MicroStrategy Stock Vs. Bitcoin: A 2025 Investment Comparison

Table of Contents

Understanding MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's Core Business

MicroStrategy is a publicly traded company primarily focused on business intelligence, analytics, and mobile software. They provide enterprise-grade software solutions for data analysis and visualization, serving a global clientele. However, in recent years, MicroStrategy's financial narrative has become inextricably linked to its massive Bitcoin holdings. This has significantly altered the company's risk profile and valuation, making it a unique investment proposition.

Bitcoin's Role in MicroStrategy's Strategy

MicroStrategy's bold strategy of accumulating a substantial amount of Bitcoin has made it a prominent player in the cryptocurrency space. This decision reflects a long-term investment thesis, viewing Bitcoin as a hedge against inflation and a store of value.

- Reasoning: MicroStrategy's management believes Bitcoin offers a superior inflation hedge compared to traditional assets like gold or government bonds.

- Reasoning: They see Bitcoin as a digital gold, anticipating future widespread adoption and price appreciation.

However, this strategy also introduces considerable risk:

- Risk: MicroStrategy's stock price is now heavily correlated with Bitcoin's price fluctuations, making it vulnerable to market downturns in the cryptocurrency sector.

- Risk: A significant drop in Bitcoin's price could severely impact MicroStrategy's financial performance and its stock valuation.

Analyzing MicroStrategy Stock Performance

MicroStrategy's stock performance has been closely tied to the performance of Bitcoin. While its software business contributes to its revenue and profitability, the market predominantly values it based on its Bitcoin holdings. Analyzing historical stock charts reveals a strong correlation between Bitcoin's price movements and MicroStrategy's stock price. This highlights the importance of understanding Bitcoin's price dynamics when assessing MicroStrategy's investment potential. External factors, such as broader market trends and regulatory changes affecting both the technology sector and the cryptocurrency market, also impact its performance.

Bitcoin's Potential and Risks in 2025

Bitcoin's Technological Foundation

Bitcoin operates on a decentralized, public blockchain, making it resistant to censorship and single points of failure. This technology underpins its value proposition as a secure, transparent, and immutable digital asset.

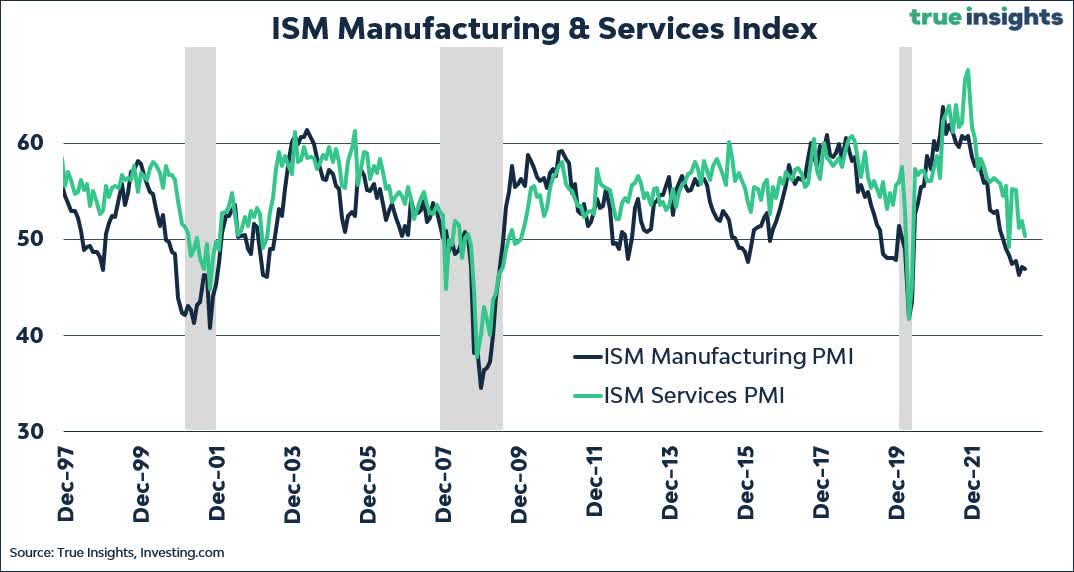

Bitcoin's Price Volatility

Bitcoin's price history is marked by extreme volatility. Factors influencing its price include:

- Regulatory Changes: Government regulations and policies regarding cryptocurrencies significantly impact market sentiment and price.

- Market Sentiment: News events, social media trends, and overall investor confidence greatly affect Bitcoin's price.

- Adoption Rate: Increased adoption by institutions, businesses, and individuals drives demand and potentially pushes the price higher.

Potential catalysts for price increases in 2025 include:

- Increased Institutional Adoption: Continued growth in institutional investment could significantly increase demand.

- Global Economic Uncertainty: Economic instability could drive investors towards Bitcoin as a safe haven asset.

Potential risks include:

- Regulatory Crackdown: Stricter government regulations could stifle growth and suppress the price.

- Technological Vulnerabilities: Although unlikely, undiscovered vulnerabilities in the Bitcoin network could pose a threat.

- Competition: The emergence of competing cryptocurrencies could potentially erode Bitcoin's market dominance.

Bitcoin's Long-Term Value Proposition

Predicting Bitcoin's price in 2025 is speculative. However, several scenarios are possible. Widespread adoption could lead to significant price appreciation, while regulatory hurdles or technological disruptions could lead to price declines. Macroeconomic factors, such as inflation and global economic conditions, will also play a crucial role.

Direct Comparison: MicroStrategy Stock vs. Bitcoin in 2025

Risk Tolerance

Investing in MicroStrategy stock inherently involves a higher degree of risk due to its dependence on Bitcoin's price. Bitcoin itself carries significant volatility, making it a high-risk, high-reward investment. The correlation between Bitcoin's price and MicroStrategy's stock price means that losses in one will likely translate into losses in the other.

Potential Returns

Both MicroStrategy stock and Bitcoin offer the potential for high returns, but this comes with substantial risk. The potential for significantly higher returns with Bitcoin is balanced against its greater volatility.

- Investment Horizons: A long-term investment horizon is generally recommended for both assets, given their volatility. Short-term speculation is highly risky.

Diversification Strategies

Both MicroStrategy stock and Bitcoin can be part of a diversified investment portfolio, but only as a small portion. Their high correlation and volatility dictate that they shouldn't constitute a significant percentage of one’s overall investments.

Conclusion: Making Informed Decisions on MicroStrategy Stock and Bitcoin Investments in 2025

Investing in either MicroStrategy stock or Bitcoin requires careful consideration of individual risk tolerance and investment goals. While both offer potential for substantial returns, they also carry substantial risk. The strong correlation between MicroStrategy's stock price and Bitcoin's price further underscores the importance of understanding the dynamics of the cryptocurrency market. Remember to conduct thorough research and consider consulting with a qualified financial advisor before making any investment decisions. Don't treat this article as financial advice; further research is crucial before making any 2025 investment in MicroStrategy Stock or Bitcoin. Explore reputable financial resources and stay updated on market trends to make informed choices about your investment strategy.

Featured Posts

-

Understanding The Scholar Rock Stock Drop On Monday

May 08, 2025

Understanding The Scholar Rock Stock Drop On Monday

May 08, 2025 -

Market Dislocation Fuels Brookfields Opportunistic Investment Approach

May 08, 2025

Market Dislocation Fuels Brookfields Opportunistic Investment Approach

May 08, 2025 -

Gear Up For Celtics Glory Find Your Perfect Fan Apparel At Fanatics

May 08, 2025

Gear Up For Celtics Glory Find Your Perfect Fan Apparel At Fanatics

May 08, 2025 -

Pogoda V Permi I Permskom Krae Ozhidaetsya Pokholodanie I Snegopady V Kontse Aprelya 2025

May 08, 2025

Pogoda V Permi I Permskom Krae Ozhidaetsya Pokholodanie I Snegopady V Kontse Aprelya 2025

May 08, 2025 -

Bitcoins Critical Juncture Understanding The Price Action And Potential Outcomes

May 08, 2025

Bitcoins Critical Juncture Understanding The Price Action And Potential Outcomes

May 08, 2025