Navigating The Dragon's Den: A Comprehensive Guide For Pitching Your Business

Table of Contents

Crafting a Compelling Business Pitch

The foundation of a successful pitch lies in understanding your audience and crafting a narrative that resonates. A poorly prepared pitch, no matter how innovative your idea, is unlikely to attract investment.

Understanding Your Audience (Investor Personas)

Before you even begin writing your pitch, you need to deeply understand your target investors. This isn't a one-size-fits-all approach. Different investors have different priorities, risk tolerances, and investment styles.

- Analyze investor portfolios: Examine the types of companies they've previously invested in. This reveals their investment preferences and areas of expertise.

- Identify common investment themes: What industries or business models do they favor? Are they focused on early-stage startups, or more mature businesses?

- Understand risk tolerance levels: Are they looking for high-growth, high-risk ventures, or more stable, lower-risk investments? Tailoring your pitch to their risk appetite is crucial.

Knowing your audience allows you to tailor your message, highlighting the aspects of your business that are most relevant to their investment criteria.

Developing a Concise and Persuasive Narrative

Your pitch needs to be concise, compelling, and easy to understand. Avoid jargon and focus on the core value proposition of your business.

- Highlight unique selling propositions (USPs): What makes your business different and better than the competition? Clearly articulate these USPs early on.

- Showcase market opportunity and size: Demonstrate the potential market for your product or service. Provide data to support your claims.

- Demonstrate traction and growth potential: If you already have some traction (e.g., sales, users, partnerships), highlight this. Also, present realistic and achievable growth projections.

- Start with a strong hook: Grab the investor's attention immediately with a compelling statistic, anecdote, or problem statement.

- Clearly articulate your value proposition: What problem do you solve, and how do you solve it better than anyone else?

- Present a strong team: Investors invest in people as much as they invest in ideas. Highlight the expertise and experience of your team.

- Focus on key metrics and financial projections: Provide clear, concise, and realistic financial projections, demonstrating the potential for return on investment (ROI).

Mastering the Art of Storytelling

Numbers are important, but a successful pitch is more than just a data dump. It's a story. Frame your pitch as a narrative that connects with investors on an emotional level.

- Use real-life examples and case studies: Illustrate your points with compelling examples and evidence.

- Evoke emotions with relatable scenarios: Connect with investors on a personal level by showing the impact your business has or will have.

- Use visuals to support key data points: Charts, graphs, and images can help make your data more accessible and memorable.

- Practice your delivery: Rehearse your pitch multiple times to ensure you're confident, clear, and engaging.

Preparing for Investor Questions and Objections

No pitch goes without questions and potential objections. Anticipating these and preparing thoughtful responses is critical.

Anticipating Difficult Questions

Identify potential weaknesses in your business model and prepare well-reasoned responses. This shows investors you’ve thoroughly considered the risks.

- Consider market competition: How does your business stand out from the competition? What’s your competitive advantage?

- Address potential risks and challenges: Be transparent about potential challenges and have strategies to mitigate them.

- Prepare for questions about scalability and sustainability: How will your business grow and remain profitable in the long term?

Handling Investor Scrutiny Gracefully

Even with meticulous preparation, you'll face tough questions. Maintain your composure and professionalism.

- Practice active listening skills: Pay close attention to what investors are saying and respond thoughtfully.

- Respond to criticism constructively: Don’t get defensive. Listen to feedback and use it to improve your pitch and business.

- Demonstrate adaptability and willingness to learn: Show that you’re open to feedback and willing to adapt your approach.

Post-Pitch Follow-Up and Negotiation

The pitch itself is only the first step. Following up and negotiating effectively are crucial for securing funding.

Sending a Thank You Note and Following Up

A timely and personalized thank you note shows respect and professionalism.

- Personalize your thank you notes: Refer to specific points discussed during the pitch.

- Highlight key takeaways from the pitch: Reiterate the value proposition and key differentiators of your business.

- Respect their time and schedule: Avoid overwhelming investors with excessive follow-up.

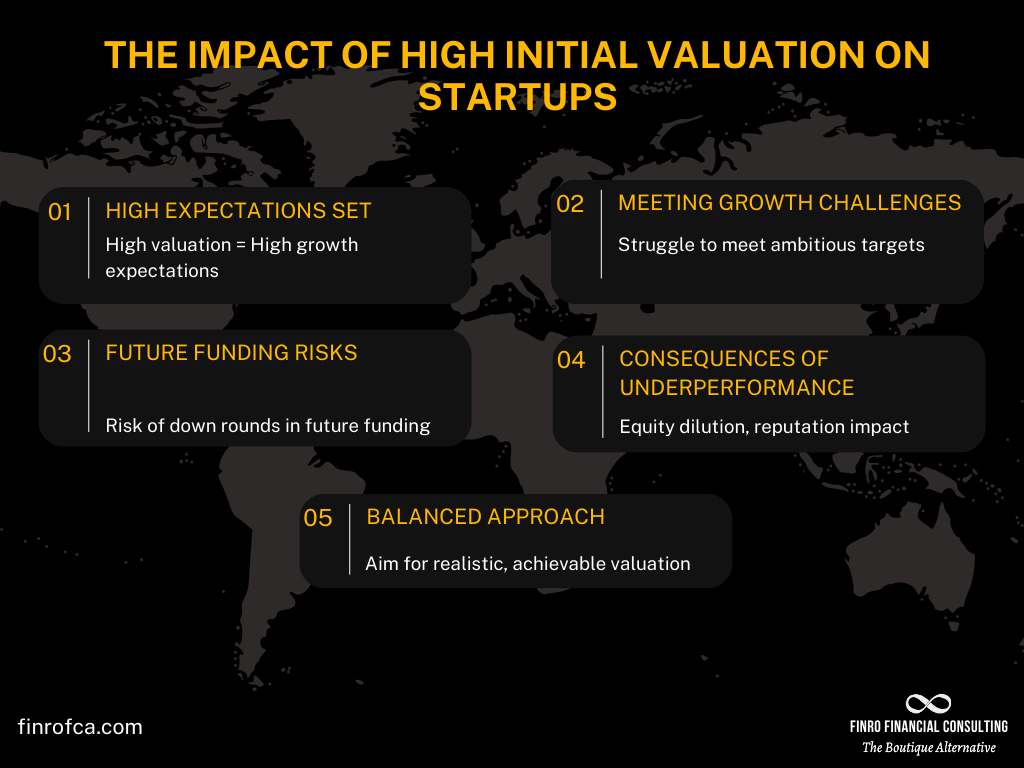

Negotiating Investment Terms

Securing funding involves negotiation. Understand the terms and seek professional guidance.

- Understand valuation and equity dilution: Know the value of your company and how much equity you're willing to give up.

- Negotiate favorable terms and conditions: Ensure the investment terms are beneficial to your business.

- Seek legal counsel for contract review: Have a lawyer review any investment agreements before signing.

Conclusion

Successfully navigating the "Dragon's Den" of investor pitches requires careful preparation, a compelling narrative, and the ability to handle challenging questions. By focusing on crafting a strong business pitch, anticipating investor concerns, and executing a thoughtful follow-up strategy, entrepreneurs significantly increase their chances of securing the funding they need. Don't let the challenge intimidate you – use this guide to confidently navigate the world of investment pitching and secure the future of your business. Remember, mastering the art of pitching your business is a journey, not a destination. Keep refining your approach and learning from each experience. Start perfecting your business pitch today!

Featured Posts

-

Quick And Easy Shrimp Ramen Stir Fry

May 01, 2025

Quick And Easy Shrimp Ramen Stir Fry

May 01, 2025 -

Navigating The Complexities Of Nuclear Litigation A Holland And Knight Perspective

May 01, 2025

Navigating The Complexities Of Nuclear Litigation A Holland And Knight Perspective

May 01, 2025 -

Hunters 32 Points Power Cavaliers To 10th Straight Win

May 01, 2025

Hunters 32 Points Power Cavaliers To 10th Straight Win

May 01, 2025 -

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025 -

Eurovision 2025 Betting Tips Latest Odds And Predictions

May 01, 2025

Eurovision 2025 Betting Tips Latest Odds And Predictions

May 01, 2025

Latest Posts

-

Pinpointing Success A Geographic Analysis Of The Countrys New Business Hot Spots

May 02, 2025

Pinpointing Success A Geographic Analysis Of The Countrys New Business Hot Spots

May 02, 2025 -

Rust A Retrospective Review Following The On Set Accident

May 02, 2025

Rust A Retrospective Review Following The On Set Accident

May 02, 2025 -

Stock Market Valuation Concerns Bof As Response To Investor Anxiety

May 02, 2025

Stock Market Valuation Concerns Bof As Response To Investor Anxiety

May 02, 2025 -

The Strategic Importance Of Effective Middle Management For Organizational Success

May 02, 2025

The Strategic Importance Of Effective Middle Management For Organizational Success

May 02, 2025 -

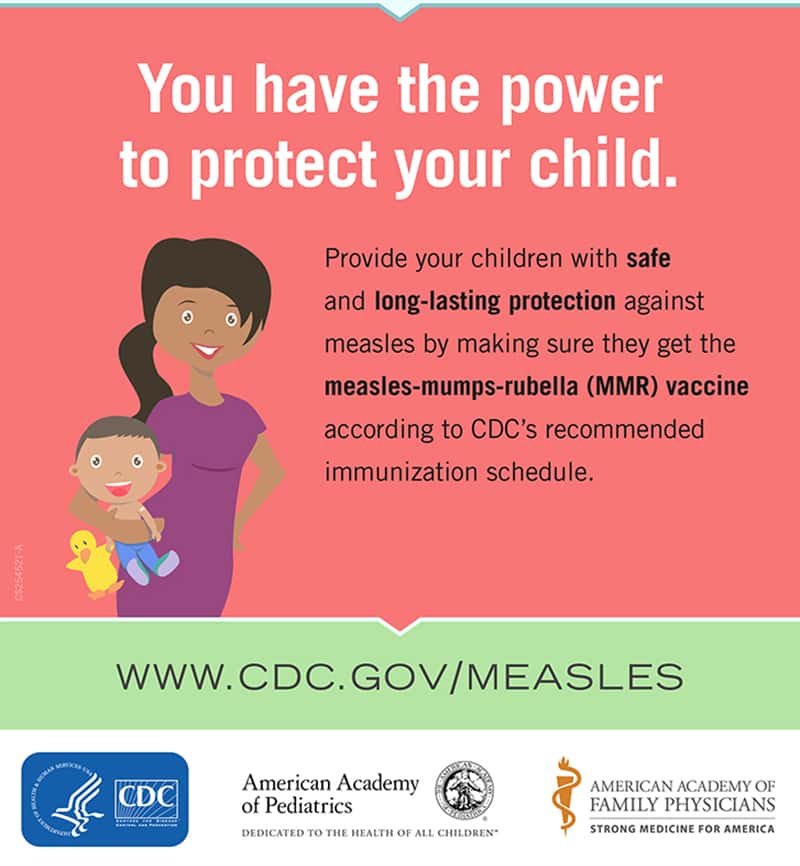

Us Vaccine Safety And The Current Measles Epidemic

May 02, 2025

Us Vaccine Safety And The Current Measles Epidemic

May 02, 2025