Saudi ABS Market Transformation: Impact Of A Key Regulatory Shift

Table of Contents

H2: The Regulatory Shift: Unveiling the New Framework

The recent regulatory overhaul in the Saudi ABS market aims to enhance efficiency, transparency, and investor protection. This new framework represents a significant leap forward for the Kingdom's financial sector, fostering a more robust and attractive environment for ABS issuance and investment.

H3: Details of the New Regulations:

The new regulations encompass several key areas:

- Changes to issuance requirements: Streamlined procedures and reduced bureaucratic hurdles have been introduced, making the ABS issuance process significantly more efficient. This includes simplifying documentation requirements and accelerating approval timelines.

- Impact on credit ratings and risk assessment: The regulatory shift emphasizes robust credit rating methodologies and risk assessment frameworks, aligning with international best practices. This enhanced scrutiny aims to provide investors with greater confidence in the underlying assets.

- New guidelines for transparency and disclosure: The new regulations mandate greater transparency in the disclosure of information related to ABS transactions. This includes detailed information on the underlying assets, the structuring of the securities, and the associated risks.

- Amendments to investor protection measures: Strengthened investor protection mechanisms are in place, including clear guidelines on investor rights and dispute resolution procedures. This builds investor confidence and promotes market stability.

Bullet Points:

- Increased efficiency in the issuance process, leading to faster time-to-market for new ABS products.

- Enhanced investor confidence due to improved transparency and robust risk assessment frameworks.

- Potential challenges for smaller issuers in meeting the new compliance requirements.

- New opportunities for specialized ABS products tailored to specific market segments.

H2: Impact on Market Participants:

The regulatory shift has far-reaching consequences for various market participants.

H3: Effect on Issuers:

The new regulations present both opportunities and challenges for issuers:

- Changes in costs associated with ABS issuance: While some costs may increase due to enhanced compliance requirements, the streamlined issuance process could offset these, leading to overall cost efficiencies.

- Increased compliance burdens: Issuers need to adapt to the new regulatory framework, investing in compliance infrastructure and expertise. This may present a challenge, particularly for smaller institutions.

- Access to broader investor base: Improved transparency and investor protection measures are expected to attract a wider range of both domestic and international investors, expanding the pool of potential buyers for ABS.

H3: Impact on Investors:

The regulatory shift significantly impacts investors:

- Changes in risk profiles of ABS: While the new regulations aim to reduce risk, a more rigorous risk assessment process may lead to some adjustments in the risk profiles of certain ABS products.

- Impact on returns and yield: The changes may influence the returns and yield on ABS, depending on factors such as competition, market demand, and risk assessment.

- Increased transparency and due diligence opportunities: Greater transparency allows investors to perform more thorough due diligence, leading to better-informed investment decisions.

- Attractiveness of the Saudi ABS market to foreign investors: The improved regulatory environment and enhanced investor protection measures make the Saudi ABS market more attractive to international investors.

Bullet Points:

- Increased efficiency benefits both issuers and investors.

- Enhanced transparency leads to better-informed investment decisions.

- Higher compliance costs for issuers may impact pricing and profitability in the short term.

- Attraction of foreign investment will increase liquidity and depth in the Saudi ABS market.

H2: Growth Opportunities and Challenges in the Transformed Saudi ABS Market:

The regulatory changes create both significant growth opportunities and challenges.

H3: Emerging Market Segments:

The transformed Saudi ABS market offers several promising avenues for growth:

- Growth in specific ABS sectors: The securitization of auto loans, mortgages, and other asset classes is expected to see significant expansion.

- Development of innovative ABS structures: The new regulatory framework allows for the development of more sophisticated and innovative ABS structures, catering to diverse investor needs.

- Potential for securitization of previously untapped assets: The regulatory changes could unlock opportunities for securitizing previously untapped asset classes, further diversifying the market.

H3: Challenges and Mitigation Strategies:

Successful market transformation requires addressing several challenges:

- Implementation challenges for issuers and regulators: Smooth implementation of the new regulations requires close cooperation between issuers and regulatory bodies.

- Need for enhanced market infrastructure: Developing robust market infrastructure, including technology and data management systems, is crucial for efficient functioning.

- Addressing potential systemic risks: Proactive measures are needed to identify and mitigate potential systemic risks associated with the growth of the ABS market.

Bullet Points:

- Significant growth potential in various ABS sectors.

- Need for strong regulatory oversight and market infrastructure development.

- Potential for increased systemic risk requires careful management.

3. Conclusion:

The regulatory shift marks a pivotal moment in the Saudi ABS market transformation, creating a more efficient, transparent, and investor-friendly environment. While challenges remain, the potential for growth is substantial. The enhanced transparency, improved investor protection, and streamlined issuance processes are expected to attract both domestic and international investment, fueling significant expansion in the coming years. The key takeaways are increased efficiency, improved transparency, and substantial growth opportunities.

Stay informed about the ongoing Saudi ABS market transformation and seize the opportunities arising from this key regulatory shift. Explore the resources available from the Saudi Central Bank and other relevant financial institutions to understand the nuances of this dynamic market and leverage the potential of the evolving Saudi ABS market.

Featured Posts

-

Ripple Vs Sec Understanding The Implications Of The Reduced 50 M Settlement For Xrp Investors

May 02, 2025

Ripple Vs Sec Understanding The Implications Of The Reduced 50 M Settlement For Xrp Investors

May 02, 2025 -

Fotos De Laura Keller De Biquini Em Retiro De Tantra Yoga

May 02, 2025

Fotos De Laura Keller De Biquini Em Retiro De Tantra Yoga

May 02, 2025 -

Ripple Lawsuit Sec Considers Xrp Commodity Classification In Settlement Talks

May 02, 2025

Ripple Lawsuit Sec Considers Xrp Commodity Classification In Settlement Talks

May 02, 2025 -

Post Election Audit Pilot Program Begins In Maine

May 02, 2025

Post Election Audit Pilot Program Begins In Maine

May 02, 2025 -

Investing In Childhood A Critical Investment In Future Generations Well Being

May 02, 2025

Investing In Childhood A Critical Investment In Future Generations Well Being

May 02, 2025

Latest Posts

-

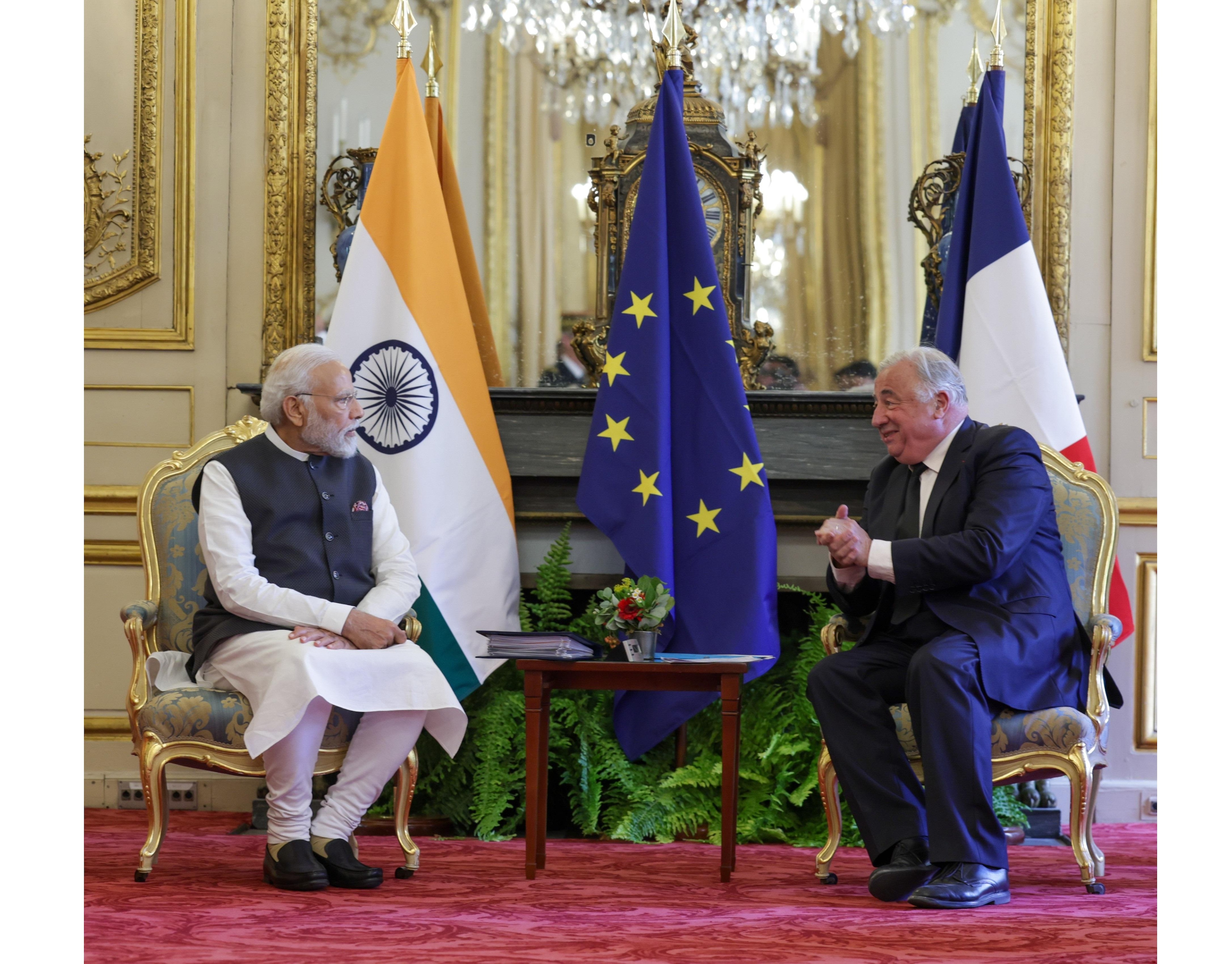

Indias Pm Modis Upcoming France Trip Ai Summit And Ceo Forum Participation

May 03, 2025

Indias Pm Modis Upcoming France Trip Ai Summit And Ceo Forum Participation

May 03, 2025 -

Pm Modis France Visit Key Engagements Include Ai Summit And Ceo Forum

May 03, 2025

Pm Modis France Visit Key Engagements Include Ai Summit And Ceo Forum

May 03, 2025 -

Foreign Secretary Announces Pm Modis Participation In Frances Ai Summit And Ceo Forum

May 03, 2025

Foreign Secretary Announces Pm Modis Participation In Frances Ai Summit And Ceo Forum

May 03, 2025 -

Indias Pm Modi To Engage In Ai Summit And Ceo Forum During France Trip

May 03, 2025

Indias Pm Modi To Engage In Ai Summit And Ceo Forum During France Trip

May 03, 2025 -

Pm Modi To Co Chair Ai Summit Address Business Leaders In France

May 03, 2025

Pm Modi To Co Chair Ai Summit Address Business Leaders In France

May 03, 2025