PFC Halts EoW Transfer To Gensol Following Submission Of Forged Documents

Table of Contents

The Forged Documents and Their Impact

The PFC EoW transfer halt is directly attributed to the discovery of fraudulent documentation submitted by Gensol Energy during the bidding process. The forged documents included crucial financial statements and operational permits, essential for validating Gensol's capacity to manage the EoW assets effectively. Specific irregularities included altered signatures, falsified dates, and the fabrication of key performance indicators.

- Type of documents forged: Financial statements, operational permits, and contracts.

- Specific details of the forgery: Altered signatures, backdated permits, inflated financial figures, and fabricated contract clauses.

- Evidence used to identify the forgery: Forensic document analysis, inconsistencies identified during internal PFC audits, and witness testimonies corroborating suspicions of fraudulent activity.

The immediate consequence of this discovery was the immediate and complete suspension of the EoW asset transfer to Gensol, placing the entire transaction in jeopardy. The PFC is now facing the difficult task of reassessing its options and initiating appropriate legal action.

PFC's Response and Investigation

Following the discovery of the forged documents, PFC released an official statement confirming the halt of the EoW transfer to Gensol and launching a full-scale internal investigation. The statement emphasized PFC's commitment to transparency and its determination to pursue all available legal avenues to address the situation.

- Public statements released by PFC: A formal press release outlining the situation and the steps being taken. Further updates are expected as the investigation progresses.

- Internal investigation details: An independent third-party firm has been engaged to conduct a thorough review of the bidding process and related documentation. The details of the internal investigation remain largely confidential pending the outcome of the investigation.

- Legal actions initiated or planned: PFC is exploring various legal options, including potential civil lawsuits against Gensol and criminal charges against individuals involved in the forgery.

- Measures taken to prevent future fraudulent activities: PFC is reviewing and strengthening its due diligence processes, including implementing more stringent document verification procedures and enhancing employee training on fraud detection. This includes enhancing its internal control systems and working with external experts in fraud prevention.

Gensol's Reaction and Potential Consequences

Gensol Energy has issued a statement acknowledging the PFC's concerns regarding the EoW transfer and is cooperating with the ongoing investigation. However, the company has not yet explicitly addressed the allegations of submitting forged documents.

- Gensol's official statement: A statement expressing cooperation with the investigation, but lacking a direct response to the forgery allegations.

- Potential financial impact on Gensol: The halt of the EoW transfer could significantly impact Gensol's financial projections and future investment plans. Potential loss of contracts and reputational damage could result in further financial strain.

- Potential legal ramifications for Gensol: Gensol faces potential legal action from PFC, including civil lawsuits and penalties for fraudulent activities. The outcome of the ongoing investigation will be crucial in determining the legal consequences.

- Impact on Gensol's future projects and partnerships: This incident could severely damage Gensol's reputation, potentially affecting its ability to secure future projects and partnerships within the energy sector.

Impact on the Energy Sector

The PFC EoW transfer halt has far-reaching implications for the broader energy sector. The incident highlights the critical need for robust due diligence processes and underscores the potential consequences of inadequate verification measures.

- Impact on investor confidence: The incident may erode investor confidence in the energy sector, particularly concerning the integrity of large-scale transactions.

- Potential for regulatory changes: Regulatory bodies may review and potentially strengthen existing guidelines concerning due diligence and fraud prevention within the energy industry. Increased scrutiny of transactions is highly likely.

- Increased focus on due diligence practices: Companies will likely prioritize strengthening their internal due diligence procedures and invest in technologies to help prevent similar fraudulent activities.

Conclusion

The PFC's decision to halt the EoW asset transfer to Gensol serves as a stark reminder of the critical importance of robust due diligence in high-value transactions. The discovery of forged documents underscores the potential risks associated with inadequate verification and emphasizes the need for stricter regulatory oversight. This incident should encourage a sector-wide review of current processes and a commitment to improving fraud prevention strategies.

Call to Action: Stay informed about the ongoing investigation into the PFC EoW transfer halt by regularly searching for "PFC EoW Transfer Halt" and related keywords. Businesses involved in similar transactions must prioritize due diligence, strengthen their fraud prevention measures, and implement best practices to mitigate risks. Understanding the implications of this case is crucial for safeguarding your business against the devastating consequences of fraudulent activity.

Featured Posts

-

Dubai Dice Adios A Paolini Y Pegula En Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En Wta 1000

Apr 27, 2025 -

Aintree Grand National 2025 Runners Analysis And Predictions

Apr 27, 2025

Aintree Grand National 2025 Runners Analysis And Predictions

Apr 27, 2025 -

Rethinking Middle Management Their Value In Modern Business

Apr 27, 2025

Rethinking Middle Management Their Value In Modern Business

Apr 27, 2025 -

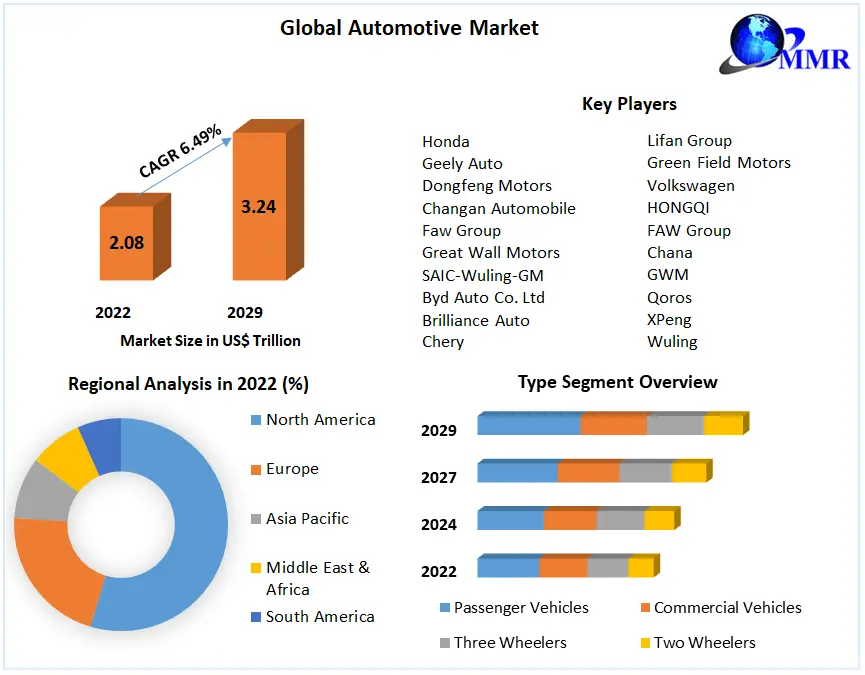

Bmw Porsche And The Complexities Of The Chinese Automotive Market

Apr 27, 2025

Bmw Porsche And The Complexities Of The Chinese Automotive Market

Apr 27, 2025 -

Justin Herbert Chargers 2025 Season Opener In Brazil Confirmed

Apr 27, 2025

Justin Herbert Chargers 2025 Season Opener In Brazil Confirmed

Apr 27, 2025