Pakistan's $1.3 Billion IMF Loan: Review Amidst Regional Tensions

Table of Contents

The Loan's Conditions and Pakistan's Economic Realities

The $1.3 billion Pakistan IMF loan is not a simple handout; it comes with stringent conditions designed to steer the country towards fiscal responsibility and sustainable growth. The IMF's demands reflect the severity of Pakistan's economic crisis, characterized by high inflation, a dwindling foreign exchange reserve, and a mounting debt burden.

-

Crucial Reforms Demanded by the IMF: The IMF's conditions typically involve a multi-pronged approach focusing on fiscal consolidation (reducing government spending and increasing revenue), exchange rate adjustments (allowing the Pakistani Rupee to depreciate to reflect market realities), and crucial energy sector reforms (improving efficiency and reducing losses in the power sector). These reforms are fundamental to restoring macroeconomic stability.

-

Impact on Pakistan's Vulnerable Population: The implementation of these reforms, often involving austerity measures like subsidy cuts and tax increases, disproportionately impacts Pakistan's vulnerable population. Reduced social safety nets can lead to increased poverty and hardship, potentially fueling social unrest. The delicate balance between necessary fiscal adjustments and social protection is a major challenge.

-

Potential for Social Unrest: Austerity measures, while economically necessary in the short-term, can lead to widespread discontent and potential social unrest. The government needs to carefully manage the implementation of these reforms to minimize the negative social consequences and ensure a smooth transition. Effective communication and targeted support programs are vital.

-

Challenges in Implementing Reforms: The political landscape in Pakistan adds another layer of complexity. Political instability and a lack of consensus on crucial economic reforms can hinder the successful implementation of the IMF's program. Strong political will and cooperation are crucial for navigating this challenge. The IMF loan conditions necessitate significant policy changes that require a united front from the government and all stakeholders.

Regional Geopolitical Implications and the IMF Loan

Pakistan's economic woes are intricately intertwined with regional geopolitical dynamics. The volatile security situation, including strained relations with India and the ongoing instability in Afghanistan, significantly impacts investor confidence and foreign investment in Pakistan.

-

Geopolitical Instability and Investor Confidence: Regional tensions create uncertainty, discouraging foreign direct investment (FDI), a vital component of economic growth. Investors are hesitant to commit capital in an environment characterized by geopolitical instability.

-

Impact of Regional Conflicts on Loan Success: Escalating regional conflicts can divert resources away from economic reforms, hindering the successful implementation of the IMF loan conditions. Any further escalation of tensions could jeopardize the loan's objectives.

-

IMF Consideration of Regional Factors: The IMF is aware of the regional context and likely factors these geopolitical realities into its loan conditions and its monitoring of the program's progress. However, the primary focus remains on achieving macroeconomic stability within Pakistan.

-

Repercussions of Failure: Failure to meet the IMF's conditions amidst regional instability could have severe consequences, potentially leading to further economic deterioration and increasing reliance on external assistance. The international community's confidence in Pakistan's economic management will be significantly impacted.

Alternative Solutions and Long-Term Economic Sustainability

While the IMF loan provides crucial short-term relief, Pakistan needs a long-term strategy for sustainable economic growth that goes beyond reliance on external assistance.

-

Role of Foreign Direct Investment (FDI): Attracting FDI is vital, but it requires creating a stable and predictable investment climate. Addressing issues like bureaucratic hurdles, corruption, and security concerns is crucial to attracting significant FDI.

-

Economic Diversification: Pakistan's over-reliance on specific sectors makes it vulnerable to external shocks. Diversifying the economy into higher-value-added industries is essential for long-term resilience.

-

Effectiveness of Structural Reforms: Implementing structural reforms that improve governance, enhance the business environment, and promote innovation is paramount for achieving sustainable growth. These reforms should address issues like corruption and bureaucratic inefficiencies.

-

Regional Cooperation: Regional economic cooperation can foster trade and investment, creating synergies that benefit all participating nations. Collaboration on infrastructure development and energy projects could yield significant benefits.

The Role of Domestic Policies in the Success of the IMF Loan

The success of the Pakistan IMF loan hinges not just on external factors but crucially on effective domestic policies and strong governance.

-

Political Stability and Government Effectiveness: Political stability and a strong, efficient government are vital for implementing reforms and ensuring transparency and accountability in the use of loan funds. Political consensus on economic policy is paramount.

-

Transparency and Accountability: Transparency in the management of the loan funds and accountability for their effective use are essential to build public trust and ensure the loan's success. Independent oversight mechanisms are necessary.

-

Public Awareness and Support: Public awareness and understanding of the reforms are crucial for generating support and ensuring smooth implementation. Effective communication strategies are necessary to build public buy-in.

Conclusion

The Pakistan IMF loan represents a critical juncture for the nation's economic future. The loan's conditions, while demanding, are designed to address fundamental economic imbalances. However, the success of the program depends on a complex interplay of factors, including the successful implementation of reforms, navigating regional geopolitical challenges, and fostering strong domestic policy coordination. Further research into the subject is essential for understanding the intricate dynamics at play in Pakistan's economic recovery efforts. Continue to monitor developments related to the Pakistan IMF loan for a complete picture of its impact. The effective management of this loan, coupled with a comprehensive long-term economic strategy, is crucial for ensuring Pakistan's economic stability and sustainable growth. Understanding the intricacies of the Pakistan IMF loan and its implications is critical for shaping the country's future.

Featured Posts

-

Tech Billionaires Inauguration Donations 194 Billion In Losses And Counting

May 09, 2025

Tech Billionaires Inauguration Donations 194 Billion In Losses And Counting

May 09, 2025 -

Revealed Alpines Young Driver Colapinto Tests At Monza

May 09, 2025

Revealed Alpines Young Driver Colapinto Tests At Monza

May 09, 2025 -

High Potential 5 Instances Where Morgans Smartness Failed

May 09, 2025

High Potential 5 Instances Where Morgans Smartness Failed

May 09, 2025 -

Sto Xamilotero Epipedo 23 Eton I Krisi Xionioy Sta Imalaia

May 09, 2025

Sto Xamilotero Epipedo 23 Eton I Krisi Xionioy Sta Imalaia

May 09, 2025 -

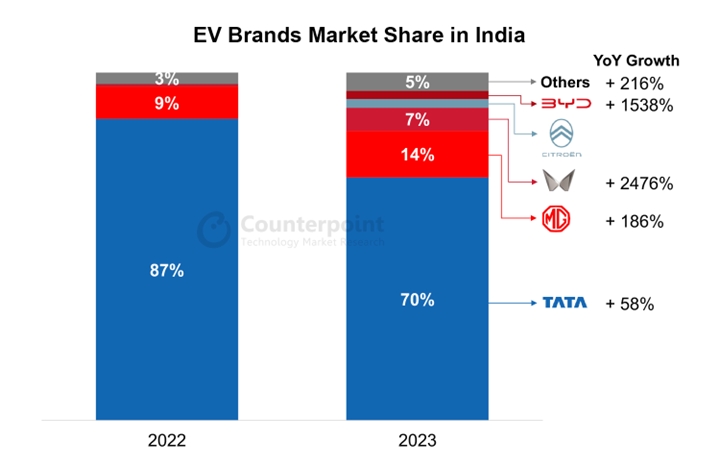

Chinas Automotive Market A Complex Landscape For Foreign Automakers

May 09, 2025

Chinas Automotive Market A Complex Landscape For Foreign Automakers

May 09, 2025