No MEG Bid For Cenovus: CEO Emphasizes Internal Growth Strategy

Table of Contents

Cenovus' Internal Growth Strategy: A Detailed Look

Prioritizing Organic Expansion over Acquisitions

Cenovus has explicitly chosen organic growth as its primary path to success. This strategy prioritizes maximizing value from existing assets and operations rather than pursuing acquisitions. The company believes its current resources and operational capabilities provide a solid foundation for substantial and sustainable growth. This internal focus translates into several key initiatives:

- Increased Capital Expenditure in Existing Projects: Cenovus is significantly investing in its existing oil sands and upstream operations to enhance production and efficiency. This includes upgrading facilities and expanding production capacity in key areas.

- Technological Advancements for Improved Extraction Rates: The company is actively embracing technological advancements to optimize extraction rates and reduce operational costs. This includes implementing innovative techniques in reservoir management and production optimization.

- Streamlining Operational Processes to Reduce Costs and Boost Profitability: Cenovus is committed to streamlining its operational processes, focusing on efficiency gains and cost reduction measures to enhance profitability. This involves continuous improvement initiatives across all aspects of the business.

- Expansion into New, Promising Energy Sectors: While maintaining its core competency in oil and gas, Cenovus is exploring opportunities in renewable energy sources, aligning with broader sustainability goals and market trends.

Financial Strength and Stability Supporting Organic Growth

Cenovus' decision to reject the MEG Cenovus takeover is underpinned by its strong financial position. The company's robust financial health allows it to fund its ambitious internal growth initiatives without relying on external financing or potentially dilutive acquisitions. Key indicators of this strength include:

- Stable Cash Flow Projections: Cenovus projects stable and consistent cash flows, providing ample resources to fund its capital expenditure plans and other strategic objectives.

- Strong Credit Rating: The company boasts a strong credit rating, reflecting its financial stability and low risk profile, facilitating access to capital markets if needed.

- Reduced Debt Levels: Cenovus has actively pursued debt reduction strategies, strengthening its balance sheet and providing greater financial flexibility.

- Successful Debt Reduction Strategies: The company's successful implementation of debt reduction programs demonstrates its financial discipline and commitment to long-term stability.

Long-Term Vision for Sustainable Growth

Cenovus' strategic vision goes beyond purely financial metrics. The company is firmly committed to sustainable and responsible energy practices, integrating Environmental, Social, and Governance (ESG) factors into its decision-making process. This commitment is reflected in:

- Environmental, Social, and Governance (ESG) Initiatives: Cenovus is actively engaged in various ESG initiatives, aiming to minimize its environmental footprint and contribute positively to society.

- Carbon Reduction Targets and Strategies: The company has established clear carbon reduction targets and is implementing various strategies to achieve these goals.

- Investment in Renewable Energy Sources: Cenovus is actively exploring and investing in renewable energy sources to diversify its portfolio and reduce its carbon intensity.

- Commitment to Community Development and Stakeholder Engagement: Cenovus is committed to building strong relationships with local communities and engaging actively with its stakeholders.

Analysis of the Rejected MEG Bid and its Implications

Why Cenovus Rejected the MEG Bid

The rejection of the MEG bid stems from several factors. Cenovus' leadership deemed the offer price too low, undervaluing the company's significant assets and future potential. Furthermore, there were fundamental differences in corporate strategies and long-term visions between the two companies. A merger would have presented significant integration risks and potentially disrupted Cenovus' successful internal growth trajectory.

- MEG's Offer Price Considered Too Low: Cenovus management believed the MEG bid significantly underestimated the company's intrinsic value and future growth prospects.

- Differences in Corporate Strategies and Long-Term Visions: The companies' divergent strategic approaches and long-term visions created incompatibility, making a merger potentially disruptive.

- Potential Risks Associated with the Acquisition: Cenovus assessed the potential risks and challenges associated with the acquisition and concluded that they outweighed the potential benefits.

Market Reaction and Future Outlook

The market reacted [insert market reaction details - e.g., positively/negatively] to the announcement of the rejected MEG Cenovus takeover bid. [Insert details about stock price fluctuations]. Analysts generally [insert analyst opinions - e.g., support/question] Cenovus' decision, citing the company's strong financial position and the potential risks associated with the acquisition. While the immediate future might involve continued focus on organic growth, the possibility of future partnerships or acquisitions cannot be entirely ruled out.

- Stock Price Fluctuations Following the Announcement: Detail the impact of the announcement on Cenovus' stock price.

- Analyst Opinions and Predictions: Summarize the reactions and predictions from financial analysts.

- Potential Future Acquisition Targets or Partnerships: Speculate on potential future actions by Cenovus, considering market conditions and strategic goals.

Conclusion: Cenovus’ Commitment to Independent Growth

Cenovus' rejection of the MEG bid underscores its unwavering commitment to its internal growth strategy. The company's strong financial position, clear long-term vision, and commitment to sustainable practices provide a solid foundation for achieving its ambitious goals independently. The reasons for rejecting the MEG Cenovus takeover are clear: the undervaluation of the company and the potential disruption of its successful organic growth strategy.

Stay informed about Cenovus' progress as it implements its strategic plan for independent growth. Follow future developments on the Cenovus MEG bid situation and related news. Learn more about Cenovus's long-term vision and commitment to sustainable energy. The Cenovus acquisition story is far from over, and understanding their independent growth strategy is key to understanding their future.

Featured Posts

-

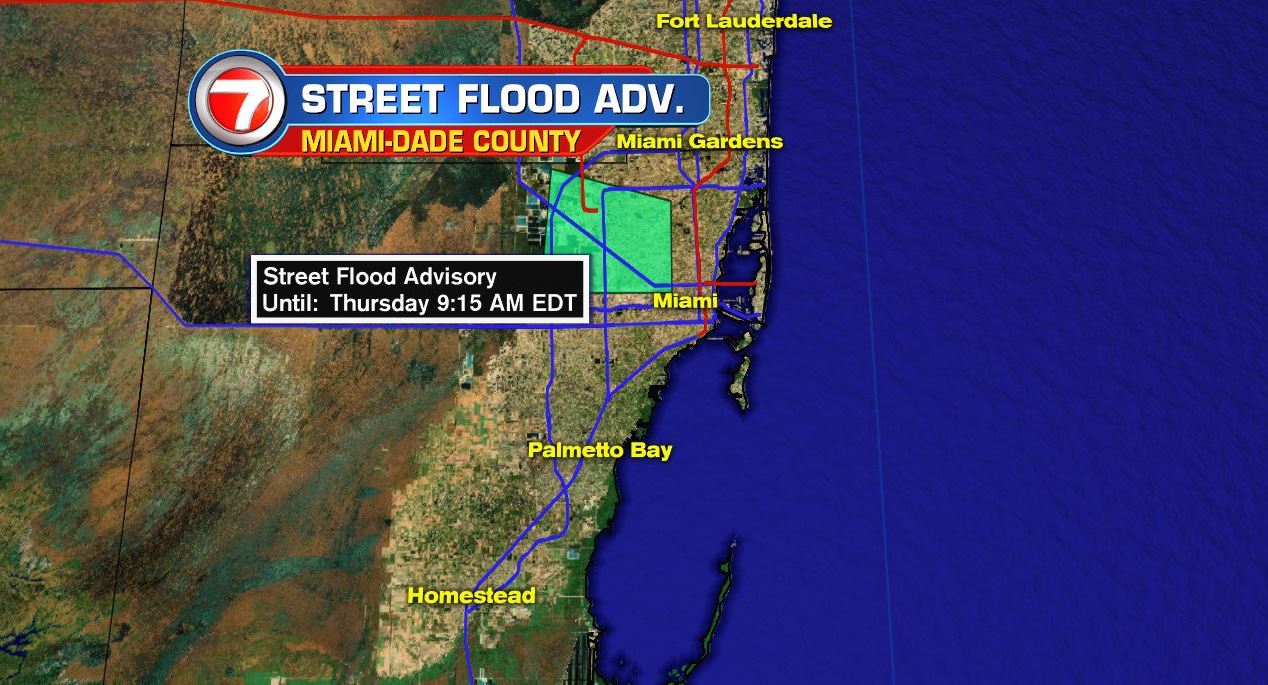

Miami Valley Flood Advisory What You Need To Know About The Severe Weather

May 25, 2025

Miami Valley Flood Advisory What You Need To Know About The Severe Weather

May 25, 2025 -

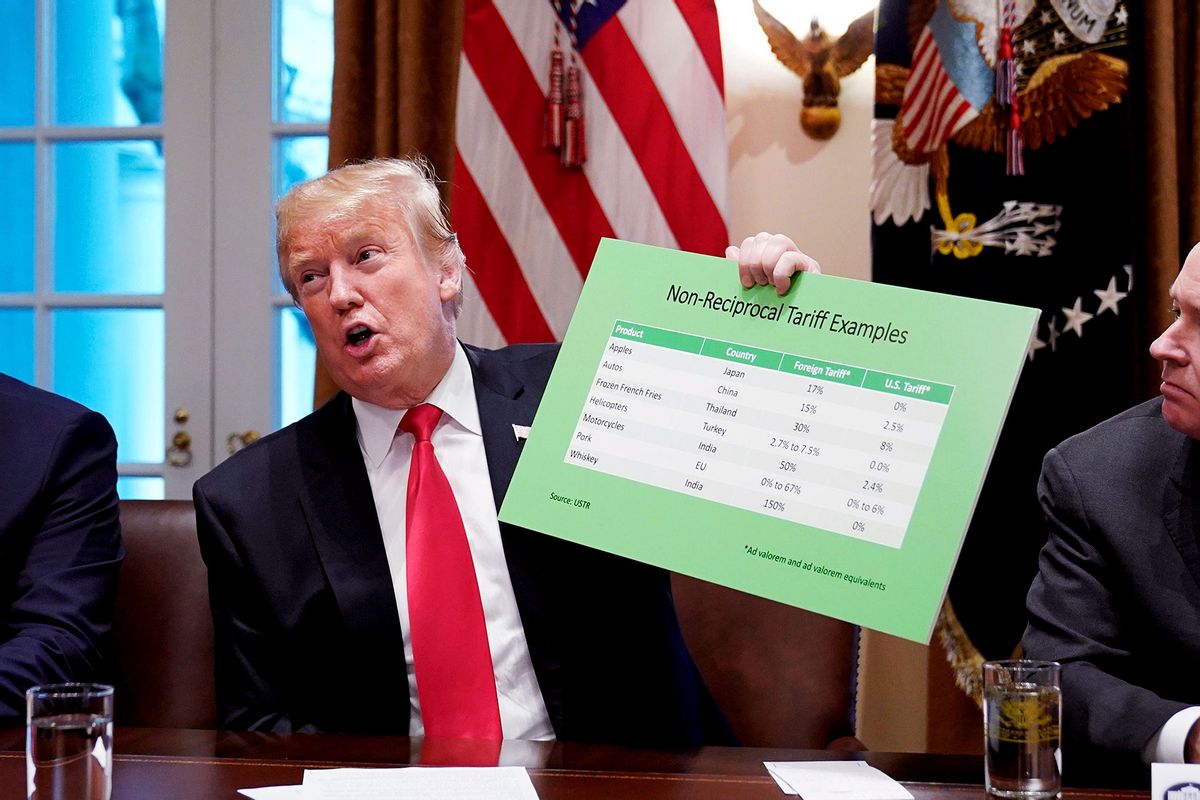

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stocks

May 25, 2025

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stocks

May 25, 2025 -

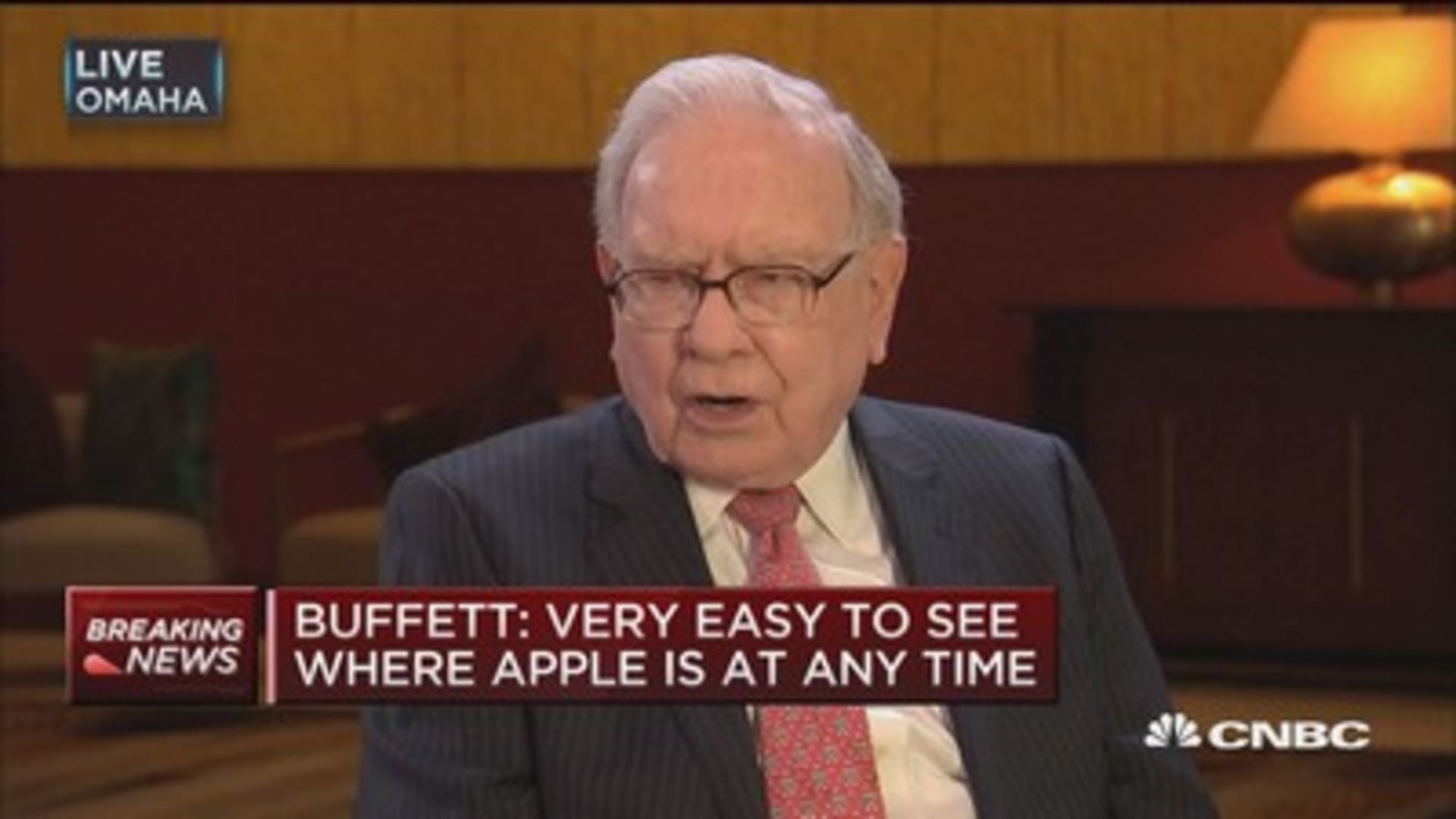

Is Apple Vulnerable Analyzing The Impact Of Tariffs On Buffetts Holdings

May 25, 2025

Is Apple Vulnerable Analyzing The Impact Of Tariffs On Buffetts Holdings

May 25, 2025 -

Car Overturns On M56 Motorway Crash Causes Casualties

May 25, 2025

Car Overturns On M56 Motorway Crash Causes Casualties

May 25, 2025 -

Amerikaanse Beurs Daalt Aex Blijft Stijgen

May 25, 2025

Amerikaanse Beurs Daalt Aex Blijft Stijgen

May 25, 2025

Latest Posts

-

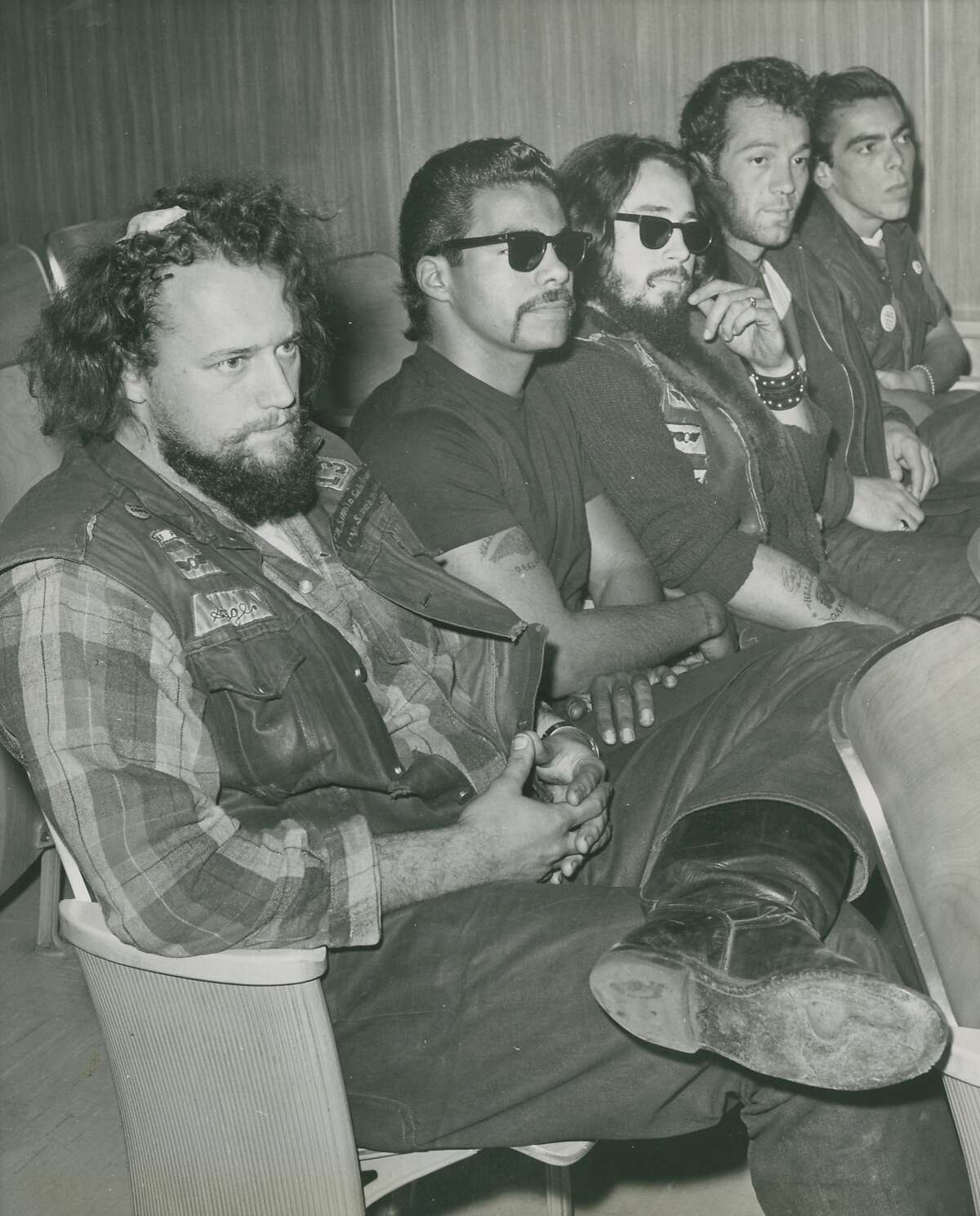

Memorial Service For Hells Angels Member Craig Mc Ilquham Held Sunday

May 25, 2025

Memorial Service For Hells Angels Member Craig Mc Ilquham Held Sunday

May 25, 2025 -

Hells Angels Motorcycle Club Mourns Member Killed In Crash

May 25, 2025

Hells Angels Motorcycle Club Mourns Member Killed In Crash

May 25, 2025 -

Hells Angels Craig Mc Ilquham Memorial Service Held Sunday

May 25, 2025

Hells Angels Craig Mc Ilquham Memorial Service Held Sunday

May 25, 2025 -

Hells Angels Pay Respects At Fallen Brothers Funeral

May 25, 2025

Hells Angels Pay Respects At Fallen Brothers Funeral

May 25, 2025 -

Sunday Memorial Service Honors Late Hells Angels Craig Mc Ilquham

May 25, 2025

Sunday Memorial Service Honors Late Hells Angels Craig Mc Ilquham

May 25, 2025