Navigate The Private Credit Boom: 5 Key Do's And Don'ts

Table of Contents

Do: Conduct Thorough Due Diligence

Before investing in any private credit opportunity, comprehensive due diligence is paramount. This crucial step helps mitigate risk and ensures informed decision-making.

Assess the Borrower's Financial Health

- Review financial statements: Scrutinize balance sheets, income statements, and cash flow statements for any red flags.

- Assess creditworthiness: Evaluate the borrower's credit history and debt-to-equity ratio to gauge their ability to repay the loan.

- Analyze cash flow projections: Carefully examine the borrower's projected cash flows to determine their ability to meet debt obligations.

- Verify collateral value: Independently verify the value of any collateral offered to secure the loan.

Thorough due diligence isn't merely about reviewing numbers; it's about understanding the underlying business. Independent verification of financial information is crucial, especially for larger investments. Engaging professional due diligence services can significantly reduce the risk of overlooking critical red flags, protecting your investment in the private credit market. Overlooking these steps can lead to significant financial losses in the competitive alternative lending landscape.

Understand the Loan Structure and Terms

- Analyze interest rates: Compare interest rates to prevailing market rates and assess their competitiveness.

- Review fees: Understand all associated fees, including origination fees, management fees, and prepayment penalties.

- Examine covenants: Carefully analyze the loan covenants, which outline restrictions and obligations for the borrower.

- Study repayment schedules: Understand the repayment terms, including amortization schedules and balloon payments.

- Identify potential risks: Clearly define and assess all potential risks associated with the loan, such as interest rate risk, credit risk, and liquidity risk.

Understanding various loan structures, such as senior secured debt (lower risk, lower return) and subordinated debt (higher risk, higher potential return), is crucial. Each structure presents a different risk-return profile, impacting your overall portfolio performance within the private credit boom.

Don't: Overlook Liquidity Risk

Private credit investments are inherently illiquid. Unlike publicly traded bonds, selling private debt can be challenging and time-consuming. Failing to account for liquidity risk can severely impact your investment strategy.

Assess the Exit Strategy

- Consider potential liquidity challenges: Realistically assess the difficulty of selling your private credit investment before committing.

- Explore secondary market options: Investigate the existence and depth of any secondary market for the specific private debt investment.

- Plan for potential delays in repayments: Account for potential delays in repayments and the impact on your overall cash flow.

A well-defined exit strategy is essential for mitigating liquidity risk. This involves understanding the potential challenges of selling private debt and having alternative plans in place. The illiquidity inherent in private credit investments necessitates a proactive approach to managing this key risk within the private credit boom.

Do: Diversify Your Portfolio

Diversification is a cornerstone of successful investing in any market, and the private credit boom is no exception.

Spread Investments Across Different Borrowers and Sectors

- Avoid concentration risk: Don't concentrate investments in a single borrower or industry sector.

- Consider geographic diversification: Spread your investments across different geographic regions to reduce risk.

Diversification helps mitigate risk by reducing the impact of any single investment performing poorly. A well-balanced portfolio of private credit investments across various borrowers and sectors can significantly improve overall portfolio performance during the private credit boom.

Don't: Neglect Professional Advice

Navigating the complexities of private credit investing requires specialized expertise.

Seek Expertise in Private Credit Investing

- Engage legal counsel: Ensure your investments comply with all applicable legal and regulatory requirements.

- Consult tax advisors: Understand the tax implications of your private credit investments.

- Work with experienced private credit fund managers: Leverage their expertise in sourcing, evaluating, and managing private credit investments.

The complexities of legal structures, tax regulations, and market dynamics in the private credit space necessitate seeking specialized advice. Understanding legal and regulatory requirements is vital for compliant and successful private credit investing.

Do: Monitor Your Investments Regularly

Active management is crucial for successful private credit investing.

Stay Informed on Market Conditions and Borrower Performance

- Regularly review financial performance: Track key performance indicators (KPIs) for each investment.

- Stay updated on industry trends: Monitor market conditions and anticipate potential shifts in the private credit market.

- Adjust strategies as needed: Be prepared to adapt your investment strategy based on changes in the market and borrower performance.

Regular monitoring allows for early identification and mitigation of potential problems. Using portfolio management tools can significantly improve your ability to track and manage private credit investments effectively. Proactive management is essential for successfully navigating the dynamic landscape of the private credit boom.

Mastering the Private Credit Boom: Key Takeaways and Next Steps

This article highlighted five key do's and don'ts for successfully navigating the private credit boom: conduct thorough due diligence, avoid overlooking liquidity risk, diversify your portfolio, seek professional advice, and monitor your investments regularly. Understanding and addressing these factors is vital for mitigating risks and maximizing returns in this dynamic market. The benefits of due diligence, diversification, and professional expertise cannot be overstated. Regular monitoring and a clear understanding of liquidity risk are critical for long-term success in the private credit market.

Ready to navigate the exciting opportunities of the private credit boom? Start by conducting thorough due diligence and seeking expert guidance. Don't hesitate to contact us for more information on private credit investing strategies.

Featured Posts

-

Office365 Security Flaw Costs Executives Millions Fbi Investigation Reveals

May 05, 2025

Office365 Security Flaw Costs Executives Millions Fbi Investigation Reveals

May 05, 2025 -

Singapore Election What To Expect From The Upcoming Vote

May 05, 2025

Singapore Election What To Expect From The Upcoming Vote

May 05, 2025 -

Wb Weather Update Heatwave Warning For Four Bengal Districts

May 05, 2025

Wb Weather Update Heatwave Warning For Four Bengal Districts

May 05, 2025 -

Gold Market Update Back To Back Weekly Declines For 2025

May 05, 2025

Gold Market Update Back To Back Weekly Declines For 2025

May 05, 2025 -

Paddy Pimblett Was Dustin Poirier Wrong To Retire

May 05, 2025

Paddy Pimblett Was Dustin Poirier Wrong To Retire

May 05, 2025

Latest Posts

-

Buffett Rejects Claims Of Backing Trumps Reciprocal Tariffs

May 05, 2025

Buffett Rejects Claims Of Backing Trumps Reciprocal Tariffs

May 05, 2025 -

Warren Buffett Denies Trump Tariff Support All Reports False

May 05, 2025

Warren Buffett Denies Trump Tariff Support All Reports False

May 05, 2025 -

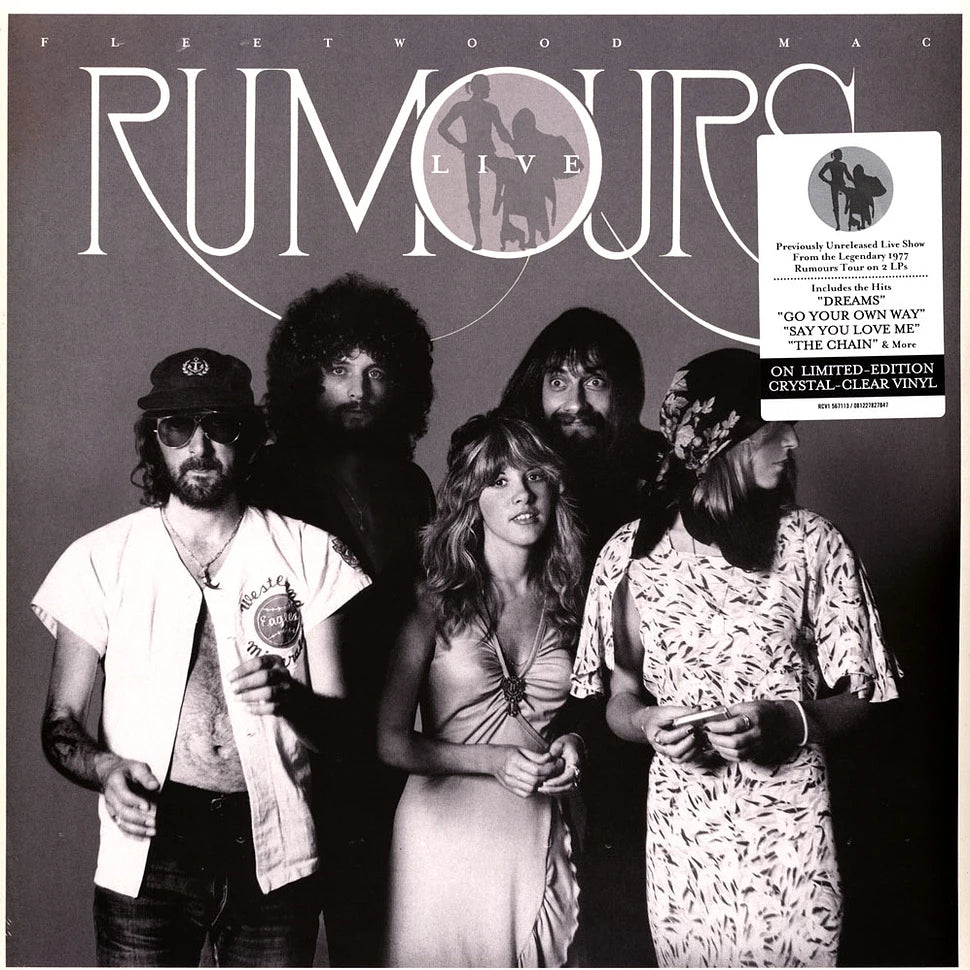

Rumours 48th Anniversary The Impact Of Personal Conflict On Fleetwood Macs Iconic Album

May 05, 2025

Rumours 48th Anniversary The Impact Of Personal Conflict On Fleetwood Macs Iconic Album

May 05, 2025 -

The Making Of Rumours How Fleetwood Macs Personal Lives Fueled A Legendary Album 48 Years Later

May 05, 2025

The Making Of Rumours How Fleetwood Macs Personal Lives Fueled A Legendary Album 48 Years Later

May 05, 2025 -

Novo Izdanje Gibonija Promoviranje Na Sarajevo Book Fairu

May 05, 2025

Novo Izdanje Gibonija Promoviranje Na Sarajevo Book Fairu

May 05, 2025