News Corp: Undervalued And Underappreciated? Analyzing The Potential

Table of Contents

News Corp's Diversified Portfolio: A Strength Often Overlooked

News Corp's success hinges on its impressively diversified portfolio, a strength often underestimated by market analysts. This diversification acts as a powerful buffer against market fluctuations, creating more stable revenue streams than many competitors.

The Power of Diversification: News Corp's Holdings Across Multiple Sectors

News Corp's holdings span several key sectors, mitigating risk and offering diverse growth opportunities. Its portfolio includes:

- Newspapers: A significant presence in major markets with titles like The Wall Street Journal, The Times, and The Sun, providing substantial revenue and influence. These publications maintain considerable market share, despite the challenges of the digital age.

- Book Publishing: A robust portfolio of publishing houses, including HarperCollins, contributing significantly to revenue through both physical and digital sales. HarperCollins enjoys a strong reputation and consistently publishes best-selling titles across numerous genres.

- Digital Real Estate: A rapidly growing segment contributing increasingly to News Corp's overall portfolio value. This encompasses various digital properties and online platforms.

This portfolio diversification offers significant advantages in terms of risk mitigation and stable revenue streams. The performance of one segment can offset weaknesses in another, leading to greater overall stability.

Synergies and Cross-Promotional Opportunities: Unlocking Hidden Value

The true power of News Corp's diversified portfolio lies in the potential for synergistic effects and cross-selling opportunities. For example:

- Newspapers can promote books published by HarperCollins, driving sales and increasing brand awareness.

- Digital platforms can cross-promote content from newspapers and books, creating a more unified user experience and expanding reach.

- Shared resources and infrastructure can lead to significant improvements in operational efficiency.

These synergistic opportunities are often overlooked, representing a significant potential for future growth and improved profitability.

Undervalued Assets and Hidden Growth Potential

News Corp possesses several undervalued assets and avenues for future growth that are often not fully reflected in its current market valuation.

Real Estate Holdings: A Significant, Often-Unrecognized Asset

News Corp owns significant real estate holdings, particularly in key media markets. These properties represent a substantial, often-underappreciated asset on the company's balance sheet. The potential for future asset appreciation is considerable, particularly as these properties are strategically located in high-demand areas. Further development or strategic sale of these assets could unlock significant value for shareholders. A thorough analysis of the real estate portfolio and its property valuation is needed to fully assess its contribution to News Corp's overall worth.

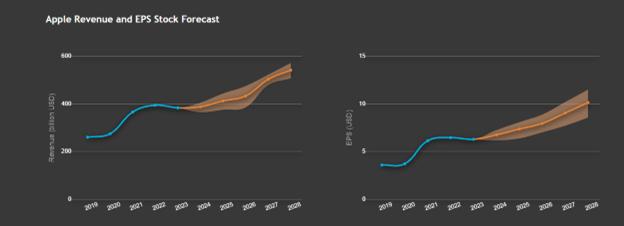

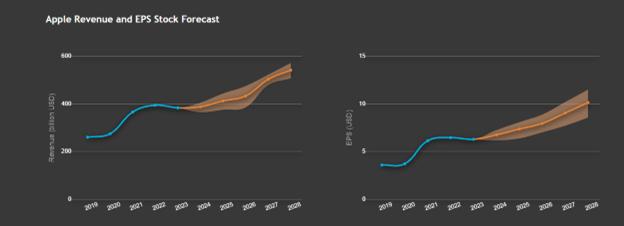

Digital Transformation and Future Growth: Adapting to the Evolving Landscape

News Corp is actively pursuing a robust digital strategy to capitalize on the growing digital media landscape. Initiatives include:

- Expansion of digital subscriptions: Leveraging the strength of its brands to attract paying subscribers to online content.

- Growth in online advertising revenue: Developing innovative online advertising models to tap into the growing digital advertising market.

- Exploration of new media initiatives: Investing in emerging technologies and platforms to maintain a competitive edge.

This ongoing digital transformation will be key to News Corp's future growth and securing its position in the increasingly competitive media world. The success of these initiatives could significantly increase online revenue and overall company valuation.

Addressing Concerns and Potential Risks

While News Corp presents a compelling investment case, it's crucial to acknowledge potential challenges and risks.

Competition in the Media Landscape: Navigating a Dynamic Environment

The media landscape is highly competitive, with established players and new entrants constantly vying for market share. Key competitors include other large media conglomerates and tech giants with significant digital footprints. News Corp's competitive advantages lie in its established brands, diversified portfolio, and ability to adapt to changing consumer preferences. A thorough analysis of the market competition and the competitive landscape is crucial to assess the company's long-term prospects. Understanding the strengths and strategies of its key competitors will be vital to evaluating News Corp's future performance.

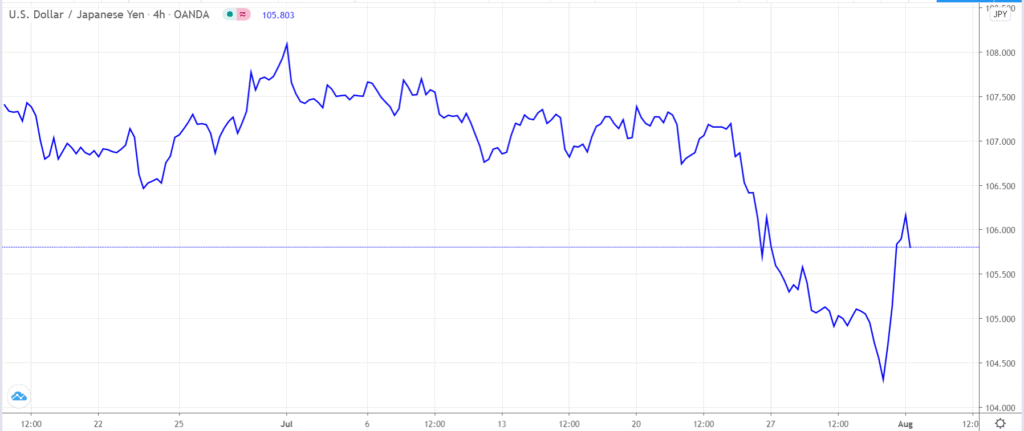

Economic Factors and Market Volatility: External Pressures

Macroeconomic factors, such as inflation and recessionary pressures, can significantly impact News Corp's performance. Advertising revenue, in particular, is sensitive to economic downturns. A comprehensive risk assessment considering market volatility and potential economic headwinds is necessary for a realistic evaluation of the investment potential.

Conclusion: Is News Corp Truly Undervalued? A Call to Action

News Corp, with its diversified portfolio, undervalued assets, and strategic digital initiatives, presents a compelling investment case. The potential for synergistic effects across its various segments and the significant value held within its real estate and digital holdings suggest that the current market valuation may not fully reflect its true worth. While potential risks exist, including market competition and macroeconomic factors, a thorough due diligence process is recommended to fully understand the long-term prospects. Given the compelling arguments presented, a deeper dive into News Corp's financials and future prospects is warranted. Is News Corp truly undervalued and underappreciated? The evidence suggests it might be. Consider researching News Corp stock and News Corp investment opportunities further.

Featured Posts

-

Terrapins Defeat Delaware In Thrilling 5 4 Softball Game

May 24, 2025

Terrapins Defeat Delaware In Thrilling 5 4 Softball Game

May 24, 2025 -

80 Millio Forintos Extrak Ezen A Porsche 911 Esen

May 24, 2025

80 Millio Forintos Extrak Ezen A Porsche 911 Esen

May 24, 2025 -

Dow Jones Index Cautious Climb Continues After Strong Pmi Data

May 24, 2025

Dow Jones Index Cautious Climb Continues After Strong Pmi Data

May 24, 2025 -

Nicki Chapman Shares Her Stunning Chiswick Garden Design

May 24, 2025

Nicki Chapman Shares Her Stunning Chiswick Garden Design

May 24, 2025 -

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025 -

Reputation Wreckage 17 Celebrities Whose Careers Ended Abruptly

May 24, 2025

Reputation Wreckage 17 Celebrities Whose Careers Ended Abruptly

May 24, 2025 -

Understanding Frank Sinatras Four Marriages

May 24, 2025

Understanding Frank Sinatras Four Marriages

May 24, 2025