Rise In Japan Trading House Shares Following Berkshire Hathaway's Stake

Table of Contents

Berkshire Hathaway's Investment in Japanese Trading Houses

Berkshire Hathaway's foray into the Japanese trading house sector marked a pivotal moment. The investment, announced in [Insert Date], involved acquiring significant stakes in five major Japanese trading houses: Mitsubishi Corporation, Mitsui & Co., Itochu Corporation, Sumitomo Corporation, and Marubeni Corporation. While the exact percentages varied slightly across the companies, each investment represented a considerable commitment, totaling billions of dollars.

Berkshire Hathaway's rationale behind this investment remains a subject of much discussion. While no official statement explicitly detailed the reasons, several factors likely played a crucial role:

- Long-term growth potential: Japan's trading houses are deeply entrenched in the global economy, acting as intermediaries for a wide range of commodities and services. Their established global networks and diversified operations offer considerable long-term growth prospects.

- Undervalued assets: Some analysts suggest that Berkshire Hathaway saw these trading houses as undervalued assets, presenting a compelling investment opportunity.

- Strategic diversification: The investment aligns with Berkshire Hathaway's strategy of diversifying its portfolio and gaining exposure to different global markets.

Bullet points:

- Mitsubishi Corporation: [Percentage of shares acquired]

- Mitsui & Co.: [Percentage of shares acquired]

- Itochu Corporation: [Percentage of shares acquired]

- Sumitomo Corporation: [Percentage of shares acquired]

- Marubeni Corporation: [Percentage of shares acquired]

- Total Investment Value: [Approximate total value in USD]

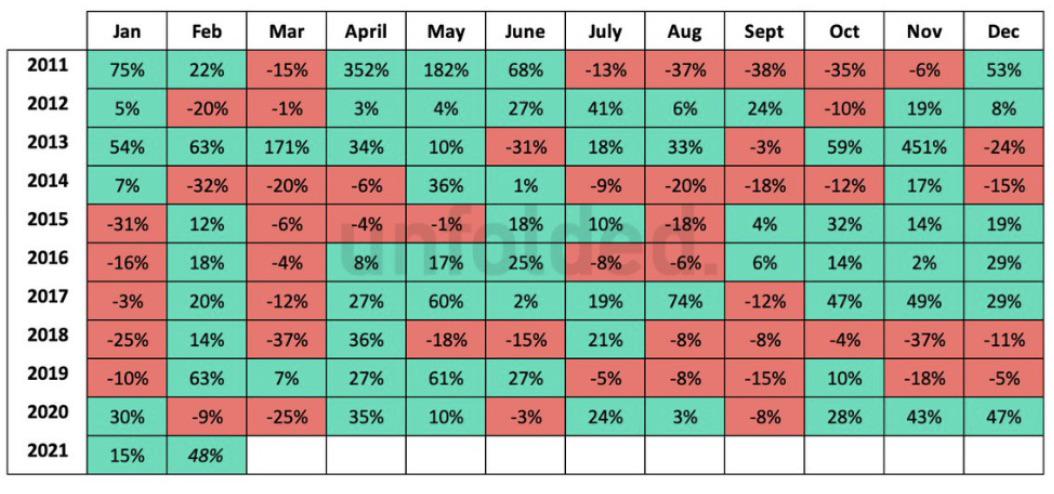

Impact on Share Prices of Japanese Trading Houses

The immediate impact of Berkshire Hathaway's investment was dramatic. The share prices of all five targeted trading houses experienced significant increases following the announcement.

(Insert chart/graph here showing the share price increases for each company since the investment.)

The percentage increase varied slightly among the companies, but collectively, the surge was substantial. This increase wasn't simply a short-term blip; trading volumes also increased significantly, indicating heightened investor interest.

Bullet points:

- Mitsubishi Corporation: [Percentage increase in share price]

- Mitsui & Co.: [Percentage increase in share price]

- Itochu Corporation: [Percentage increase in share price]

- Sumitomo Corporation: [Percentage increase in share price]

- Marubeni Corporation: [Percentage increase in share price]

- Comparison to Nikkei 225: [Comparative performance against the Nikkei 225 index]

Market Reactions and Analyst Opinions

The market's response to Berkshire Hathaway's investment was largely positive. Many analysts lauded the move, viewing it as a significant vote of confidence in the Japanese trading house sector and the Japanese economy as a whole.

However, not all opinions were uniformly positive. Some analysts expressed caution, highlighting potential risks and challenges associated with the global economic climate and the inherent complexities of the trading house business model. Nevertheless, the prevailing sentiment was one of optimism.

Bullet points:

- Positive opinions: "[Quote from a prominent analyst expressing positive views on the investment]"

- Neutral opinions: "[Quote from a neutral analyst offering a balanced perspective]"

- Potential Risks: [Mention potential risks like global economic slowdown, geopolitical factors, etc.]

Long-Term Implications for Japanese Trading Houses and the Market

Berkshire Hathaway's investment is likely to have significant long-term implications for Japanese trading houses and the broader market. The influx of capital and increased investor confidence could lead to:

- Increased profitability and growth: The enhanced financial standing could enable these companies to pursue aggressive expansion strategies and invest in innovative projects.

- Improved corporate governance: The scrutiny that comes with a high-profile investment may drive improvements in corporate governance and transparency.

- Attraction of further foreign investment: Berkshire Hathaway's move could serve as a catalyst, attracting further foreign investment into the Japanese market.

Bullet points:

- Increased Foreign Direct Investment (FDI): [Discuss the potential impact on FDI in Japan]

- Economic Growth: [Analysis of how this investment might influence Japan's economic growth]

- Global Competitiveness: [How this might improve Japan's global economic competitiveness]

Conclusion: The Future of Japan Trading House Shares Post-Berkshire Hathaway Investment

The significant rise in Japanese trading house share prices following Berkshire Hathaway's investment underscores the profound impact of strategic foreign investment. This bold move by Warren Buffett acted as a powerful catalyst, boosting investor confidence and highlighting the potential of these often-overlooked companies. The long-term implications are promising, suggesting a brighter future for Japanese trading houses and potentially attracting further foreign investment into the Japanese stock market. We encourage you to research the individual trading houses mentioned and consider the potential for further investment in Japan trading houses based on this analysis. Explore opportunities in the Japanese stock market and learn more about Berkshire Hathaway's investment strategy to make informed investment decisions.

Featured Posts

-

Superman Cinema Con Footage Krypto The Superdog Steals The Show

May 08, 2025

Superman Cinema Con Footage Krypto The Superdog Steals The Show

May 08, 2025 -

First Look Dystopian Horror Movie Based On Stephen Kings Novel Title

May 08, 2025

First Look Dystopian Horror Movie Based On Stephen Kings Novel Title

May 08, 2025 -

Bitcoin Buying Volume On Binance A Six Month Low Broken

May 08, 2025

Bitcoin Buying Volume On Binance A Six Month Low Broken

May 08, 2025 -

Ethereum Price Holding Above Support But Is A Drop To 1 500 Imminent

May 08, 2025

Ethereum Price Holding Above Support But Is A Drop To 1 500 Imminent

May 08, 2025 -

The Biggest Oscars Snubs Of All Time A Look Back At Hollywoods Biggest Misses

May 08, 2025

The Biggest Oscars Snubs Of All Time A Look Back At Hollywoods Biggest Misses

May 08, 2025