Ontario's Economic Growth Plan: Focus On Manufacturing Tax Credits

Table of Contents

Types of Manufacturing Tax Credits Available in Ontario

Ontario offers a range of tax credits designed to stimulate growth within its manufacturing sector. Understanding the nuances of each program is crucial for maximizing your potential savings.

The Ontario Manufacturing Tax Credit (OMTC)

The Ontario Manufacturing Tax Credit (OMTC) is a cornerstone incentive designed to support manufacturing activities within the province. This credit offers a direct reduction in your provincial corporate income tax liability.

- OMTC Eligibility: To qualify for the OMTC, your business must be engaged in manufacturing activities in Ontario, meeting specific criteria relating to production processes and the nature of your goods. Detailed OMTC eligibility requirements are available on the Ontario government website.

- OMTC Application: The application process involves submitting the required forms and documentation to the Ministry of Finance. The OMTC application process is generally straightforward, although careful preparation is essential. Refer to the official website for complete guidelines on the OMTC application process.

- Ontario Manufacturing Tax Credit Amount: The amount of the credit is calculated based on your qualified manufacturing expenses, usually expressed as a percentage of eligible costs. The exact Ontario manufacturing tax credit amount will vary depending on your specific circumstances and the relevant year's legislation.

Other Relevant Provincial and Federal Tax Credits

Beyond the OMTC, manufacturers may be eligible for other valuable Ontario business tax credits at the provincial and federal levels. These can significantly enhance your overall tax savings.

- Federal Tax Credits for Manufacturing: The federal government offers several programs that can complement provincial incentives. A prime example is the Scientific Research and Experimental Development Tax Credit (SR&ED), which supports businesses investing in research and development related to their manufacturing processes. For detailed information, visit the Canada Revenue Agency (CRA) website.

- Other Provincial Credits: Depending on your specific manufacturing activities and location, you might also qualify for other provincial programs targeting specific sectors or regions. It's crucial to research all potential opportunities.

Targeted Tax Credits for Specific Manufacturing Sectors

Ontario also provides targeted tax credits for specific manufacturing sub-sectors, recognizing the unique needs and challenges within different industries.

- Automotive Tax Credits Ontario: The automotive industry often benefits from dedicated programs designed to support innovation and investment in this key sector. Check the Ontario government website for the most up-to-date details on automotive tax credits Ontario.

- Aerospace Tax Credits Ontario: Similarly, the aerospace sector might find specialized incentives to support research, development, and manufacturing within the province. Look into programs focusing on aerospace tax credits Ontario.

Eligibility Requirements and Application Process

Understanding the Ontario manufacturing tax credit eligibility requirements is paramount to successful application. These requirements vary depending on the specific credit you're applying for. Factors to consider include:

- Business Size: Some programs may have size restrictions, targeting small and medium-sized enterprises (SMEs).

- Location: Your business's location within Ontario might influence eligibility for certain regional incentives.

- Type of Manufacturing Activity: The nature of your manufacturing operations needs to align with the program's definition of eligible activities.

- Investment Thresholds: Some programs require a minimum level of investment to qualify for the tax credit.

The application process typically involves completing specific forms, gathering supporting documentation, and submitting everything through designated channels. Detailed instructions and forms are available on the relevant government websites. Always carefully review the application guidelines before submitting. Refer to the official website for links to relevant forms and instructions on applying for Ontario manufacturing tax credits.

Maximizing the Benefits of Manufacturing Tax Credits

To fully leverage the potential of Ontario manufacturing tax credits, strategic planning is crucial.

- Comprehensive Tax Planning: Consulting with a qualified tax professional is highly recommended to ensure you identify all applicable credits and maximize your tax savings. Effective tax planning for manufacturers Ontario involves a thorough review of your operations and expenses to optimize your claim.

- Accurate Record Keeping: Maintaining detailed and accurate records of all eligible expenses is essential for a successful application and to demonstrate compliance.

- Professional Advice: Engaging a tax accountant or consultant specializing in Ontario manufacturing tax credit optimization can significantly increase your chances of maximizing your returns. Their expertise can help you navigate the complexities of the application process and identify any potential overlooked opportunities.

The Economic Impact of Manufacturing Tax Credits on Ontario

Ontario manufacturing tax credits play a vital role in stimulating economic growth within the province.

- Job Creation in Ontario Manufacturing: These incentives encourage investment in the manufacturing sector, leading to the creation of new jobs and the preservation of existing ones.

- Economic Impact of Manufacturing Tax Credits Ontario: By supporting innovation and expansion, the credits contribute to a stronger and more competitive manufacturing base within Ontario, benefiting the entire economy.

- Supporting Data: Government reports frequently highlight the positive correlation between tax incentives and increased economic activity, investment, and job growth in the manufacturing sector. These reports often provide statistical data supporting these claims.

Conclusion: Unlocking Growth with Ontario's Manufacturing Tax Credits

Ontario's commitment to supporting its manufacturing sector through a comprehensive suite of tax credits is a clear indication of the province's focus on long-term economic prosperity. By understanding and utilizing these incentives, such as the OMTC, manufacturers can significantly enhance their profitability, expand their operations, and contribute to the overall growth of the Ontario economy. Don't miss out on this crucial opportunity to boost your bottom line. Learn more about Ontario manufacturing tax credits today! Apply for Ontario manufacturing tax incentives today and maximize your Ontario business tax credits. Visit the official Ontario government website for detailed information and application forms.

Featured Posts

-

Hawkgirls Wings A Key Detail Revealed In James Gunns Superman Movie

May 07, 2025

Hawkgirls Wings A Key Detail Revealed In James Gunns Superman Movie

May 07, 2025 -

Xrp Whales Massive 20 M Token Purchase A Big Bet On Xrps Future

May 07, 2025

Xrp Whales Massive 20 M Token Purchase A Big Bet On Xrps Future

May 07, 2025 -

George Pickenss Struggles The Steelers Only Remaining Option

May 07, 2025

George Pickenss Struggles The Steelers Only Remaining Option

May 07, 2025 -

Playoff Risers Donovan Mitchell And Jalen Brunson Deliver

May 07, 2025

Playoff Risers Donovan Mitchell And Jalen Brunson Deliver

May 07, 2025 -

Yankee Broadcasters Controversial Comment On Seattle Mariners

May 07, 2025

Yankee Broadcasters Controversial Comment On Seattle Mariners

May 07, 2025

Latest Posts

-

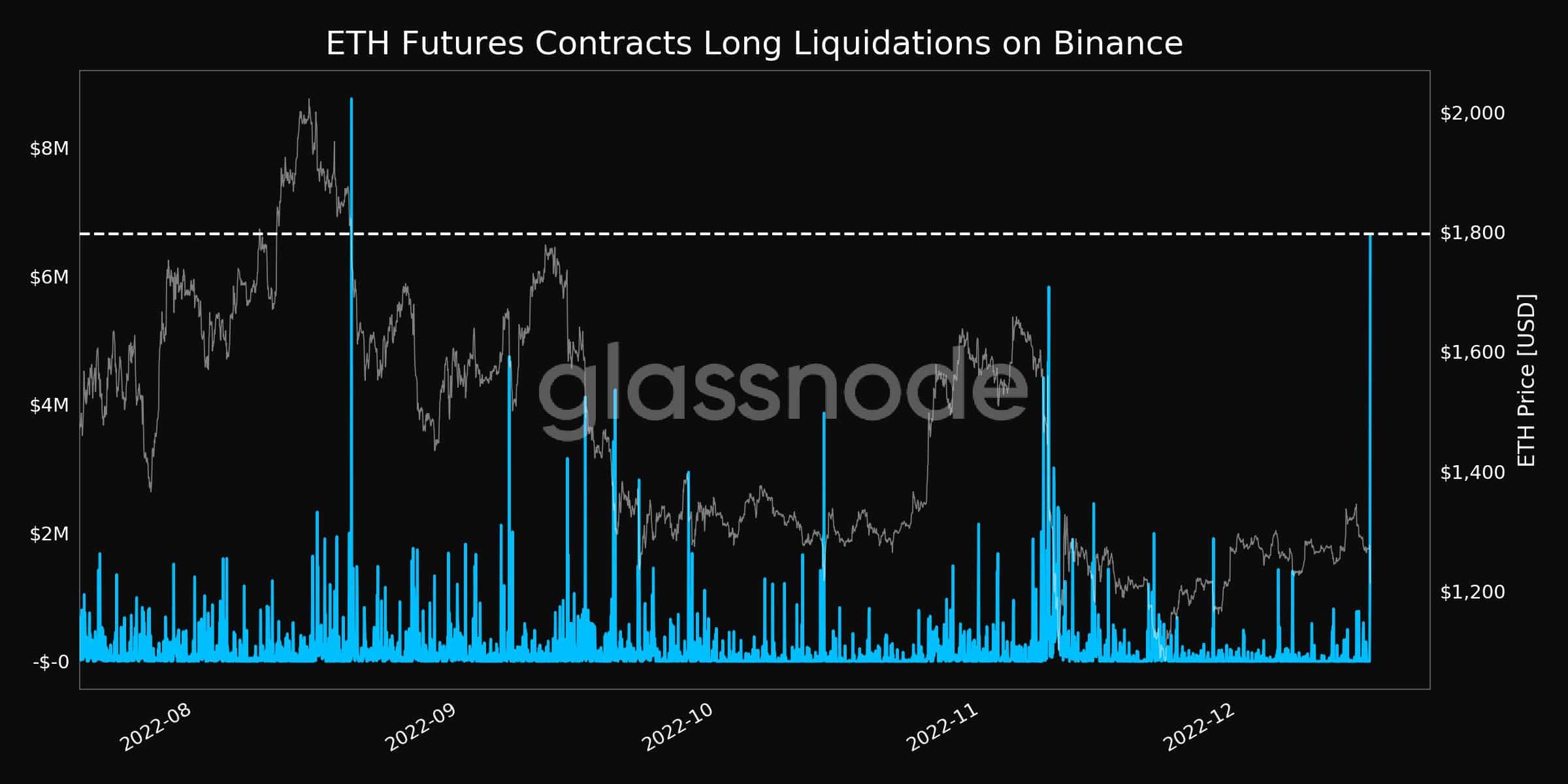

Are More Ethereum Liquidations Ahead After 67 M Drop

May 08, 2025

Are More Ethereum Liquidations Ahead After 67 M Drop

May 08, 2025 -

Ethereum Market Crash Recent 67 M Liquidation Raises Concerns

May 08, 2025

Ethereum Market Crash Recent 67 M Liquidation Raises Concerns

May 08, 2025 -

67 Million Ethereum Liquidated Analyzing The Market Implications

May 08, 2025

67 Million Ethereum Liquidated Analyzing The Market Implications

May 08, 2025 -

Analyst Predicts 4 000 Ethereum Price Cross X Indicators And Institutional Buying

May 08, 2025

Analyst Predicts 4 000 Ethereum Price Cross X Indicators And Institutional Buying

May 08, 2025 -

Ethereum Liquidation Event 67 Million In Losses Whats Next

May 08, 2025

Ethereum Liquidation Event 67 Million In Losses Whats Next

May 08, 2025