One Cryptocurrency Standing Strong Despite The Trade War

Table of Contents

Bitcoin's Resilience Amidst Global Uncertainty

Bitcoin's decentralized nature and limited supply have historically positioned it as a potential safe haven during times of economic instability. Unlike traditional currencies susceptible to government manipulation, Bitcoin operates independently of central banks and geopolitical events. This inherent characteristic contributes significantly to its resilience in the face of trade wars and global uncertainty.

- Bitcoin's price fluctuations compared to other cryptocurrencies during the trade war: While the overall crypto market experienced a downturn, Bitcoin's price volatility was comparatively less dramatic than many altcoins. This suggests a degree of stability often lacking in other digital assets.

- Analysis of Bitcoin's market capitalization and its dominance in the crypto market: Bitcoin's market capitalization remains significantly higher than all other cryptocurrencies combined, highlighting its dominant position and investor confidence. This dominance acts as a stabilizing factor within the broader crypto market.

- Highlight instances where Bitcoin acted as a safe-haven asset, similar to gold during economic downturns: Historical data reveals a correlation between periods of economic uncertainty and increased demand for Bitcoin, mirroring the behavior of traditional safe-haven assets like gold.

- Explain how its decentralized nature makes it less susceptible to geopolitical influences: The decentralized, peer-to-peer nature of Bitcoin makes it less vulnerable to the impact of trade wars and other geopolitical factors that influence traditional financial markets.

Why Bitcoin is Outperforming Other Cryptocurrencies

While the entire cryptocurrency market felt the impact of the trade war, Bitcoin's performance stands in stark contrast to many altcoins. Several factors contribute to this divergence:

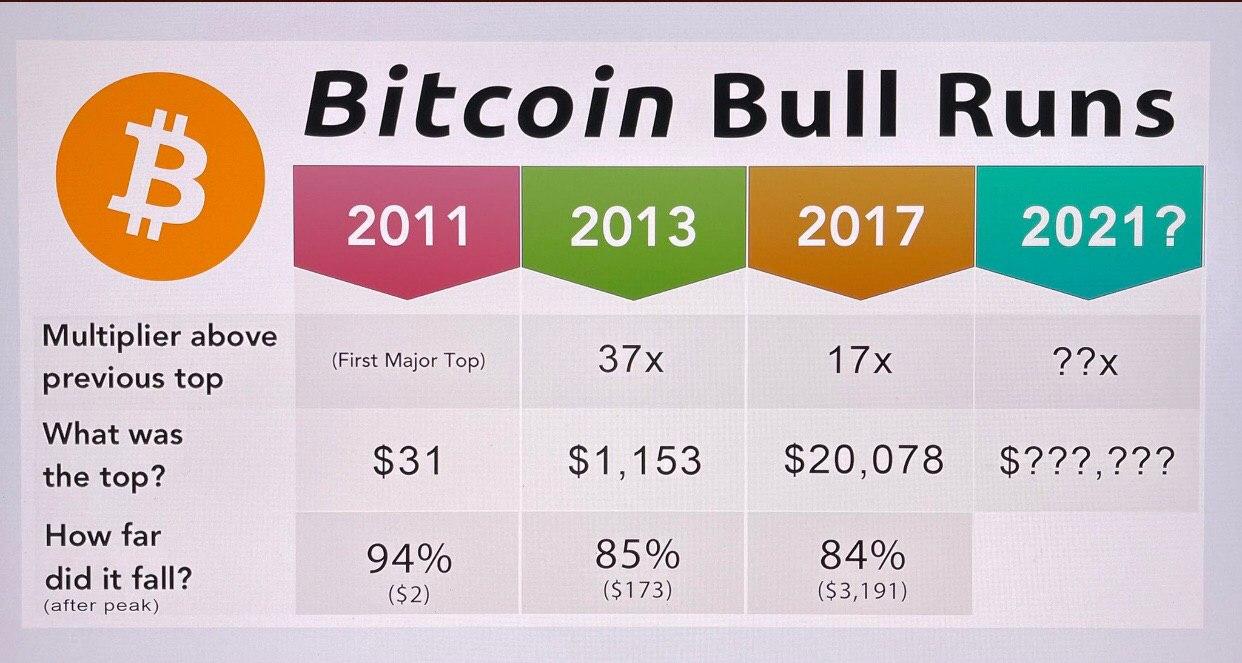

- Performance comparison charts showing Bitcoin versus major altcoins: Charts illustrating Bitcoin's price performance against major altcoins during the trade war clearly show a difference in volatility and overall performance. Bitcoin displayed relatively greater stability.

- Discuss factors affecting altcoin performance, such as regulatory uncertainty and project viability: Many altcoins are subject to greater regulatory uncertainty and concerns regarding project viability, making them more susceptible to market downturns.

- Analyze the influence of investor sentiment and risk appetite on asset allocation: During periods of uncertainty, investors often shift towards assets perceived as safer, driving capital towards established cryptocurrencies like Bitcoin.

- Explore the impact of technological advancements on Bitcoin's long-term prospects: Continuous development and improvements in Bitcoin's underlying technology contribute to its long-term potential and enhance its appeal as a stable digital asset.

Bitcoin as a Hedge Against Geopolitical Risk

The inherent characteristics of Bitcoin position it as a potential hedge against the geopolitical risks associated with trade wars and global uncertainty. Its limited supply, decentralized nature, and established track record make it an attractive addition to a diversified investment portfolio.

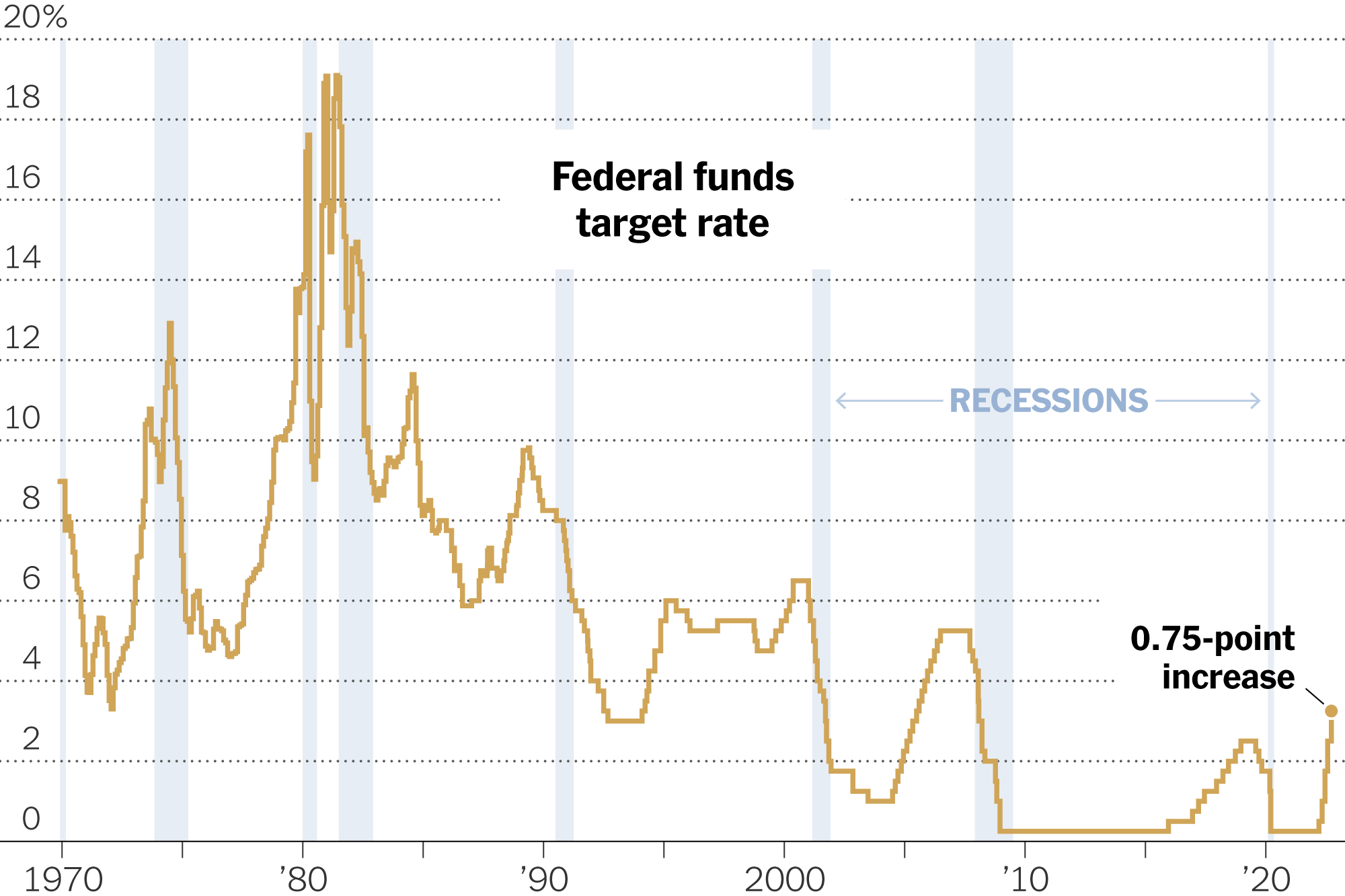

- Explain the concept of hedging and its importance in investment strategies: Hedging involves mitigating risk by investing in assets that are negatively correlated with existing holdings. Bitcoin’s price often moves independently of traditional markets, making it a potential hedging tool.

- Discuss how Bitcoin’s limited supply and decentralized nature make it an attractive hedge: The fixed supply of Bitcoin acts as a natural inflation hedge, while its decentralized nature makes it less vulnerable to political or economic instability in any single region.

- Compare Bitcoin's performance to traditional safe-haven assets like gold during periods of geopolitical stress: Analysis shows Bitcoin, while more volatile than gold, has demonstrated similar tendencies as a safe-haven asset during times of geopolitical stress.

- Analyze the potential of Bitcoin as an inflation hedge: The finite supply of Bitcoin makes it a potential alternative to traditional fiat currencies, offering protection against inflationary pressures.

Conclusion

Bitcoin's resilience during the trade war underscores its potential as a valuable asset in a volatile market. Its outperformance of other cryptocurrencies highlights the significance of its decentralized nature and limited supply. Bitcoin's position as a potential safe-haven asset and hedge against geopolitical risk makes it an increasingly attractive investment for those seeking to diversify their portfolios. Invest in Bitcoin today and explore its potential as a long-term investment strategy in an uncertain world. Learn more about Bitcoin's resilience and discover the benefits of adding this cryptocurrency to your investment strategy by visiting [link to reputable exchange/educational resource].

Featured Posts

-

Bitcoin Rebound Is This The Start Of A New Bull Market

May 08, 2025

Bitcoin Rebound Is This The Start Of A New Bull Market

May 08, 2025 -

Dwp Benefit Stoppage Four Word Letters Warning Uk Households

May 08, 2025

Dwp Benefit Stoppage Four Word Letters Warning Uk Households

May 08, 2025 -

Bank Of England Is A Half Point Rate Cut The Right Move

May 08, 2025

Bank Of England Is A Half Point Rate Cut The Right Move

May 08, 2025 -

Thunder Vs Pacers Latest Injury News And Starting Lineups March 29

May 08, 2025

Thunder Vs Pacers Latest Injury News And Starting Lineups March 29

May 08, 2025 -

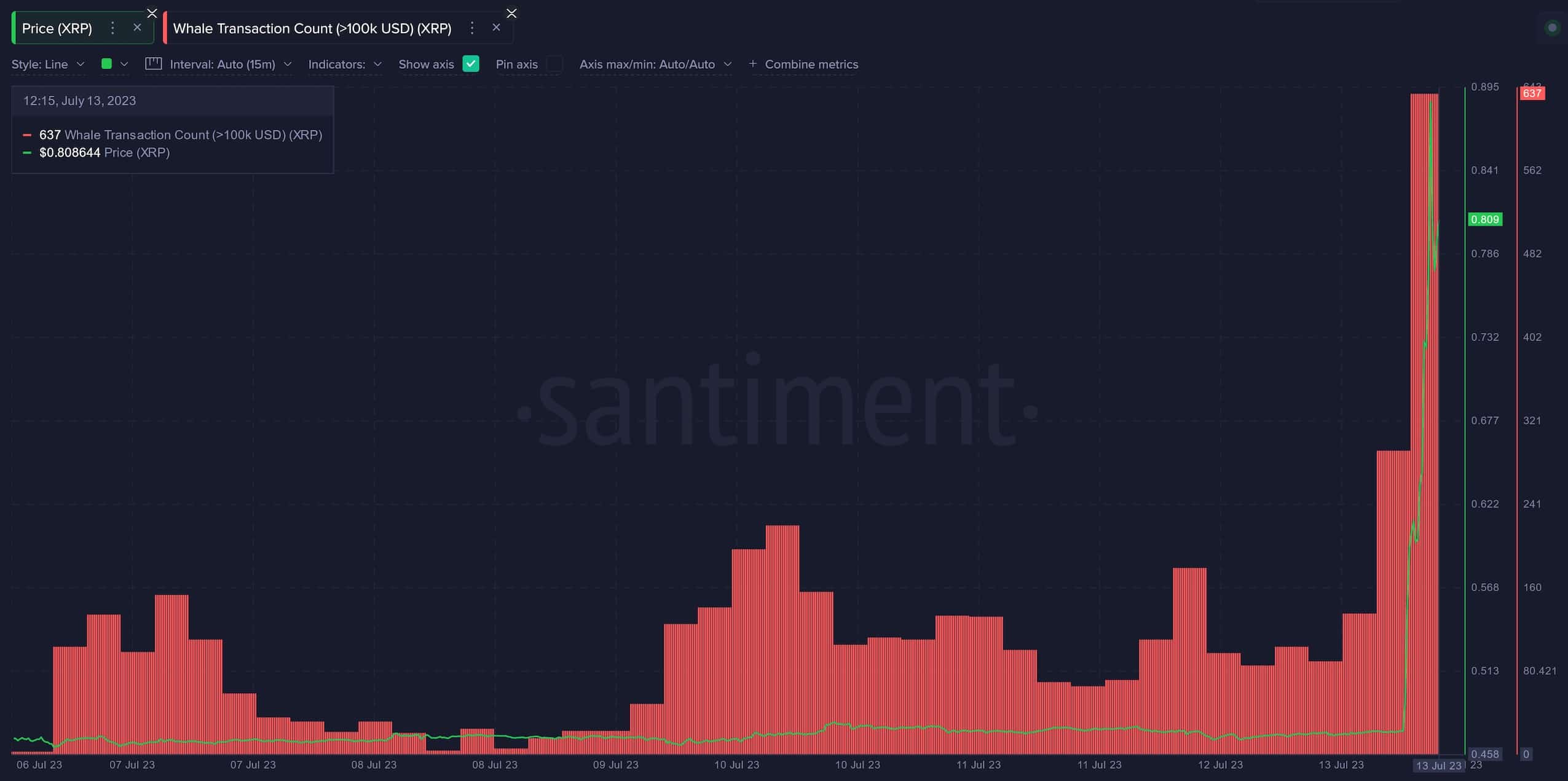

Xrp Whale Makes Waves 20 M Token Buy Signals Potential Price Surge

May 08, 2025

Xrp Whale Makes Waves 20 M Token Buy Signals Potential Price Surge

May 08, 2025