Private Credit Jobs: 5 Essential Dos And Don'ts For Success

Table of Contents

Do: Network Strategically within the Private Credit Industry

The private credit industry thrives on relationships. Building a strong network is crucial for uncovering hidden job opportunities and gaining valuable insights.

Target Key Players:

Focus your networking efforts on individuals and firms specializing in private credit, including:

- Private equity firms: These firms often have dedicated credit teams or invest in credit-related strategies.

- Hedge funds: Many hedge funds employ sophisticated credit strategies, offering diverse private credit job opportunities.

- Credit funds: These funds exclusively focus on private credit investments, providing a wealth of specific roles.

To effectively network:

- Attend industry conferences and events: These events provide unparalleled opportunities to meet professionals, learn about new trends, and make connections.

- Leverage LinkedIn: Actively connect with professionals in private credit, participate in relevant groups, and engage with their content.

- Informational interviews: Request informational interviews to learn about specific roles, gain industry insights, and build relationships.

Cultivate Meaningful Relationships:

Networking isn't just about collecting business cards; it's about building genuine connections.

- Follow up after meetings: Send personalized thank-you notes expressing your appreciation and reiterating your interest.

- Offer assistance: If possible, offer to help your contacts with their work or projects, demonstrating your initiative and value.

- Stay updated: Keep abreast of industry news and share relevant insights with your network, fostering engagement.

- Participate in online forums: Engage in relevant online discussions and contribute valuable perspectives.

- Become a resource: Aim to become a valuable contact for others in your network, offering assistance and support.

Don't: Underestimate the Importance of Financial Modeling Skills

Proficiency in financial modeling is non-negotiable for most private credit jobs. You'll be using these skills daily.

Master Excel and Financial Modeling Software:

Private credit roles demand strong analytical capabilities.

- Excel mastery: Become proficient in advanced Excel functions, including VBA (Visual Basic for Applications), to automate tasks and build efficient models.

- Financial modeling software: Familiarize yourself with industry-standard software such as Argus and the Bloomberg Terminal. These tools are indispensable for analyzing complex financial data.

- Practice: Build complex financial models regularly to hone your skills and demonstrate your capabilities to potential employers. Consider seeking out relevant certifications.

- Showcase your skills: Highlight your financial modeling expertise prominently in your resume and cover letter, using quantifiable achievements.

Neglect Understanding of Credit Analysis:

A deep understanding of credit analysis is paramount.

- Ratio analysis: Master fundamental credit ratios (e.g., leverage, coverage, liquidity) to assess a borrower's financial health.

- Cash flow projections: Become adept at forecasting future cash flows to determine a borrower's ability to service debt.

- Covenant compliance: Understand loan covenants and their implications for borrowers.

- Credit instruments: Familiarize yourself with various credit instruments (e.g., term loans, revolving credit facilities, bonds) and their features.

- Real-world practice: Analyze real-world credit scenarios to build practical experience and improve your analytical skills.

Do: Tailor Your Resume and Cover Letter to Specific Private Credit Roles

Generic applications rarely stand out. Each application should be laser-focused on the specific requirements of the job.

Highlight Relevant Skills and Experience:

Customize your resume and cover letter to match the job description.

- Quantify achievements: Use numbers and data to demonstrate the impact of your previous work (e.g., "Increased efficiency by 15%").

- Action verbs: Use strong action verbs to showcase your accomplishments (e.g., "Managed," "Developed," "Analyzed").

- Keywords: Incorporate keywords from the job description to improve your application's visibility to applicant tracking systems (ATS).

- Skills emphasis: Highlight relevant skills such as financial modeling, credit analysis, deal structuring, and underwriting.

Demonstrate Understanding of the Target Firm:

Research the firms you apply to thoroughly.

- Investment strategies: Understand their investment focus, target industries, and typical deal sizes.

- Portfolio companies: Research their portfolio companies to demonstrate your knowledge of their investment approach.

- Firm culture: Learn about the firm's culture and values to tailor your application to align with their preferences.

- Specific deals: Mention specific deals or investments that interest you and demonstrate your understanding of their strategies.

Don't: Underprepare for Interviews

Thorough preparation is crucial for success in private credit job interviews.

Practice Behavioral and Technical Questions:

Prepare for both behavioral and technical questions.

- Behavioral questions: Practice answering behavioral questions (e.g., "Tell me about a time you failed") using the STAR method (Situation, Task, Action, Result).

- Technical questions: Practice explaining complex financial concepts clearly and concisely (e.g., "Explain discounted cash flow analysis").

- Anticipate questions: Based on the job description, anticipate potential questions and prepare thoughtful responses.

Neglect Asking Thoughtful Questions:

Asking insightful questions demonstrates your engagement and interest.

- Role-specific questions: Ask questions that demonstrate your understanding of the role and the firm's challenges.

- Avoid generic questions: Avoid questions easily answered through online research.

- Culture and future: Ask about the firm's culture, future plans, and any challenges they are currently facing.

Do: Follow Up After Interviews

Following up demonstrates your continued interest and professionalism.

Send Thank-You Notes:

Send personalized thank-you notes to each interviewer within 24 hours.

- Personalization: Address each interviewer by name and reference specific aspects of the conversation.

- Key takeaways: Reiterate your interest and highlight key discussion points.

- Conciseness: Keep your note brief, professional, and focused.

Maintain Consistent Contact (Professionally):

If you don't hear back within the expected timeframe, a polite follow-up email is acceptable.

- Avoid excessive follow-ups: One or two follow-up emails are sufficient.

- Professional tone: Maintain a respectful and professional tone throughout your communication.

- Respect their time: Be mindful of the recruiter's and hiring manager's busy schedules.

Conclusion:

Securing a fulfilling career in private credit jobs requires a strategic and proactive approach. By following these dos and don'ts, focusing on networking, mastering essential skills like financial modeling and credit analysis, and preparing thoroughly for interviews, you significantly increase your chances of success. Remember to tailor your application materials, actively engage with the private credit community, and follow up diligently. Don't let the competitive landscape discourage you; with dedication and the right strategies, a rewarding career in private credit jobs is within your reach. Start networking and building your skills today to launch your career in private credit.

Featured Posts

-

Long Awaited Kashmir Rail Link Finally Opens Pm Modis Inauguration Date

May 01, 2025

Long Awaited Kashmir Rail Link Finally Opens Pm Modis Inauguration Date

May 01, 2025 -

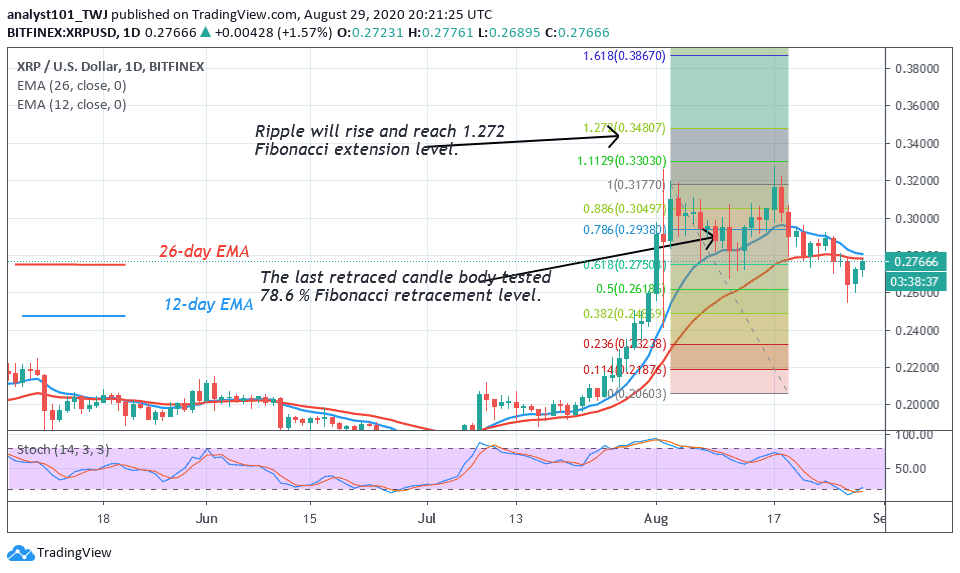

Is Xrp Ripple A Buy Under 3 A Detailed Investment Analysis

May 01, 2025

Is Xrp Ripple A Buy Under 3 A Detailed Investment Analysis

May 01, 2025 -

Foodie Adventures Await Your Next Windstar Cruise

May 01, 2025

Foodie Adventures Await Your Next Windstar Cruise

May 01, 2025 -

Eagles White House Celebration Jalen Hurts Absence And Trumps Tush Push

May 01, 2025

Eagles White House Celebration Jalen Hurts Absence And Trumps Tush Push

May 01, 2025 -

1 Million Giveaway Allegations Of Misconduct Against Michael Sheen And Channel 4

May 01, 2025

1 Million Giveaway Allegations Of Misconduct Against Michael Sheen And Channel 4

May 01, 2025

Latest Posts

-

4 Takeaways From The Celtics Win Over The Cavaliers Derrick Whites Impact

May 01, 2025

4 Takeaways From The Celtics Win Over The Cavaliers Derrick Whites Impact

May 01, 2025 -

Celtics Beat Cavaliers 4 Key Takeaways From Derrick Whites Heroics

May 01, 2025

Celtics Beat Cavaliers 4 Key Takeaways From Derrick Whites Heroics

May 01, 2025 -

10th Straight Win For Cavaliers De Andre Hunters Key Role In Victory Over Trail Blazers

May 01, 2025

10th Straight Win For Cavaliers De Andre Hunters Key Role In Victory Over Trail Blazers

May 01, 2025 -

Cleveland Cavaliers Defeat Portland Trail Blazers De Andre Hunters Stellar Game Secures 10th Consecutive Victory

May 01, 2025

Cleveland Cavaliers Defeat Portland Trail Blazers De Andre Hunters Stellar Game Secures 10th Consecutive Victory

May 01, 2025 -

Kinopoisk I Rekord Ovechkina Unikalniy Podarok Dlya Samykh Malenkikh

May 01, 2025

Kinopoisk I Rekord Ovechkina Unikalniy Podarok Dlya Samykh Malenkikh

May 01, 2025