Navigating The Private Credit Job Market: 5 Do's & Don'ts

Table of Contents

5 Do's for Success in the Private Credit Job Market

Do 1: Network Strategically

Building a strong network is paramount in the private credit industry. It's not just about collecting business cards; it's about cultivating meaningful relationships.

- Attend Industry Events: Conferences, workshops, and even smaller networking events focused on private debt, alternative lending, and direct lending offer invaluable opportunities to connect with professionals.

- Leverage Online Platforms: LinkedIn groups dedicated to finance, private equity, and private credit are goldmines for connecting with potential mentors and employers. Actively participate in discussions and share insightful content.

- Informational Interviews: Don't be afraid to reach out to individuals working in private credit firms for informational interviews. These conversations provide invaluable insights into the industry and can open doors to unadvertised opportunities.

- Target Your Efforts: Focus your networking on firms and individuals whose investment strategies and company culture align with your career aspirations and skills in credit analysis and financial modeling. Don't cast a wide net; be strategic and targeted.

- Consistent Follow-Up: After meeting someone, send a personalized follow-up email reiterating your interest and expressing gratitude for their time. Maintain contact and nurture these relationships over time.

Do 2: Highlight Relevant Skills & Experience

Your resume and cover letter are your first impression. Make them count.

- Tailor Your Application: Don't use a generic template. Each application should be tailored to the specific job description, highlighting the skills and experiences most relevant to the role.

- Quantify Your Achievements: Instead of simply stating your responsibilities, quantify your accomplishments using numbers and data. For example, "Increased portfolio performance by 15% through improved credit analysis techniques" is far more impactful than "Managed a portfolio of assets."

- Showcase Your Understanding of Alternative Lending and Direct Lending: Demonstrate a clear understanding of different lending strategies within the private credit space.

- Keywords are Key: Incorporate relevant keywords like financial modeling, credit analysis, due diligence, alternative lending, direct lending throughout your resume and cover letter. Use Applicant Tracking System (ATS) friendly formatting.

Do 3: Master the Interview Process

The interview stage is where you can truly showcase your skills and personality.

- Prepare for Diverse Questions: Expect behavioral questions assessing your soft skills, technical questions testing your knowledge of financial modeling and credit analysis, and potentially case study interviews that evaluate your problem-solving abilities.

- Utilize the STAR Method: Structure your answers using the STAR method (Situation, Task, Action, Result) to provide concise and impactful responses to behavioral questions.

- Thorough Firm Research: Demonstrate your knowledge of the firm's investment strategy, portfolio companies, and recent transactions. Show genuine interest in their work.

- Ask Insightful Questions: Prepare thoughtful questions that demonstrate your interest and understanding of the firm and the private credit market. This shows initiative and engagement.

Do 4: Develop Specialized Knowledge

Continuous learning is vital in the ever-evolving private credit landscape.

- Obtain Relevant Certifications: Consider pursuing certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) to demonstrate your expertise.

- Advanced Education: An advanced degree in finance, accounting, or a related field can significantly enhance your qualifications.

- Stay Updated: Read industry publications, attend webinars, and follow key influencers on social media to stay abreast of current trends and regulatory changes in the private debt market.

Do 5: Showcase Your Passion for Private Credit

Genuine enthusiasm is infectious.

- Demonstrate Deep Understanding: Show you understand the complexities of the private credit market, beyond just the basics.

- Express Enthusiasm: Let your passion for the industry's challenges and rewards shine through in your interactions.

- Articulate Long-Term Goals: Clearly articulate your career aspirations within the private credit sector.

5 Don'ts When Seeking a Private Credit Job

Don't 1: Neglect Networking: Networking is crucial; don't underestimate its power.

Don't 2: Submit Generic Applications: Tailor each application to the specific job description.

Don't 3: Underprepare for Interviews: Thorough preparation is essential for success.

Don't 4: Ignore Industry Knowledge: Stay informed about market trends and regulations.

Don't 5: Lack Enthusiasm: Demonstrate genuine interest and passion for the private credit industry.

Conclusion

Successfully navigating the private credit job market requires strategic planning and diligent effort. By following these five do's and don'ts, you'll significantly improve your chances of landing your dream role in the exciting world of private credit. Remember to network effectively, tailor your application materials, prepare thoroughly for interviews, stay informed about industry trends, and showcase your enthusiasm. Start building your private credit career today!

Featured Posts

-

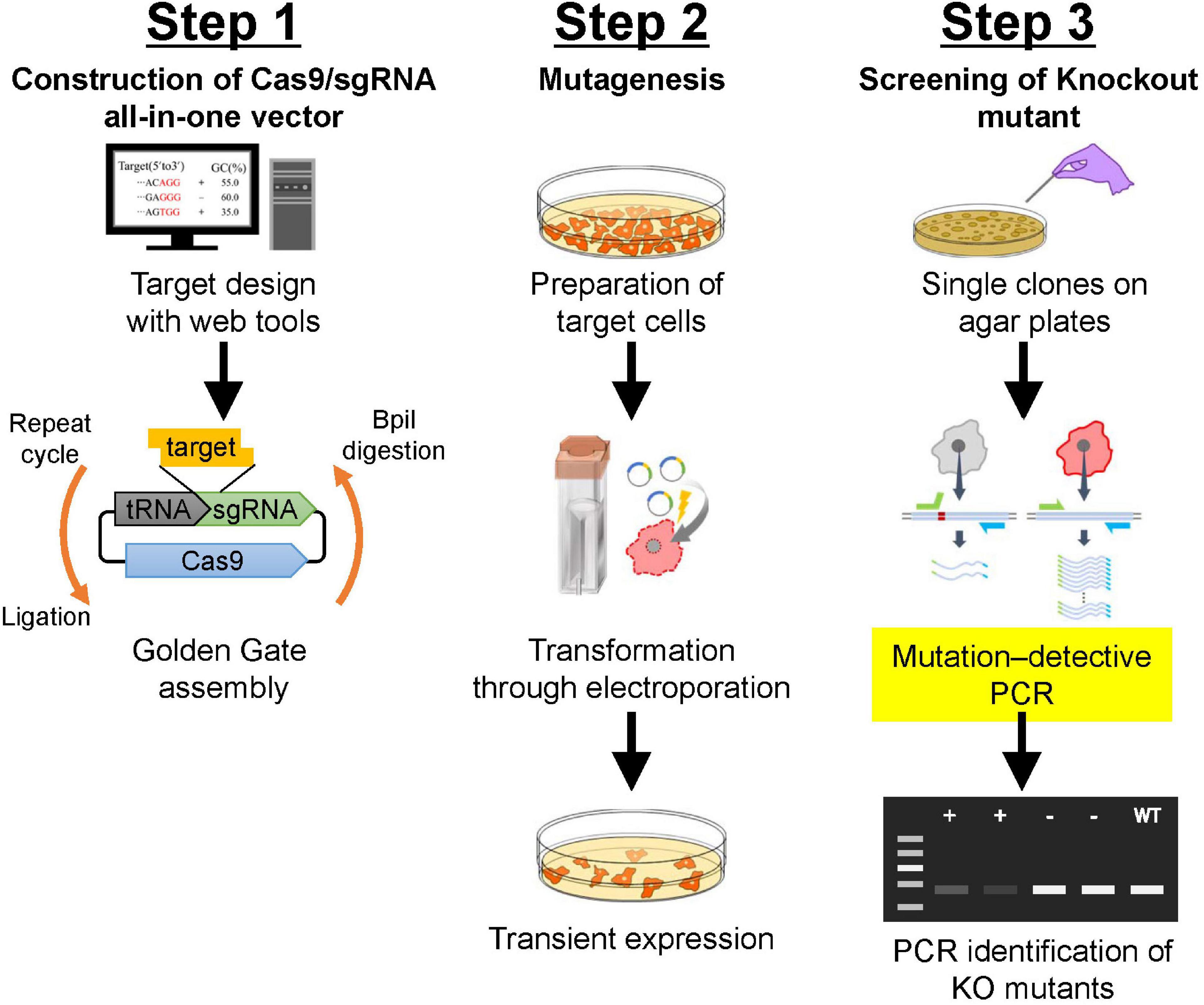

Crispr Mediated Whole Gene Transfer A Powerful New Tool

May 30, 2025

Crispr Mediated Whole Gene Transfer A Powerful New Tool

May 30, 2025 -

Microsoft Activision Merger Ftcs Appeal Challenges Antitrust Ruling

May 30, 2025

Microsoft Activision Merger Ftcs Appeal Challenges Antitrust Ruling

May 30, 2025 -

Dow Jones S And P 500 Market Update Live Prices For May 29

May 30, 2025

Dow Jones S And P 500 Market Update Live Prices For May 29

May 30, 2025 -

Dolbergs Afloser Fc Kobenhavns Strategier Pa Transfervinduet

May 30, 2025

Dolbergs Afloser Fc Kobenhavns Strategier Pa Transfervinduet

May 30, 2025 -

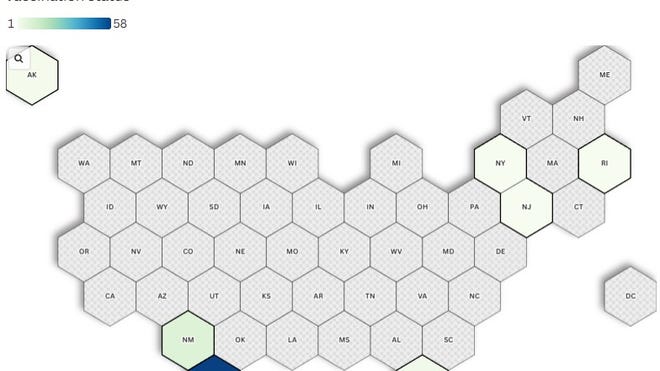

Measles Outbreak In Texas A Growing Concern With New Cases

May 30, 2025

Measles Outbreak In Texas A Growing Concern With New Cases

May 30, 2025