Podcast: Redefining Financial Literacy

Table of Contents

A staggering number of adults struggle with basic financial concepts. This financial illiteracy leads to crippling debt, missed opportunities for savings and investment, and a pervasive sense of financial insecurity. But what if financial literacy wasn't just about balancing your checkbook? This article explores how a redefined financial literacy, encompassing a broader, more holistic approach, can empower you to take control of your finances and achieve lasting financial well-being. We'll delve into the key elements of a modern approach to financial education, highlighting the importance of technology, emotional intelligence, and long-term planning.

H2: Beyond Budgeting: A Holistic Approach to Financial Literacy

Traditional financial literacy often focuses narrowly on budgeting – creating a budget and sticking to it. While budgeting is crucial for money management, it's only one piece of the puzzle. A truly holistic approach to financial literacy recognizes the interconnectedness of various aspects of personal finance. It's about understanding the bigger picture and building a strong financial foundation for the future.

This means going beyond simply tracking expenses. A truly effective approach to personal finance incorporates:

- Understanding different investment vehicles: Exploring diverse investment options like stocks, bonds, mutual funds, and ETFs is vital for building wealth and securing your financial future. Learning about risk tolerance and diversification is key to long-term investing success.

- Developing a long-term financial plan: This encompasses setting clear financial goals, such as retirement planning, college savings for children, or buying a home. A well-defined plan provides direction and motivation throughout your financial journey.

- Managing debt effectively: Understanding different types of debt (credit card debt, student loans, mortgages) and implementing strategies for repayment is crucial. High-interest debt can significantly hinder financial progress. Effective debt management involves prioritizing high-interest debts and exploring debt consolidation options.

- Protecting your assets: Insurance (health, life, home, auto) plays a vital role in safeguarding your financial security against unexpected events. Estate planning ensures your assets are distributed according to your wishes.

- Building good credit: A strong credit score is essential for securing loans, mortgages, and even some rental agreements. Understanding credit reports and managing credit responsibly is a crucial element of financial health.

- Understanding taxes and tax planning: Basic tax knowledge is essential to maximizing your financial resources and avoiding penalties. Tax planning, while complex, can be simplified with the right resources and professional guidance.

H2: Leveraging Technology for Enhanced Financial Literacy

Technology has revolutionized personal finance management, offering a wide array of tools and resources to enhance financial literacy. From budgeting apps to robo-advisors, technology makes managing your finances more efficient and accessible than ever before.

- Budgeting apps (Mint, YNAB): These apps automate expense tracking, providing valuable insights into your spending habits and helping you identify areas for improvement.

- Investment platforms (Robinhood, Fidelity): These platforms offer convenient access to investment opportunities, allowing you to diversify your portfolio and potentially grow your wealth.

- Robo-advisors: These automated investment platforms provide portfolio management services based on your risk tolerance and financial goals. They offer a cost-effective way to invest, especially for beginners.

- Financial literacy websites and educational resources: Numerous websites and online courses provide valuable information on various aspects of personal finance, making financial education readily available.

- Data security and privacy: It’s crucial to choose reputable financial technology providers and to be mindful of data security risks. Understanding how your data is protected is critical.

H2: Addressing the Emotional Side of Finances

Our relationship with money is deeply intertwined with our emotions. Emotional spending, fear of investing, and financial anxieties are common obstacles to achieving financial well-being. Addressing these emotional aspects is just as important as understanding the technical aspects of finance.

- Mindfulness and financial decision-making: Practicing mindfulness helps you make rational financial decisions rather than impulsive ones driven by emotions.

- Identifying and addressing emotional spending triggers: Understanding what triggers emotional spending (stress, boredom, sadness) allows you to develop strategies to manage these triggers and avoid impulsive purchases.

- Seeking professional help: Financial anxiety or trauma can significantly impact your financial decisions. Don’t hesitate to seek help from a therapist or financial counselor.

- Setting realistic financial goals: Setting achievable goals promotes motivation and prevents feelings of overwhelm.

H2: Building a Sustainable Financial Future: Long-Term Strategies

Developing a sustainable financial future requires long-term planning and a commitment to continuous learning. The financial landscape is constantly changing, so adapting your strategies is crucial.

- Creating a personalized financial plan: This plan should reflect your individual goals, circumstances, and risk tolerance. A financial advisor can help you create a comprehensive plan.

- Regularly reviewing and adjusting your financial plan: Life changes (marriage, children, career changes) necessitate reviewing and adjusting your financial plan to ensure it remains aligned with your goals.

- Seeking advice from financial advisors: A financial advisor can provide personalized guidance and support, helping you navigate complex financial decisions.

- Staying informed about changes in financial regulations and economic trends: Keeping up with current events is crucial for making informed financial decisions.

Conclusion:

Redefining financial literacy means moving beyond basic budgeting to embrace a holistic approach that encompasses investment, debt management, asset protection, and emotional intelligence. Leveraging technology and focusing on long-term planning are crucial for building a sustainable financial future. Remember, financial freedom is achievable through continuous learning and informed decision-making.

Listen to our podcast, "Redefining Financial Literacy," today and start building your path to financial freedom! [Link to Podcast] You can also download our free guide on "Investing for Beginners" to enhance your financial literacy journey. [Link to Guide]

Featured Posts

-

Bof A On Stock Market Valuations A Reason For Investor Calm

May 31, 2025

Bof A On Stock Market Valuations A Reason For Investor Calm

May 31, 2025 -

Banksy In Bournemouth Verifying The Westcliff Artwork Authenticity

May 31, 2025

Banksy In Bournemouth Verifying The Westcliff Artwork Authenticity

May 31, 2025 -

Munguias Adverse Vada Finding A Detailed Analysis

May 31, 2025

Munguias Adverse Vada Finding A Detailed Analysis

May 31, 2025 -

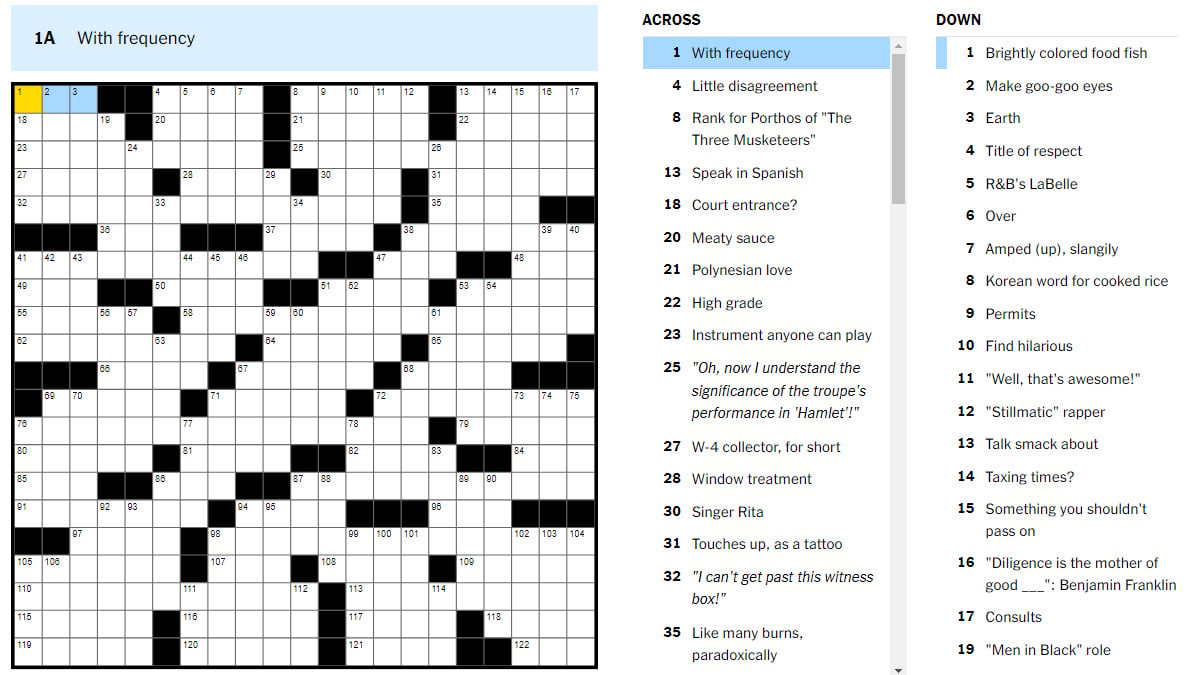

Nyt Mini Crossword Answers Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Answers Saturday May 3rd

May 31, 2025 -

The Unexpected Value Of Street Art Comparing Two Homeowners Experiences With A Banksy

May 31, 2025

The Unexpected Value Of Street Art Comparing Two Homeowners Experiences With A Banksy

May 31, 2025