Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: Explained

Table of Contents

What is the NAV and How is it Calculated for this Specific ETF?

The Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, understanding its NAV calculation requires considering several factors:

-

Breakdown of Assets: This ETF invests in a diversified portfolio of global equities, mirroring the MSCI World Index. The NAV calculation begins by valuing each holding based on its market price. This includes a broad range of large and mid-cap companies across developed markets worldwide.

-

Currency Hedging Impact: The "USD Hedged" aspect is crucial. This means the ETF employs a hedging strategy to mitigate the risk of currency fluctuations between the base currency of the underlying assets and the US dollar. This hedging involves using financial instruments like currency forwards or swaps to reduce exposure to exchange rate volatility. The effectiveness of this hedging strategy will impact the NAV, particularly during periods of significant currency movements.

-

Liabilities and Expenses: The calculation subtracts liabilities, which include management fees, operating expenses, and other costs associated with running the ETF. These expenses directly reduce the NAV per share.

-

Simplified Formula and Example: A simplified NAV calculation can be represented as:

NAV = (Total Asset Value - Total Liabilities) / Number of Outstanding Shares. For example, if the total asset value is $100 million, total liabilities are $1 million, and there are 10 million shares outstanding, the NAV would be ($100 million - $1 million) / 10 million shares = $9.90 per share. This is a simplified illustration; the actual calculation is more complex and involves professional valuation methodologies.

Where to Find the Daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist?

Staying updated on the daily NAV is essential for informed investment decisions. You can find this information from several reliable sources:

-

Official Sources: Amundi's official website is the primary source for the most accurate and up-to-date NAV data. Check their investor relations section or ETF fact sheets.

-

Brokerage Platforms: Most reputable brokerage firms that offer the Amundi MSCI World II UCITS ETF USD Hedged Dist will display the current NAV on their trading platforms. This information may be delayed, depending on the platform's data feed.

-

Financial News Websites: Many financial news websites and data providers (e.g., Bloomberg, Yahoo Finance) publish ETF NAVs, including that of the Amundi MSCI World II UCITS ETF USD Hedged Dist. However, always verify the information with the official source.

-

Frequency of Updates: The NAV is typically updated daily, usually at the end of the trading day.

Interpreting the NAV and its Significance for Investment Decisions

Understanding the NAV is more than just knowing a number; it's a crucial tool for making informed investment decisions.

-

NAV's Role in Performance Tracking: Comparing the NAV over time provides a clear picture of the ETF's performance. Increases in NAV reflect positive performance, while decreases indicate negative performance.

-

Comparing NAV to Market Price: The market price of an ETF can differ slightly from its NAV due to supply and demand in the market. Small discrepancies are normal, but significant deviations might signal market inefficiencies or trading opportunities.

-

Understanding NAV in the Context of Buy and Sell Decisions: While market price dictates the actual transaction cost, the NAV provides a fundamental valuation of the ETF's underlying assets. Investors should consider both NAV and market price when making buy or sell decisions.

-

Impact of Market Fluctuations on NAV: The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist, like any equity ETF, is susceptible to market fluctuations. Global market events, economic news, and changes in individual company performance all affect the underlying assets and, consequently, the NAV.

Conclusion: Making Informed Decisions Using the Net Asset Value (NAV)

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for successful investing in this global equity ETF. Regularly monitoring the NAV, understanding its calculation, and comparing it to the market price are key strategies for making informed buy and sell decisions. Remember that the USD hedging strategy also plays a role in influencing the NAV, especially during periods of currency volatility. By actively tracking the NAV and considering its implications, you can better manage your investments in this ETF. Stay informed about the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF USD Hedged Dist investments. Consult the official Amundi website and your brokerage platform for the most up-to-date information.

Featured Posts

-

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025 -

Photos Lego Master Manny Garcias Visit To Veterans Memorial Elementary

May 24, 2025

Photos Lego Master Manny Garcias Visit To Veterans Memorial Elementary

May 24, 2025 -

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia Photos From The Visit

May 24, 2025

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia Photos From The Visit

May 24, 2025 -

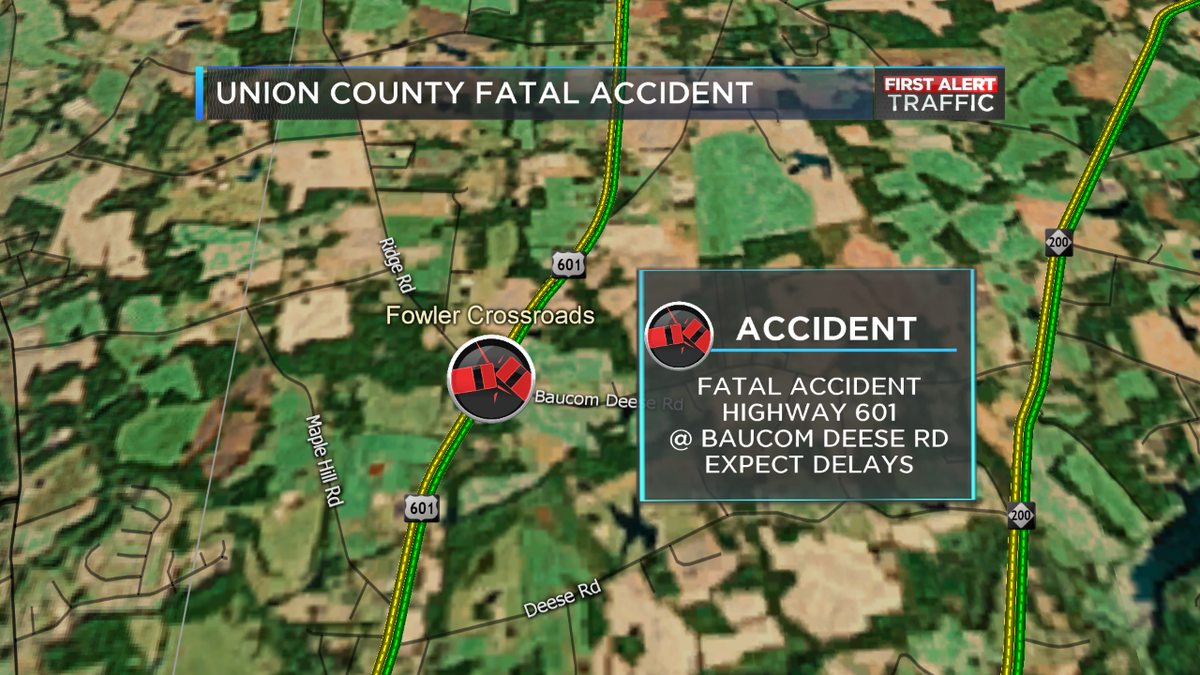

Emergency Services Respond To Major Crash Road Closure In Effect

May 24, 2025

Emergency Services Respond To Major Crash Road Closure In Effect

May 24, 2025 -

Onko Tuukka Taponen F1 Kuljettaja Jo Taenae Vuonna Uudet Tiedot

May 24, 2025

Onko Tuukka Taponen F1 Kuljettaja Jo Taenae Vuonna Uudet Tiedot

May 24, 2025

Latest Posts

-

The Phone Rings A Look At She Still Waiting By The Phone

May 24, 2025

The Phone Rings A Look At She Still Waiting By The Phone

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

Waiting By The Phone The Lingering Power Of A Simple Gesture

May 24, 2025

Waiting By The Phone The Lingering Power Of A Simple Gesture

May 24, 2025 -

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025 -

M6 Southbound Road Closure Following Accident Expect Delays

May 24, 2025

M6 Southbound Road Closure Following Accident Expect Delays

May 24, 2025