Nicolai Tangen: Managing Investments Amidst Trump's Trade Wars

Table of Contents

This article explores how Nicolai Tangen, the CEO of Norway's sovereign wealth fund (NBIM), managed the significant challenges posed by Donald Trump's trade wars. We examine his investment strategies, portfolio adjustments, and the overall impact of these geopolitical events on the fund's performance. Understanding Tangen's approach offers valuable insights into navigating turbulent global economic landscapes and provides a case study in effective investment management during periods of high uncertainty.

The Impact of Trump's Trade Wars on Global Markets

Donald Trump's trade policies, characterized by aggressive tariffs and escalating trade disputes, created a period of significant uncertainty in global markets. These policies disrupted established trade relationships and triggered widespread volatility.

- Increased market volatility: The unpredictable nature of Trump's trade actions led to heightened market volatility, making it challenging for investors to accurately predict market trends and asset prices. This volatility impacted various asset classes, from equities to bonds.

- Disruptions to global supply chains: Tariffs and trade restrictions disrupted established global supply chains, leading to increased costs for businesses and impacting the availability of goods. This had a ripple effect throughout many industries.

- Sector-specific impacts: Certain sectors were disproportionately affected. The technology sector faced significant challenges due to trade tensions between the US and China, while the agricultural sector suffered from retaliatory tariffs.

- Shifts in global trade relationships: Trump's trade policies forced businesses to reconsider their supply chains and global partnerships, leading to a restructuring of international trade relationships.

The World Trade Organization (WTO) reported a significant decline in global trade volume during this period, underscoring the detrimental impact of these trade wars on global economic growth.

Nicolai Tangen's Investment Strategy During the Trade Wars

Nicolai Tangen's investment philosophy centers on long-term value investing, emphasizing a diversified portfolio across various asset classes and geographical regions. This approach proved crucial in mitigating the risks associated with Trump's unpredictable trade policies.

- Long-term value investing: NBIM under Tangen's leadership maintains a focus on long-term value creation, minimizing short-term market fluctuations' influence on investment decisions.

- Diversification: A core tenet of Tangen’s strategy is diversification across asset classes (equities, fixed income, real estate, etc.) and geographical regions. This reduces the impact of any single event or sector on the overall portfolio performance.

- Active vs. passive management: NBIM employs a combination of active and passive management strategies. While a significant portion of the portfolio is passively managed, active management allows for strategic adjustments based on market conditions and emerging geopolitical risks, a crucial element during the Trump trade wars.

- Risk mitigation: Tangen prioritized risk mitigation through careful due diligence, stress testing, and scenario planning. This allowed NBIM to anticipate potential market downturns and make informed decisions to protect the portfolio.

For example, while precise details of NBIM’s internal portfolio adjustments remain confidential, reports suggest strategic shifts away from sectors heavily reliant on global trade to those deemed less vulnerable during periods of increased trade uncertainty.

Portfolio Adjustments and Risk Management

In response to the trade wars, NBIM, under Tangen's leadership, implemented several portfolio adjustments and risk management strategies.

- Shifting allocations: NBIM likely shifted allocations away from sectors directly impacted by tariffs and trade disputes towards sectors considered more resilient to these external pressures. This involved both reductions in holdings and increased investments in other, more stable areas.

- Hedging strategies: To mitigate currency and trade risks, NBIM may have employed hedging strategies such as using derivatives to offset potential losses from fluctuating exchange rates or trade-related uncertainties.

- ESG factors: NBIM's increased focus on Environmental, Social, and Governance (ESG) factors could have played a role in portfolio adjustments, favoring companies with strong ESG profiles that are better positioned for long-term sustainability, irrespective of short-term market volatility caused by trade disputes.

- Divestments: While not publicly confirmed, it’s plausible that NBIM divested from specific companies or sectors heavily exposed to the negative effects of Trump's trade policies.

These risk management strategies aimed to protect the fund's capital and ensure its long-term value, showcasing a proactive approach to navigating geopolitical instability.

The Performance of NBIM Under Tangen During This Period

Analyzing NBIM's performance during the Trump trade wars requires access to detailed internal data, which is not publicly released. However, by examining publicly available market data and NBIM’s overall strategic approach, we can draw some informed conclusions.

- Performance against benchmarks: While precise figures remain confidential, we can assume NBIM sought to maintain or exceed its benchmark returns, given its long-term investment horizon and focus on value creation.

- Successes and challenges: The unpredictable nature of the trade wars presented both successes and challenges. Diversification likely helped mitigate losses in certain sectors, while other investments might have faced headwinds.

- Impact on returns: Tangen’s strategies likely contributed to mitigating negative impacts from the trade wars, although the overall returns would have been influenced by many market factors beyond Tangen's direct control.

- Criticisms and controversies: Public scrutiny of NBIM's performance is common, and there might have been some criticism, but this was likely related to broader market performance rather than specifically to Tangen’s response to trade wars.

A comprehensive performance analysis would require access to NBIM’s internal data, which is not publicly accessible.

Conclusion

This article explored how Nicolai Tangen steered Norway's sovereign wealth fund through the turbulent waters of Trump's trade wars. His focus on long-term value investing, diversification, and proactive risk management proved crucial in navigating the uncertainties of this period. The analysis highlights the importance of adaptability and strategic decision-making in managing global investments during times of significant geopolitical upheaval. Tangen's approach serves as a valuable case study for other investment managers facing similar challenges in the volatile world of global finance.

Call to Action: Learn more about the strategies employed by leading investment managers like Nicolai Tangen to successfully navigate global economic uncertainties. Understanding these strategies is crucial for anyone interested in Nicolai Tangen’s approach to investment management in volatile markets, particularly when considering the impact of future geopolitical events on global investment portfolios.

Featured Posts

-

Ufc 314 Card Takes Hit Cancellation Of Popular Knockout Artists Fight

May 04, 2025

Ufc 314 Card Takes Hit Cancellation Of Popular Knockout Artists Fight

May 04, 2025 -

Remembering Ruth Buzzi A Legacy Of Laughter On Sesame Street And Laugh In

May 04, 2025

Remembering Ruth Buzzi A Legacy Of Laughter On Sesame Street And Laugh In

May 04, 2025 -

Transportation Department Announces May Workforce Reduction

May 04, 2025

Transportation Department Announces May Workforce Reduction

May 04, 2025 -

Electric Motor Independence Breaking Free From Chinas Dominance

May 04, 2025

Electric Motor Independence Breaking Free From Chinas Dominance

May 04, 2025 -

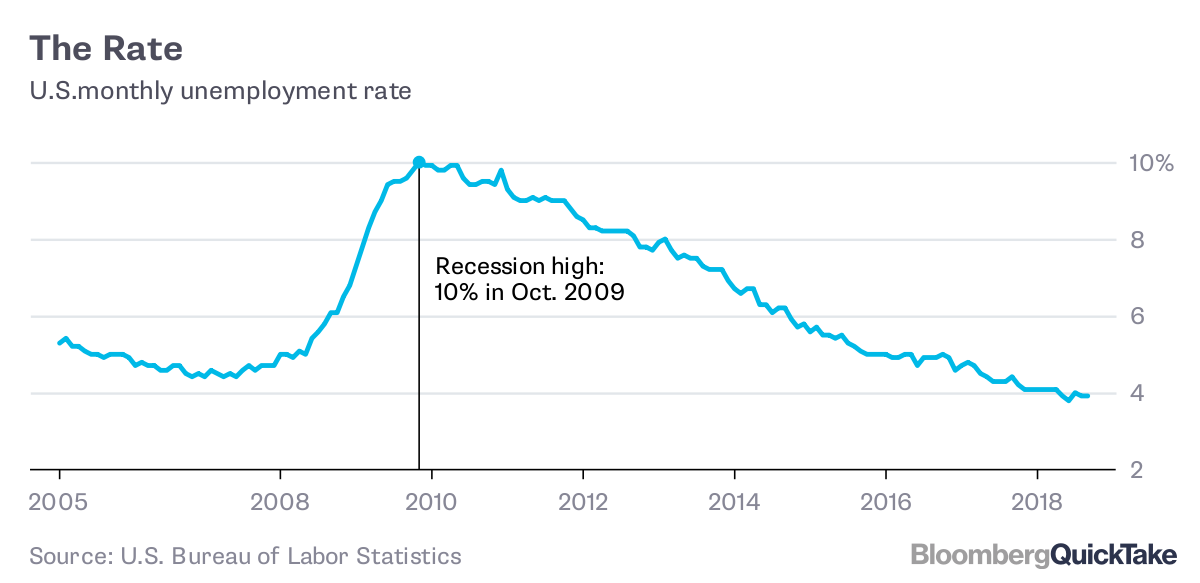

Analysis Of Aprils U S Jobs Report 177 000 Jobs 4 2 Unemployment

May 04, 2025

Analysis Of Aprils U S Jobs Report 177 000 Jobs 4 2 Unemployment

May 04, 2025

Latest Posts

-

James Burns Belfast Hospital Hammer Incident Ex Soldiers Motivation Explored

May 04, 2025

James Burns Belfast Hospital Hammer Incident Ex Soldiers Motivation Explored

May 04, 2025 -

Emma Stones Custom Louis Vuitton Sequin Dress At The 2025 Oscars

May 04, 2025

Emma Stones Custom Louis Vuitton Sequin Dress At The 2025 Oscars

May 04, 2025 -

Oscars 2025 Fashion Emma Stones Show Stopping Sequin Gown And Old Hollywood Hair

May 04, 2025

Oscars 2025 Fashion Emma Stones Show Stopping Sequin Gown And Old Hollywood Hair

May 04, 2025 -

Belfast Man Threatens Hospital With Hammer Ex Soldiers Violent Act

May 04, 2025

Belfast Man Threatens Hospital With Hammer Ex Soldiers Violent Act

May 04, 2025 -

Emma Stones Oscars 2025 Look A Bold Sequin Louis Vuitton Dress And Classic Hairstyle

May 04, 2025

Emma Stones Oscars 2025 Look A Bold Sequin Louis Vuitton Dress And Classic Hairstyle

May 04, 2025