Moody's Downgrade: Dow Futures And Dollar React – Live Updates

Table of Contents

Keywords: Moody's downgrade, Dow futures, dollar reaction, credit rating, market reaction, live updates, financial markets, US economy, stock market, investment, trading

The financial world is reeling from Moody's announcement of a credit rating downgrade for the United States. This unprecedented move has sent immediate shockwaves through global markets, triggering significant volatility in Dow futures and the US dollar. This article provides live updates and analysis of the unfolding situation, exploring the market reaction, Moody's rationale, and expert predictions.

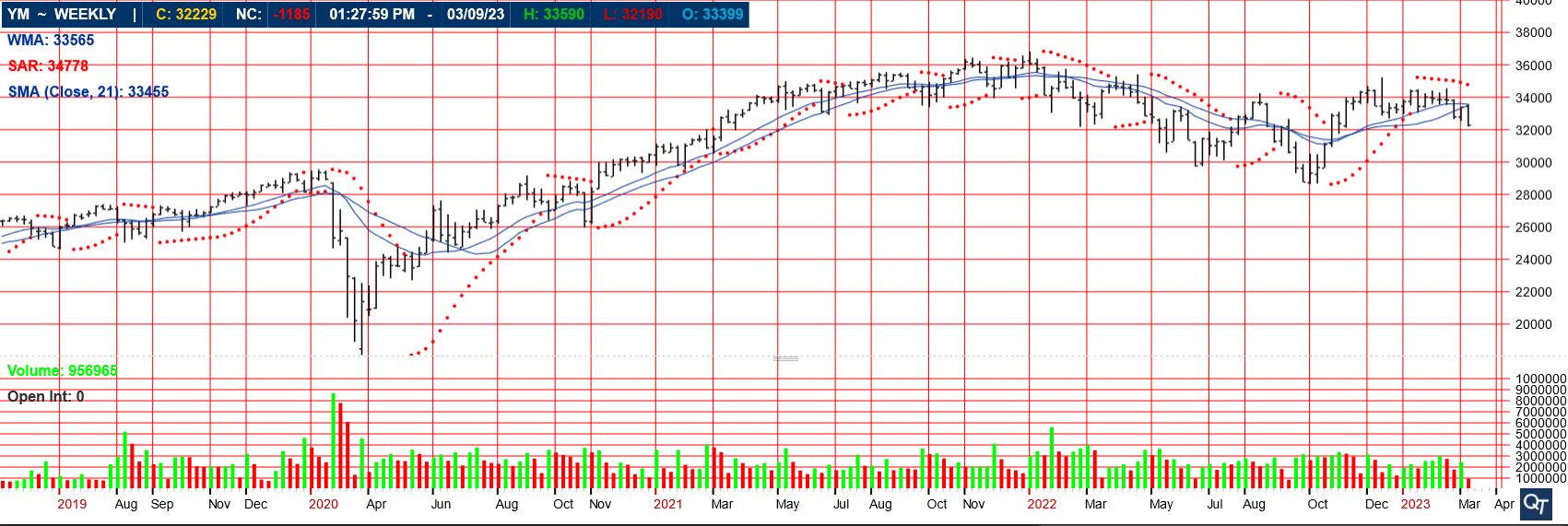

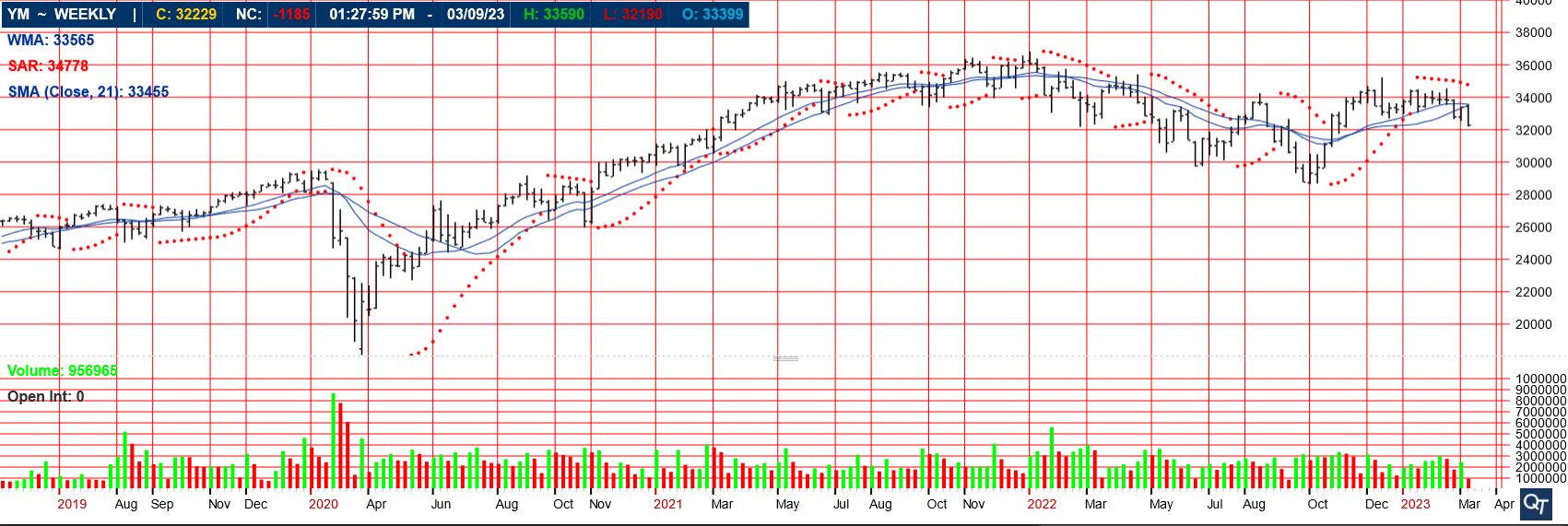

Immediate Market Reaction to Moody's Downgrade

The Moody's downgrade announcement triggered an immediate and dramatic market reaction. The impact is being felt across various asset classes, highlighting the gravity of this credit rating change.

Dow Futures Plunge

Following the news, Dow futures experienced a sharp decline. Preliminary data shows a drop of [Insert Percentage]% – a significant plunge reflecting investor concerns about the implications of the downgrade for the US economy. This represents a loss of [Insert Point Value] points.

- Pre-market trading activity: Trading volumes surged significantly in the pre-market hours, indicating heightened investor anxiety and frantic attempts to adjust portfolios.

- Impact on specific sectors: Sectors like financials and technology, typically sensitive to economic shifts, showed particularly pronounced declines.

- Analyst predictions: Early analyst predictions suggest further volatility in the short term, with the extent of the downturn depending on the market's response to potential government measures.

US Dollar Volatility

The impact on the US dollar is complex. While often considered a safe-haven asset during times of uncertainty, the Moody's downgrade has introduced a new layer of complexity. Initial reports indicate [Describe whether the dollar strengthened or weakened and by what percentage against major currencies like the Euro and Yen].

- Exchange rates against major currencies: The USD experienced [describe the movement, e.g., a weakening against the Euro, strengthening against the Yen]. Specific exchange rates will be updated as the situation unfolds.

- Safe-haven status of the dollar: The traditional safe-haven status of the dollar is being tested as investors weigh the implications of the downgrade on the long-term stability of the US economy.

- Impact on international trade: The change in the dollar's value will significantly impact international trade, making US exports either more or less competitive depending on the direction of the movement.

Treasury Yields

The downgrade has also significantly impacted treasury yields. [Describe the movement – increase or decrease]. This reflects changing investor sentiment and expectations regarding future interest rates and economic growth.

- Yield curve shifts: The yield curve [explain the shift, e.g., steepened or flattened], providing insights into investor expectations about future economic conditions.

- Investor sentiment: Investor sentiment is currently [describe as pessimistic, cautious, etc.], leading to [explain the impact on treasury yields].

- Impact on borrowing costs: The movement in treasury yields will directly impact borrowing costs for both businesses and consumers.

Analysis of Moody's Rationale for Downgrade

Moody's cited several key factors in its decision to downgrade the US credit rating. Understanding these factors is crucial for assessing the long-term implications.

Key Factors Cited by Moody's

Moody's highlighted the following reasons for the downgrade:

- Fiscal challenges: The increasing national debt and the lack of a comprehensive plan to address the long-term fiscal trajectory were major concerns.

- Political gridlock: The persistent political polarization and the resulting inability to enact meaningful fiscal reforms contributed to the downgrade.

- Growing national debt: The continuing increase in the national debt relative to GDP poses a significant risk to the US's long-term fiscal health.

Comparison to Other Credit Rating Agencies

While Moody's is the first of the major rating agencies to downgrade the US, it’s important to compare this decision with the assessments of S&P and Fitch. [Discuss whether S&P or Fitch have similar ratings or outlook and explain any differences in methodology and potential implications].

- Differing methodologies: Slight variations in rating methodologies can lead to different assessments, even with similar data inputs.

- Consensus among rating agencies: The lack of consensus among rating agencies could create uncertainty in the markets.

- Potential for further downgrades: There's a possibility of further downgrades from other agencies if the US government doesn't take substantial steps to address the underlying fiscal issues.

Expert Opinions and Predictions

Understanding the perspectives of leading economists and market strategists is vital for navigating this volatile period.

Economist Commentary

Prominent economists offer diverse perspectives on the potential impact of the downgrade: [Include quotes and insights from economists; remember to cite your sources]. These predictions often range from [mention range of predictions about inflation, economic growth, etc.].

- Impact on inflation: Economists are divided on the impact of the downgrade on inflation, with some expecting [mention an effect], while others foresee [mention another effect].

- Economic growth forecasts: Forecasts for economic growth have [describe movement, e.g., been revised downward] following the announcement.

- Potential policy responses: The government’s response will be crucial in determining the ultimate economic impact; anticipated responses include [mention potential policy responses].

Market Strategist Views

Market strategists are advising investors to adopt a [describe the recommended strategy, e.g., cautious] approach.

- Recommendations for investors: Strategies include [mention strategies such as diversification, risk management, etc.].

- Sector-specific advice: Some sectors may be more vulnerable than others [mention examples].

- Risk management strategies: Investors are urged to implement robust risk management strategies to mitigate potential losses.

Conclusion

Moody's downgrade of the US credit rating has triggered significant volatility in Dow futures and the US dollar. The immediate market reaction was a sharp decline in Dow futures and volatility in the dollar. Moody's cited fiscal challenges, political gridlock, and the growing national debt as key factors behind the downgrade. Expert opinions are varied, but caution and robust risk management strategies are advised. The long-term consequences remain to be seen, but the situation warrants close monitoring.

Call to Action: Stay informed on the evolving situation with our continued live updates on the Moody's downgrade and its impact on Dow futures and the dollar. For continuous market analysis and financial news related to the Moody's downgrade, bookmark this page and check back for updates. Follow us for more on the impacts of this significant credit rating downgrade.

Featured Posts

-

Peppa Pigs Mummy A New Baby Gender Reveal

May 21, 2025

Peppa Pigs Mummy A New Baby Gender Reveal

May 21, 2025 -

Antiques Roadshow Appearance Leads To Arrest Of American Couple In Britain

May 21, 2025

Antiques Roadshow Appearance Leads To Arrest Of American Couple In Britain

May 21, 2025 -

The Goldbergs Everything You Need To Know About The Cast And Characters

May 21, 2025

The Goldbergs Everything You Need To Know About The Cast And Characters

May 21, 2025 -

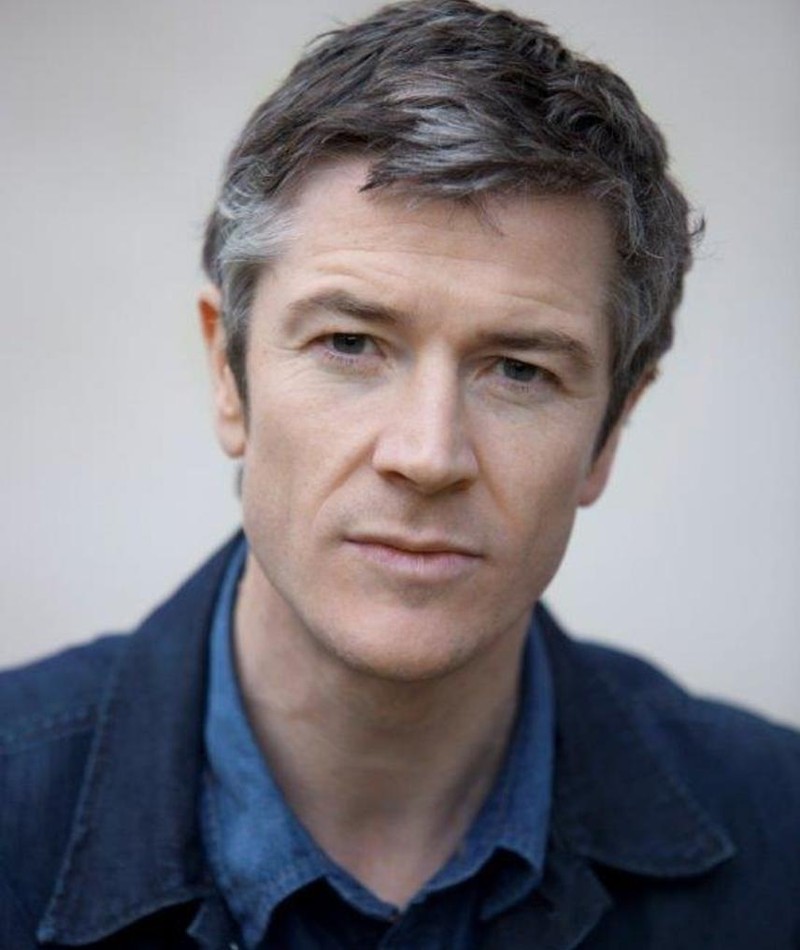

Barry Ward Interview The Irish Actor On Typecasting

May 21, 2025

Barry Ward Interview The Irish Actor On Typecasting

May 21, 2025 -

Half Dome Wins Abn Group Victoria Media Account A Strategic Partnership

May 21, 2025

Half Dome Wins Abn Group Victoria Media Account A Strategic Partnership

May 21, 2025

Latest Posts

-

Winter Storm And School Closings A Guide For Parents And Students

May 21, 2025

Winter Storm And School Closings A Guide For Parents And Students

May 21, 2025 -

Navigating Winter Weather Advisories And School Closures

May 21, 2025

Navigating Winter Weather Advisories And School Closures

May 21, 2025 -

12 Ai Stocks To Watch Reddits Most Popular Choices

May 21, 2025

12 Ai Stocks To Watch Reddits Most Popular Choices

May 21, 2025 -

Big Bear Ai Stock A Current Market Evaluation And Buying Recommendation

May 21, 2025

Big Bear Ai Stock A Current Market Evaluation And Buying Recommendation

May 21, 2025 -

Winter Weather Advisory School Delays And Closures

May 21, 2025

Winter Weather Advisory School Delays And Closures

May 21, 2025