Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc: A Comprehensive Guide

Table of Contents

What Influences the Net Asset Value (NAV) of Amundi MSCI All Country World UCITS ETF USD Acc?

The Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc, like any ETF, isn't static; it fluctuates based on several key factors. Understanding these factors is crucial for interpreting NAV movements and making sound investment choices.

Underlying Asset Performance

The primary driver of the ETF's NAV is the performance of its underlying assets – a globally diversified portfolio of equities mirroring the MSCI All Country World Index. Positive performance in the global market translates to a higher NAV, while negative performance leads to a lower NAV. This is directly linked to the price fluctuations of the individual companies within the index.

- Market Fluctuations: Global economic growth, recessionary fears, and market sentiment significantly impact the prices of these equities.

- Geopolitical Events: Major political events, such as wars or elections, can trigger significant volatility and influence NAV.

- Company Earnings: Strong company earnings reports generally boost stock prices and thus the ETF's NAV; conversely, poor earnings can depress the NAV.

- Interest Rate Changes: Changes in interest rates influence borrowing costs for companies, impacting their profitability and stock prices, and subsequently, the ETF's NAV.

Currency Fluctuations

Since the Amundi MSCI All Country World UCITS ETF USD Acc is denominated in US Dollars (USD), fluctuations in exchange rates impact the NAV. The ETF holds assets in various currencies; therefore, changes in these exchange rates relative to the USD affect the overall value expressed in USD.

- USD/EUR: A strengthening USD against the Euro (EUR) will increase the USD value of European holdings, positively impacting the NAV.

- USD/JPY: Similarly, USD strength against the Japanese Yen (JPY) will influence the NAV positively.

- Emerging Market Currencies: Fluctuations in emerging market currencies can have a significant, albeit sometimes unpredictable, impact on the overall NAV.

Expenses and Fees

The ETF incurs various expenses, including management fees, expense ratios, and operational costs. These expenses are deducted from the overall asset value, resulting in a difference between the gross NAV (before expenses) and the net NAV (after expenses). The net NAV is the figure investors typically see reported.

- Management Fees: These are charged annually for the management and administration of the ETF.

- Expense Ratio: This represents the total annual cost of owning the ETF, expressed as a percentage of the assets under management.

- Other Operational Costs: These include administrative, custodial, and other operational expenses.

Dividend Distributions

The Amundi MSCI All Country World UCITS ETF USD Acc typically distributes dividends received from its underlying holdings. When dividends are paid out, the NAV is adjusted downwards to reflect the distribution.

- Ex-Dividend Date: The NAV drops on the ex-dividend date, the day after which you must own the ETF shares to be entitled to the dividend.

- Frequency: Dividend distributions may occur quarterly or semi-annually, depending on the dividend policies of the underlying companies.

How to Find the NAV of Amundi MSCI All Country World UCITS ETF USD Acc?

Accessing accurate and up-to-date NAV information is essential. There are several reliable sources you can utilize.

Official Sources

The most reliable source for the NAV is generally the ETF provider's website (Amundi). Major financial data providers such as Bloomberg, Refinitiv, and Yahoo Finance also provide this data.

- Amundi Website: Check the official Amundi website for the latest NAV figures.

- Financial Data Providers: Use reputable financial data providers for real-time and historical NAV data.

Brokerage Platforms

Most brokerage platforms display the current NAV of ETFs held within your portfolio. However, be aware that there might be minor discrepancies in the displayed NAV due to varying data update times.

- Interactive Brokers: Provides real-time and historical NAV data.

- TD Ameritrade: Offers detailed ETF information, including NAV.

- Fidelity: Provides comprehensive ETF data, including NAV.

Using NAV for Investment Decisions Regarding the Amundi MSCI All Country World UCITS ETF USD Acc

Understanding the NAV is not just about tracking its value; it's about using it strategically in your investment process.

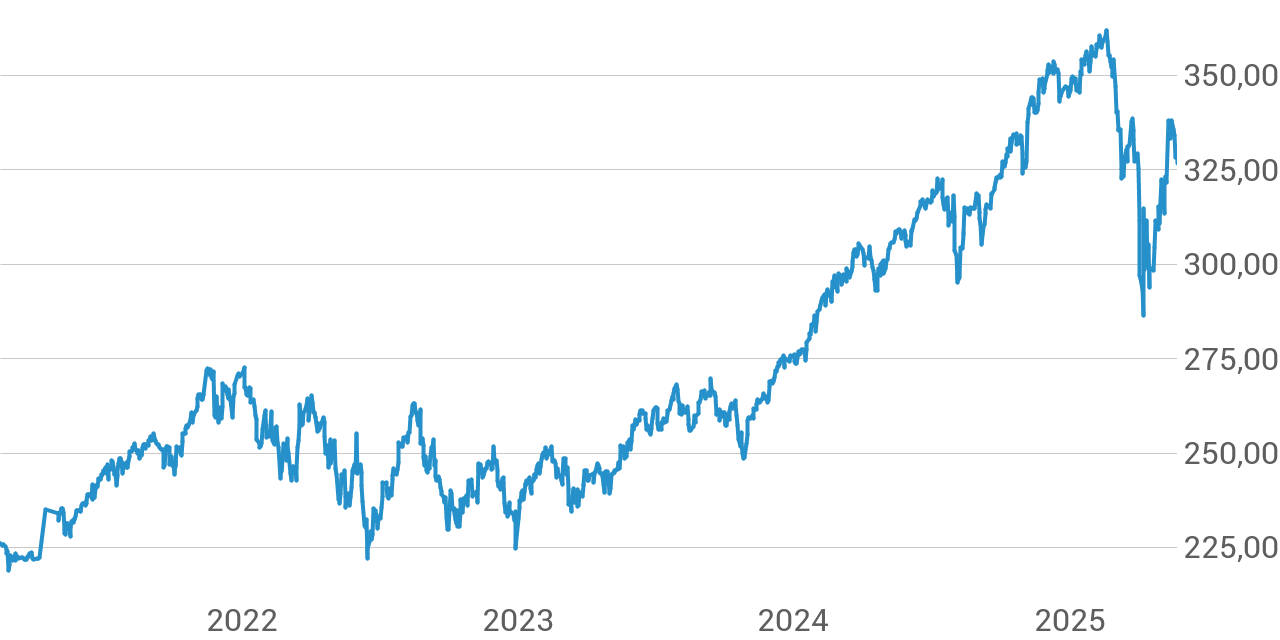

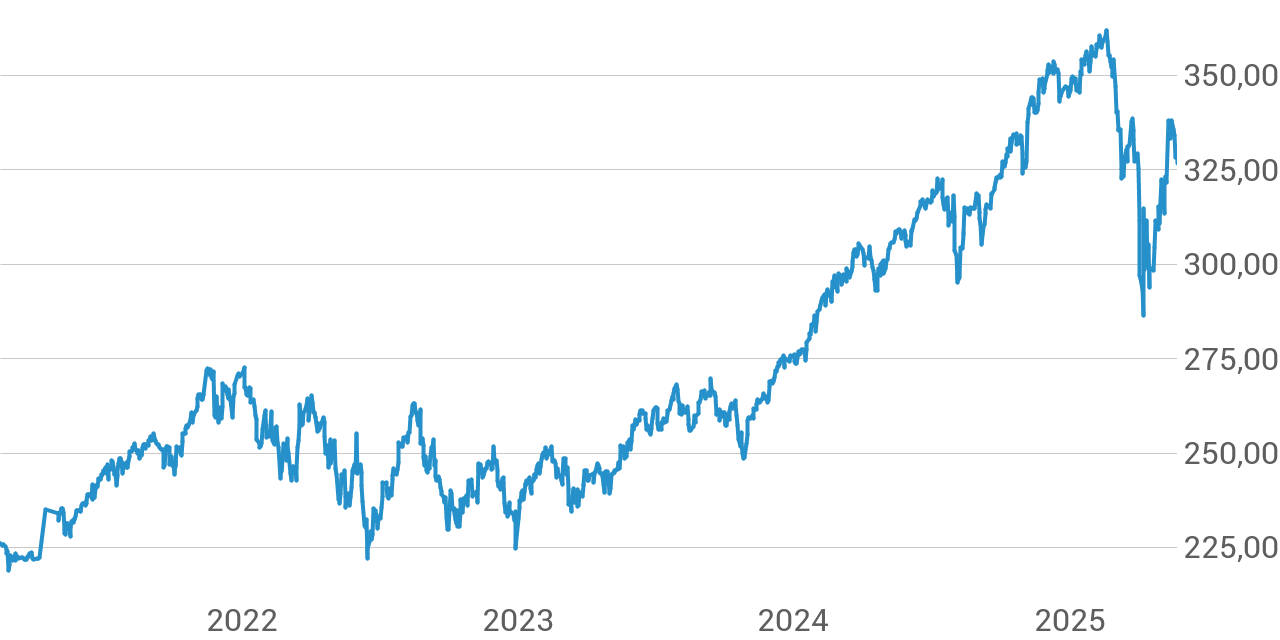

Monitoring Performance

Regularly monitoring the NAV helps track the ETF's performance over time. Compare the NAV to its benchmark index (MSCI All Country World Index) to assess its relative performance.

- Charting: Use charting tools to visualize NAV trends and identify potential patterns.

- Spreadsheets: Track NAV changes over time in a spreadsheet for detailed analysis.

Buy and Sell Decisions

While NAV is a vital factor, it shouldn't be the sole determinant for buy or sell decisions. Consider other factors, such as your risk tolerance, investment goals, and overall market conditions.

- Dollar-Cost Averaging: Use the NAV to implement a dollar-cost averaging strategy, investing a fixed amount at regular intervals regardless of NAV fluctuations.

- Value Investing: Consider buying when the NAV appears undervalued relative to the underlying assets' intrinsic value (although this requires advanced valuation techniques).

Conclusion: Mastering the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc

The Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is a dynamic figure influenced by underlying asset performance, currency fluctuations, expenses, and dividend distributions. By understanding these factors and utilizing reliable sources to track the NAV, you gain valuable insights into the ETF's performance. Regularly monitor your Amundi MSCI All Country World UCITS ETF NAV, employing effective strategies like dollar-cost averaging and informed decision-making based on your overall investment plan. Mastering the nuances of tracking ETF NAV and understanding its implications will contribute significantly to the success of your investment in the Amundi MSCI All Country World UCITS ETF USD Acc and other ETFs in your portfolio. Remember to always conduct your own research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

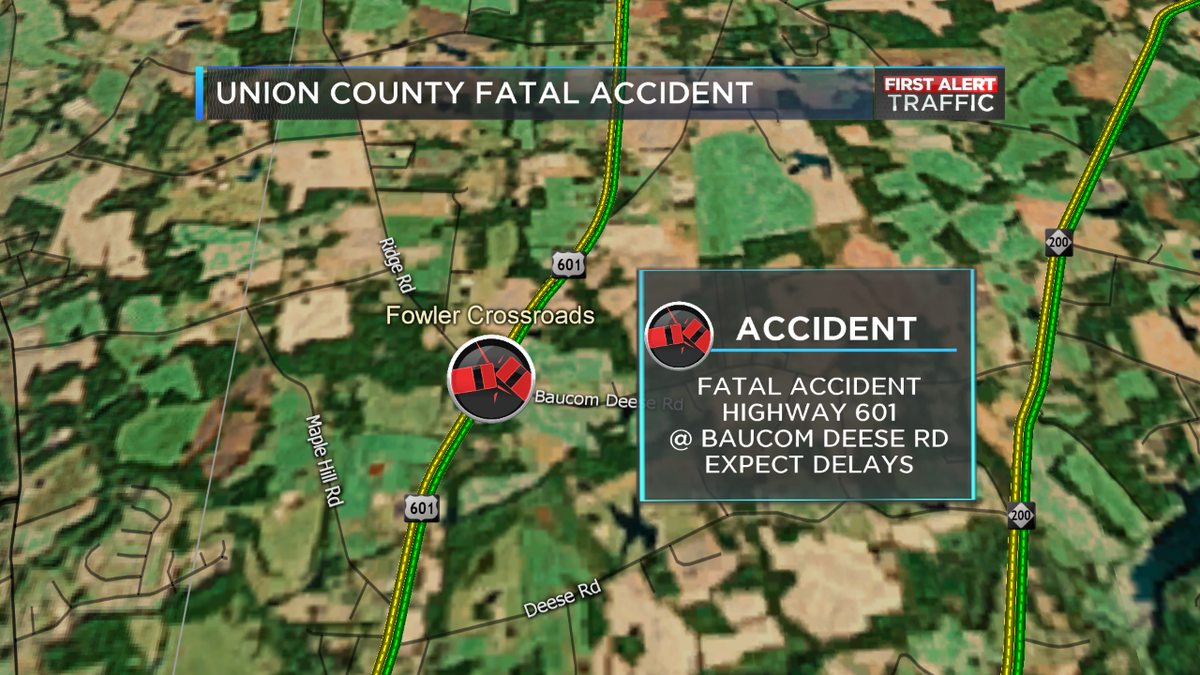

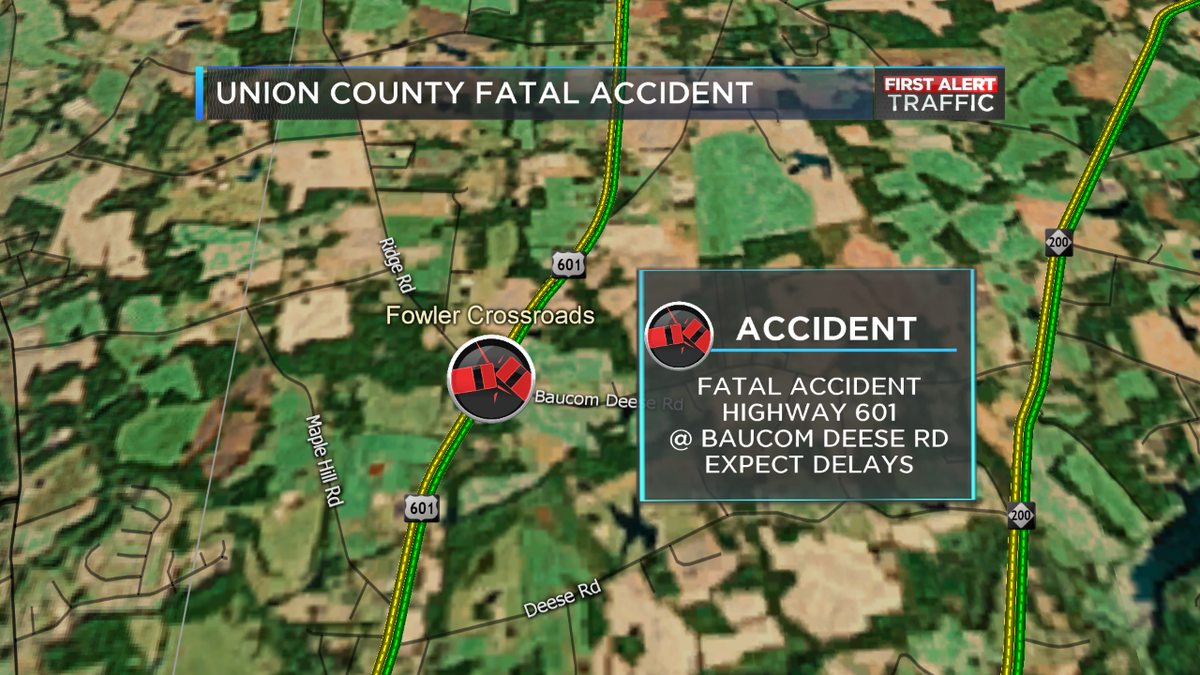

M6 Southbound Road Closure Following Accident Expect Delays

May 24, 2025

M6 Southbound Road Closure Following Accident Expect Delays

May 24, 2025 -

Picture This Soundtrack Complete Song List From The Prime Video Rom Com

May 24, 2025

Picture This Soundtrack Complete Song List From The Prime Video Rom Com

May 24, 2025 -

Escape To The Country Top Locations For A Countryside Getaway

May 24, 2025

Escape To The Country Top Locations For A Countryside Getaway

May 24, 2025 -

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025 -

Annie Kilners Posts Following Kyle Walkers Night Out

May 24, 2025

Annie Kilners Posts Following Kyle Walkers Night Out

May 24, 2025

Latest Posts

-

The Phone Rings A Look At She Still Waiting By The Phone

May 24, 2025

The Phone Rings A Look At She Still Waiting By The Phone

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

Waiting By The Phone The Lingering Power Of A Simple Gesture

May 24, 2025

Waiting By The Phone The Lingering Power Of A Simple Gesture

May 24, 2025 -

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025 -

M6 Southbound Road Closure Following Accident Expect Delays

May 24, 2025

M6 Southbound Road Closure Following Accident Expect Delays

May 24, 2025