Personal Loan Interest Rates Today: Find Your Best Rate

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several factors work together to determine the personal loan interest rate you'll receive. Understanding these factors is the first step to securing a favorable rate.

Credit Score: The Foundation of Your Rate

Your credit score is arguably the most significant factor influencing your personal loan interest rate. Lenders use your credit score to assess your creditworthiness and risk. A higher credit score demonstrates a history of responsible borrowing and repayment, leading to lower interest rates.

- Excellent Credit (750+): Expect the lowest interest rates.

- Good Credit (700-749): You'll likely receive competitive rates.

- Fair Credit (650-699): You may qualify for a loan, but with higher interest rates.

- Poor Credit (Below 650): Securing a loan might be challenging, and rates will be significantly higher, if available at all.

Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) regularly for errors. Improving your credit score before applying for a loan can significantly reduce your interest rate. Consider strategies like paying down debt, maintaining low credit utilization, and consistently paying bills on time.

Loan Amount: Size Matters

The amount you borrow also impacts your interest rate. Larger loan amounts often carry higher interest rates because they represent a greater risk to the lender.

- Explore options for smaller loan amounts if possible to potentially secure a lower rate.

- Consider a shorter loan term to reduce the overall interest paid, even if it means higher monthly payments.

- Always compare rates from multiple lenders for different loan amounts to find the best fit.

Loan Term: The Length of Your Commitment

The length of your loan term (the repayment period) directly affects your monthly payments and the total interest you pay.

- Shorter terms: Result in higher monthly payments but significantly lower total interest paid over the life of the loan.

- Longer terms: Lead to lower monthly payments but result in substantially higher total interest paid.

- Carefully consider your budget and financial goals when choosing a loan term. Weigh the pros and cons of each to determine the best fit for your circumstances.

Lender Type: Banks, Credit Unions, and Online Lenders

Different types of lenders offer varying interest rates, fees, and terms.

- Banks: Often provide competitive rates, especially for borrowers with excellent credit histories.

- Credit Unions: May offer lower rates to their members, but membership requirements might apply.

- Online Lenders: Provide convenient application processes but may have higher fees or less flexible terms. Carefully compare all aspects before making a decision.

Current Economic Conditions: The Macroeconomic Impact

Prevailing economic conditions, such as inflation and interest rate hikes by central banks, significantly influence personal loan interest rates.

- Interest rates generally rise during periods of high inflation or increased economic uncertainty.

- Stay informed about current economic trends to time your loan application strategically, ideally aiming for periods with favorable rates.

How to Find the Best Personal Loan Interest Rates

Finding the best personal loan interest rate requires proactive steps and careful comparison.

Shop Around and Compare: Don't Settle for the First Offer

Comparing offers from multiple lenders is crucial to securing the most favorable rate.

- Use reputable online comparison tools to quickly see rates from different lenders.

- Contact multiple lenders directly to discuss your specific needs and obtain personalized quotes.

- Pay close attention to the Annual Percentage Rate (APR), which includes interest and fees.

- Carefully review all fees associated with each loan offer, including origination fees, late fees, and prepayment penalties.

Check Your Eligibility: Pre-qualification vs. Pre-approval

Understanding the difference between pre-qualification and pre-approval is essential.

- Pre-qualification: Provides an estimate of the interest rate you might qualify for without impacting your credit score. This is a great first step.

- Pre-approval: Involves a hard credit pull and provides a more firm commitment from the lender. This usually happens later in the process.

Negotiate with Lenders: Your Bargaining Power

In some cases, you might be able to negotiate a lower interest rate, especially if you have a strong credit history and multiple offers from competing lenders.

- Highlight your excellent credit score and responsible borrowing history.

- Politely present competing offers to show you're shopping around.

- Maintain a professional and courteous demeanor throughout the negotiation process.

Understanding APR and Other Loan Fees

Understanding the APR and associated fees is vital for making informed decisions.

APR Explained: The True Cost of Borrowing

The Annual Percentage Rate (APR) represents the total cost of borrowing, including interest and fees. It's a crucial metric for comparing loan offers.

- Always compare APRs across different lenders.

- A lower APR generally indicates a better deal.

Common Loan Fees: Hidden Costs to Consider

Several fees can add to the overall cost of your personal loan.

- Origination fees: Charged upfront by the lender to process your loan application.

- Late payment fees: Penalties for missed or late loan payments.

- Prepayment penalties: Fees for paying off your loan early.

Conclusion:

Securing the best personal loan interest rates involves understanding several key factors, including your credit score, the loan amount and term, the type of lender, and prevailing economic conditions. By diligently shopping around, comparing offers, understanding APR and associated fees, and potentially negotiating with lenders, you can significantly reduce the total cost of your personal loan. Start your search for the best personal loan interest rates today! Use our comparison tools [link to comparison tool if applicable] to find the perfect loan for your needs.

Featured Posts

-

Kanye Wests Wife Bianca Censoris Latest Public Appearance Sparks Debate

May 28, 2025

Kanye Wests Wife Bianca Censoris Latest Public Appearance Sparks Debate

May 28, 2025 -

Arsenal Transfer News Keown Hints At Undisclosed Striker Signing

May 28, 2025

Arsenal Transfer News Keown Hints At Undisclosed Striker Signing

May 28, 2025 -

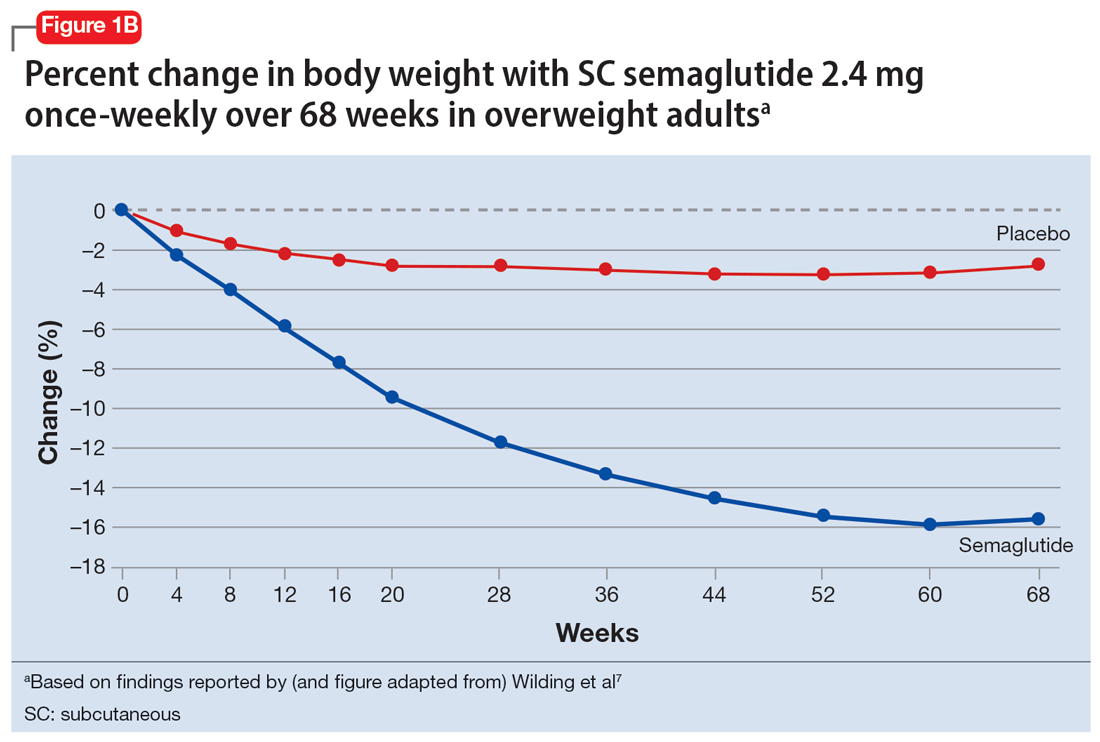

Ozempic And Beyond The Growing Applications Of Glp 1 Receptor Agonists

May 28, 2025

Ozempic And Beyond The Growing Applications Of Glp 1 Receptor Agonists

May 28, 2025 -

Sabalenkas Roland Garros Win Overshadows Nadals Emotional Exit

May 28, 2025

Sabalenkas Roland Garros Win Overshadows Nadals Emotional Exit

May 28, 2025 -

Understanding Stock Market Valuations Why Bof A Remains Optimistic

May 28, 2025

Understanding Stock Market Valuations Why Bof A Remains Optimistic

May 28, 2025

Latest Posts

-

Experience Bioluminescent Waves Best So Cal Beaches And Times

May 30, 2025

Experience Bioluminescent Waves Best So Cal Beaches And Times

May 30, 2025 -

Australias Marine Fauna Under Siege The Devastating Impact Of Killer Seaweed

May 30, 2025

Australias Marine Fauna Under Siege The Devastating Impact Of Killer Seaweed

May 30, 2025 -

Southern California Bioluminescence Spring And Fall Viewing Guide

May 30, 2025

Southern California Bioluminescence Spring And Fall Viewing Guide

May 30, 2025 -

The Killer Seaweed Exterminating Australias Marine Fauna

May 30, 2025

The Killer Seaweed Exterminating Australias Marine Fauna

May 30, 2025 -

Manila Bay Assessing The Longevity Of Its Recent Improvements

May 30, 2025

Manila Bay Assessing The Longevity Of Its Recent Improvements

May 30, 2025