PwC's Controversial Downsizing: Exit Strategy From Over A Dozen Countries Explained

Table of Contents

Reasons Behind PwC's Downsizing

PwC's decision to downsize its global footprint wasn't impulsive; it's a response to several converging factors that necessitate a strategic realignment.

Market Saturation and Increased Competition

The professional services sector is increasingly competitive. PwC, along with the other Big Four firms (Deloitte, EY, and KPMG), faces relentless pressure.

- Increased Competition from Big Four Rivals: The Big Four are constantly vying for market share, leading to intense price competition and a need for efficiency.

- Rise of Boutique Consulting Firms: Niche consulting firms specializing in specific areas are attracting clients seeking more specialized expertise.

- Impact of Technological Advancements: Automation and AI are transforming the industry, requiring significant investments in technology and potentially impacting workforce needs.

Market saturation, particularly in certain regions where PwC had a less dominant presence, also played a role. For example, some smaller European markets may have offered limited growth potential compared to the investment required to maintain operations.

Profitability Concerns and Cost-Cutting Measures

PwC's decision is inextricably linked to profitability concerns. While the firm remains a global powerhouse, declining profitability in certain markets necessitated a cost-cutting strategy.

- Declining Profitability in Certain Markets: Specific regions, possibly those with slower economic growth or stricter regulatory environments, may have experienced lower-than-expected returns on investment.

- Need to Streamline Operations: Downsizing allows PwC to centralize resources, improve efficiency, and reduce overhead costs.

- Focus on Core Business Areas: By withdrawing from less profitable markets, PwC can reinvest resources into its core strengths and high-growth sectors.

While precise financial data remains confidential, industry analysts suggest a correlation between the downsizing and a need to improve overall financial performance.

Regulatory Scrutiny and Risk Management

Increased regulatory scrutiny and the associated compliance costs are another factor contributing to PwC's decision.

- Increased Regulatory Compliance Costs: Maintaining compliance with ever-changing regulations, especially in different jurisdictions, can be expensive and resource-intensive.

- Stricter Auditing Standards: The post-financial crisis era has brought stricter auditing standards and increased regulatory oversight, demanding significant investments in compliance infrastructure.

- Potential Reputational Risks: Operating in regions with high regulatory risks might expose PwC to potential reputational damage. A proactive withdrawal minimizes these risks. Specific countries with complex regulatory landscapes or higher levels of political instability likely influenced this decision.

Countries Affected by PwC's Exit Strategy

PwC's exit strategy has affected numerous countries across different continents. While the exact list fluctuates, the firm's withdrawal has notably impacted several markets in Europe, Latin America, and Africa. Specific examples include [Insert list of countries here, categorized geographically and with brief explanations for each region/country, if information is available]. The impact on clients and employees in each of these regions varied depending on the level of PwC’s established presence and the availability of alternative service providers.

Impact on Clients and Employees

PwC's downsizing has profound implications for both its clients and its employees.

Client Transition and Service Continuity

PwC is actively managing client transitions to ensure service continuity.

- Client Handovers to Other Firms: PwC is working to smoothly transfer clients to other firms, often collaborating with competitors or affiliated organizations.

- Provisions for Service Continuity: Agreements are in place to mitigate disruptions to ongoing client services. This may include temporary support or phased transitions.

- Potential Disruption to Client Services: Despite best efforts, some level of disruption is inevitable, posing challenges for clients relying on PwC's services.

Employee Support and Relocation

PwC is committed to supporting affected employees through this transition.

- Job Placement Assistance: The firm is providing resources to help employees find new jobs, including career counseling and networking opportunities.

- Severance Packages: Generous severance packages are offered to ensure financial stability during the job search.

- Relocation Support: For employees willing to relocate, PwC offers assistance with relocation costs and finding new roles within the firm.

- Retraining Opportunities: In some cases, retraining opportunities are provided to help employees adapt to changing industry demands.

Long-Term Implications for PwC

PwC's strategic retreat represents a calculated risk. The long-term implications are complex and multifaceted.

- Global Presence and Market Share: While the downsizing may impact its global reach in the short term, it could strengthen PwC's position in core markets where it maintains a strong competitive advantage.

- Strategic Implications for Future Growth: This restructuring should allow for better resource allocation to high-growth sectors and technologies.

- Potential Opportunities: Focusing on core markets could lead to enhanced profitability and opportunities for innovation and expansion in strategically chosen areas.

Conclusion

PwC's controversial downsizing is a multifaceted response to market saturation, profitability concerns, and increased regulatory scrutiny. The impact on clients involves careful transition planning, while employees are receiving substantial support. While the firm's global presence may be altered, this strategic realignment may ultimately position PwC for stronger long-term growth. Stay informed on the evolving landscape of the professional services industry and the ongoing implications of PwC's controversial downsizing. Follow [your publication/website] for the latest updates and analysis.

Featured Posts

-

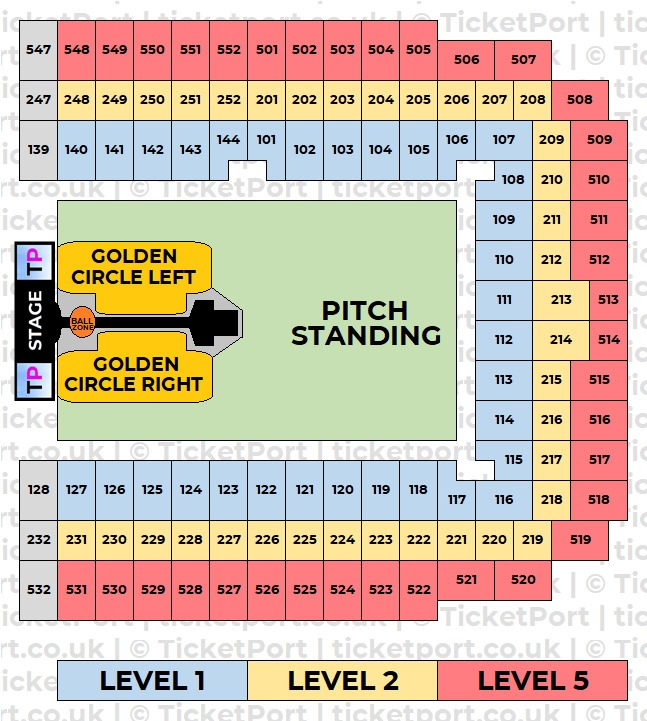

Capital Summertime Ball 2025 Tickets The Ultimate Guide To Purchase

Apr 29, 2025

Capital Summertime Ball 2025 Tickets The Ultimate Guide To Purchase

Apr 29, 2025 -

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 29, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 29, 2025 -

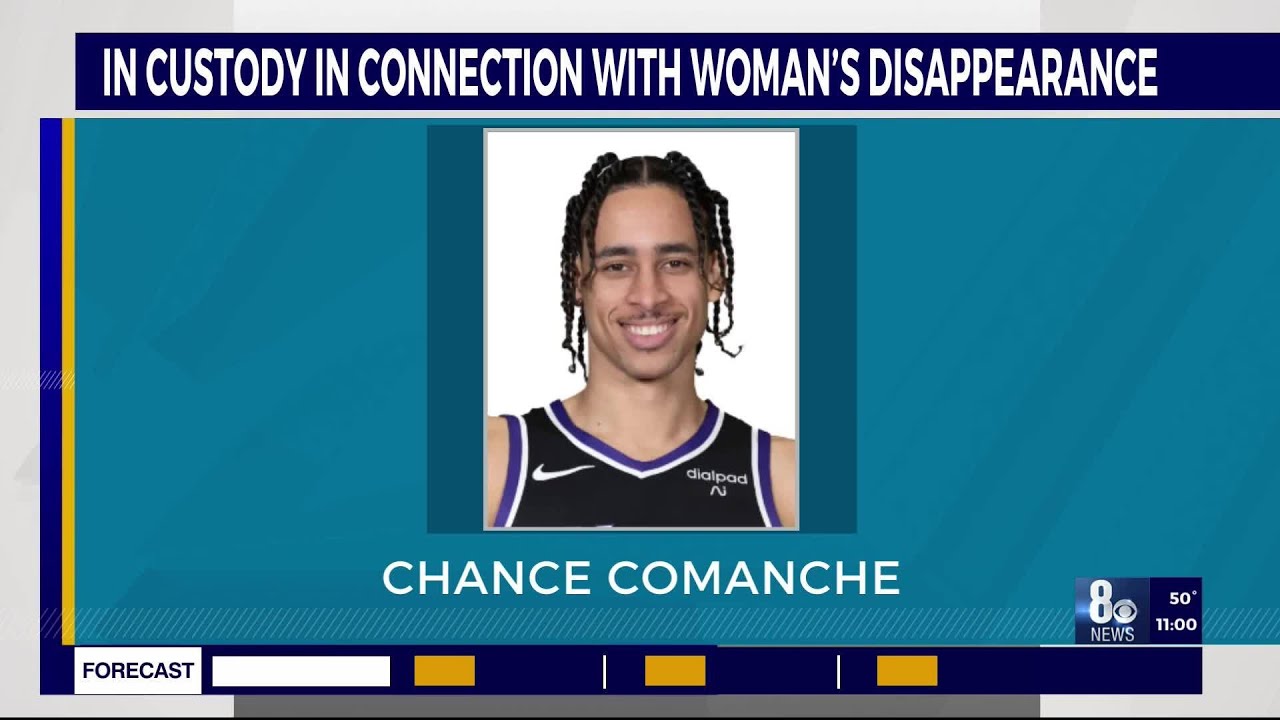

Update Missing British Paralympian Sam Ruddocks Disappearance In Las Vegas

Apr 29, 2025

Update Missing British Paralympian Sam Ruddocks Disappearance In Las Vegas

Apr 29, 2025 -

Getting Tickets To The Capital Summertime Ball 2025 A Step By Step Guide

Apr 29, 2025

Getting Tickets To The Capital Summertime Ball 2025 A Step By Step Guide

Apr 29, 2025 -

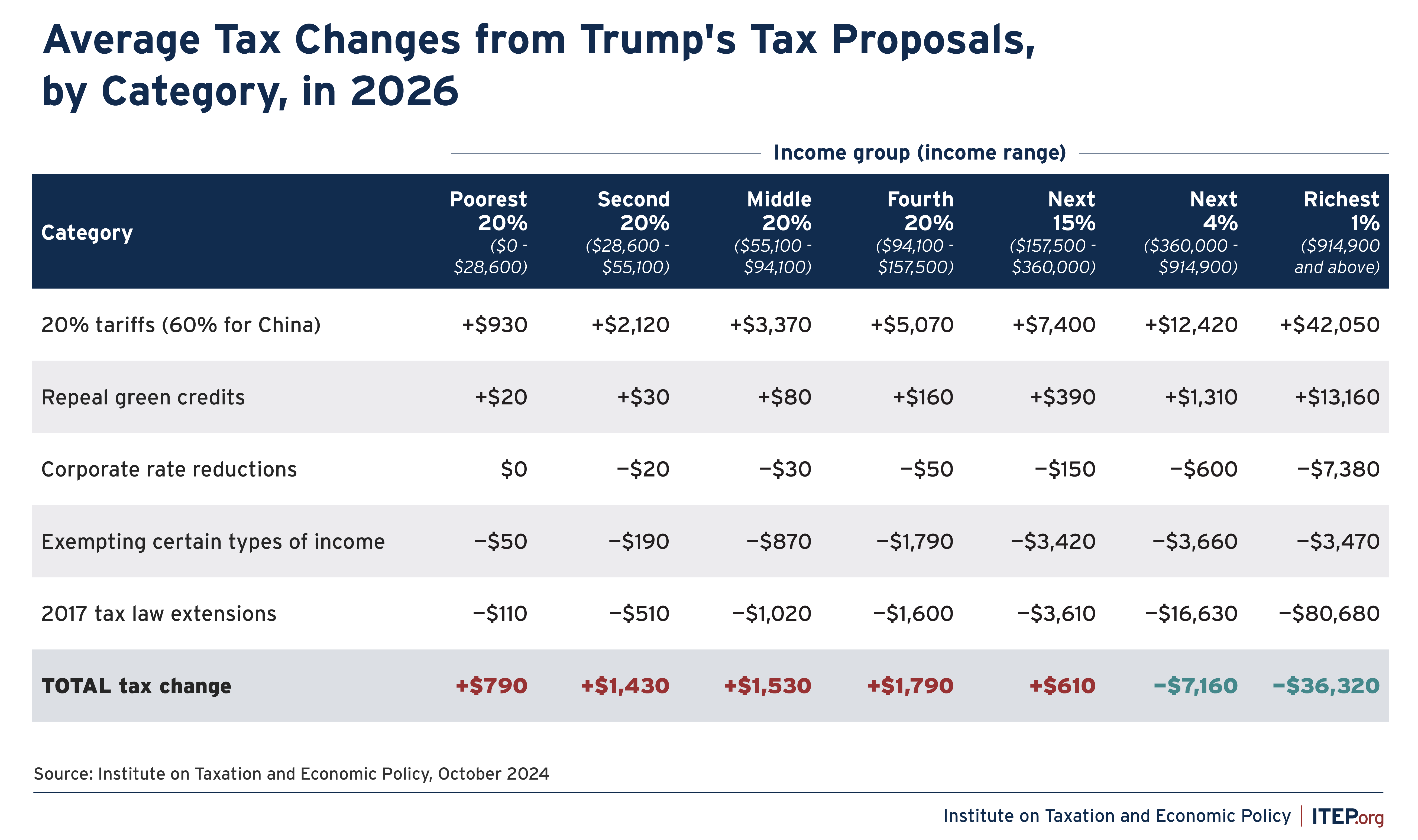

Trumps Tax Plan Republican Opposition And Potential Roadblocks

Apr 29, 2025

Trumps Tax Plan Republican Opposition And Potential Roadblocks

Apr 29, 2025