short-term vs. long-term market impacts: Short-term, markets experienced increased uncertainty and volatility. Long-term, the tariffs potentially led to higher prices for consumers, disruptions to supply chains, and retaliatory measures from affected countries.

- Expert opinions on the decision's global implications: Many economists warned of potential negative consequences, including trade wars and global economic slowdown. Others argued that the tariffs could protect certain domestic industries.

Euronext Amsterdam's Unique Sensitivity to the Tariff Decision

The 8% increase on Euronext Amsterdam was disproportionately large compared to other European stock exchanges. This unique sensitivity stemmed from the specific composition of companies listed on the exchange and their exposure to the global trade dynamics affected by Trump's tariffs. Certain sectors within Euronext Amsterdam benefited significantly, while others remained largely unaffected.

- Specific examples of companies with significant stock increases: [Insert examples of companies and sectors that saw significant gains, citing sources where possible]. This could include companies involved in sectors less directly affected by the tariffs, or those who benefitted from increased demand due to shifting trade patterns.

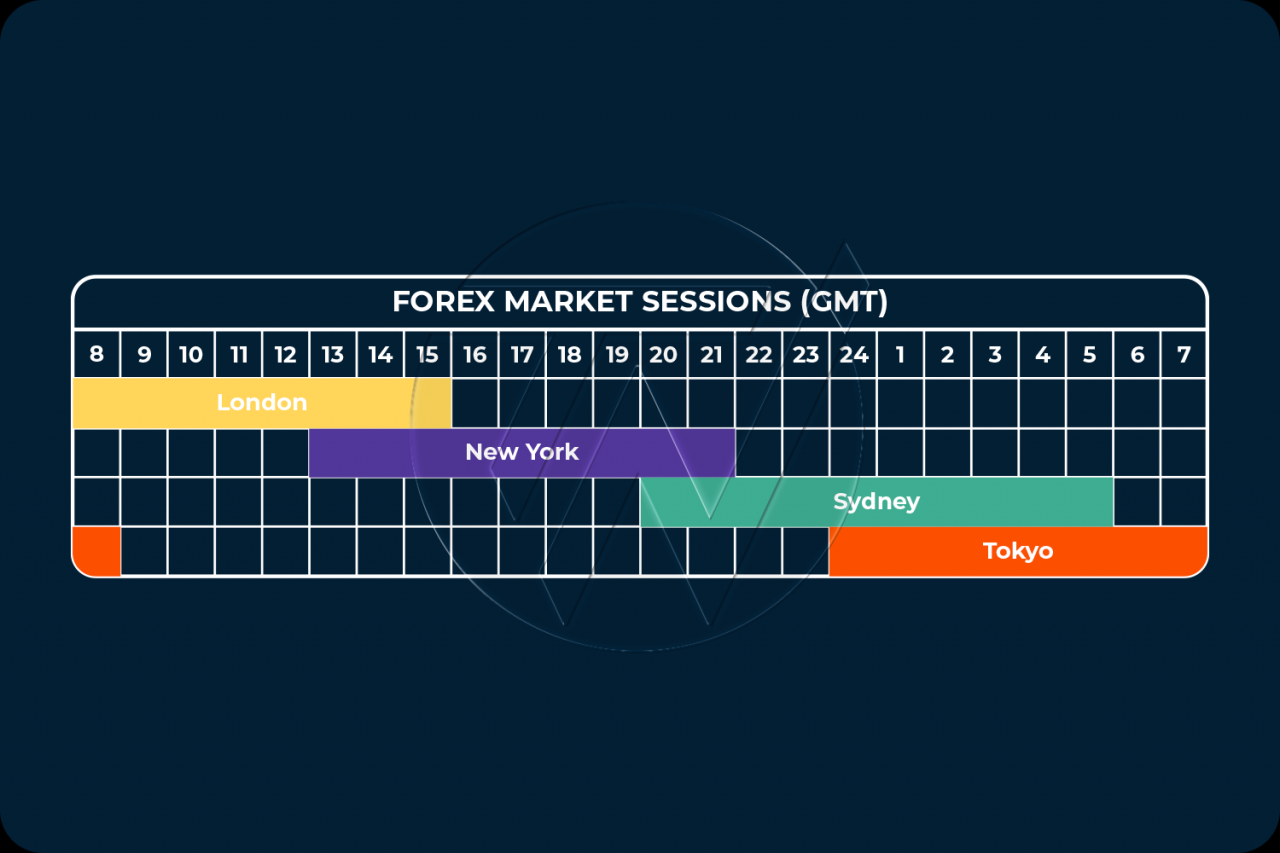

- Analysis of trading volume on Euronext Amsterdam during the period: The increased trading volume during this period highlighted the heightened market activity and investor response to the tariff decision. [Include data on trading volume if available].

- Comparison to other European stock exchanges' reactions: Comparing the performance of Euronext Amsterdam to other major European exchanges such as the London Stock Exchange or the Frankfurt Stock Exchange provides valuable context and highlights the unique impact on the Amsterdam market.

Market Analysis: Factors Contributing to the 8% Stock Increase

While Trump's tariff decision played a significant role, other factors contributed to the 8% stock increase on Euronext Amsterdam. These include investor sentiment, speculation, and broader macroeconomic conditions. Understanding the interplay of these factors provides a more nuanced view of the market reaction.

- Analysis of investor behavior (buying/selling patterns): [Discuss observed buying and selling patterns, including data on investor sentiment indices, if available]. Did investors anticipate long-term benefits, or were they reacting to short-term opportunities?

- Impact of other news and events on Euronext Amsterdam: Were there other concurrent news events or announcements that influenced investor behavior on Euronext Amsterdam during this period?

- Discussion of potential short-term and long-term market volatility: The impact of Trump's tariffs, and the subsequent market reaction, created a potential for increased market volatility. Both short-term fluctuations and long-term uncertainty were likely consequences.

Long-Term Implications and Future Market Predictions for Euronext Amsterdam

The long-term implications of Trump's tariff decision on Euronext Amsterdam remain uncertain. However, by analyzing current trends and potential future developments, we can formulate some predictions.

- Predictions for specific sectors within Euronext Amsterdam: [Offer predictions for specific sectors based on your analysis, considering their exposure to global trade and other relevant factors].

- Potential for future volatility in response to further policy changes: Future policy shifts in global trade could significantly impact Euronext Amsterdam. The market's sensitivity to such changes should be considered.

- Advice for investors regarding Euronext Amsterdam: [Offer advice to investors, such as diversification strategies or recommendations for monitoring specific market indicators].

Conclusion: Euronext Amsterdam Stock Market: A Case Study in Tariff Impact

The 8% stock increase on Euronext Amsterdam following Trump's tariff decision serves as a compelling case study illustrating the complex interplay between global trade policies and stock market performance. While the tariffs were a significant catalyst, other factors such as investor sentiment and broader macroeconomic conditions played crucial roles. Understanding these nuances is essential for navigating the complexities of the Euronext Amsterdam market and making informed investment decisions. To stay informed about the Euronext Amsterdam market and gain a deeper understanding of the impact of global trade policies on stock performance, subscribe to our market analysis updates or conduct further research on the topic. Continue monitoring the Euronext Amsterdam stock market and related global trade news for comprehensive insights.

Featured Posts

-

Lady Gaga And Fiance Make Stylish Entrance At Snl Afterparty

May 24, 2025

Lady Gaga And Fiance Make Stylish Entrance At Snl Afterparty

May 24, 2025 -

Shareholders Unanimously Approve All Resolutions At Imcd N V Agm

May 24, 2025

Shareholders Unanimously Approve All Resolutions At Imcd N V Agm

May 24, 2025 -

French Pms Policies Under Scrutiny Former Pm Speaks Out

May 24, 2025

French Pms Policies Under Scrutiny Former Pm Speaks Out

May 24, 2025 -

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 24, 2025

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 24, 2025 -

Esc 2025 Eurovision Village Concert Featuring Conchita Wurst And Jj

May 24, 2025

Esc 2025 Eurovision Village Concert Featuring Conchita Wurst And Jj

May 24, 2025

Latest Posts

-

The Nfls Tush Push Lives On The End Of The Butt Ban

May 24, 2025

The Nfls Tush Push Lives On The End Of The Butt Ban

May 24, 2025 -

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

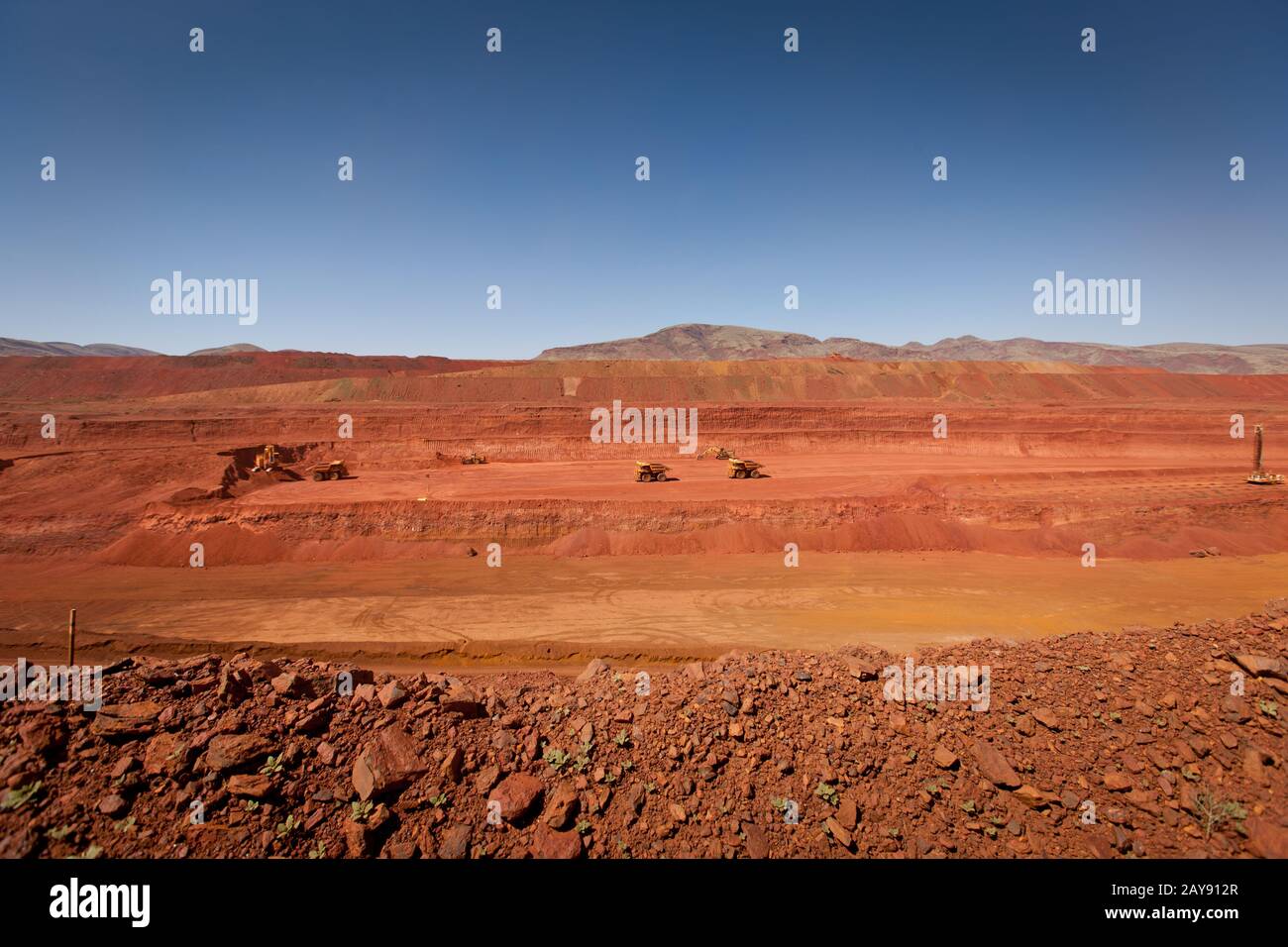

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025