Palantir's History Of Financial Results: Understanding The High P/E Ratio

Table of Contents

Palantir's Revenue Growth and Profitability

Early Years and Initial Public Offering (IPO)

Palantir's journey began with a focus on providing sophisticated data analytics platforms, primarily to government clients. Its early years were marked by significant revenue growth fueled by lucrative government contracts. This strong foundation laid the groundwork for its highly anticipated Initial Public Offering (IPO) in 2020.

- Key Revenue Figures (Early Years): While precise early-stage revenue figures aren't always publicly available, Palantir experienced substantial year-on-year growth, reflecting the increasing demand for its big data solutions.

- IPO Pricing and Initial Investor Sentiment: Palantir's IPO was met with a mix of excitement and skepticism, with investors questioning its long-term profitability and dependence on government contracts. The initial stock price reflected this uncertainty.

- Analysis: Palantir's early revenue growth, while impressive, was largely concentrated in the government sector, creating concerns about diversification and future growth beyond this niche.

Subsequent Financial Performance

Since its IPO, Palantir has continued to demonstrate revenue growth, albeit with some fluctuations. The company has actively pursued expansion into the commercial sector, diversifying its customer base beyond government contracts.

- Year-over-Year Revenue Growth: Palantir has consistently reported positive year-over-year revenue growth, although the rate of growth has varied from year to year, reflecting shifts in market demand and the success of its sales efforts. (Illustrative chart/graph would be inserted here showing revenue growth over time).

- Key Profitability Metrics: While Palantir has reported profits in some quarters, its margins remain under scrutiny. Key metrics like gross margin, operating margin, and net income margin are important indicators of the company's profitability and efficiency. (Illustrative chart/graph would be inserted here showing key margin trends over time).

- Analysis: The shift towards commercial contracts and the expansion of product offerings are key factors influencing Palantir's financial performance. However, achieving consistent and substantial profitability remains a challenge.

Understanding Palantir's High P/E Ratio

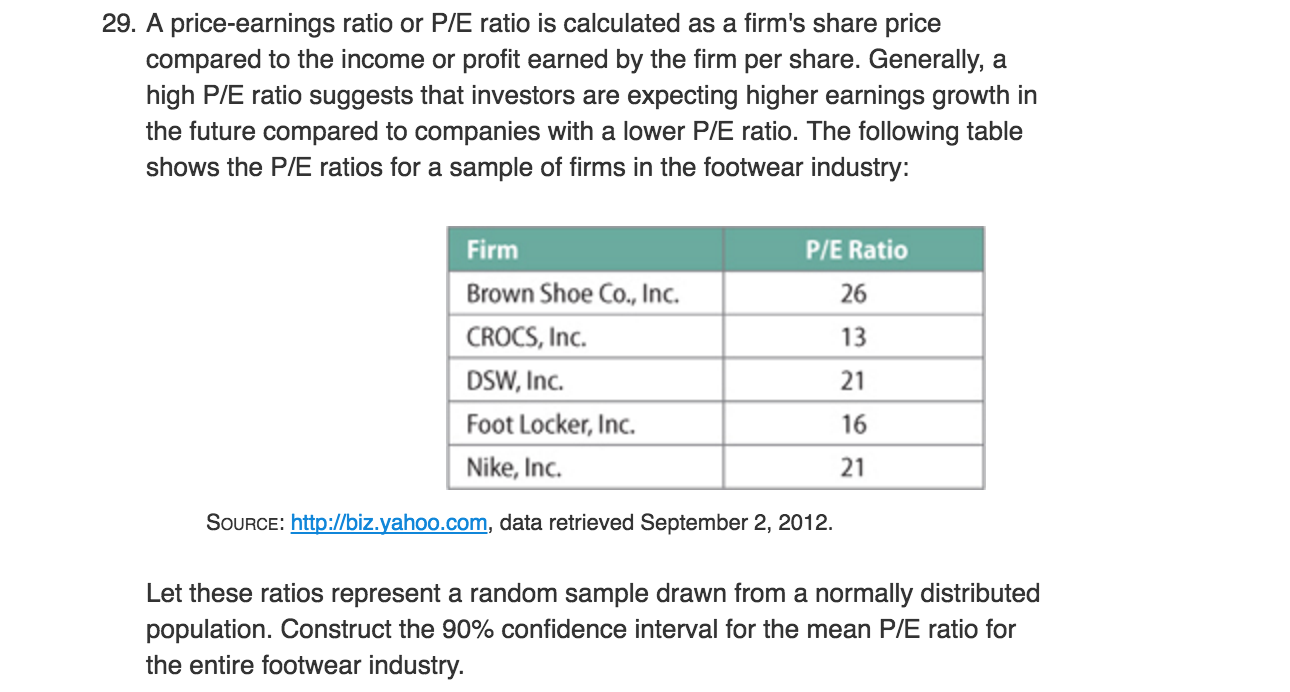

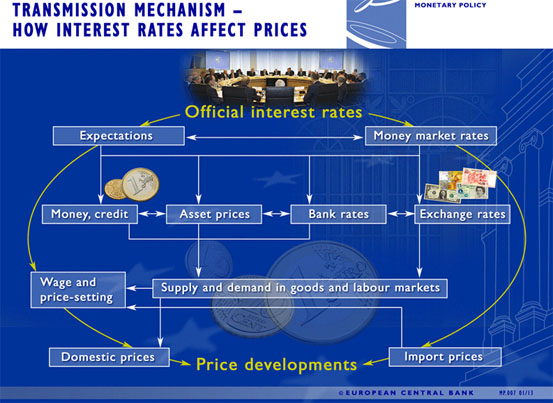

P/E Ratio Explained

The Price-to-Earnings (P/E) ratio is a crucial valuation metric used by investors to assess a company's stock price relative to its earnings per share (EPS). A high P/E ratio typically suggests that investors are willing to pay a premium for the company's future earnings potential.

- Formula: P/E Ratio = Market Price per Share / Earnings per Share

- Influencing Factors: Several factors influence a company's P/E ratio, including growth prospects, risk, and overall market sentiment. High-growth companies often command higher P/E ratios due to the expectation of future earnings growth.

- Analysis: Palantir's high P/E ratio reflects investor optimism about its long-term growth prospects, driven by its innovative technology, expanding market reach, and potential for increased revenue from both government and commercial sectors.

Comparison with Competitors

Comparing Palantir's P/E ratio to its competitors provides crucial context. Several companies operate in the big data and analytics space, but Palantir's unique business model and focus on large-scale, complex data projects set it apart.

- Competitor P/E Ratios: A direct comparison requires considering publicly traded companies with comparable business models and market positions. (A table comparing P/E ratios of relevant competitors would be inserted here).

- Analysis: The discrepancies in P/E ratios between Palantir and its competitors highlight the market's differing assessments of their growth potential, risk profiles, and overall competitive advantages. Palantir's higher ratio reflects the market's premium placed on its technological leadership and perceived potential for market dominance.

Factors Influencing Investor Sentiment and Stock Valuation

Government Contracts and Revenue Streams

Government contracts form a substantial portion of Palantir's revenue. This reliance has both advantages and disadvantages for investors.

- Percentage of Revenue from Government Contracts: A significant portion of Palantir's revenue historically came from government contracts, raising concerns about the stability and predictability of its cash flow.

- Long-Term Contract Outlook: Securing long-term government contracts provides revenue stability, but can also limit agility and responsiveness to market changes.

- Risks and Opportunities: Government contracts often come with strict regulatory requirements and potential delays, but they also provide access to substantial budgets and mission-critical projects.

- Analysis: The dependence on government contracts influences investor sentiment, creating both potential upside (stable revenue streams) and downside (reduced flexibility and dependence on government spending).

Innovation and Future Growth Prospects

Palantir's continued investment in research and development, and its expansion into emerging technologies like AI, are crucial drivers of investor confidence.

- Key Technological Advancements: Palantir's platform continues to evolve, incorporating advanced AI and machine learning capabilities to enhance its data analytics offerings.

- New Product Launches: The introduction of new products and services expands Palantir's market reach and revenue potential.

- Expansion into New Markets: Moving beyond its core government and enterprise clientele to explore new market segments is key to long-term growth.

- Analysis: Palantir's innovative capabilities and future growth potential justify, in the eyes of many investors, its high valuation despite current profitability levels.

Conclusion: Investing in Palantir: A High-Growth, High-Risk Proposition

Palantir's high P/E ratio reflects a complex interplay of factors, including its revenue growth, profitability challenges, dependence on government contracts, and its potential for future growth fueled by technological innovation. Understanding Palantir's valuation requires a thorough analysis of its financial performance, business model, and competitive landscape. Analyzing Palantir's P/E ratio in isolation is insufficient; a holistic understanding of its business is crucial.

Before making any investment decisions regarding Palantir stock, it is crucial to conduct thorough due diligence. Consider the inherent risks associated with high-growth technology companies and the specific challenges posed by Palantir's unique financial profile and its high P/E ratio. Further research into Palantir's financials and the complexities of evaluating high-growth tech companies is strongly recommended for any investor considering adding Palantir to their portfolio. Understanding Palantir's valuation fully requires careful consideration of all available data and a deep understanding of the market dynamics that influence its stock price.

Featured Posts

-

The Countrys Emerging Business Hubs A Geographic Analysis

May 07, 2025

The Countrys Emerging Business Hubs A Geographic Analysis

May 07, 2025 -

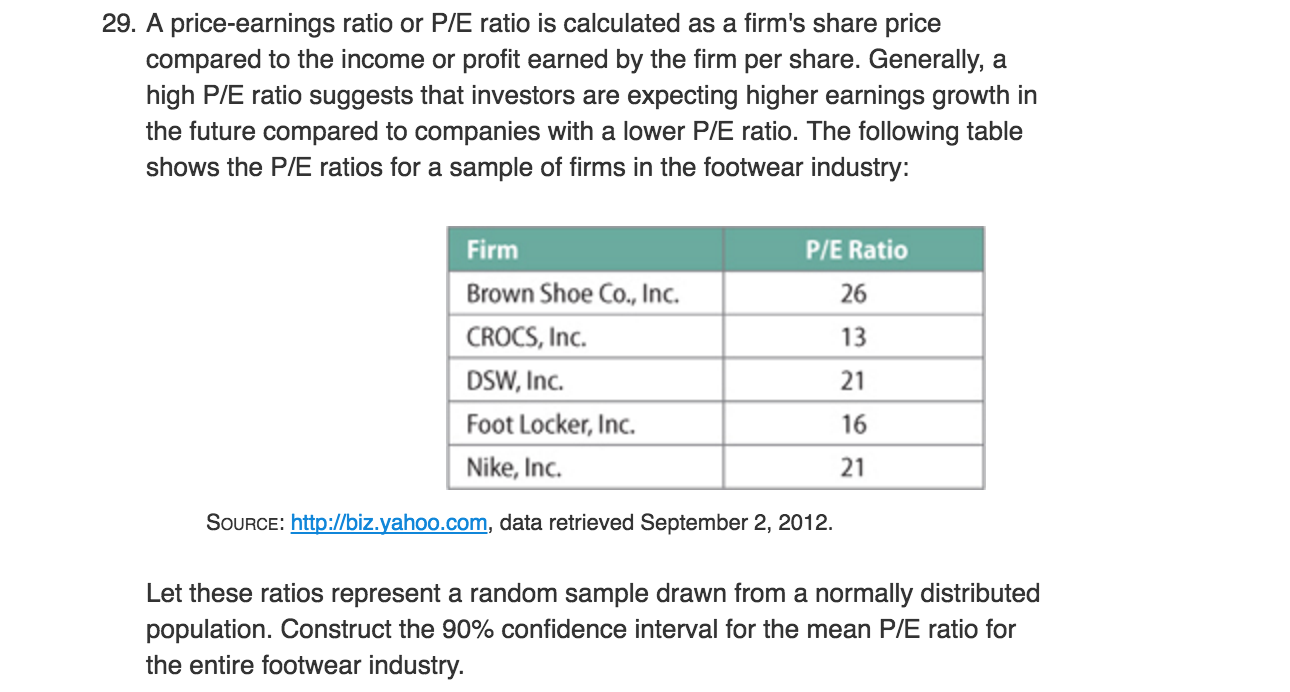

Chicago Bulls Vs Cleveland Cavaliers Cavaliers Win By 22

May 07, 2025

Chicago Bulls Vs Cleveland Cavaliers Cavaliers Win By 22

May 07, 2025 -

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir This Fall

May 07, 2025

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir This Fall

May 07, 2025 -

Thailands Negative Inflation Analyzing The Impact On The Economy And Monetary Policy

May 07, 2025

Thailands Negative Inflation Analyzing The Impact On The Economy And Monetary Policy

May 07, 2025 -

Inside The Conclave Understanding The Election Of The Pope

May 07, 2025

Inside The Conclave Understanding The Election Of The Pope

May 07, 2025

Latest Posts

-

Demolition Of Historic Pierce County Home Makes Way For New Park

May 08, 2025

Demolition Of Historic Pierce County Home Makes Way For New Park

May 08, 2025 -

Matt Damons Calculated Career Ben Afflecks Perspective

May 08, 2025

Matt Damons Calculated Career Ben Afflecks Perspective

May 08, 2025 -

A New Challenger Appears Rethinking The Best War Film After Saving Private Ryan

May 08, 2025

A New Challenger Appears Rethinking The Best War Film After Saving Private Ryan

May 08, 2025 -

Ben Afflecks Praise For Matt Damons Smart Role Choices

May 08, 2025

Ben Afflecks Praise For Matt Damons Smart Role Choices

May 08, 2025 -

7 Hidden Gems Streaming On Paramount Right Now

May 08, 2025

7 Hidden Gems Streaming On Paramount Right Now

May 08, 2025