Oil Supply Shocks: How The Airline Industry Is Feeling The Pinch

Table of Contents

Soaring Jet Fuel Costs: The Primary Impact

The most immediate and impactful consequence of oil supply shocks is the sharp increase in jet fuel costs. This surge has a cascading effect, impacting nearly every aspect of airline operations.

Direct Impact on Operating Costs

Rising fuel prices translate directly into higher operating costs, significantly eroding profit margins. Airlines, many of whom are still recovering from the pandemic's financial strain, are finding their already tight budgets stretched even thinner.

- Increased fuel hedging costs: To mitigate the risk of fluctuating fuel prices, airlines utilize hedging strategies, but the current volatility makes even these protective measures costly and less effective.

- Reduced profitability on existing routes: Many previously profitable routes are now becoming financially unsustainable due to the increased fuel burden.

- Pressure to increase ticket prices: Airlines are under immense pressure to raise ticket prices to offset the soaring fuel costs, potentially impacting passenger demand.

- Difficulty in absorbing unexpected price surges: The unpredictable nature of oil supply shocks makes it challenging for airlines to accurately forecast and budget for fuel expenses, leading to financial instability.

Fuel Efficiency Measures and Technological Advancements

Faced with these unprecedented challenges, airlines are aggressively pursuing strategies to minimize fuel consumption and enhance operational efficiency.

- Investing in more fuel-efficient aircraft: Airlines are increasingly investing in newer aircraft models designed for better fuel economy, a long-term strategy requiring significant capital investment.

- Optimizing flight routes and schedules for fuel savings: Advanced flight planning software and sophisticated route optimization techniques are being employed to minimize fuel burn during flights.

- Implementing advanced flight planning software: Technology plays a crucial role in reducing fuel consumption through precise route planning, optimized speeds, and efficient weight management.

- Exploring alternative fuels (sustainable aviation fuel - SAF): The industry is actively researching and investing in sustainable aviation fuels (SAF) as a long-term solution to reduce reliance on traditional fossil fuels and mitigate carbon emissions. This is a crucial step toward both environmental responsibility and fuel cost reduction in the longer term.

Impact on Airline Routes and Network Planning

The economic realities of significantly higher fuel costs are forcing airlines to re-evaluate their route networks and operational strategies.

Route Optimization and Potential Cancellations

Higher fuel prices make less profitable routes unsustainable, forcing airlines to make difficult decisions regarding their network.

- Airlines may consolidate routes or reduce frequencies: Less lucrative routes may see reduced flight frequencies or complete cancellations to minimize losses.

- Potential cancellation of less lucrative long-haul flights: Long-haul flights, which consume significantly more fuel, are particularly vulnerable to cancellation or suspension.

- Shift towards shorter, more fuel-efficient routes: Airlines are likely to favor shorter, domestic flights that consume less fuel and are less susceptible to price volatility.

- Increased focus on domestic travel: Domestic travel is expected to see increased demand as international travel becomes more expensive.

Strategic Partnerships and Alliances

To better navigate the challenges posed by oil supply shocks, airlines are increasingly seeking collaboration and strategic partnerships.

- Code-sharing agreements to expand networks efficiently: Code-sharing agreements allow airlines to expand their reach without the financial burden of operating additional flights themselves.

- Joint ventures for better fuel procurement deals: Joint ventures enable airlines to negotiate better fuel prices through bulk purchasing and leverage economies of scale.

- Enhanced collaboration on maintenance and technology: Sharing resources and expertise in maintenance and technology can help reduce operational costs and improve fuel efficiency.

The Ripple Effect: Impacts on Passengers and the Wider Economy

The impact of oil supply shocks on the airline industry extends far beyond the airlines themselves, affecting passengers and the broader economy.

Increased Ticket Prices for Passengers

Airlines will likely pass a significant portion of increased fuel costs onto passengers, leading to higher ticket prices.

- Reduced affordability of air travel for some consumers: Higher airfares will reduce the affordability of air travel, particularly for budget-conscious travelers.

- Potential decrease in passenger numbers: Increased ticket prices could lead to a decrease in overall passenger numbers, impacting airline revenues further.

- Shift in demand towards budget airlines: Budget airlines, often with more efficient operations and lower overhead costs, may see increased demand as consumers seek more affordable travel options.

Economic Consequences

The increased cost of air travel has broader economic consequences, impacting tourism, trade, and overall economic activity.

- Reduced international trade due to higher transportation costs: Higher airfreight costs can hinder international trade, impacting businesses and supply chains.

- Negative impact on tourism sectors dependent on air travel: The tourism industry, heavily reliant on air travel, will likely suffer due to reduced passenger numbers and higher travel costs.

- Potential job losses within the airline industry and related sectors: Decreased profitability and potential route cancellations could lead to job losses within the airline industry and related support sectors.

Conclusion

Oil supply shocks present a formidable challenge to the airline industry. The sharp increase in jet fuel prices is significantly impacting operating costs, compelling airlines to adapt through route adjustments, fuel efficiency improvements, and, unfortunately, increased ticket prices. The ripple effects are substantial, affecting passengers, the wider economy, and global trade. Staying informed about the evolving impact of oil supply shocks on air travel is crucial for consumers, businesses, and investors alike. Understanding these dynamics is key to navigating the challenges and opportunities presented by fluctuating oil prices and their effect on air travel. Continue to monitor the situation and adapt your travel plans and investment strategies accordingly to best manage the implications of oil supply shocks on the aviation industry.

Featured Posts

-

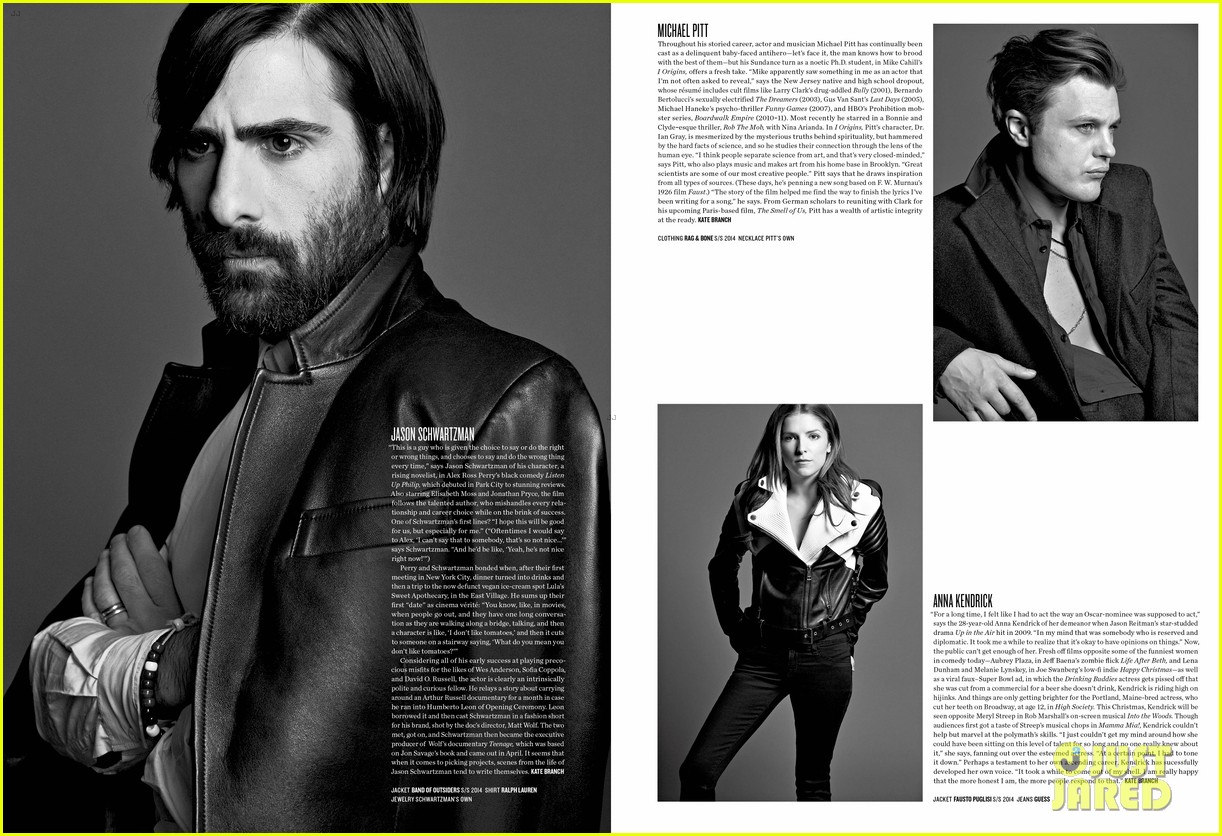

Lively And Kendrick A Hollywood Reunion Amidst Past Feud Speculation

May 04, 2025

Lively And Kendrick A Hollywood Reunion Amidst Past Feud Speculation

May 04, 2025 -

Kivinin Kabugu Yenir Mi Oence Bilmeniz Gerekenler

May 04, 2025

Kivinin Kabugu Yenir Mi Oence Bilmeniz Gerekenler

May 04, 2025 -

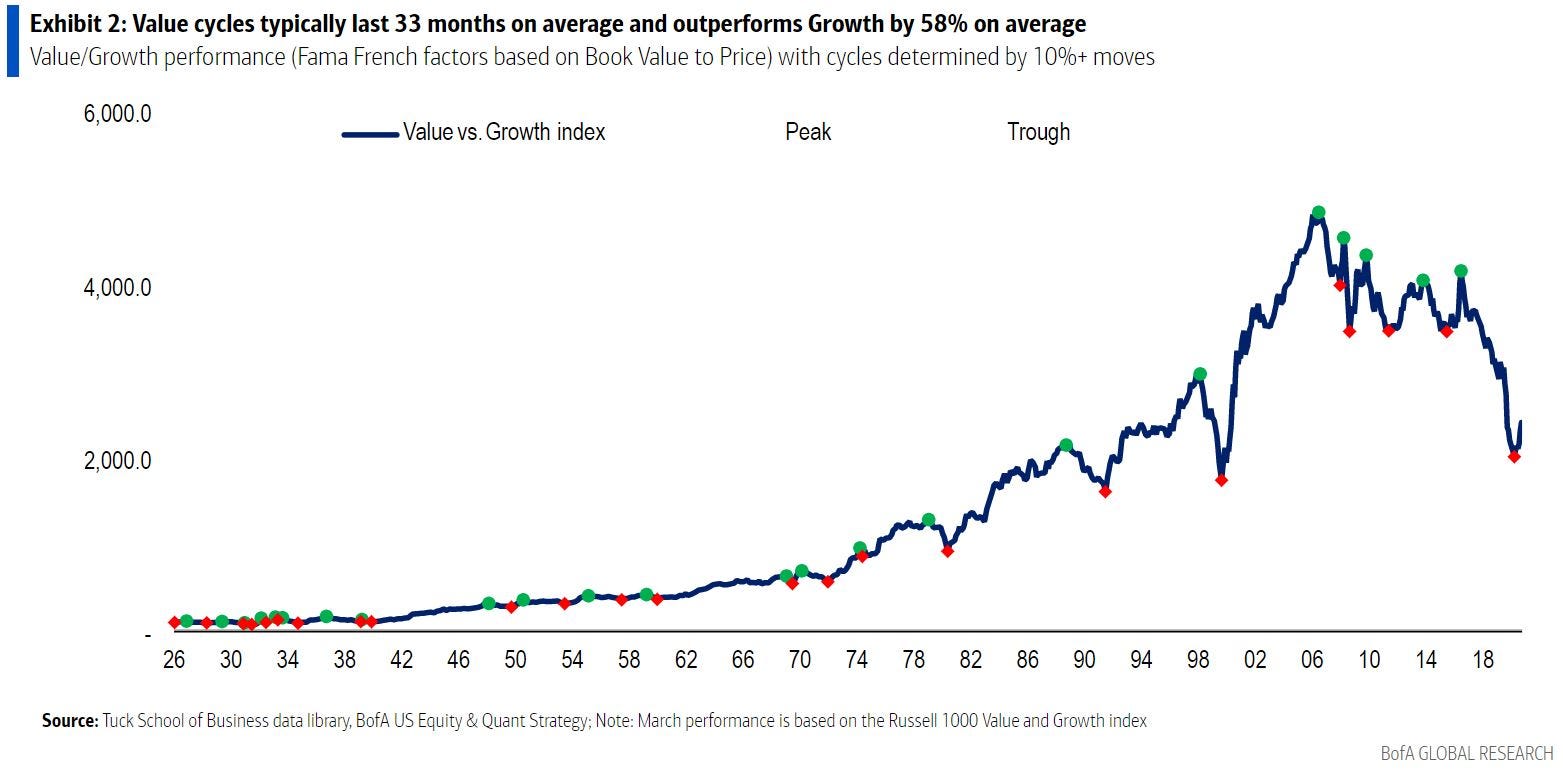

Bof As Rationale Why High Stock Market Valuations Are Not A Cause For Alarm

May 04, 2025

Bof As Rationale Why High Stock Market Valuations Are Not A Cause For Alarm

May 04, 2025 -

Nicolai Tangen Managing Investments Amidst Trumps Trade Wars

May 04, 2025

Nicolai Tangen Managing Investments Amidst Trumps Trade Wars

May 04, 2025 -

Anna Kendricks Absence Would Hurt The Accountant 3 Evidence From The Accountant 2

May 04, 2025

Anna Kendricks Absence Would Hurt The Accountant 3 Evidence From The Accountant 2

May 04, 2025

Latest Posts

-

This Summers It Top Anna Kendricks Shell Crop Top

May 04, 2025

This Summers It Top Anna Kendricks Shell Crop Top

May 04, 2025 -

Anna Kendricks Shell Crop Top Trend A Fashion Editors Pick

May 04, 2025

Anna Kendricks Shell Crop Top Trend A Fashion Editors Pick

May 04, 2025 -

I Want Anna Kendricks Glittering Shell Crop Top This Summer

May 04, 2025

I Want Anna Kendricks Glittering Shell Crop Top This Summer

May 04, 2025 -

Did Anna Kendrick Diss Blake Lively At A Simple Favor Screening

May 04, 2025

Did Anna Kendrick Diss Blake Lively At A Simple Favor Screening

May 04, 2025 -

Anna Kendrick Shades Blake Lively A Simple Favor Premiere Moment

May 04, 2025

Anna Kendrick Shades Blake Lively A Simple Favor Premiere Moment

May 04, 2025