Reduced Steel Production In China: Implications For Iron Ore Demand

Table of Contents

Declining Steel Production in China: The Underlying Factors

Several interconnected factors contribute to the decline in Chinese steel production. Understanding these underlying causes is crucial for predicting future trends and mitigating risks.

Government Policies and Environmental Regulations

China's government has implemented increasingly stringent environmental regulations to combat air pollution and achieve its carbon neutrality goals. These policies directly impact steel production:

- Stricter Emission Standards: New regulations limit emissions of pollutants like sulfur dioxide and particulate matter, forcing steel mills to invest in cleaner technologies or face penalties.

- Capacity Reduction Initiatives: The government has actively pursued policies to reduce overcapacity in the steel sector, leading to mill closures and production cuts.

- Energy Efficiency Targets: Policies promoting energy efficiency and the adoption of renewable energy sources within the steel industry are driving changes in production processes.

- Example: The "Ten-Year Plan": Initiatives like China's ten-year plan for steel industry restructuring have resulted in significant capacity cuts and a shift towards higher-value steel products.

Weakening Domestic and Global Demand

A slowdown in China's economic growth has directly impacted steel consumption. This is further exacerbated by global economic uncertainties:

- Slower Infrastructure Spending: Reduced investment in construction and infrastructure projects, key drivers of steel demand, has significantly lowered consumption.

- Decreased Real Estate Development: The ongoing property market slowdown in China has led to a substantial decrease in demand for steel reinforcement bars and other construction materials.

- Weakening Global Economy: Global economic headwinds have dampened export demand for Chinese steel products, adding to the pressure on domestic production.

- Data Showing Decline: Statistics from the National Bureau of Statistics of China clearly indicate a consistent year-on-year decline in steel consumption.

Rising Production Costs

Increased input costs are squeezing the profitability of Chinese steel mills, impacting production levels:

- Higher Iron Ore and Coking Coal Prices: Fluctuations in the prices of these key raw materials directly affect the cost of steel production.

- Elevated Energy Prices: Rising energy costs, particularly for electricity and coal, significantly increase operating expenses.

- Labor Costs and Other Expenses: Increased labor costs and other operational expenses further contribute to the rising cost of steel production.

- Impact on Viability: The combined effect of these rising costs is making steel production less profitable, incentivizing some mills to reduce output or even shut down.

Impact on Iron Ore Demand and Prices

The reduction in Chinese steel production has had a profound and immediate impact on the global iron ore market.

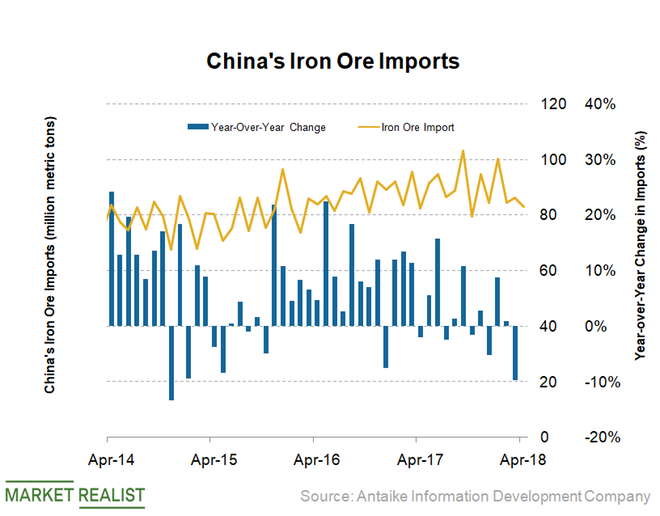

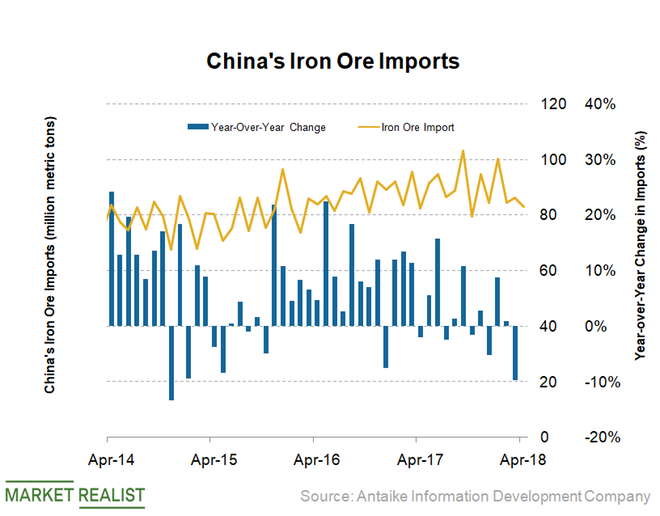

Direct Impact on Iron Ore Imports

The decreased demand for steel has directly translated into lower iron ore imports into China:

- Reduced Purchases from Major Suppliers: Australia and Brazil, major iron ore exporters, have experienced a significant drop in their exports to China.

- Import Volume Decline: Data from Chinese customs authorities clearly shows a marked decrease in iron ore import volumes.

- Impact on Port Activity: Reduced iron ore imports have impacted port activity and related logistics operations in Chinese ports.

- Trade Data Analysis: Analyzing trade data reveals a strong correlation between Chinese steel production and iron ore import volumes.

Price Volatility and Market Fluctuations

The link between steel production and iron ore prices is undeniable:

- Price Correlation: Reduced steel demand leads to a decrease in iron ore prices, creating significant price volatility.

- Market Fluctuations: The iron ore market has experienced considerable price swings due to fluctuations in Chinese steel production.

- Historical Price Trends: Examining historical iron ore price trends reveals a clear relationship with the ups and downs of Chinese steel production.

- Impact on Mining Companies: Iron ore mining companies have felt the impact of reduced demand and price volatility on their profitability.

Diversification of Iron Ore Supply Chains

The dependence on Chinese steel mills has prompted other countries to diversify their iron ore supply sources:

- New Partnerships: Iron ore producers are forging new partnerships and trade agreements with steel mills globally.

- Alternative Sources: The search for alternative sources of iron ore is intensifying to reduce reliance on China.

- Long-Term Implications: This diversification will reshape the global iron ore market landscape in the long term.

- Strategic Alliances: Countries are forming strategic alliances to secure stable and reliable iron ore supplies.

Future Outlook and Implications for the Global Steel and Iron Ore Markets

Predicting the future of the Chinese steel industry and its impact on iron ore demand requires careful consideration of various factors.

Predictions for Chinese Steel Production

Forecasting future steel production in China is complex but crucial:

- Production Level Forecasts: Experts offer varying predictions, some anticipating a continued decline, while others suggest a potential stabilization or even modest growth.

- Long-Term Trends: Analyzing long-term trends in urbanization, infrastructure development, and industrial growth is vital for accurate forecasting.

- Scenario Planning: Developing different scenarios—optimistic, pessimistic, and most likely—allows for better risk management.

Strategic Responses from Iron Ore Producers

Major iron ore producers are actively adapting to the changing market dynamics:

- Cost Optimization: Focus on improving operational efficiency and reducing production costs is paramount.

- Value-Added Products: Developing and marketing value-added iron ore products enhances profitability.

- Market Diversification: Reducing dependence on the Chinese market through diversification into other steel-producing regions.

Geopolitical Implications

The decline in Chinese steel production has significant geopolitical implications:

- Global Trade Dynamics: Shifts in steel production capacity will impact global trade flows and trade balances.

- Market Share Shifts: Other steel-producing countries will likely see an increase in market share.

- International Relations: This shift will influence international relations and potentially lead to new economic alliances.

Conclusion

The reduction in steel production in China has triggered a significant ripple effect across the global iron ore market. Decreased demand, price volatility, and shifts in supply chains are all major consequences. Iron ore producers must adapt to this new reality by focusing on efficiency, diversification, and strategic partnerships. Understanding the implications of reduced steel production in China is crucial for stakeholders across the entire value chain. Further monitoring of Chinese industrial policy and global economic trends is essential for navigating this evolving landscape. Stay informed on the latest developments related to reduced steel production in China to effectively manage risks and capitalize on opportunities in this dynamic market.

Featured Posts

-

David Vs Morgan An Analysis Of High Potential And Weakness

May 10, 2025

David Vs Morgan An Analysis Of High Potential And Weakness

May 10, 2025 -

Plantation De Vignes A Dijon 2 500 M Dans Le Secteur Des Valendons

May 10, 2025

Plantation De Vignes A Dijon 2 500 M Dans Le Secteur Des Valendons

May 10, 2025 -

2025 A Good Year For Stephen King Despite A Potential Monkey Flop

May 10, 2025

2025 A Good Year For Stephen King Despite A Potential Monkey Flop

May 10, 2025 -

Investing In Palantir Technologies A Look Ahead To May 5th And Beyond

May 10, 2025

Investing In Palantir Technologies A Look Ahead To May 5th And Beyond

May 10, 2025 -

Racial Hate Crime Womans Unprovoked Attack Leaves Man Dead

May 10, 2025

Racial Hate Crime Womans Unprovoked Attack Leaves Man Dead

May 10, 2025