Market Reaction: House Tax Bill Passage Affects Bonds, Stocks, And Bitcoin

Table of Contents

Impact on the Stock Market

The stock market's response to the House tax bill was multifaceted, with varying reactions across different sectors. Analyzing this market reaction requires a nuanced approach, considering both overall market volatility and sector-specific performances.

Sector-Specific Reactions

Different sectors reacted uniquely to the tax bill's passage, reflecting the varied implications of the legislation for specific industries.

-

Technology Stocks: Many tech companies, often with high profits and significant capital expenditures, saw a surge in their stock prices. This was largely attributed to the anticipated benefits of lower corporate tax rates. For example, the stock price of [Example Tech Company A] increased by X% in the days following the bill's passage.

-

Energy Stocks: Conversely, energy stocks experienced a more muted response, with some even experiencing a slight dip. This could be linked to potential changes in tax incentives for the energy sector, or broader market concerns unrelated to the bill itself. [Example Energy Company B]'s stock price, for instance, showed a Y% decrease.

-

Financial Stocks: Financial institutions demonstrated a mixed reaction, with some benefiting from the anticipated economic growth while others faced potential regulatory changes.

Reasons for Sector-Specific Variations: The differing responses highlight how specific tax implications affect various industries. Tax breaks for capital expenditures favored technology companies, while changes in energy subsidies influenced the energy sector's performance. Understanding these sector-specific nuances is key to interpreting the overall market reaction.

Overall Market Volatility

Following the bill's passage, market volatility increased significantly. Indices like the S&P 500 and the Dow Jones Industrial Average experienced notable fluctuations.

-

Increased Trading Volume: Trading volumes surged in the days following the vote, indicating heightened investor activity and uncertainty.

-

VIX Index Changes: The VIX volatility index, a measure of market fear, spiked, reflecting increased investor anxiety about the potential economic consequences of the tax bill.

-

Investor Sentiment: Investor sentiment shifted considerably, with increased uncertainty and speculation driving price swings.

Effect on the Bond Market

The House tax bill's impact on the bond market was primarily felt through changes in interest rates and subsequent bond price fluctuations.

Interest Rate Changes

The tax bill's potential to stimulate economic growth led to expectations of higher inflation and consequently, rising interest rates.

-

Relationship between Tax Policy and Bond Yields: Lower corporate taxes generally lead to increased corporate borrowing, which increases demand for loanable funds. This increased demand often translates to higher interest rates.

-

Examples of Specific Bond Yield Movements: [Example: Yields on 10-year Treasury bonds increased by Z% in the week following the bill's passage.] This reflects investor anticipation of future rate hikes.

Bond Price Fluctuations

Rising interest rates generally cause bond prices to fall, as existing bonds with lower yields become less attractive compared to newly issued bonds offering higher returns.

-

Different Bond Types: Government bonds and corporate bonds reacted differently, with the sensitivity varying depending on the bond's maturity and credit rating.

-

Data Points Demonstrating Changes in Bond Prices: [Example: The price of a specific corporate bond declined by A% after the bill's passage, reflecting the impact of rising interest rates.]

Bitcoin's Response to the House Tax Bill

Bitcoin's reaction to the House tax bill was complex, influenced by its inherent volatility and unrelated market factors.

Bitcoin Price Volatility

Bitcoin's price exhibited its typical volatility, making it difficult to directly link any specific price movements solely to the tax bill's passage.

-

Correlation (or lack thereof): While some correlation might exist between broader market uncertainty and Bitcoin's price, establishing a direct causal relationship between the tax bill and Bitcoin’s price movements is challenging.

-

Charts or graphs illustrating Bitcoin price fluctuations: [Include a relevant chart showcasing Bitcoin's price behavior around the time of the bill's passage.]

Regulatory Uncertainty

The tax bill’s passage didn't directly address cryptocurrency regulation, but it introduced some uncertainty about potential future legislation.

-

Influence on Investor Sentiment: This regulatory uncertainty might have contributed to shifts in investor sentiment, affecting Bitcoin's value.

-

Potential Future Tax Implications: The lack of clear tax guidelines for cryptocurrencies remains a concern for investors, creating potential future volatility.

Safe-Haven Asset Status

Bitcoin's role as a safe-haven asset during periods of market uncertainty is debated. The tax bill's passage did not definitively establish or refute this status.

- Factors contributing to (or detracting from) safe-haven status: Bitcoin's volatility hinders its acceptance as a true safe-haven asset, as investors often seek stability during uncertain times.

Conclusion

The passage of the House tax bill has had a multifaceted impact on the financial markets. We've observed varied reactions in the stock market, with sector-specific responses, and fluctuations in the bond market due to interest rate changes. Bitcoin's response was complex, influenced by its inherent volatility and potential regulatory implications. Staying informed about the ongoing market reaction to the House tax bill is critical for making sound investment decisions. Continue monitoring the effects on bonds, stocks, and Bitcoin to effectively manage your portfolio in this dynamic environment. Learn more about how to navigate these market changes by [link to relevant resource/article].

Featured Posts

-

Demna At Gucci Analyzing The Creative Direction Change

May 24, 2025

Demna At Gucci Analyzing The Creative Direction Change

May 24, 2025 -

Would Damien Darhk Defeat Superman Neal Mc Donoughs Exclusive Answer

May 24, 2025

Would Damien Darhk Defeat Superman Neal Mc Donoughs Exclusive Answer

May 24, 2025 -

Euronext Amsterdam Stock Market Reaction 8 Increase After Trumps Tariff Pause

May 24, 2025

Euronext Amsterdam Stock Market Reaction 8 Increase After Trumps Tariff Pause

May 24, 2025 -

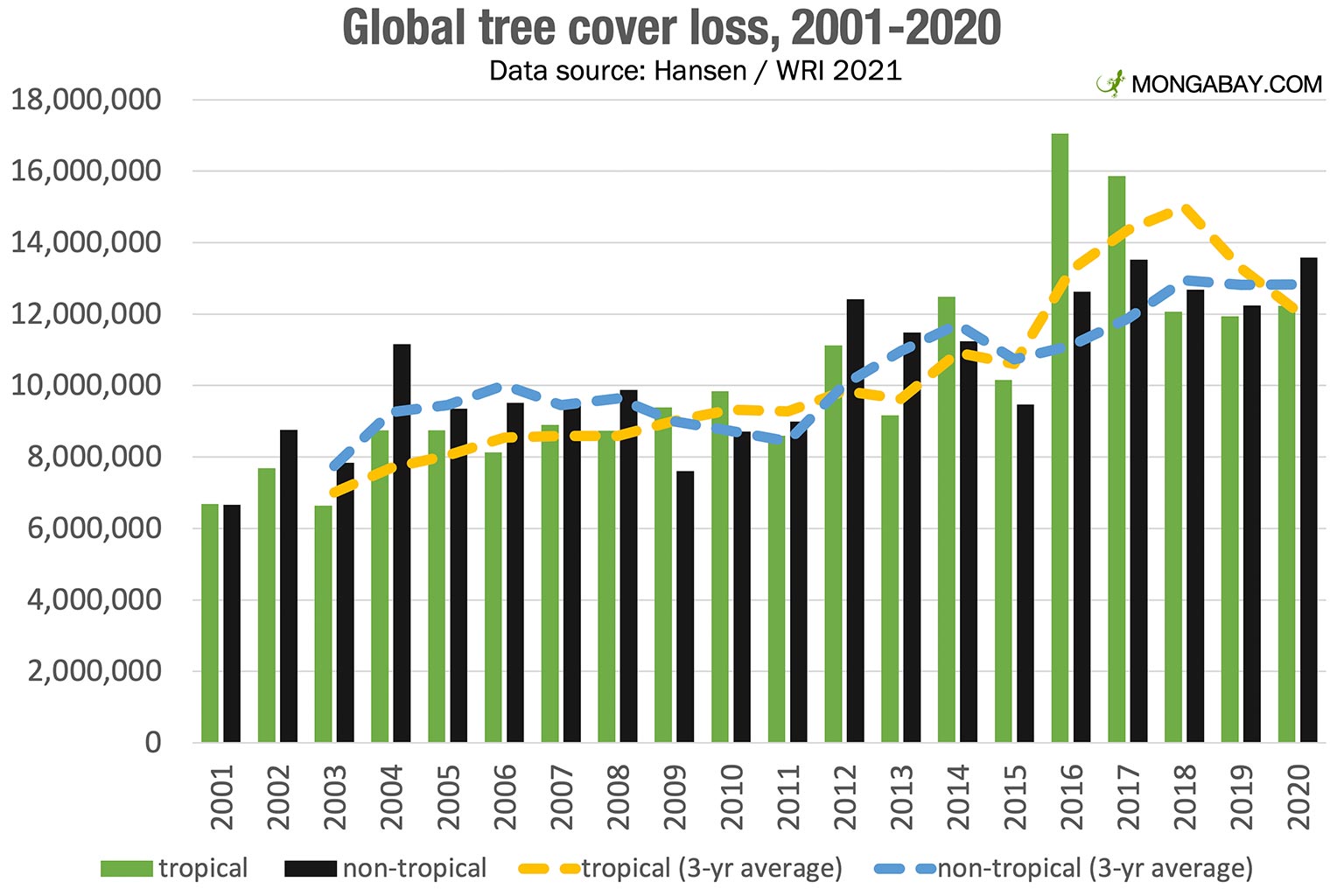

Wildfires Drive Unprecedented Global Forest Loss A Critical Analysis

May 24, 2025

Wildfires Drive Unprecedented Global Forest Loss A Critical Analysis

May 24, 2025 -

Billie Jean King Cup Kazakhstans Unexpected Win Over Australia

May 24, 2025

Billie Jean King Cup Kazakhstans Unexpected Win Over Australia

May 24, 2025

Latest Posts

-

Sylvester Stallones Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025

Sylvester Stallones Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025 -

The Last Rodeo Highlighting Neal Mc Donoughs Acting

May 24, 2025

The Last Rodeo Highlighting Neal Mc Donoughs Acting

May 24, 2025 -

Experience Free Films And Meet Stars At The Dallas Usa Film Festival

May 24, 2025

Experience Free Films And Meet Stars At The Dallas Usa Film Festival

May 24, 2025 -

Free Movie Screenings And Celebrity Appearances At The Usa Film Festival In Dallas

May 24, 2025

Free Movie Screenings And Celebrity Appearances At The Usa Film Festival In Dallas

May 24, 2025 -

The Last Rodeo Neal Mc Donoughs Leading Man Performance

May 24, 2025

The Last Rodeo Neal Mc Donoughs Leading Man Performance

May 24, 2025