Plummeting Home Sales Signal Housing Market Crisis

Table of Contents

Rising Interest Rates: The Primary Culprit

The single most significant factor contributing to the plummeting home sales is the sharp increase in interest rates. Higher interest rates directly translate to higher mortgage payments, significantly reducing affordability for potential homebuyers. This impact ripples throughout the housing market, affecting not just buyers but also developers and the broader economy.

- Impact on mortgage payments: A seemingly small increase in interest rates can dramatically increase monthly mortgage payments, making homeownership unattainable for many.

- Reduced purchasing power for buyers: Higher interest rates effectively reduce the amount buyers can borrow, shrinking their purchasing power and limiting their options in the housing market.

- Increased borrowing costs for developers: Developers face higher costs for construction loans, potentially leading to fewer new homes being built and exacerbating the existing housing shortage.

- Data showing the increase in interest rates and its impact on sales: Recent data from [insert reputable source, e.g., National Association of Realtors] shows a [insert percentage]% decline in home sales since interest rate hikes began, clearly demonstrating the correlation. The average 30-year fixed mortgage rate is currently at [insert current rate], up significantly from [insert previous rate] just a few months ago. This substantial increase in mortgage rates is a key driver of the affordability crisis.

Inflation's Impact on Housing Affordability

Inflation is another major contributor to the current housing market crisis. Rising prices for building materials, labor, and everyday goods reduce consumer spending power, making it harder for people to afford a home. The ripple effects of inflation impact the entire housing ecosystem.

- Increased construction costs: The cost of lumber, concrete, and other building materials has skyrocketed, driving up the price of new homes.

- Reduced consumer spending power: With inflation eroding purchasing power, consumers have less disposable income to allocate towards housing.

- The ripple effect of inflation on the entire economy, impacting housing: High inflation erodes consumer confidence, leading to decreased demand across various sectors, including real estate.

- Statistics linking inflation rates to home sales declines: [Insert data linking inflation rates to home sales declines from a reliable source, e.g., Bureau of Labor Statistics]. The current inflation rate of [insert current inflation rate]% directly impacts the affordability of housing and the ability of consumers to purchase homes.

Inventory Shortage and its Paradoxical Role

While a low inventory might seem beneficial for sellers, it significantly contributes to the housing market crisis. Limited housing inventory drives up prices, making homes even less affordable for buyers. This paradox further restricts market activity and amplifies the crisis.

- The impact of supply chain issues on new construction: Disruptions to supply chains have hampered new home construction, limiting the supply of available homes.

- Demand exceeding supply in many markets: In many areas, demand for housing far outpaces the available supply, creating intense competition among buyers and pushing prices higher.

- The effect of limited inventory on competition amongst buyers: The scarcity of homes fuels bidding wars, resulting in inflated prices beyond the reach of many potential buyers.

- Data showing the current inventory levels and their impact on sales prices: The current housing inventory is at [insert data from a reliable source showing low inventory levels], contributing to a [insert percentage]% increase in home prices compared to last year. This severe supply and demand imbalance is a defining characteristic of the current housing market crisis.

Potential Consequences of the Housing Market Crisis

The consequences of a declining housing market extend far beyond the real estate sector. A prolonged housing market crisis could trigger a broader economic downturn, leading to significant job losses and financial instability.

- Impact on the overall economy: A slump in the housing market can have a domino effect, impacting related industries and consumer spending.

- Job losses in related industries (construction, real estate): A decline in home sales leads to job losses in the construction, real estate, and related industries.

- Potential for a broader financial crisis: The interconnected nature of the financial system means a housing market crash could destabilize the entire economy.

- Effects on local communities and property tax revenue: Declining property values can severely impact local governments' revenue streams, affecting public services.

Conclusion

The current plummeting home sales are a clear indicator of a serious housing market crisis. Rising interest rates, inflation, and a chronic housing shortage are creating a perfect storm, threatening to destabilize the economy and impact millions of people. Understanding the housing market crisis is crucial. The potential long-term consequences are severe, potentially leading to an economic downturn and widespread financial hardship. Stay informed about the housing market crisis and take appropriate steps to protect your financial interests. Consider consulting with a financial advisor to navigate the housing market crisis effectively. Further resources and information can be found at [Insert links to relevant websites, articles, etc.]. Navigating the housing market crisis requires vigilance and informed decision-making.

Featured Posts

-

Hanouna Le Pen 2027 Jacobelli Alerte Sur Une Potentielle Interdiction

May 30, 2025

Hanouna Le Pen 2027 Jacobelli Alerte Sur Une Potentielle Interdiction

May 30, 2025 -

Dmps Announces New Cell Phone Policy For Students

May 30, 2025

Dmps Announces New Cell Phone Policy For Students

May 30, 2025 -

Deutsche Banks Digital Transformation Accelerated By Ibm Software

May 30, 2025

Deutsche Banks Digital Transformation Accelerated By Ibm Software

May 30, 2025 -

Boesen Selected As Grand View University Commencement Speaker

May 30, 2025

Boesen Selected As Grand View University Commencement Speaker

May 30, 2025 -

V Tolyatti Sostoitsya Otkrytiy Seminar Russkoy Inzhenernoy Shkoly

May 30, 2025

V Tolyatti Sostoitsya Otkrytiy Seminar Russkoy Inzhenernoy Shkoly

May 30, 2025

Latest Posts

-

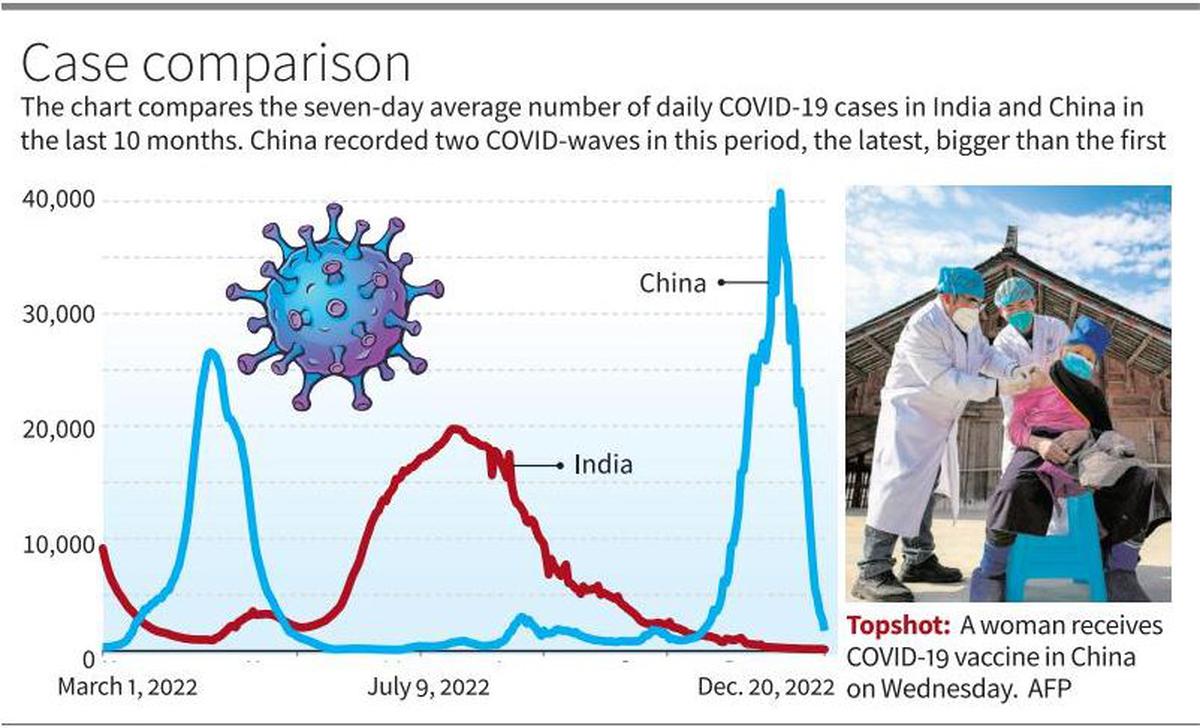

Tracking The Spread New Covid 19 Variant And Rising Case Numbers Nationally

May 31, 2025

Tracking The Spread New Covid 19 Variant And Rising Case Numbers Nationally

May 31, 2025 -

National Increase In Covid 19 Cases A New Variant Emerges

May 31, 2025

National Increase In Covid 19 Cases A New Variant Emerges

May 31, 2025 -

New Covid 19 Variant Fueling Case Increase Across The Nation

May 31, 2025

New Covid 19 Variant Fueling Case Increase Across The Nation

May 31, 2025 -

Rise In Covid 19 Cases Linked To New Variant National Update

May 31, 2025

Rise In Covid 19 Cases Linked To New Variant National Update

May 31, 2025 -

Covid 19 Variant Surge Increased Cases Reported Nationally

May 31, 2025

Covid 19 Variant Surge Increased Cases Reported Nationally

May 31, 2025