Market Turmoil? ETF Investments Reach New Highs

Table of Contents

Why are ETF Investments Flourishing During Market Uncertainty?

The increase in ETF investments during periods of economic uncertainty isn't coincidental; it's a direct result of the inherent advantages ETFs offer. They provide solutions to several key investor concerns, making them an attractive option for both seasoned and novice investors.

Diversification and Risk Management

ETFs offer built-in diversification, spreading investments across multiple assets and sectors. This inherent diversification significantly reduces the impact of any single stock or sector underperforming. This is a crucial advantage during market downturns.

- Reduced portfolio volatility: Compared to individual stock investments, ETFs generally exhibit lower volatility, providing a smoother investment ride.

- Diverse asset class access: A single ETF can provide exposure to diverse asset classes, including stocks, bonds, commodities, and even real estate, within a single investment. This allows for strategic diversification across various market segments.

- Easy access to international markets: Globally diversified ETFs offer easy access to international markets, further mitigating risk and potentially enhancing returns. This is particularly valuable in a globalized economy.

Liquidity and Accessibility

ETFs trade like stocks on major exchanges, offering investors easy buying and selling options throughout the trading day. This liquidity is especially attractive during periods of market volatility when quick adjustments to portfolios are necessary. This ease of access is a significant contributor to their rising popularity.

- Transparent pricing: ETF prices are transparent and readily available throughout the trading day, allowing investors to make informed decisions based on real-time market data.

- Low transaction costs: Compared to actively managed mutual funds, ETFs typically have lower transaction costs, making them more cost-effective for frequent trading or portfolio adjustments.

- Easy access through brokerage accounts: ETFs are readily accessible through most brokerage accounts, simplifying the investment process and eliminating unnecessary complexities.

Cost-Effectiveness

Many ETFs have low expense ratios, making them a cost-effective way to gain broad market exposure. This is a significant advantage, particularly for long-term investors who benefit from compounding returns over time. The lower cost structure translates directly to higher potential returns.

- Lower fees: Compared to actively managed funds with higher management fees, ETFs generally boast lower expense ratios.

- Higher return potential: Lower expense ratios mean a larger portion of investment returns stays with the investor, leading to potentially higher overall returns.

- Suitable for various portfolio sizes: ETFs are suitable for both small and large investment portfolios, making them accessible to a wide range of investors.

Types of ETFs Thriving in Market Volatility

Certain types of ETFs tend to perform better during market downturns, making them particularly attractive during periods of uncertainty. These are often referred to as “safe haven” investments.

Defensive ETFs

Investors are flocking to ETFs focused on defensive sectors like consumer staples, utilities, and healthcare, which tend to exhibit relative stability even during economic downturns. These sectors often provide steady dividends and less sensitivity to market fluctuations.

- Examples: Consumer Staples Select Sector SPDR Fund (XLP), Utilities Select Sector SPDR Fund (XLU), and various healthcare ETFs.

- Stable dividends and lower volatility: These sectors are known for offering relatively stable dividends and exhibiting lower volatility compared to more cyclical sectors.

Bond ETFs

With rising interest rates, investors are looking towards bond ETFs to provide income and stability in their portfolios. Bond ETFs offer a different type of diversification, complementing equity investments.

- Examples: iShares Core U.S. Aggregate Bond ETF (AGG), Vanguard Total Bond Market ETF (BND).

- Diversification and income generation: Bond ETFs provide diversification away from equities and generate income through interest payments, providing a potential hedge against inflation (depending on the bond type).

Gold ETFs

Gold is often considered a safe haven asset during periods of uncertainty, leading to increased investment in gold ETFs. Gold's perceived value as a store of wealth during economic instability makes it an attractive addition to a diversified portfolio.

- Example: SPDR Gold Shares (GLD).

- Portfolio hedge: Gold ETFs act as a portfolio hedge during times of economic or geopolitical instability, potentially mitigating losses in other asset classes.

Potential Risks and Considerations for ETF Investments

While ETFs offer numerous benefits, investors should be aware of potential risks:

- Market risk: Like all investments, ETFs are subject to market risk, meaning their value can fluctuate.

- Sector-specific risks: If an ETF is not sufficiently diversified, it may be heavily impacted by underperformance within a specific sector.

- Tracking error: There's a risk that an ETF's performance may not perfectly match the underlying index it tracks.

Proper due diligence and a thorough understanding of your risk tolerance are crucial before investing in any ETF. Consulting with a financial advisor can help you determine the best investment strategy for your individual needs and risk profile.

Conclusion

The surge in ETF investments, even amidst market turmoil, underscores their growing importance as a versatile and accessible investment tool. Their inherent diversification, liquidity, and cost-effectiveness make them attractive options for navigating uncertain economic landscapes. While understanding the potential risks is vital, the benefits of ETF investments for a well-diversified portfolio are undeniable. Start exploring the world of ETF investments today and find the right ETFs to fit your investment strategy. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions. Don't miss the opportunity to benefit from the increasing popularity of ETF investments.

Featured Posts

-

Reports Claim Kanye West Controls Bianca Censoris Daily Life

May 28, 2025

Reports Claim Kanye West Controls Bianca Censoris Daily Life

May 28, 2025 -

Arraez Carted Off After Collision Dubon Involved In Mlb Incident

May 28, 2025

Arraez Carted Off After Collision Dubon Involved In Mlb Incident

May 28, 2025 -

Ana Peleteiro Y 12 Atletas Mas Rumbo Al Mundial De Atletismo En Pista Cubierta De Nanjing

May 28, 2025

Ana Peleteiro Y 12 Atletas Mas Rumbo Al Mundial De Atletismo En Pista Cubierta De Nanjing

May 28, 2025 -

Swiatek And Alcaraz Win Opening Matches At Roland Garros

May 28, 2025

Swiatek And Alcaraz Win Opening Matches At Roland Garros

May 28, 2025 -

Amas Nominations Highlight K Pops Global Rise Rose Rm Jimin Ateez And Stray Kids Lead The Charge

May 28, 2025

Amas Nominations Highlight K Pops Global Rise Rose Rm Jimin Ateez And Stray Kids Lead The Charge

May 28, 2025

Latest Posts

-

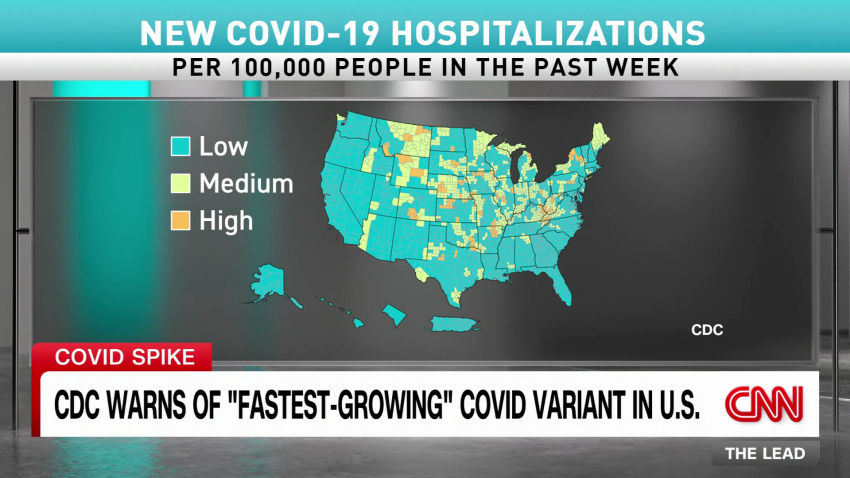

New Covid 19 Wave Concerns Rise In Asia Indias Preparedness

May 31, 2025

New Covid 19 Wave Concerns Rise In Asia Indias Preparedness

May 31, 2025 -

The New Covid Variant Lp 8 1 Key Facts And Concerns

May 31, 2025

The New Covid Variant Lp 8 1 Key Facts And Concerns

May 31, 2025 -

New Covid 19 Variants Ba 1 And Lf 7 In India Insacog Data And Risk Assessment

May 31, 2025

New Covid 19 Variants Ba 1 And Lf 7 In India Insacog Data And Risk Assessment

May 31, 2025 -

Covid 19 Outbreak Hong Kong Singapore Surge Is India Next

May 31, 2025

Covid 19 Outbreak Hong Kong Singapore Surge Is India Next

May 31, 2025 -

Covid 19 Variant Lp 8 1 Information And Updates

May 31, 2025

Covid 19 Variant Lp 8 1 Information And Updates

May 31, 2025