S&P/TSX Composite Index: Record Intraday High

Table of Contents

Factors Contributing to the S&P/TSX Composite Index Record High

Several interconnected factors have propelled the S&P/TSX Composite Index to its record-breaking high. Understanding these factors is crucial for investors looking to capitalize on opportunities and mitigate potential risks.

Strong Corporate Earnings

Canadian companies across various sectors have reported exceptionally strong financial results, fueling the surge in the S&P/TSX Composite Index.

- Energy Sector: The energy sector has been a significant contributor, driven by elevated oil and gas prices. Companies like Suncor Energy and Canadian Natural Resources have seen substantial earnings growth.

- Technology Sector: The tech sector has also shown impressive performance, with companies benefiting from increased digital adoption and technological advancements.

- Materials Sector: The materials sector, encompassing mining and other resource-based companies, has also seen robust growth, driven by global demand for raw materials.

Analyst predictions point towards continued positive earnings momentum for several key players in these sectors, suggesting that this upward trend in the S&P/TSX Composite Index might persist. For instance, analysts at RBC Capital Markets forecast a 15% increase in earnings for the energy sector in the next quarter.

Positive Economic Indicators

Positive economic indicators paint a rosy picture for the Canadian economy, bolstering investor confidence and driving the S&P/TSX Composite Index higher.

- GDP Growth: Canada has experienced consistent GDP growth in recent quarters, signaling a strong and expanding economy.

- Employment Rate: The unemployment rate remains low, indicating a healthy labor market and strong consumer spending.

- Inflation Data: While inflation remains a concern, recent data suggests a potential slowdown, easing investor anxieties.

These positive indicators demonstrate a resilient Canadian economy, further supporting the upward trajectory of the S&P/TSX Composite Index. A recent report by Statistics Canada showed a 2.5% GDP growth in Q2 2024, exceeding market expectations.

Global Market Trends

The performance of the S&P/TSX Composite Index is also influenced by global market trends.

- US Market Performance: The strong performance of the US markets has a positive spillover effect on the Canadian market, boosting investor sentiment.

- Commodity Prices: Elevated commodity prices, particularly in energy and metals, benefit Canadian resource-based companies and contribute to the index's growth.

The interconnectedness of global and domestic markets highlights the importance of considering global factors when analyzing the S&P/TSX Composite Index.

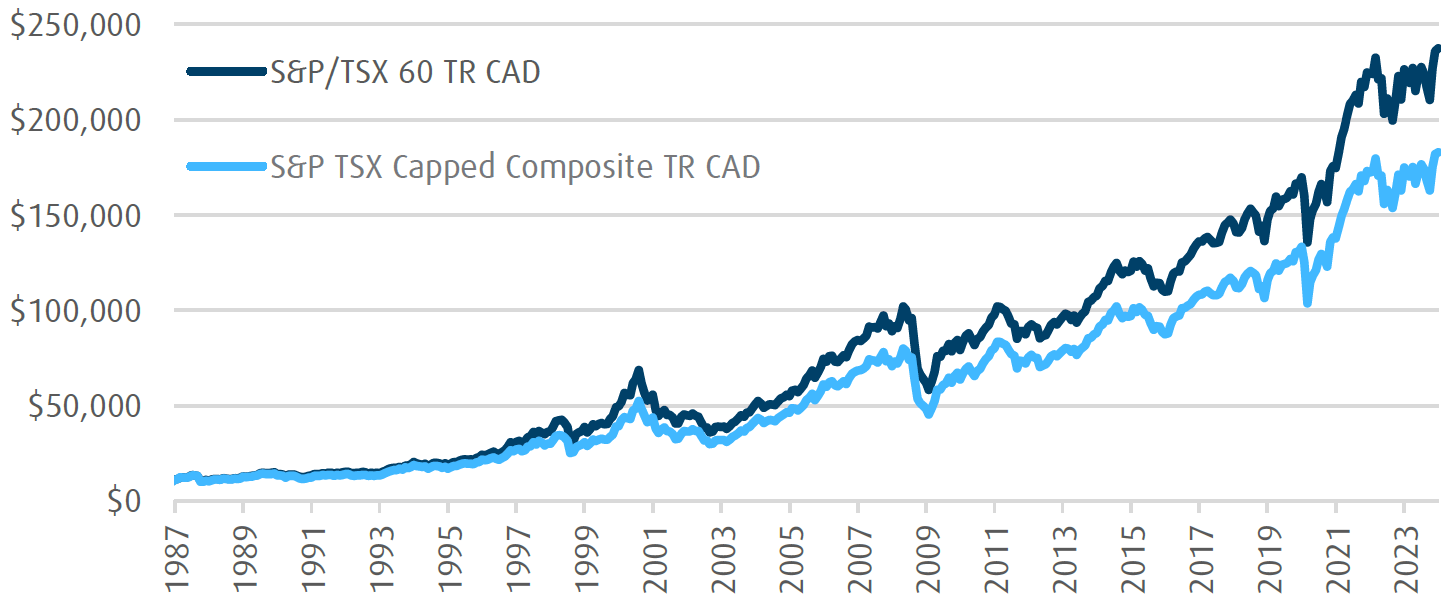

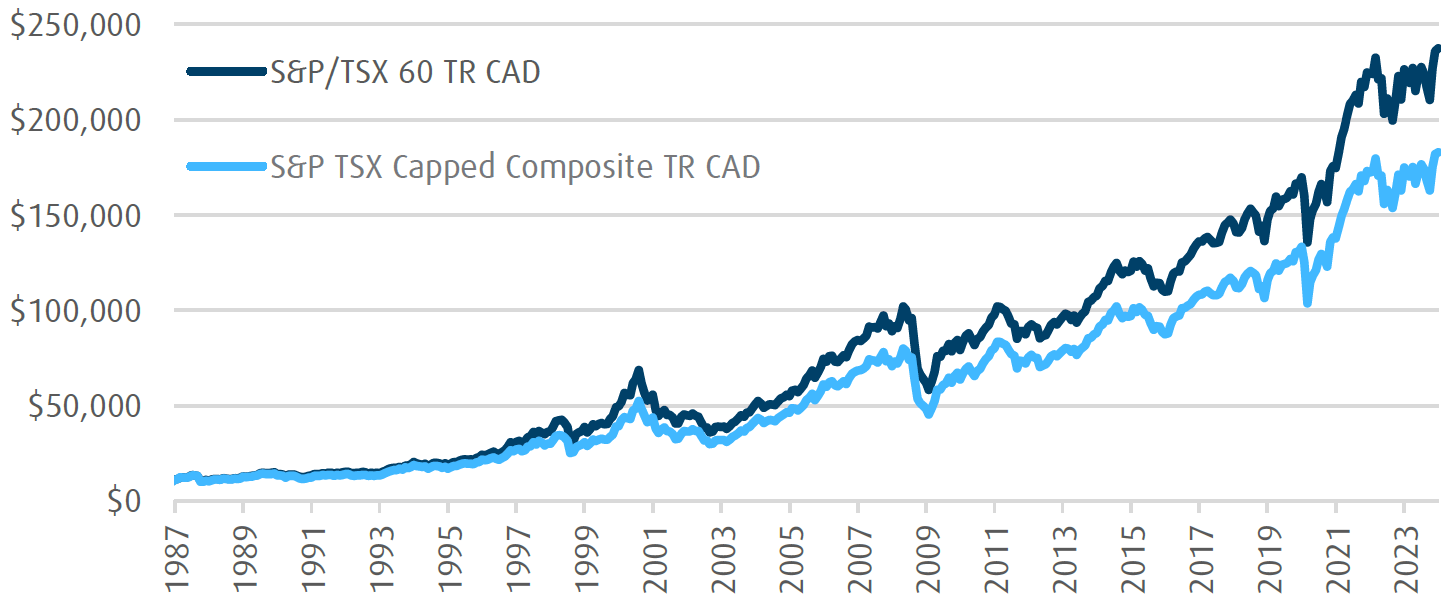

Market Analysis: Understanding the S&P/TSX Composite Index Surge

Analyzing the recent surge in the S&P/TSX Composite Index requires a multifaceted approach, considering sectoral performance, investor sentiment, and technical indicators.

Sectoral Performance

The rise of the S&P/TSX Composite Index is not uniform across all sectors. Some sectors have outperformed others, contributing disproportionately to the overall increase. The energy and materials sectors, for example, have been key drivers of the index's recent growth.

Investor Sentiment

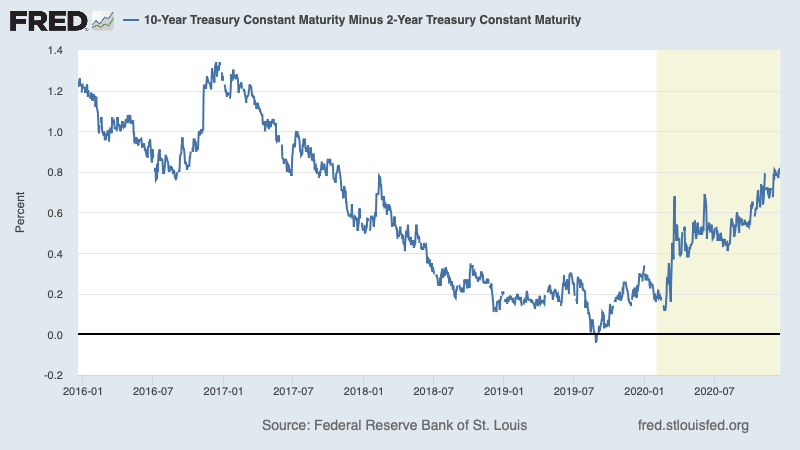

Positive investor sentiment plays a critical role in driving up the S&P/TSX Composite Index. Factors such as relatively stable interest rates and a perception of political stability have contributed to increased investor confidence. However, it’s crucial to acknowledge that sentiment can shift rapidly, impacting market fluctuations.

Technical Analysis

Technical analysis suggests a continued upward trend for the S&P/TSX Composite Index, though this is not a guarantee. Certain indicators point towards further potential growth, but investors should remain cautious and aware of potential reversals. (Note: Specific technical indicators and charts would be included in a full article.)

Implications for Investors: Navigating the S&P/TSX Composite Index High

The record high of the S&P/TSX Composite Index presents both opportunities and challenges for investors.

Investment Strategies

Given the current market conditions, a diversified investment strategy is recommended.

- Diversification: Spreading investments across different sectors and asset classes can mitigate risk and capture potential growth opportunities.

- Value Investing: Identifying undervalued companies with strong fundamentals can offer attractive returns.

- Growth Investing: Investing in companies with high growth potential can generate significant returns, but also carries higher risk.

Long-Term Outlook

The long-term outlook for the S&P/TSX Composite Index remains positive, but potential risks exist. Factors such as global economic uncertainty, inflation, and geopolitical events could impact future performance. While the current high suggests significant growth, investors should maintain a long-term perspective and consider their risk tolerance before making any investment decisions.

Conclusion: The Future of the S&P/TSX Composite Index

The record intraday high of the S&P/TSX Composite Index is a result of strong corporate earnings, positive economic indicators, and favorable global market trends. Understanding these factors and the prevailing investor sentiment is crucial for making informed investment decisions related to the S&P/TSX Composite Index. While the outlook appears positive, investors should remain vigilant and diversify their portfolios to mitigate potential risks. Stay informed about the S&P/TSX Composite Index and its fluctuations by conducting thorough research and consulting with a financial advisor to make sound investment choices regarding the S&P/TSX Composite Index and similar Canadian market indices.

Featured Posts

-

Yankees Vs Mariners Prediction Picks And Odds For Todays Mlb Game

May 17, 2025

Yankees Vs Mariners Prediction Picks And Odds For Todays Mlb Game

May 17, 2025 -

Star Wars Andor Novel Axed The Impact Of Ai On Publishing

May 17, 2025

Star Wars Andor Novel Axed The Impact Of Ai On Publishing

May 17, 2025 -

Apple Tv Discount 3 Months For 3 Last Chance

May 17, 2025

Apple Tv Discount 3 Months For 3 Last Chance

May 17, 2025 -

Murderbot Starring Alexander Skarsgard Streaming Release Date And Time

May 17, 2025

Murderbot Starring Alexander Skarsgard Streaming Release Date And Time

May 17, 2025 -

Understanding The Challenges Japans Steep Government Bond Yield Curve

May 17, 2025

Understanding The Challenges Japans Steep Government Bond Yield Curve

May 17, 2025