Palantir Stock: Is A 40% Rise By 2025 Realistic? Investment Analysis.

Table of Contents

Palantir Technologies (PLTR) has been a rollercoaster ride since its IPO, captivating investors with its innovative data analytics platform but also leaving them grappling with significant price volatility. This analysis investigates the feasibility of a 40% surge in Palantir stock price by 2025, a bold prediction requiring a deep dive into its current market position, growth potential, and inherent risks. We'll examine key factors influencing its future performance to help you assess whether this ambitious target is realistic for your investment portfolio.

Palantir's Current Market Position and Competitive Landscape

Market Share and Growth in Government and Commercial Sectors

Palantir operates within the highly competitive data analytics market, serving both government and commercial clients. While precise market share figures are difficult to obtain, Palantir holds a significant position in the government sector, particularly in the US, thanks to its strong relationships and contracts with intelligence agencies and defense departments. Its commercial sector growth is showing promise, though it faces stiffer competition from established giants like AWS and Microsoft Azure.

Palantir's competitive advantages stem from its proprietary platforms, notably Foundry. Foundry offers a unique, user-friendly interface designed for complex data integration and analysis, attracting clients seeking to streamline their data operations. However, the competition is fierce, and AWS and Azure boast substantial market share and considerable resources.

- Market Penetration Statistics: While precise public data is limited, Palantir's reported revenue growth indicates increasing market penetration, though quantifying its exact market share remains challenging.

- Key Competitors: Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), Databricks

- Unique Selling Propositions: Foundry's ease of use, strong government relationships, specialized data integration capabilities.

Financial Performance and Key Metrics

Analyzing Palantir's recent financial performance provides further insight into its growth trajectory. While the company has shown revenue growth, profitability has remained a challenge. Examining key financial ratios helps to understand its financial health and the sustainability of its business model.

- Revenue Figures (Past Few Years): [Insert relevant revenue figures from Palantir's financial reports. Include links to the source.]

- Key Financial Ratios: Revenue growth rate, operating margin, free cash flow. [Provide calculated ratios with brief explanations of their significance.]

- Profitability Trends: [Analyze the trends in profitability – are margins improving? Is the company moving towards sustained profitability?]

Growth Drivers and Potential Catalysts for a 40% Rise

Expansion into New Markets and Product Development

Palantir's strategy for future growth includes expansion into new markets like healthcare and finance. These sectors represent significant opportunities for deploying Palantir's data analytics capabilities. Furthermore, ongoing product development and software upgrades are crucial for maintaining a competitive edge and attracting new customers.

- New Market Targets: Healthcare (pharmaceuticals, clinical trials), Finance (fraud detection, risk management), Supply Chain Optimization

- New Product Features: Enhancements to Foundry, development of specialized AI/ML tools, improved data visualization capabilities.

- Successful Product Implementations: Highlight successful case studies of Palantir's deployments in various sectors, showcasing tangible results and ROI for clients.

Government Contracts and Geopolitical Factors

Government contracts remain a significant revenue source for Palantir. The value and renewal of these contracts significantly influence the company's future prospects. However, reliance on government contracts exposes Palantir to geopolitical risks and potential budget fluctuations.

- Value of Significant Government Contracts: [Insert details of major contracts and their value.]

- Potential Geopolitical Risks: Changes in government priorities, international relations, and defense budgets can significantly impact revenue streams.

- Contract Renewal Possibilities: Analyze the likelihood of contract renewals and the potential for securing new government contracts.

Risks and Challenges to Achieving a 40% Stock Price Rise

Competition and Market Saturation

The data analytics market is becoming increasingly crowded, with both established tech giants and emerging startups vying for market share. This intense competition poses a significant risk to Palantir's growth. Market saturation could limit future growth opportunities and put pressure on pricing.

- Emerging Competitors: Identify specific emerging companies that could disrupt Palantir's market position.

- Market Share Projections: Analyze industry forecasts and projections for market saturation.

- Competitive Advantages: Reiterate Palantir's key competitive advantages and evaluate their sustainability in the face of growing competition.

Economic Uncertainty and Macroeconomic Factors

Economic downturns can significantly impact the tech sector, and Palantir's stock price is likely to be sensitive to macroeconomic fluctuations. Companies may reduce spending on data analytics solutions during economic uncertainty, affecting Palantir's revenue.

- Macroeconomic Factors: Interest rates, inflation, recessionary risks, overall economic growth.

- Impact on Palantir: Analyze how these factors could potentially affect Palantir's revenue and profitability.

- Financial Resilience: Assess Palantir's financial health and its capacity to withstand economic downturns.

Conclusion

This analysis has examined the possibility of a 40% rise in Palantir stock by 2025, carefully considering both its growth potential and significant challenges. Palantir possesses a powerful technology platform and a growing presence in key sectors. However, fierce competition, economic uncertainty, and reliance on government contracts present substantial risks. Whether a 40% increase is achievable remains debatable and depends on numerous factors. Thorough due diligence, continuous monitoring of Palantir's performance, and a careful assessment of the evolving market landscape are crucial before making any investment decisions related to Palantir stock. Conduct your own thorough research before investing in Palantir stock.

Featured Posts

-

Doohans F1 Aspirations Palmers Insights After Colapintos Alpine Appointment

May 09, 2025

Doohans F1 Aspirations Palmers Insights After Colapintos Alpine Appointment

May 09, 2025 -

Wynne Evans Faces Backlash Amy Walsh Offers Support After Strictly Comment

May 09, 2025

Wynne Evans Faces Backlash Amy Walsh Offers Support After Strictly Comment

May 09, 2025 -

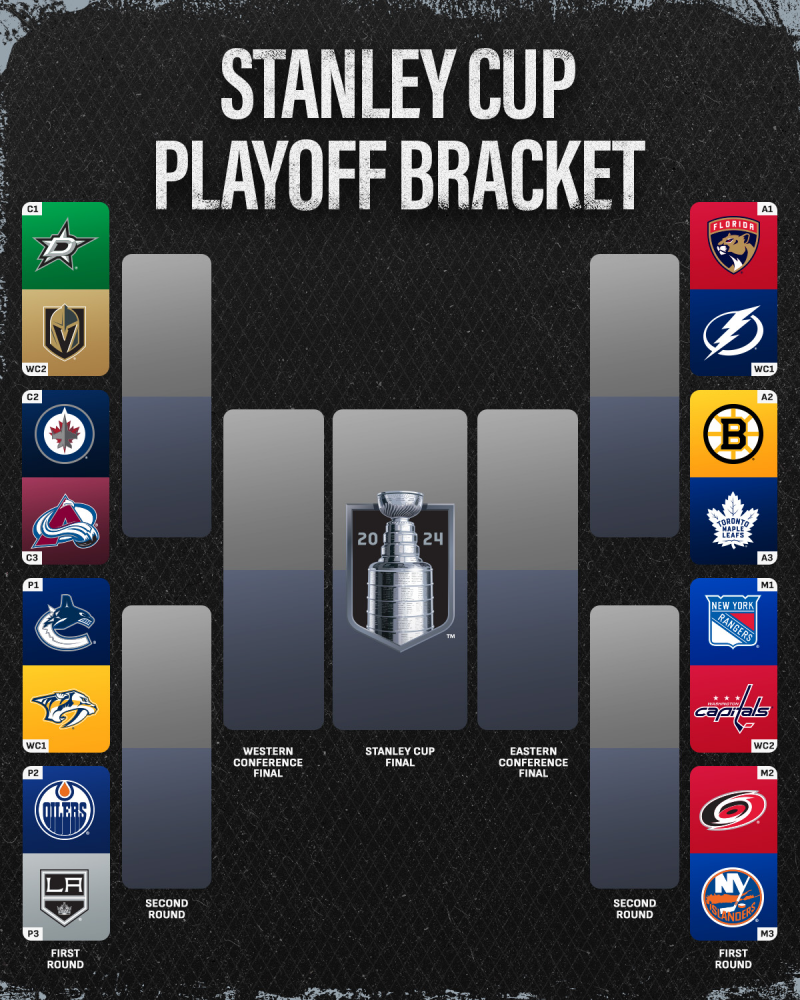

Nhl Playoffs 2025 Post Trade Deadline Predictions

May 09, 2025

Nhl Playoffs 2025 Post Trade Deadline Predictions

May 09, 2025 -

Adin Hills 27 Saves Lead Golden Knights To Victory Over Blue Jackets

May 09, 2025

Adin Hills 27 Saves Lead Golden Knights To Victory Over Blue Jackets

May 09, 2025 -

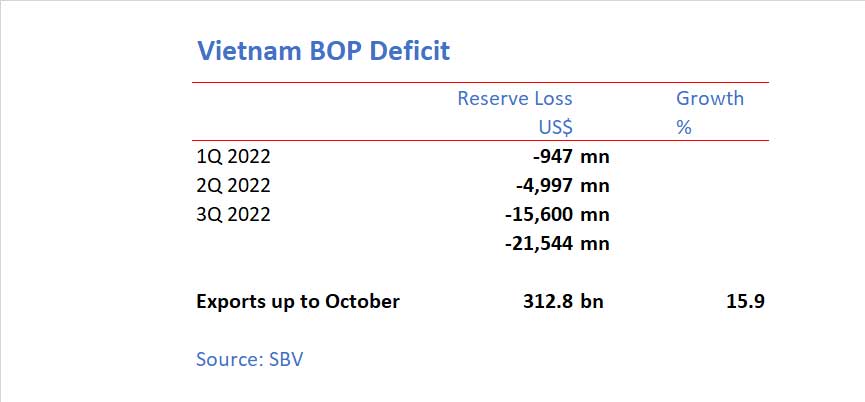

Indonesias Foreign Reserves Plunge Rupiah Weakness Takes A Toll

May 09, 2025

Indonesias Foreign Reserves Plunge Rupiah Weakness Takes A Toll

May 09, 2025