Ryanair's Growth Concerns: Tariff Disputes And Planned Share Repurchases

Table of Contents

The Impact of Tariff Disputes on Ryanair's Operations

Ryanair's operational efficiency and profitability are significantly impacted by various ongoing tariff disputes. These disputes encompass several key areas, placing considerable pressure on the airline's bottom line. Increased fuel costs, a major component of airline operational expenditure, are a primary concern. Furthermore, rising airport charges in key markets are forcing Ryanair to reassess its route network and operational strategies.

- Increased fuel costs impacting operational budgets: Fluctuating oil prices and geopolitical instability contribute to unpredictable fuel costs, squeezing profit margins.

- Potential route cancellations or adjustments due to rising airport charges: High airport fees in certain locations make some routes unprofitable, necessitating route adjustments or cancellations.

- Impact on ticket pricing and competitiveness: To maintain profitability, Ryanair may be forced to increase ticket prices, impacting its competitive advantage in the budget airline market.

- Legal battles and associated expenses: Engaging in protracted legal battles to challenge unfavorable tariffs adds significant costs to the airline's operations.

These tariff disputes pose a serious threat to Ryanair's long-term growth strategy, potentially hindering its expansion plans and impacting its ability to maintain its market dominance.

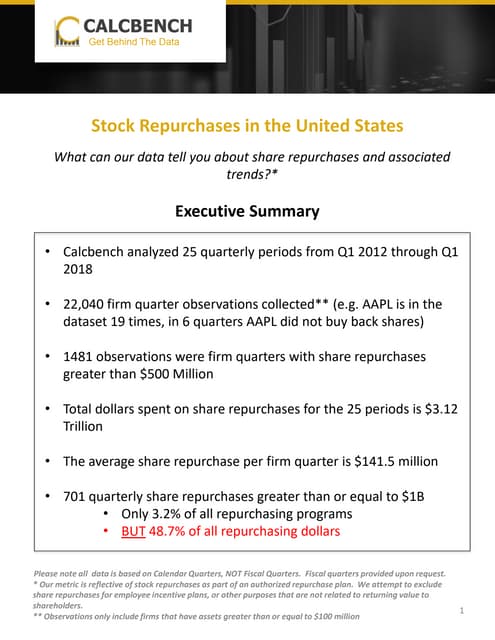

Ryanair's Share Repurchase Program: A Growth Strategy or a Defensive Measure?

Ryanair's announced share repurchase program, while seemingly ambitious, raises questions about its underlying motivations. The program, involving a significant sum of money and spanning a defined period, could be interpreted in two contrasting ways.

- Potential benefits of share repurchases for investors: Share repurchases can boost earnings per share, potentially increasing the share price and benefiting existing investors.

- Arguments for it as a signal of company strength: Proponents argue that the program demonstrates confidence in the company's future prospects and the belief that its shares are undervalued.

- Counterarguments suggesting it's a way to manage declining profitability: Critics suggest it's a way to artificially boost the share price in the face of declining profitability caused by external factors like tariff disputes.

- The impact on the company's overall financial position: The significant capital outlay for the share repurchase could limit funds available for crucial investments in fleet modernization, expansion, or other growth initiatives.

The effectiveness of the share repurchase program as a genuine growth strategy is debatable given the simultaneous pressures from tariff disputes. It might be a short-term solution masking underlying vulnerabilities.

Analyzing the Interplay Between Tariff Disputes and Share Repurchases

The simultaneous existence of escalating tariff disputes and a significant share repurchase program raises crucial questions about Ryanair's strategic priorities. The close timing of these events warrants careful consideration.

- Does the share repurchase divert funds from necessary investments? The capital allocated to share repurchases could have been used for essential upgrades to its fleet, expansion into new markets, or improved customer service.

- Does it signal a lack of confidence in future growth prospects? The decision to return capital to shareholders rather than reinvest in the business could be interpreted as a lack of confidence in future growth.

- Could it create short-term gains at the expense of long-term sustainability? A focus on short-term share price increases might compromise long-term growth and operational efficiency.

- Alternatives to share repurchases for addressing the challenges: Alternative strategies such as cost optimization, route diversification, or strategic partnerships could offer more sustainable solutions to the challenges faced by Ryanair.

The strategic wisdom of this combined approach needs careful evaluation. The apparent contradiction between returning capital to shareholders while facing significant operational headwinds warrants investor scrutiny.

The Implications for Investors

For investors, the interplay of tariff disputes and the share repurchase program presents a complex risk-reward scenario.

- Potential short-term and long-term impact on share price: The share repurchase could provide a short-term boost, but the long-term effects of the tariff disputes remain uncertain.

- Risk assessment considerations for investors: Investors need to carefully assess the risks associated with Ryanair's exposure to escalating tariff disputes and the potential impact on its profitability.

- Comparison with competitor strategies: Comparing Ryanair's strategy with those of its competitors provides valuable context and insight into its relative position.

- Advice on investment decisions: Investors should conduct thorough due diligence before making any investment decisions, considering both the short-term and long-term implications of these developments.

Conclusion: Assessing Ryanair's Future Growth Trajectory

Ryanair's future growth trajectory is clouded by the conflicting pressures of escalating tariff disputes and a significant share repurchase program. While the share buyback offers short-term gains for investors, the sustainability of this approach is questionable given the ongoing challenges. The diversion of funds from necessary investments to share repurchases raises concerns about long-term growth and operational efficiency. Investors must carefully weigh the potential risks and rewards associated with Ryanair's current strategy. To make informed investment decisions related to Ryanair's growth concerns, it is crucial to continue researching Ryanair’s financial performance and staying informed about developments regarding tariff disputes and the share repurchase program. Understanding these dynamics is critical for navigating the complexities of investing in this dynamic airline.

Featured Posts

-

Is Buy Canadian Losing Steam The Impact Of Tariffs On The Beauty Sector

May 20, 2025

Is Buy Canadian Losing Steam The Impact Of Tariffs On The Beauty Sector

May 20, 2025 -

Filmo Bado Zaidynes Zvaigzde Jennifer Lawrence Ir Antras Vaikas Vardai Ir Detales

May 20, 2025

Filmo Bado Zaidynes Zvaigzde Jennifer Lawrence Ir Antras Vaikas Vardai Ir Detales

May 20, 2025 -

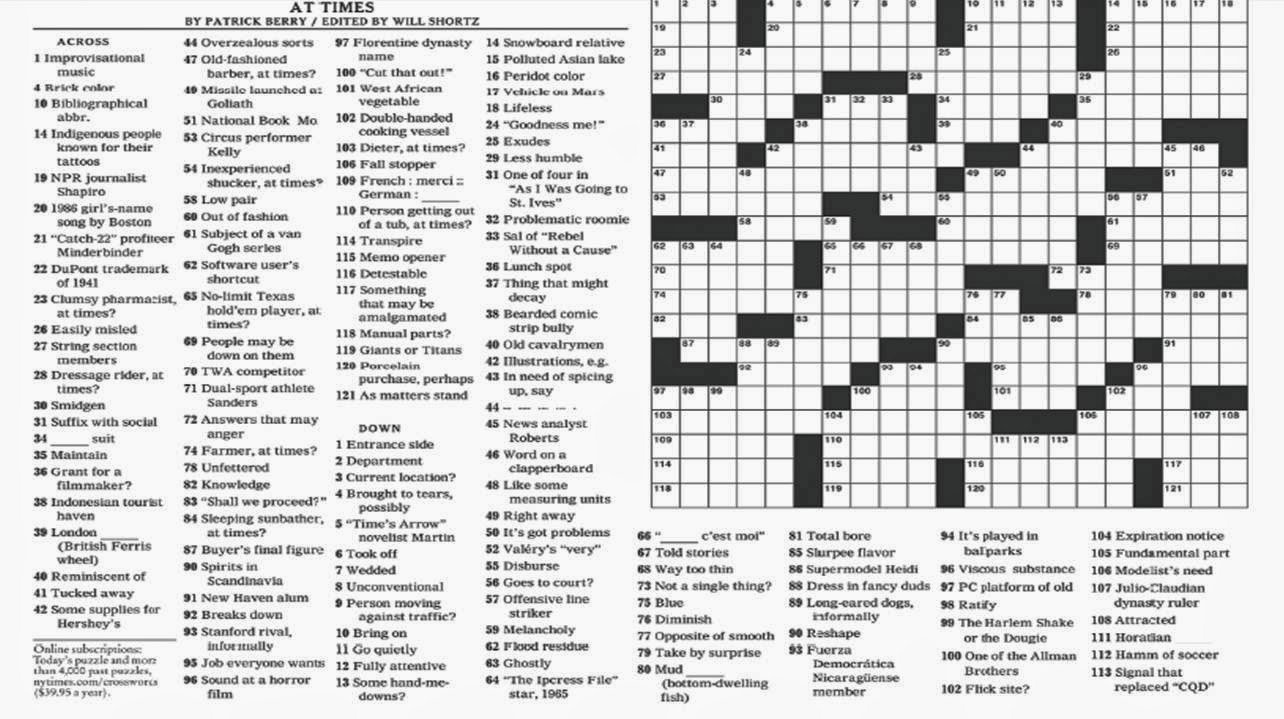

Unlock The Nyt Mini Crossword April 20 2025 Answers And Clues

May 20, 2025

Unlock The Nyt Mini Crossword April 20 2025 Answers And Clues

May 20, 2025 -

Factors Contributing To D Wave Quantum Qbts Stocks Friday Gain

May 20, 2025

Factors Contributing To D Wave Quantum Qbts Stocks Friday Gain

May 20, 2025 -

Fenerbahce Wil Keihard Optreden Tegen Tadic Na Contact Met Ajax

May 20, 2025

Fenerbahce Wil Keihard Optreden Tegen Tadic Na Contact Met Ajax

May 20, 2025

Latest Posts

-

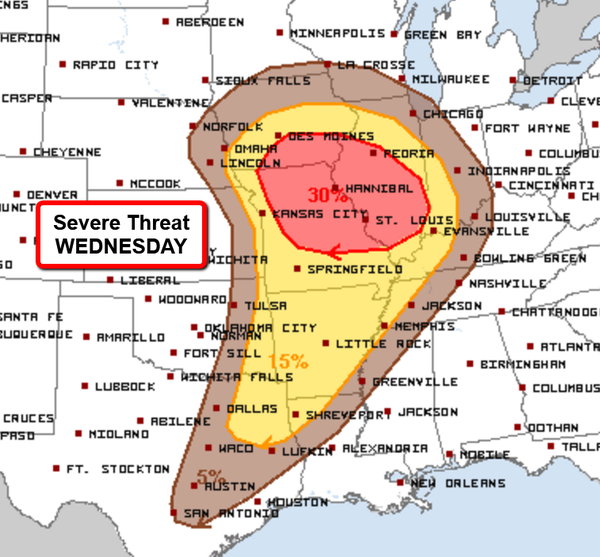

Damaging Winds How Fast Moving Storms Impact Your Area

May 20, 2025

Damaging Winds How Fast Moving Storms Impact Your Area

May 20, 2025 -

Ftv Lives A Hell Of A Run A Deep Dive Into The Story

May 20, 2025

Ftv Lives A Hell Of A Run A Deep Dive Into The Story

May 20, 2025 -

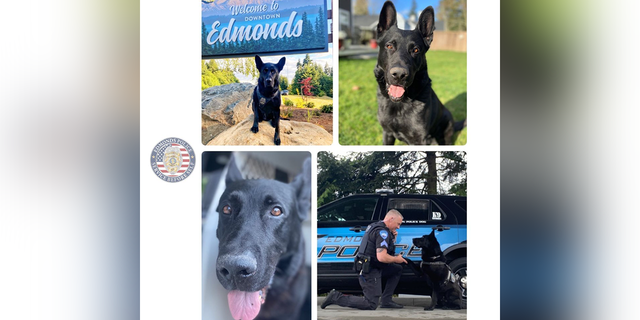

Investigation Into Washington County Breeder Following 49 Dog Removal

May 20, 2025

Investigation Into Washington County Breeder Following 49 Dog Removal

May 20, 2025 -

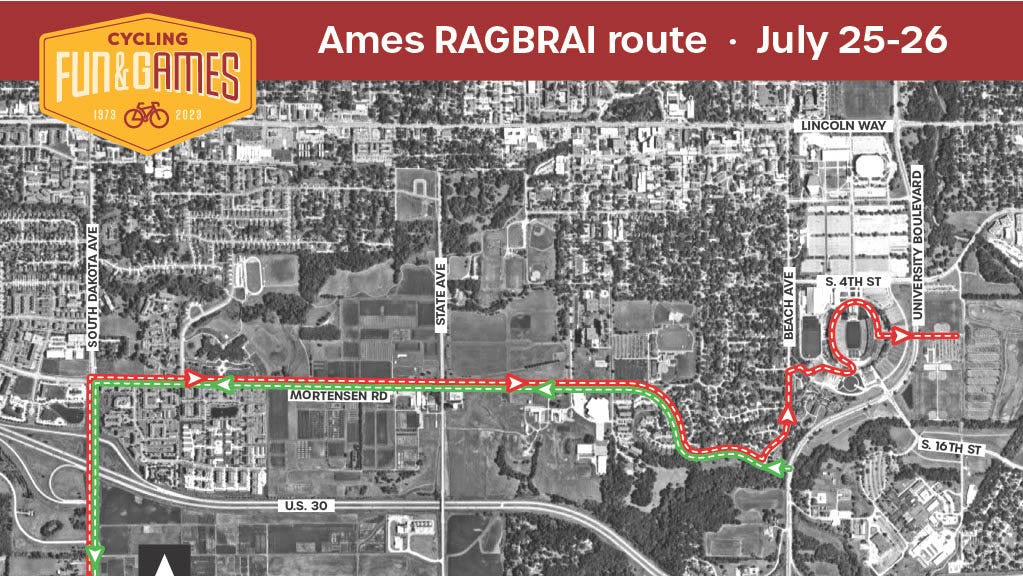

A Cyclists Dedication Scott Savilles Ragbrai And Commute Experiences

May 20, 2025

A Cyclists Dedication Scott Savilles Ragbrai And Commute Experiences

May 20, 2025 -

The Power Of Resilience Protecting Your Mental Health

May 20, 2025

The Power Of Resilience Protecting Your Mental Health

May 20, 2025