Dow Jones Index: Cautious Climb Continues After Strong PMI Data

Table of Contents

Strong PMI Data Fuels Market Optimism

The Purchasing Managers' Index (PMI) is a key economic indicator reflecting the prevailing conditions in the manufacturing and services sectors. A PMI above 50 generally signals expansion, while a reading below 50 indicates contraction. The recent release of strong PMI data, encompassing both manufacturing and services PMI, has injected a significant dose of optimism into the market. These figures exceeded analysts' expectations, pointing towards robust economic activity and boosting investor confidence.

- Stronger-than-expected PMI numbers indicate robust economic activity. The higher-than-anticipated PMI readings suggest a healthy expansion in both the manufacturing and services sectors, fueling positive sentiment.

- Increased business confidence translates to higher investor sentiment. When businesses report positive growth and outlook, it naturally encourages investors to be more bullish about the overall economy and stock market.

- Positive PMI data often leads to increased investment in stocks, boosting the Dow Jones Index. The correlation between strong PMI data and a rising Dow Jones Index is well-documented, indicating a direct relationship between economic health and market performance.

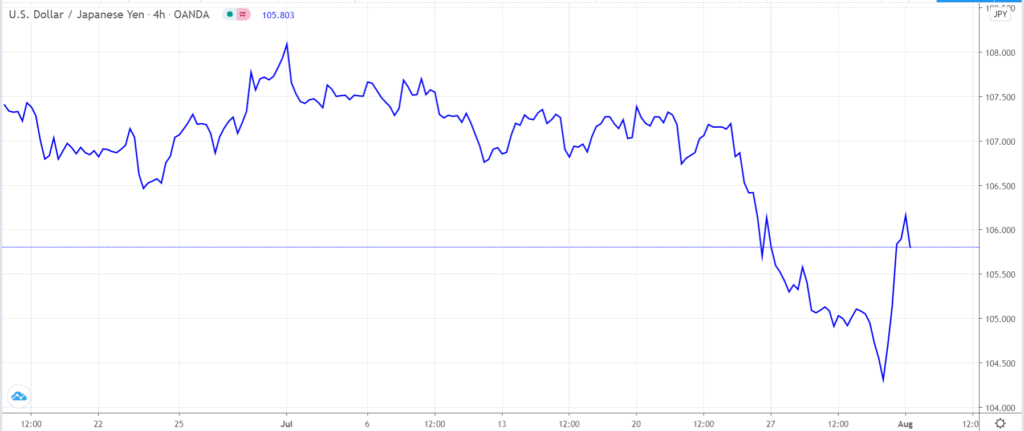

[Insert chart or graph showing correlation between PMI data and Dow Jones performance here]

Cautious Optimism: Factors Tempering the Dow's Rise

While the strong PMI data provides a positive backdrop, several factors are preventing a more significant surge in the Dow Jones Index. This cautious optimism reflects the inherent uncertainties in the global economy.

- Inflationary pressures and potential interest rate hikes: Persistent inflation remains a major concern, as central banks may respond with further interest rate hikes to curb price increases. This could dampen economic growth and negatively impact corporate profits, impacting the Dow Jones Index.

- Geopolitical uncertainties and their impact on global markets: Ongoing geopolitical tensions and conflicts introduce significant volatility into the global markets. These uncertainties can easily trigger market corrections and affect investor confidence.

- Concerns about potential supply chain disruptions: Lingering supply chain bottlenecks and disruptions can hinder business operations and constrain economic growth, potentially impacting the overall market performance, including the Dow Jones Index.

These factors contribute to the "cautious climb" observed in the Dow Jones Index, highlighting the need for a balanced perspective on market trends.

Analyzing Sector Performance within the Dow Jones Index

Analyzing the performance of individual sectors within the Dow Jones Index provides a more granular understanding of the current market dynamics. While the overall index shows a cautious climb, performance varies significantly across sectors.

- Performance of technology stocks: The technology sector, a significant component of the Dow Jones Index, has shown mixed performance recently, influenced by factors such as interest rate hikes and regulatory scrutiny.

- Performance of energy stocks: The energy sector has generally performed well, benefiting from higher oil prices. This sector's strength is a key contributor to the positive movement of the Dow Jones Index.

- Performance of financial stocks: The financial sector's performance is closely tied to interest rate movements and economic growth. Its recent performance has been relatively stable.

Significant disparities in sector performance reflect the diverse influences shaping the current market conditions.

Dow Jones Index Predictions and Future Outlook

Predicting the future performance of the Dow Jones Index is inherently challenging, given the complexities of the global economy. However, based on current economic indicators and geopolitical events, a cautiously optimistic outlook seems warranted.

- Short-term predictions for the Dow Jones Index: In the short term, a continued, albeit cautious, upward trend is possible, contingent on the continued strength of the economy and the absence of major negative surprises.

- Long-term implications of current market trends: The long-term implications depend on how effectively central banks manage inflation and the resolution of geopolitical tensions.

- Potential risks and opportunities for investors: Investors should be prepared for potential volatility and remain diversified to mitigate risks while seeking to capitalize on potential opportunities.

Several market analysts predict continued growth, but caution against excessive optimism, emphasizing the need for a balanced approach to investment strategies.

Conclusion: Navigating the Dow Jones Index's Cautious Ascent

The Dow Jones Index's recent cautious climb is a result of the positive influence of strong PMI data, counterbalanced by factors such as inflation, geopolitical uncertainties, and supply chain issues. Understanding these competing forces is crucial for navigating the current market. While the short-term outlook suggests continued growth, investors should remain vigilant and adopt a strategic approach to managing their portfolios. Stay informed about the ongoing performance of the Dow Jones Index and make informed investment decisions based on the latest market analysis. Track the Dow Jones Index regularly to capitalize on market opportunities and consult with a financial advisor for personalized strategies.

Featured Posts

-

Umfjoellun Um Nyju 100 Rafmagnsutgafu Porsche Macan

May 24, 2025

Umfjoellun Um Nyju 100 Rafmagnsutgafu Porsche Macan

May 24, 2025 -

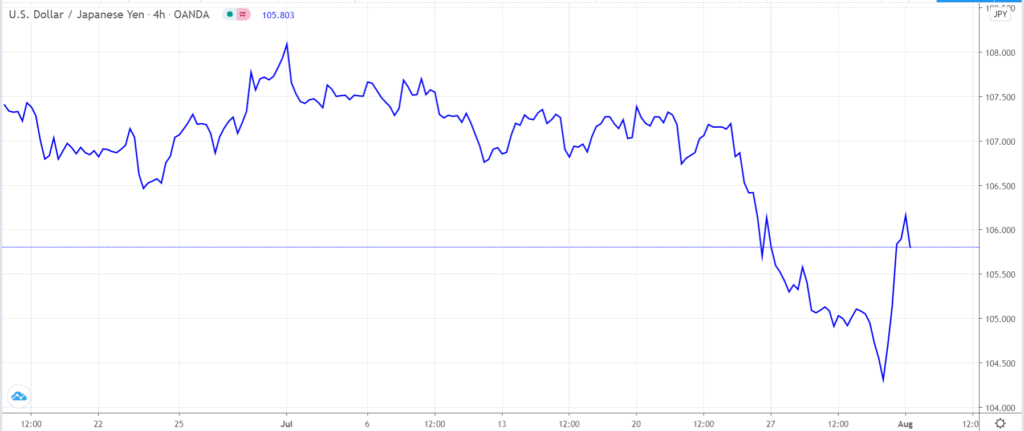

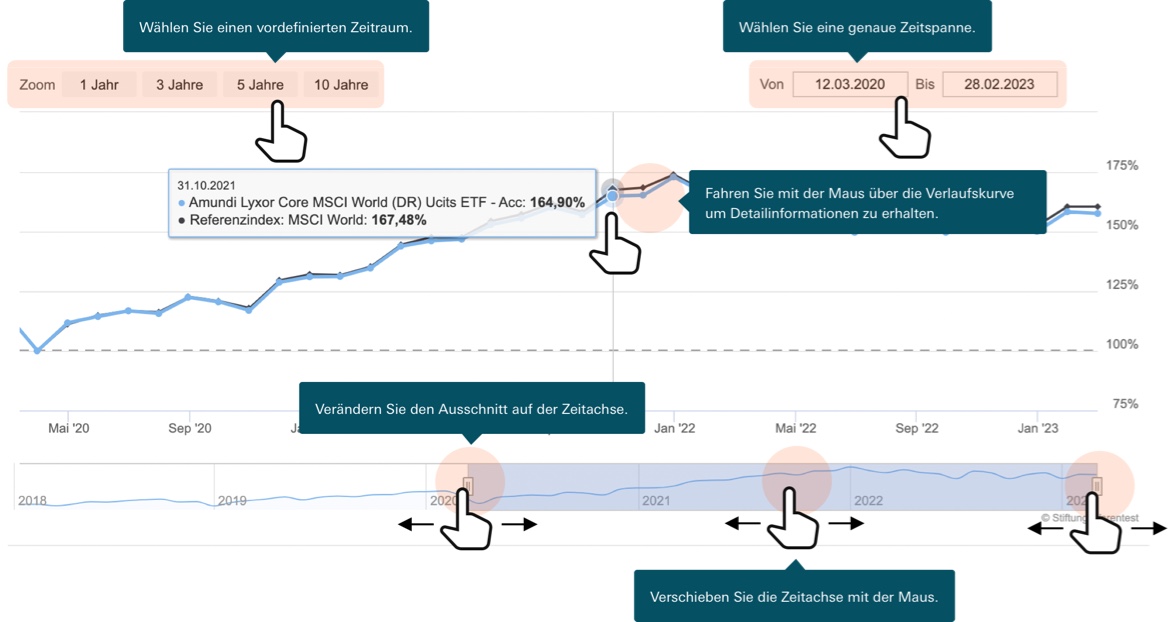

Amundi Djia Ucits Etf Distributing A Guide To Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf Distributing A Guide To Net Asset Value

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Tracking

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Tracking

May 24, 2025 -

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025 -

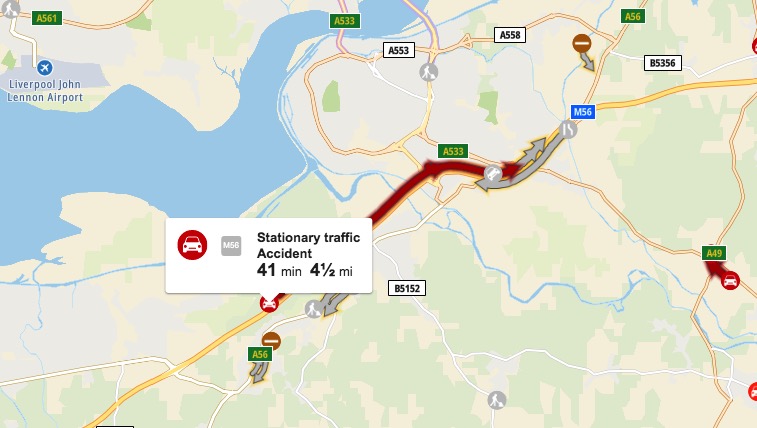

Accident On M56 Causes Major Delays Near Cheshire Deeside Border

May 24, 2025

Accident On M56 Causes Major Delays Near Cheshire Deeside Border

May 24, 2025

Latest Posts

-

Gryozy Lyubvi Ili Ilicha Otsenka Publikatsii V Gazete Trud

May 24, 2025

Gryozy Lyubvi Ili Ilicha Otsenka Publikatsii V Gazete Trud

May 24, 2025 -

Fedor Lavrov O Trillerakh I Imperatore Pavle I O Prirode Chelovecheskogo Interesa K Opasnosti

May 24, 2025

Fedor Lavrov O Trillerakh I Imperatore Pavle I O Prirode Chelovecheskogo Interesa K Opasnosti

May 24, 2025 -

Gryozy Lyubvi Ili Ilicha Gazeta Trud Kratkiy Analiz

May 24, 2025

Gryozy Lyubvi Ili Ilicha Gazeta Trud Kratkiy Analiz

May 24, 2025 -

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025 -

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 24, 2025

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 24, 2025