Regulatory Relief Requested: Indian Insurers And The Bond Forward Market

Table of Contents

Current Constraints Faced by Indian Insurers

The current regulatory framework governing insurance investments in India presents significant limitations, particularly regarding access to sophisticated risk management tools. The Insurance Regulatory and Development Authority of India (IRDAI) sets strict guidelines on investment strategies, creating hurdles for insurers seeking to effectively mitigate interest rate risk. These limitations stem from a cautious approach aimed at safeguarding policyholder funds, but they inadvertently restrict insurers' ability to optimize their investment portfolios.

- Restrictions on derivatives trading: Indian insurers face severe limitations on their ability to trade derivatives, including bond forwards, a key tool for managing interest rate risk.

- Limited access to hedging instruments: The restricted access to hedging instruments forces insurers to rely on less effective strategies, increasing their vulnerability to interest rate fluctuations.

- Difficulty in managing duration risk in bond portfolios: The inability to effectively manage duration risk exposes insurers to significant losses when interest rates shift unexpectedly.

- Potential for significant losses due to interest rate volatility: The absence of efficient hedging mechanisms leaves Indian insurers exposed to substantial losses arising from interest rate volatility, impacting their solvency and ability to meet long-term liabilities.

The IRDAI's regulations, while well-intentioned, need a review to reflect the evolving complexities of the financial markets. Data indicates significant losses incurred by insurers due to interest rate fluctuations in recent years, highlighting the urgent need for improved risk management capabilities through greater access to the bond forward market.

The Potential Benefits of Bond Forward Market Access

Access to the bond forward market offers Indian insurers a powerful tool to mitigate interest rate risk and significantly improve their investment strategies. Hedging strategies using bond forwards allow insurers to lock in interest rates, protecting their portfolios from adverse movements. This enhanced risk management translates into several crucial benefits:

- Improved risk management capabilities: Bond forwards enable insurers to precisely manage their exposure to interest rate fluctuations, reducing the potential for substantial losses.

- Enhanced portfolio diversification: Integrating bond forwards into investment strategies allows for greater diversification, leading to a more robust and stable portfolio.

- Increased investment returns through strategic hedging: Strategic use of bond forwards can enhance returns by allowing insurers to take advantage of favorable market conditions while protecting against downside risk.

- Better alignment of investment strategies with long-term liabilities: Effective interest rate risk management through the bond forward market allows insurers to better align their investment strategies with their long-term liabilities, ensuring financial stability.

Many developed markets have seen their insurance sectors significantly benefit from active participation in bond forward markets. By studying these successful models, India can learn how to safely and efficiently integrate this crucial tool into the regulatory framework. The potential for improved portfolio performance and reduced risk is substantial.

Specific Regulatory Relief Requested by Insurers

Indian insurers are advocating for several key changes to the existing regulatory framework to facilitate greater participation in the bond forward market. These requests are crucial for enabling them to adopt modern risk management practices and strengthen the overall financial stability of the sector.

- Increased investment limits in derivatives: Raising the permissible investment limits in derivatives, specifically bond forwards, will allow insurers to implement more effective hedging strategies.

- Clearer guidelines on permissible hedging strategies: Providing clearer and more comprehensive guidelines will reduce ambiguity and encourage wider adoption of hedging techniques.

- Streamlined approval processes for bond forward market participation: Simplifying the approval processes for insurers seeking to participate in the bond forward market will reduce bureaucratic hurdles and encourage quicker adoption.

- Regulatory sandbox for testing new strategies: Establishing a regulatory sandbox will allow insurers to test and refine new hedging strategies in a controlled environment before wider implementation.

These changes would not only improve the risk management capabilities of individual insurers but also contribute to the overall stability of the Indian financial system. By fostering innovation and efficient risk management, these reforms would contribute significantly to the growth and sustainability of the insurance sector.

Arguments for and Against Granting Regulatory Relief

While the potential benefits of granting regulatory relief are substantial, a balanced view must consider potential risks.

Arguments for:

- Improved risk management: Enhanced hedging capabilities reduce the vulnerability of insurers to interest rate shocks.

- Increased investment efficiency: Access to the bond forward market allows for better optimization of investment portfolios.

- Enhanced competitiveness: Allowing Indian insurers to utilize advanced risk management tools levels the playing field with global counterparts.

Arguments against:

- Potential for increased systemic risk: Increased leverage through derivatives trading could, if not properly managed, expose the system to greater risk.

- Need for robust oversight: A comprehensive regulatory framework is essential to monitor and control risk associated with increased participation in the bond forward market.

- Complexity of the market: The intricacies of the bond forward market require a high level of understanding and expertise, necessitating robust training and oversight.

However, these concerns can be addressed through careful planning and implementation. Increased surveillance, stricter capital requirements, and enhanced regulatory oversight can mitigate the potential risks while maximizing the benefits of granting access to the bond forward market.

Conclusion

The current regulatory constraints significantly hinder Indian insurers' ability to effectively manage interest rate risk. Granting access to the Bond Forward Market, coupled with the requested regulatory relief, presents a significant opportunity to improve risk management, enhance investment returns, and strengthen the overall financial stability of the Indian insurance sector. The potential benefits – improved risk management, increased investment efficiency, and enhanced competitiveness – far outweigh the potential risks, particularly when mitigated by appropriate regulatory oversight. We urge immediate consideration of these regulatory changes to unlock the full potential of the Indian Bond Forward Market for insurers, leading to a more robust and resilient insurance landscape. It's time for proactive engagement to ensure that the Indian insurance sector can fully leverage the benefits of this vital market for effective investment management and long-term financial health. Let's advocate for necessary changes to improve the accessibility of the Bond Forward Market for Indian insurers.

Featured Posts

-

Dakota Johnsons Family Supports Her At Materialist Premiere

May 10, 2025

Dakota Johnsons Family Supports Her At Materialist Premiere

May 10, 2025 -

Pakistan Economic Crisis Imf Review And Implications For India Relations

May 10, 2025

Pakistan Economic Crisis Imf Review And Implications For India Relations

May 10, 2025 -

Dividend Investing Made Easy A High Return Strategy

May 10, 2025

Dividend Investing Made Easy A High Return Strategy

May 10, 2025 -

Ve Day Speech Lai Sounds Alarm On Rising Totalitarian Threat In Taiwan

May 10, 2025

Ve Day Speech Lai Sounds Alarm On Rising Totalitarian Threat In Taiwan

May 10, 2025 -

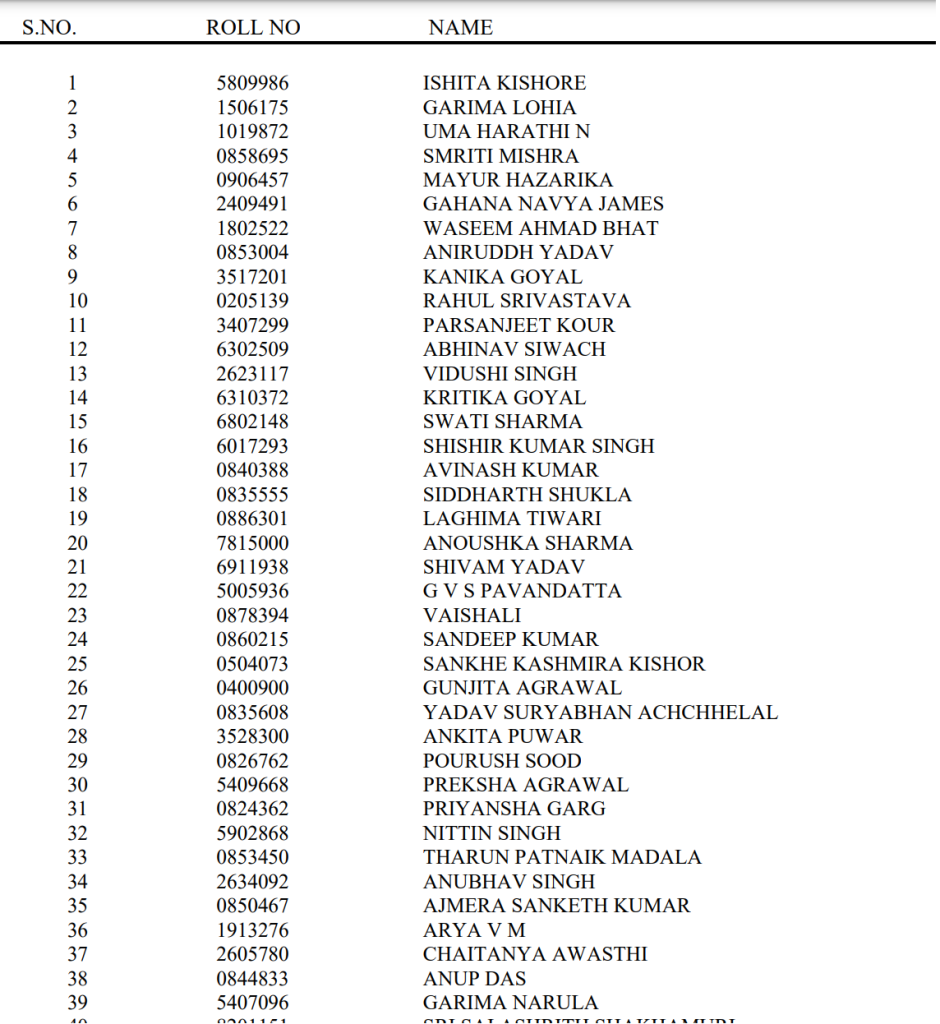

Madhyamik 2025 Result How To Check Merit List And Your Score

May 10, 2025

Madhyamik 2025 Result How To Check Merit List And Your Score

May 10, 2025