Russian Gas Phaseout: EU Discusses Spot Market Strategy

Table of Contents

The Urgency of Reducing Russian Gas Dependency

The decision to phase out Russian gas is not merely an economic one; it's a matter of geopolitical urgency. The 2022 invasion of Ukraine by Russia dramatically highlighted the vulnerability of the EU's reliance on Russian energy supplies. Russia's weaponization of its gas exports, using energy as a tool of political leverage, underscored the need for immediate and decisive action.

- Sanctions imposed on Russia following the invasion of Ukraine: These sanctions, while intended to pressure Russia, also disrupted established energy supply chains, forcing the EU to re-evaluate its dependence.

- Reliability concerns surrounding Russian gas supplies: The unpredictable nature of Russian gas deliveries, characterized by sudden cut-offs and supply squeezes, exposed the inherent risks of relying on a single, unreliable supplier.

- The need to diversify energy sources to enhance security: Diversification is paramount to bolstering energy security and reducing the EU's vulnerability to geopolitical pressures. This requires exploring alternative sources and suppliers.

- EU's strategic autonomy goals: The phaseout of Russian gas is integral to the EU's broader objective of achieving strategic autonomy in energy, reducing its dependence on external actors and enhancing its resilience.

Spot Market Dynamics and Challenges

The spot market, unlike long-term contracts, involves the buying and selling of natural gas for immediate delivery. While offering greater flexibility and responsiveness to supply and demand fluctuations, it also introduces significant challenges.

- Price volatility in spot markets and its impact on consumers and businesses: Prices in the spot market can fluctuate dramatically based on global supply and demand, leading to price spikes that impact both consumers and businesses. This volatility poses a major challenge for energy security and affordability.

- The need for robust infrastructure to handle fluctuating supply and demand: Efficient infrastructure, including pipelines, storage facilities, and LNG terminals, is crucial to manage the variable nature of spot market supplies and ensure consistent energy delivery.

- Increased competition among EU member states for available gas: The transition to the spot market intensifies competition between EU member states for securing sufficient gas supplies, potentially leading to disputes and unequal access.

- Potential for market manipulation and price gouging: The increased complexity of the spot market raises concerns about potential market manipulation and price gouging, requiring robust regulatory oversight and transparent market mechanisms.

The Role of LNG in the Spot Market

Liquefied natural gas (LNG) plays a vital role in the EU's transition to a spot market model. Its transportability by sea offers greater diversification of supply sources compared to pipeline gas, reducing dependence on specific countries.

- Increased LNG import terminals and infrastructure development: The EU is investing heavily in expanding its LNG import infrastructure, building new terminals and upgrading existing facilities to handle increased LNG volumes.

- Competition from other LNG importers globally: However, the EU faces competition from other major LNG importers globally, potentially driving up prices in the international market.

- Environmental considerations regarding LNG: While LNG provides greater flexibility, it's still a fossil fuel with associated environmental concerns, emphasizing the need for parallel investments in renewable energy sources.

Ensuring Energy Security and Affordability

Mitigating the risks associated with increased reliance on the spot market requires a multifaceted approach:

- Strategic gas reserves and their management: Building and maintaining strategic gas reserves is essential to buffer against short-term supply disruptions and price volatility. Efficient management of these reserves is crucial.

- Collaboration among member states to ensure supply: Cooperation among EU member states to coordinate gas purchases, share infrastructure, and establish joint procurement strategies is vital to enhance energy security collectively.

- Measures to protect consumers from price shocks: Governments must implement measures to shield vulnerable consumers and businesses from extreme price fluctuations, potentially through price caps, subsidies, or other social safety nets.

- Investing in renewable energy sources to reduce reliance on fossil fuels: Long-term energy security necessitates a rapid transition to renewable energy sources, reducing reliance on fossil fuels and enhancing the EU's energy independence.

Conclusion

The EU's shift towards the spot market for natural gas is a pivotal step in its strategy to phase out Russian gas and secure its energy future. While this transition offers greater flexibility and diversification, it also presents significant challenges relating to price volatility, infrastructure needs, and competition for supplies. Successfully navigating this transition requires continued investment in energy infrastructure, a rapid expansion of renewable energy sources, and close collaboration among EU member states. The successful phaseout of Russian gas and the effective management of the spot market are crucial for the EU’s energy independence and security. Learn more about the EU's energy strategy and stay informed about the latest developments in this critical area.

Featured Posts

-

Chip Tester Utac A Chinese Buyout Firms Strategic Decision

Apr 24, 2025

Chip Tester Utac A Chinese Buyout Firms Strategic Decision

Apr 24, 2025 -

5 Essential Dos And Don Ts Securing A Private Credit Role

Apr 24, 2025

5 Essential Dos And Don Ts Securing A Private Credit Role

Apr 24, 2025 -

Tesla Q1 Financial Results The Effect Of Controversy Surrounding Elon Musk

Apr 24, 2025

Tesla Q1 Financial Results The Effect Of Controversy Surrounding Elon Musk

Apr 24, 2025 -

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025 -

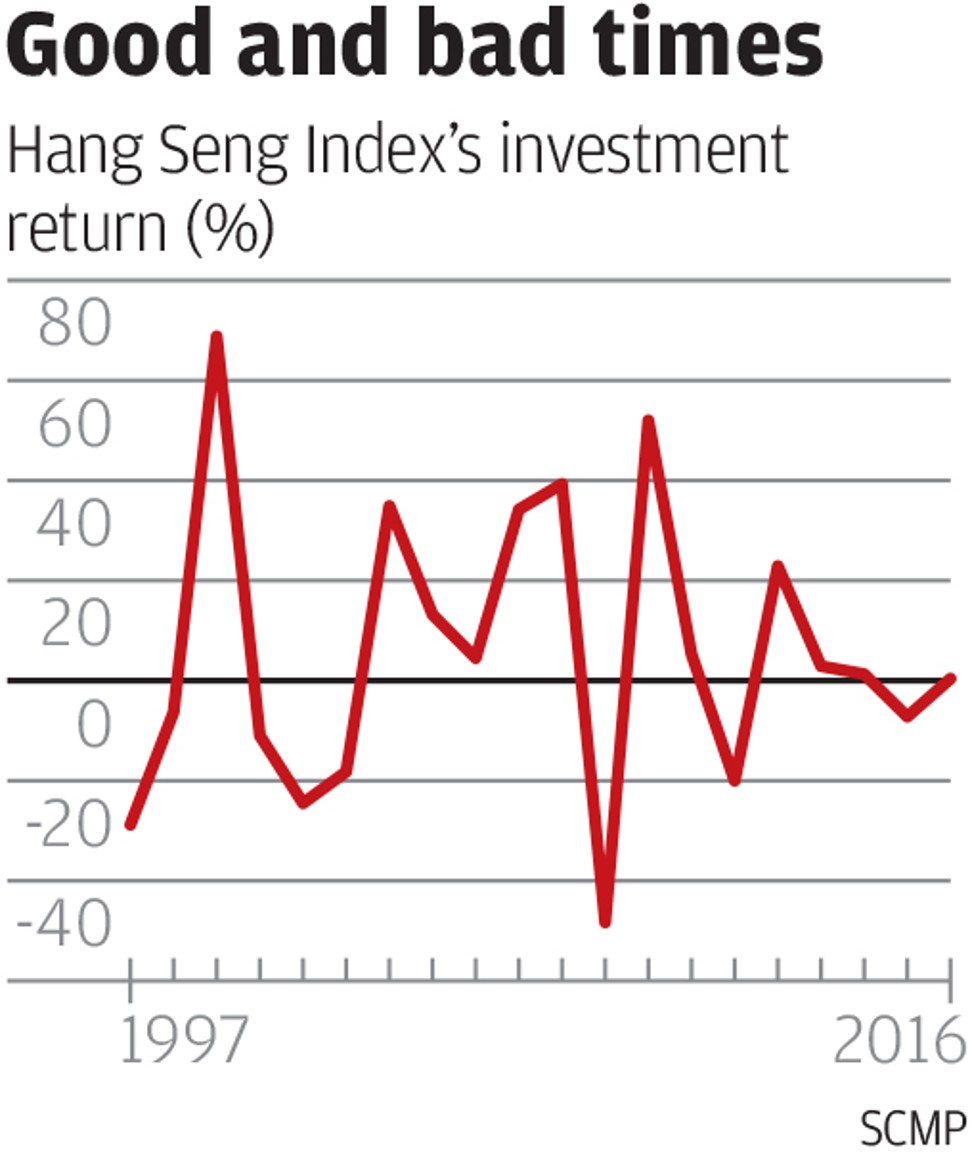

Hong Kongs Chinese Stock Market Sees Sharp Increase Amidst Trade Deal Optimism

Apr 24, 2025

Hong Kongs Chinese Stock Market Sees Sharp Increase Amidst Trade Deal Optimism

Apr 24, 2025