Ripple (XRP) Price Increase: Analyzing The Trump Influence.

Table of Contents

Trump's Stance on Cryptocurrencies and its Potential Impact on XRP

Donald Trump's public statements regarding Bitcoin and cryptocurrencies have been inconsistent, ranging from cautious skepticism to occasional hints of potential acceptance. Understanding his past rhetoric is crucial to assessing any potential "Trump effect" on XRP.

-

Positive Comments (if any): While Trump hasn't explicitly endorsed XRP, any generally positive statements about the potential of blockchain technology or cryptocurrencies could indirectly boost investor confidence in the broader crypto market, including XRP. This positive sentiment could trigger a ripple effect (pun intended) leading to increased investment.

-

Negative Comments (if any): Conversely, any critical remarks or regulatory threats aimed at cryptocurrencies could negatively impact investor sentiment, potentially leading to XRP price drops. Analyzing the historical impact of such statements on the overall cryptocurrency market is key.

-

The "Trump Effect" on Investor Confidence: Trump's pronouncements, regardless of their specific content, often create significant market volatility. His unpredictable nature can lead investors to react emotionally, driving speculative trading and impacting the price of assets, including XRP. This "Trump effect" is a significant factor to consider when analyzing XRP price fluctuations.

Specific Examples of Trump's Actions and Their Correlation with XRP Price Changes

To analyze a potential correlation, we need to examine specific instances where Trump's actions coincided with XRP price movements. For example, let's consider:

-

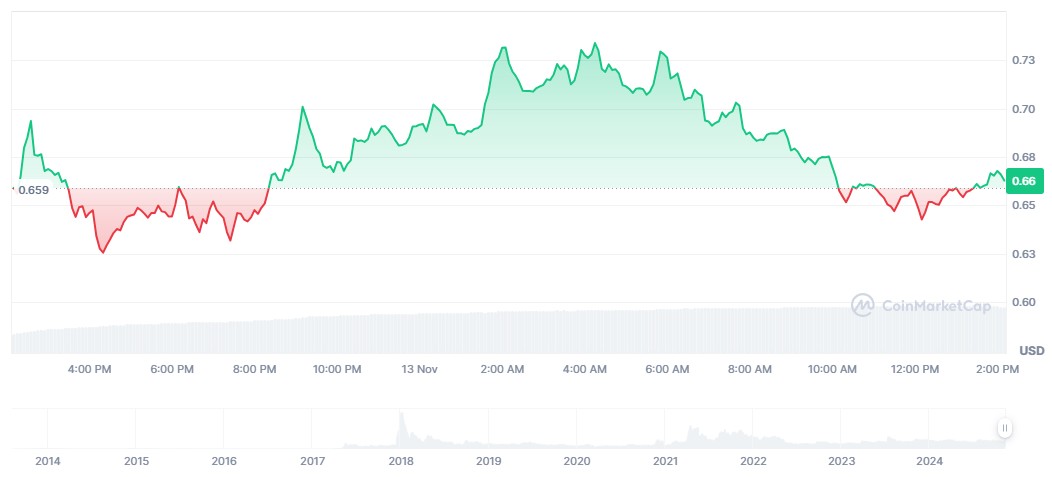

[Specific Date]: [Describe a specific event, e.g., a tweet, speech, or policy announcement by Trump]. [Analyze the subsequent price movement of XRP. Include a chart or graph if possible. Source the data from a reputable cryptocurrency exchange like Coinbase or Binance]. [Analyze the time lag between the event and the price change and discuss potential causality].

-

[Specific Date]: [Repeat the above process for another specific event].

It's crucial to note that correlation doesn't equal causation. While a coincidental price increase following a Trump statement might suggest a connection, other factors could be at play. Rigorous analysis using verifiable data is essential to establish any meaningful causal link.

The Role of Media and Social Sentiment in Amplifying the "Trump Effect"

The media plays a significant role in shaping public perception of Trump's pronouncements and their potential impact on the cryptocurrency market. Positive media coverage of a Trump statement, even if it's indirectly related to crypto, could amplify the "Trump effect," leading to increased XRP trading volume and price increases.

-

Social Media Sentiment: Platforms like Twitter and Reddit are crucial in shaping the narrative around Trump and XRP. Analyzing social media sentiment using tools that track keywords and emotional tone can provide valuable insights into how public perception influences trading decisions.

-

Speculative Trading: The "Trump effect" can easily fuel speculative trading. Investors might buy or sell XRP based on perceived (rather than factual) Trump influence, creating artificial price volatility.

-

Separating Fact from Speculation: It's crucial to discern genuine market reactions from speculative trading driven by the hype surrounding Trump's influence. Reliable news sources and careful analysis of market data are essential to make informed decisions.

The Influence of Regulatory Uncertainty and Trump's Potential Policies

Regulatory uncertainty is a major factor influencing cryptocurrency prices. Trump's past stance on regulation, or potential future policies under a hypothetical return to office, could significantly impact investor confidence in XRP.

-

Past Policies: Analyze how Trump's past administration's approach to financial regulation might have influenced investor sentiment toward cryptocurrencies like XRP.

-

Future Regulatory Changes (Hypothetical): Speculate on how different regulatory scenarios under a potential Trump administration could affect the XRP market. This involves careful consideration of both positive and negative impacts. Such analysis should be presented as speculation, not as definitive prediction.

Alternative Factors Contributing to XRP Price Volatility

Attributing XRP price movements solely to Trump's influence is an oversimplification. Several other factors contribute to its volatility:

-

Technological Advancements: Updates and improvements to Ripple's network, such as increased transaction speed or enhanced security features, can positively influence XRP's price.

-

Market Trends: The overall cryptocurrency market sentiment significantly impacts XRP's performance. A bullish market generally leads to higher XRP prices, while a bearish market often results in price drops.

-

Adoption Rates and Partnerships: Increased adoption by financial institutions and strategic partnerships with major companies can positively impact XRP's value.

-

Macroeconomic Factors: Global economic events, such as inflation, interest rate changes, and geopolitical instability, can all influence investor behavior and XRP price.

Conclusion

While there might be a correlation between certain Trump-related events and XRP price fluctuations, it's crucial to avoid drawing simplistic conclusions. The impact of Trump's actions on XRP is likely indirect and intertwined with other significant market forces. The "Trump effect" should be viewed as one factor among many influencing XRP price volatility. It's essential to consider technological advancements, market trends, adoption rates, and macroeconomic factors for a comprehensive understanding of XRP's price dynamics. Avoid speculative trading based solely on unsubstantiated claims of political influence.

Call to Action: Stay informed about the latest developments in the cryptocurrency market and continue analyzing the factors influencing the Ripple (XRP) price to make informed investment decisions. Further research into the relationship between political figures and cryptocurrency prices is encouraged to better understand the complex dynamics at play. Careful analysis of market data and consideration of multiple factors are crucial for navigating the volatile world of XRP and other cryptocurrencies.

Featured Posts

-

Check Your Bank Account Important Dwp Notification On Benefits

May 08, 2025

Check Your Bank Account Important Dwp Notification On Benefits

May 08, 2025 -

Are More Ethereum Liquidations Ahead After 67 M Drop

May 08, 2025

Are More Ethereum Liquidations Ahead After 67 M Drop

May 08, 2025 -

Can The Thunder Overcome The Grizzlies Game Preview And Analysis

May 08, 2025

Can The Thunder Overcome The Grizzlies Game Preview And Analysis

May 08, 2025 -

Increased Dwp Home Visits Impact On Benefit Claimants

May 08, 2025

Increased Dwp Home Visits Impact On Benefit Claimants

May 08, 2025 -

Bitcoins 10x Multiplier A Wall Street Disruptor

May 08, 2025

Bitcoins 10x Multiplier A Wall Street Disruptor

May 08, 2025