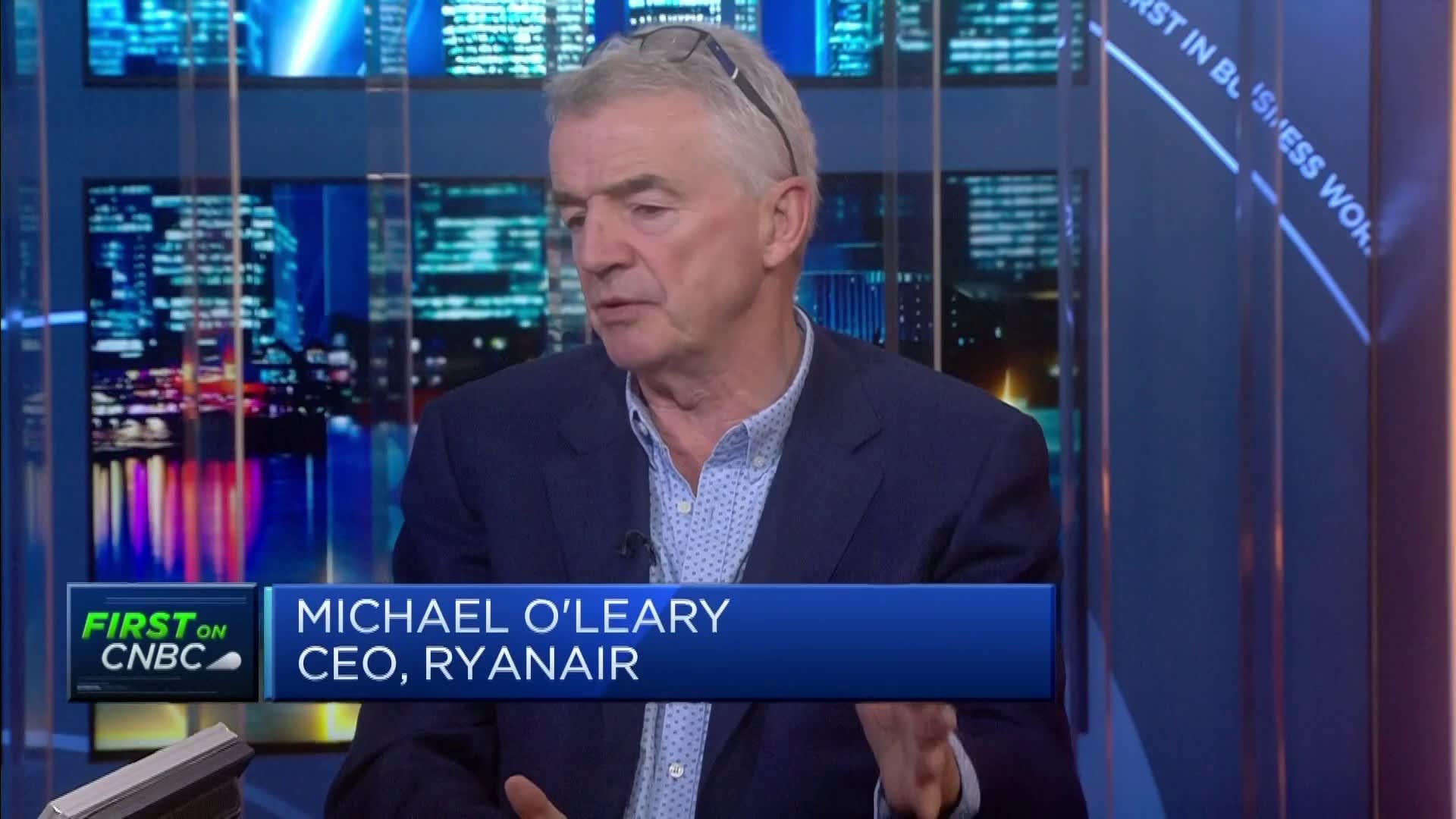

Ryanair CEO Highlights Tariff Wars As Primary Growth Risk; Details Buyback Program

Table of Contents

Tariff Wars: The Biggest Threat to Ryanair's Growth

The escalating global trade disputes pose a significant challenge to Ryanair's business model, impacting several key operational aspects. O'Leary's warnings regarding tariff wars are not to be taken lightly.

Impact of Trade Tensions on Fuel Costs

One of the most immediate and substantial impacts of trade tariffs is on fuel costs. Aviation fuel is a major expense for any airline, and Ryanair, with its vast network and high flight volume, is particularly vulnerable to price fluctuations. Escalating trade tensions often lead to increased fuel prices, directly impacting Ryanair's operational costs.

- Fuel Surcharges: Airlines often pass on increased fuel costs to consumers through surcharges, but this can impact price competitiveness and passenger numbers.

- Aviation Fuel Price Volatility: The price of aviation fuel is highly sensitive to global events, including trade wars, geopolitical instability, and supply chain disruptions. Recent spikes in fuel prices have been directly linked to trade disputes, creating uncertainty in Ryanair's cost projections.

- Data Point Example: Let's assume, for illustrative purposes, that a 10% increase in aviation fuel prices due to new trade tariffs would translate to a €X million increase in Ryanair's annual fuel bill. This substantial cost increase would directly impact profitability and potentially necessitate fare adjustments. This emphasizes the significant risk posed by global trade disputes.

Effect on Passenger Numbers and Routes

Beyond direct fuel costs, tariff wars can indirectly impact Ryanair's business through their effect on passenger numbers. Increased trade tensions can lead to reduced tourism and business travel, directly impacting demand for air travel.

- Tourism Impact: Uncertainty caused by trade wars can deter tourists from traveling, resulting in lower booking numbers for Ryanair's routes, particularly those connecting countries involved in trade disputes.

- Travel Restrictions: In extreme cases, trade disputes can even lead to travel restrictions between countries, significantly impacting Ryanair's route network and potentially requiring route cancellations or adjustments.

- Passenger Numbers Decline: A decline in passenger numbers would directly impact Ryanair's revenue, forcing the company to adapt its strategies and potentially reduce its flight frequency on affected routes.

Competitive Landscape and Market Volatility

The airline industry is inherently competitive, and tariff wars can exacerbate existing pressures and create further market volatility.

- Airline Competition: Trade tensions can create uneven playing fields for airlines based in different countries, leading to unfair competition and potentially forcing some airlines out of the market.

- Price Wars: In response to increased costs and reduced demand, airlines might engage in price wars, further eroding profit margins and impacting overall industry health.

- Market Share Fluctuation: Tariff wars can lead to significant market share fluctuations as airlines struggle to adapt to the changing economic landscape. Stronger airlines might gain market share, while weaker airlines may be forced to consolidate or even exit the market.

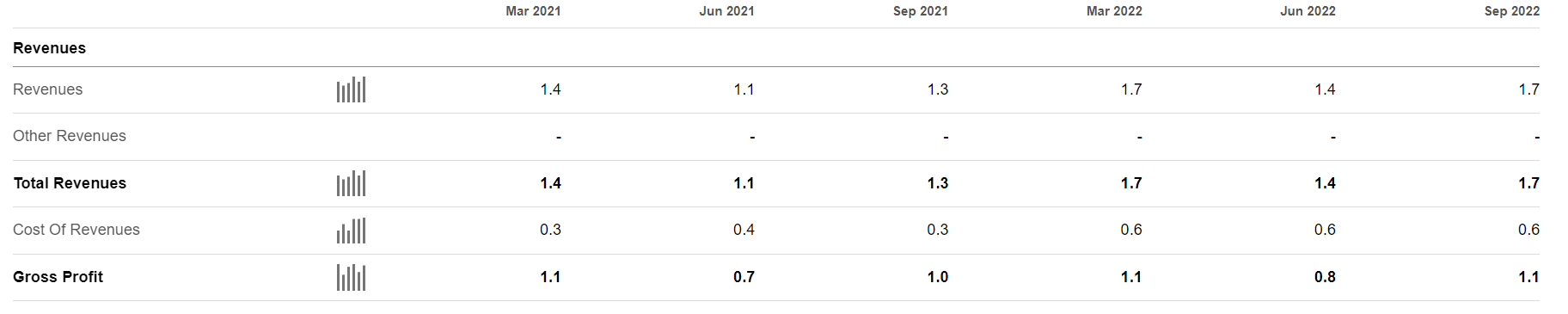

Ryanair's Buyback Program: A Strategic Response to Uncertainty?

In the face of these challenges, Ryanair's announcement of a share buyback program raises questions about its strategic response to the uncertainty created by tariff wars.

Details of the Buyback Scheme

Ryanair's buyback program involves repurchasing a significant number of its own shares. The details – the total amount, the timeline for repurchases, and the intended goals – are crucial to understanding the strategic implications. (Specific details should be inserted here, sourcing from a reliable financial news outlet.) This demonstrates Ryanair's commitment to returning value to shareholders. Keywords include: share buyback, stock repurchase, investor confidence, and financial strategy.

O'Leary's Rationale Behind the Buyback

O'Leary's rationale for the buyback likely reflects a combination of factors, including:

- Confidence in Future Performance: The buyback could signal confidence in Ryanair's ability to navigate the challenges posed by tariff wars and maintain profitability.

- Boosting Share Price: Repurchasing shares can artificially increase demand, potentially boosting the share price and improving investor sentiment.

- Returning Capital to Shareholders: The buyback allows Ryanair to return excess capital to shareholders, demonstrating a commitment to maximizing shareholder value.

Alternative Uses of Funds

While the buyback is a significant use of capital, alternative investment opportunities existed.

- Fleet Expansion: Ryanair could have used the funds to expand its fleet with more fuel-efficient aircraft.

- Route Development: Investing in new routes and expanding into new markets could have been another option.

- Technological Upgrades: Investing in new technologies to improve operational efficiency and reduce costs could have also been a strategic priority.

Conclusion: Navigating the Turbulence: Ryanair's Future in a World of Tariff Wars

In conclusion, Ryanair CEO Michael O'Leary's concerns about the impact of tariff wars on the airline's growth are significant. While the buyback program reflects a strategic response to market uncertainty, the underlying threat posed by escalating global trade tensions remains a key risk factor for Ryanair's future. The impact of fluctuating fuel prices, potential disruptions to passenger numbers and routes, and the intensified competitive landscape necessitates careful navigation. Stay informed on how Ryanair navigates the challenges of tariff wars and their impact on the airline's future growth and profitability. The ongoing situation surrounding global trade and its effect on aviation fuel prices will continue to shape Ryanair's strategy and financial performance.

Featured Posts

-

Etisia Synaylia Kathigiton Dimotikoy Odeioy Rodoy Dimokratiki

May 21, 2025

Etisia Synaylia Kathigiton Dimotikoy Odeioy Rodoy Dimokratiki

May 21, 2025 -

Australian Cross Country Run Briton Battles Adversity

May 21, 2025

Australian Cross Country Run Briton Battles Adversity

May 21, 2025 -

Nyt Mini Crossword Clues And Answers March 20 2025

May 21, 2025

Nyt Mini Crossword Clues And Answers March 20 2025

May 21, 2025 -

Analyzing The Friday Rise In D Wave Quantum Qbts Stock Value

May 21, 2025

Analyzing The Friday Rise In D Wave Quantum Qbts Stock Value

May 21, 2025 -

Ai Quantum Computing Stock A Dip Buying Opportunity

May 21, 2025

Ai Quantum Computing Stock A Dip Buying Opportunity

May 21, 2025

Latest Posts

-

Efimereyontes Iatroi Patras Odigos Gia To Savvatokyriako 12 And 13 Aprilioy

May 21, 2025

Efimereyontes Iatroi Patras Odigos Gia To Savvatokyriako 12 And 13 Aprilioy

May 21, 2025 -

Why Giorgos Giakoumakis Mls Move Might Have Faltered

May 21, 2025

Why Giorgos Giakoumakis Mls Move Might Have Faltered

May 21, 2025 -

I Katastasi Ton Sidirodromon Stin Ellada Istoriki Anadromi Kai Prooptikes

May 21, 2025

I Katastasi Ton Sidirodromon Stin Ellada Istoriki Anadromi Kai Prooptikes

May 21, 2025 -

Breite Ton Efimereyonta Giatro Sas Stin Patra 12 13 Aprilioy

May 21, 2025

Breite Ton Efimereyonta Giatro Sas Stin Patra 12 13 Aprilioy

May 21, 2025 -

Giorgos Giakoumakis Diminished Mls Transfer Value A Detailed Analysis

May 21, 2025

Giorgos Giakoumakis Diminished Mls Transfer Value A Detailed Analysis

May 21, 2025