Oil Market News And Analysis: May 16 Update

Table of Contents

Global Crude Oil Price Movements

May 16th witnessed notable fluctuations in global crude oil prices. Both benchmark crudes, Brent and West Texas Intermediate (WTI), experienced price swings reflecting the complex interplay of supply and demand factors. Analyzing crude oil price movements requires careful consideration of various influencing factors such as economic indicators and geopolitical stability.

- Brent Crude: Opened at $76.50 per barrel, reached a high of $77.20, and closed at $76.85, representing a 0.5% increase compared to the previous day's closing price. This slight increase indicates a degree of market optimism.

- WTI Crude: Started the day at $72.80 per barrel, peaked at $73.50, and settled at $73.20, showing a similar 0.6% rise compared to the previous day's close.

- Price Volatility: Despite the overall positive movement, intraday price volatility remained relatively high, suggesting continued uncertainty within the oil market. This volatility reflects the sensitivity of oil prices to unexpected news and global events. Oil price forecast models are struggling to predict the next major shift due to this ongoing uncertainty.

OPEC+ Production Decisions and Impact

OPEC+ decisions continue to be a major driver of oil price movements. The cartel's production strategies significantly influence global crude oil supply, thereby impacting price stability and overall market dynamics. Understanding OPEC+'s actions is critical for accurate oil price analysis.

- OPEC+ Meeting Summary: While no formal OPEC+ meeting took place on May 16th, market participants closely monitored statements from key members, particularly Saudi Arabia and Russia, regarding their commitment to existing production quotas. Any hint of a shift in production strategies would send ripples through the market.

- Production Adjustments: Current production levels appear to be largely maintained, but the potential for future adjustments remains a key factor in market sentiment. Close monitoring of the official statements and any indirect communications regarding potential production cuts or increases are crucial.

- Geopolitical Influence: Geopolitical tensions, particularly those involving key oil-producing nations, continue to heavily influence OPEC+ decisions. This adds another layer of complexity to oil price forecasting. Any escalation of tensions between major players in the energy sector could lead to further disruptions.

Oil Demand Outlook and Economic Indicators

Global oil demand is another pivotal factor shaping oil prices. The strength of the global economy, industrial activity, and transportation fuel consumption levels significantly influence the overall demand for crude oil. Accurate oil demand forecasts are essential for effective market analysis.

- Economic Growth: Positive economic growth in major consuming regions, such as the US, China, and Europe, generally supports higher oil demand. However, concerns about a potential global economic slowdown continue to cast a shadow over future demand projections.

- Fuel Consumption Trends: Data on gasoline, diesel, and jet fuel consumption provide valuable insights into current and projected oil demand. Seasonality also plays a vital role, with summer months usually leading to increased fuel consumption.

- Refinery Activity: Increased refinery activity signals higher demand for crude oil as refiners process it into various petroleum products. Monitoring refinery utilization rates offers additional insights into the immediate demand for crude oil.

Geopolitical Factors and Market Uncertainty

Geopolitical instability and various international relations significantly impact oil prices. Sanctions, conflicts, and political uncertainties in key oil-producing or consuming regions contribute to price volatility and overall market risk. Assessing these risks is fundamental to informed trading decisions.

- Ongoing Conflicts: Ongoing geopolitical conflicts continue to exert pressure on global oil supplies, impacting overall market stability. Any escalation in these conflicts can lead to significant price spikes.

- Supply Chain Disruptions: Geopolitical events often disrupt global supply chains, leading to uncertainty in crude oil availability. This adds to existing volatility and reinforces the importance of risk management.

- Energy Security Concerns: Geopolitical tensions often raise concerns about energy security, prompting countries to diversify their energy sources and increase strategic reserves. This factor plays a substantial role in influencing long-term market dynamics.

Conclusion

The oil market on May 16th reflected a complex interplay of factors, including relatively stable OPEC+ production levels, a moderately positive outlook for global oil demand despite underlying economic uncertainties, and continued geopolitical risk. Brent and WTI crude prices experienced modest increases, reflecting a degree of market optimism but with persistent intraday volatility. To understand the intricacies of this dynamic market, staying updated on the latest news and analyses is crucial.

Call to Action: Stay updated on the latest oil market news and analysis by regularly checking back for our daily oil price updates. Follow us for continuous coverage of the oil market and gain valuable insights into the ever-evolving world of oil market news and analysis.

Featured Posts

-

How To Book An Uber In Mumbai With Your Pet

May 17, 2025

How To Book An Uber In Mumbai With Your Pet

May 17, 2025 -

Navigating Student Loan Debt While Buying A House

May 17, 2025

Navigating Student Loan Debt While Buying A House

May 17, 2025 -

Delinquent Student Loans New Government Enforcement And Borrower Protections

May 17, 2025

Delinquent Student Loans New Government Enforcement And Borrower Protections

May 17, 2025 -

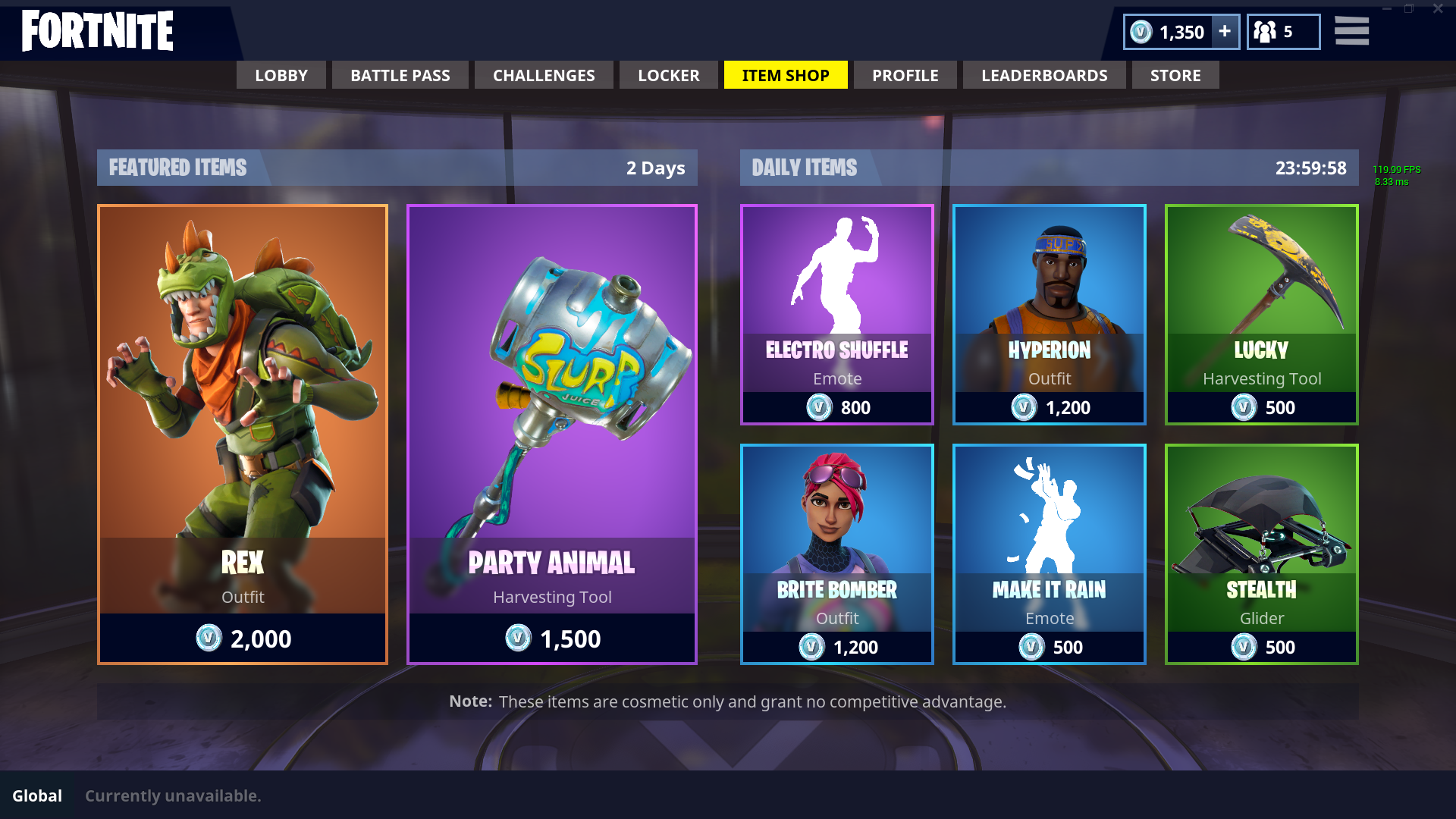

Improved Item Discovery Fortnite Item Shops New Feature

May 17, 2025

Improved Item Discovery Fortnite Item Shops New Feature

May 17, 2025 -

E Scooter On Auckland Southern Motorway Dashcam Footage Shows Risky Ride

May 17, 2025

E Scooter On Auckland Southern Motorway Dashcam Footage Shows Risky Ride

May 17, 2025