Norwegian Cruise Line Holdings Ltd. (NCLH): Earnings Beat Fuels Stock Surge

Table of Contents

Stronger-than-Expected Earnings Results

The [Quarter] earnings report revealed significantly stronger-than-anticipated performance across key metrics. This positive news fueled the NCLH stock surge and reinvigorated investor confidence in the cruise sector's recovery.

-

NCLH Revenue Exceeded Expectations: Revenue figures surpassed analyst predictions by [Insert Percentage]%, demonstrating robust demand for NCLH cruises. This is a substantial improvement compared to the same period last year and indicates a strong rebound for the company.

-

Improved Occupancy Rates Boosted Profitability: NCLH reported higher-than-anticipated occupancy rates, averaging [Insert Percentage]%. This directly translated into improved profitability, showcasing the company's success in filling its ships and maximizing revenue generation.

-

Strong Booking Trends for Upcoming Quarters: The company also highlighted robust booking trends for the remaining quarters of [Year], further strengthening investor optimism. Forward bookings are significantly up compared to the same period last year, suggesting continued demand for NCLH cruises.

-

Enhanced Profit Margins and EPS: The combination of increased revenue and improved occupancy rates led to significantly better-than-expected profit margins and earnings per share (EPS). This positive financial performance is a crucial driver of the NCLH stock surge.

-

Positive Comparison to Previous Quarters and Industry Averages: Compared to the previous quarter and to industry averages, NCLH's performance stands out, showcasing their effective recovery strategies and market positioning.

Factors Contributing to the Earnings Beat

Several factors contributed to NCLH's impressive earnings beat and the subsequent NCLH stock price increase. These positive trends suggest a sustainable path to recovery for the company.

-

Pent-Up Demand Fuels Bookings: The significant pent-up demand for leisure travel following the pandemic continues to be a major driver of increased bookings. Consumers are eager to embark on cruises, benefiting companies like NCLH.

-

Effective Pricing Strategies Maximize Revenue: NCLH implemented successful pricing strategies, balancing affordability with profitability. This allowed them to attract a broad customer base while maximizing revenue generation.

-

Operational Efficiency and Cost-Cutting Measures: The company focused on enhancing operational efficiency and implementing cost-cutting measures, contributing to improved profit margins. This strategic approach proved instrumental in navigating the challenges of the post-pandemic environment.

-

Impact of External Factors (Fuel Prices, etc.): While fluctuating fuel prices and other external factors pose challenges, NCLH appears to have successfully mitigated their negative impact through hedging strategies and operational adjustments.

Impact on NCLH Stock Price and Investor Sentiment

The release of the better-than-expected earnings report had an immediate and significant impact on the NCLH stock price.

-

Immediate Stock Price Surge: The NCLH stock price experienced a substantial increase following the earnings announcement, reflecting the positive market reaction to the strong financial results.

-

Positive Investor Sentiment: Investor sentiment towards NCLH significantly improved, with increased confidence in the company's future prospects. This positive outlook is a key factor driving further stock price growth.

-

Analyst Ratings and Investment Recommendations: Many analysts upgraded their ratings and investment recommendations for NCLH stock, further contributing to the surge. These positive assessments reinforce the strong market belief in the company's recovery and future growth.

-

Short-Term and Long-Term Price Predictions: While predicting future stock prices is inherently uncertain, the strong earnings report suggests a positive outlook for both the short-term and long-term price of NCLH stock. Analysts' predictions vary but generally show optimism.

Risks and Challenges Facing NCLH

Despite the positive news, NCLH faces several potential risks and challenges:

-

Economic Recession Risk: A potential global economic slowdown could dampen consumer spending on leisure travel, impacting demand for cruises.

-

Fluctuating Fuel Costs: The volatility of fuel prices remains a considerable concern, potentially affecting profitability.

-

Intense Competition in the Cruise Industry: The cruise industry is competitive, with other major players vying for market share.

-

Geopolitical Risks and Travel Restrictions: Geopolitical instability and unexpected travel restrictions could disrupt operations and negatively impact demand.

Conclusion

Norwegian Cruise Line Holdings Ltd. (NCLH) delivered impressive [Quarter] earnings, significantly surpassing expectations and fueling a substantial surge in its stock price. This positive performance stems from strong booking trends, effective pricing strategies, and improved operational efficiency. While risks such as economic uncertainty and fuel price volatility exist, the company's strong performance signals a promising recovery. The impressive earnings beat makes NCLH stock an intriguing prospect for investors interested in the cruise industry recovery. Continue to monitor NCLH stock and its performance closely for potential investment opportunities. Learn more about NCLH stock and its future prospects by [link to further resources/analysis].

Featured Posts

-

Verdeelstation Oostwold Bewoners Teleurgesteld Over Onafwendbare Komst

May 01, 2025

Verdeelstation Oostwold Bewoners Teleurgesteld Over Onafwendbare Komst

May 01, 2025 -

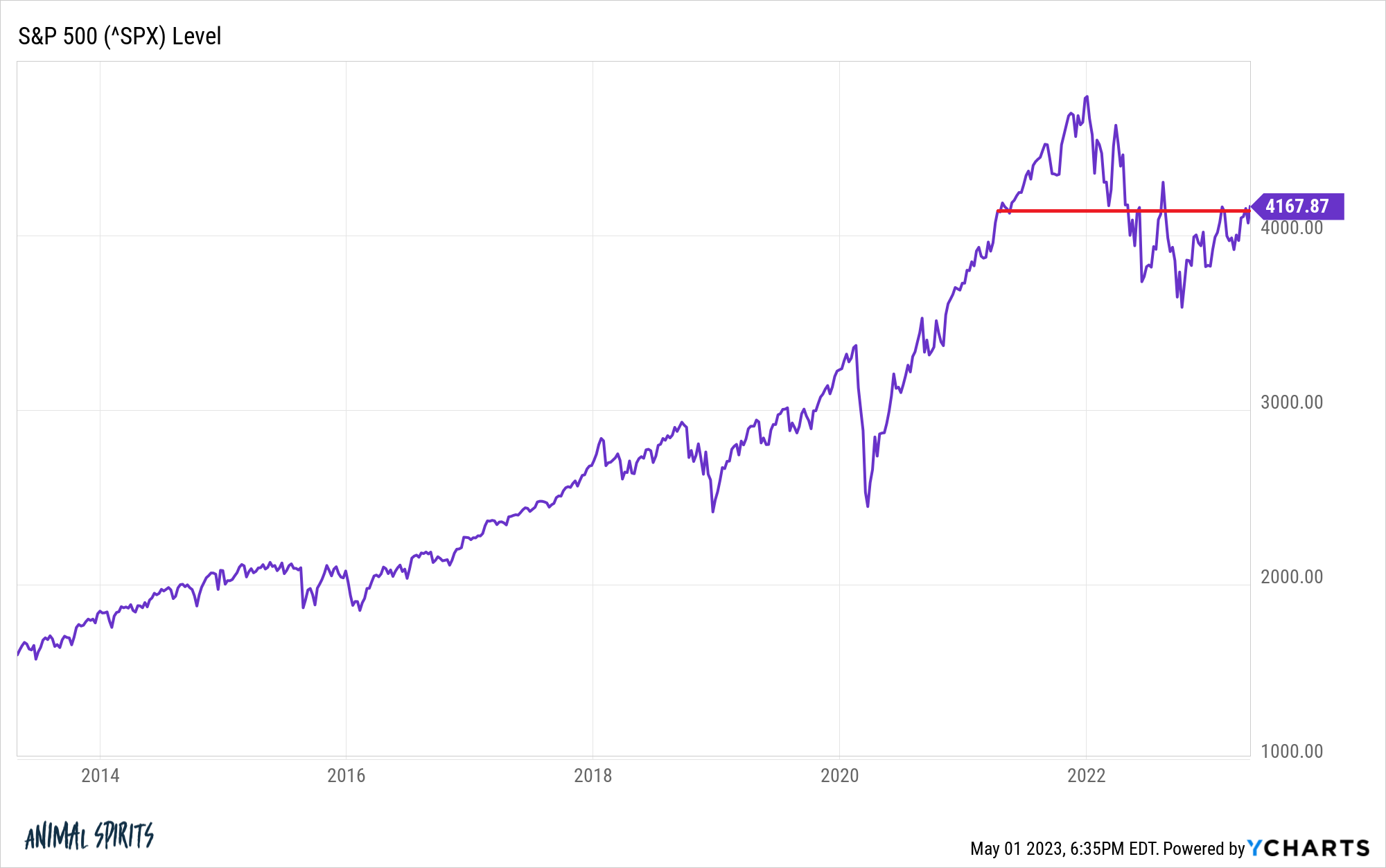

Addressing High Stock Market Valuations Bof As View For Investors

May 01, 2025

Addressing High Stock Market Valuations Bof As View For Investors

May 01, 2025 -

West Bank Raid Leads To Palestinian Journalists Arrest

May 01, 2025

West Bank Raid Leads To Palestinian Journalists Arrest

May 01, 2025 -

Kentucky Facing Storm Damage Assessment Backlog Causes And Solutions

May 01, 2025

Kentucky Facing Storm Damage Assessment Backlog Causes And Solutions

May 01, 2025 -

Dallas Icon Dies At 100 Remembering A Life Well Lived

May 01, 2025

Dallas Icon Dies At 100 Remembering A Life Well Lived

May 01, 2025

Latest Posts

-

Louisville Residents How To Report Storm Damage And Debris

May 01, 2025

Louisville Residents How To Report Storm Damage And Debris

May 01, 2025 -

Severe Weather Cleanup Louisville Launches Debris Pickup Program

May 01, 2025

Severe Weather Cleanup Louisville Launches Debris Pickup Program

May 01, 2025 -

Louisvilles River Road Closure A Crisis For Local Restaurants

May 01, 2025

Louisvilles River Road Closure A Crisis For Local Restaurants

May 01, 2025 -

Louisville Declares State Of Emergency Tornado Aftermath And Major Flooding Expected

May 01, 2025

Louisville Declares State Of Emergency Tornado Aftermath And Major Flooding Expected

May 01, 2025 -

Louisville Storm Debris Pickup Submit Your Request Now

May 01, 2025

Louisville Storm Debris Pickup Submit Your Request Now

May 01, 2025