Ripple Lawsuit: SEC Considers XRP Commodity Classification In Settlement Talks

Table of Contents

The SEC's Case Against Ripple Labs and its Arguments

The SEC's initial claim against Ripple Labs centers on the allegation that XRP is an unregistered security. They argue that Ripple's distribution and sale of XRP constituted an illegal offering of securities, violating federal securities laws. Their argument rests heavily on legal precedents and existing regulatory frameworks.

Key arguments presented by the SEC include:

- The Howey Test: The SEC applies the Howey Test, a cornerstone of securities law, arguing that XRP investors reasonably expected profits based on Ripple's efforts. This implies an investment contract, a key element in defining a security.

- Ripple's Sales and Distribution: The SEC scrutinizes Ripple's various sales and distribution methods of XRP, claiming these activities were designed to generate profit for Ripple and its investors, further solidifying the security classification.

- Investment Contract Nature: The SEC maintains that the relationship between Ripple and XRP purchasers constitutes an investment contract, thereby fulfilling the criteria for XRP's classification as a security.

[Link to relevant SEC filings and legal documents]

Ripple's Defense and Counterarguments

Ripple vehemently contests the SEC's claims, arguing that XRP is a decentralized digital asset functioning as a currency or commodity, not a security. They point to key distinctions to refute the SEC's characterization.

Ripple's key counterarguments include:

- Decentralization of XRP: Ripple emphasizes the decentralized nature of XRP and its operational characteristics, highlighting its independent existence outside of Ripple's direct control.

- Lack of Direct Investment Contracts: Ripple argues there's no direct investment contract between Ripple and XRP purchasers; individuals buy XRP on open exchanges, not directly from Ripple.

- Comparison to Other Cryptocurrencies: Ripple points to other cryptocurrencies that the SEC hasn't deemed securities, suggesting a lack of consistent application of regulatory frameworks.

[Link to Ripple's official statements and legal filings]

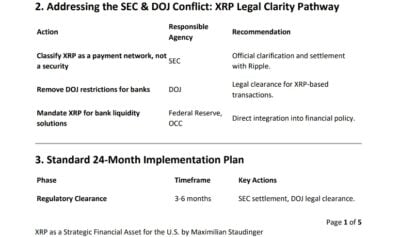

The Potential for XRP Commodity Classification in a Settlement

A significant possibility within the ongoing settlement negotiations is the SEC classifying XRP as a commodity. This would represent a significant shift from the SEC's initial claim. The implications are profound:

- Reduced Regulatory Scrutiny: Classifying XRP as a commodity would significantly reduce regulatory oversight compared to being classified as a security.

- Potential Increase in XRP's Market Value: A commodity classification could potentially lead to a surge in XRP's market value as investor uncertainty diminishes.

- Impact on Future Cryptocurrency Regulations: The outcome will set a precedent, influencing future regulatory approaches towards other cryptocurrencies.

Legal precedents and regulatory frameworks related to commodity classifications will play a critical role in determining the outcome and shaping future regulations.

The Implications of a Settlement for XRP Investors and the Crypto Market

The Ripple lawsuit's resolution will drastically impact XRP investors and the broader cryptocurrency landscape. Several scenarios are possible:

- Price Volatility: Regardless of the outcome, expect significant price volatility in XRP depending on market reaction to the settlement terms.

- Legal Ramifications for Other Cryptocurrencies: The precedent set by this case could significantly impact the regulatory landscape for other cryptocurrencies.

- Impact on Investor Confidence: The outcome could significantly influence investor confidence, either boosting or hindering future investments in the crypto market.

[Include expert opinions and market analyses]

Understanding the Ripple vs. SEC Case’s Impact on the Future of Crypto Regulation

The Ripple lawsuit's long-term implications for cryptocurrency regulation are immense. The outcome will likely:

- Increase Regulatory Clarity: A clear ruling could bring much-needed clarity to the ambiguous regulatory landscape surrounding cryptocurrencies.

- Lead to More Comprehensive Crypto Regulations: The case could catalyze the development of more comprehensive regulations, either nationally or internationally.

- Impact Innovation in Crypto: The resulting regulatory framework could either foster or stifle innovation within the cryptocurrency industry.

Conclusion: Ripple Lawsuit: Navigating the Uncertainty of XRP's Future

The Ripple lawsuit presents a complex legal battle with significant ramifications. Both sides have presented compelling arguments regarding XRP's classification, highlighting the challenges in applying existing securities laws to novel digital assets. The SEC's consideration of XRP's commodity classification in settlement talks is a pivotal development, impacting XRP investors, the overall cryptocurrency market, and the future direction of crypto regulation. Stay updated on the Ripple lawsuit; follow the latest developments regarding XRP and learn more about the SEC’s stance on cryptocurrency classifications. Further research into "XRP price prediction," "SEC crypto regulation," and "Ripple lawsuit updates" is encouraged to navigate this evolving landscape.

Featured Posts

-

Riot Fest Announces 2025 Lineup Featuring Green Day And Weezer

May 02, 2025

Riot Fest Announces 2025 Lineup Featuring Green Day And Weezer

May 02, 2025 -

Kshmyr Tnaze Army Chyf Ka Jng Lrne Ka Ezm

May 02, 2025

Kshmyr Tnaze Army Chyf Ka Jng Lrne Ka Ezm

May 02, 2025 -

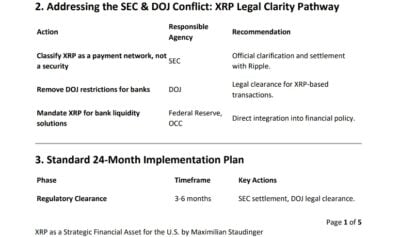

Urgent Action Needed A Global Perspective On Improving Youth Mental Health In Canada

May 02, 2025

Urgent Action Needed A Global Perspective On Improving Youth Mental Health In Canada

May 02, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Center Of The Lawsuit

May 02, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Center Of The Lawsuit

May 02, 2025 -

Shhr Glbn Kb Tk Khnjr Ka Nshanh Ayksprys Ardw Ky Rpwrt

May 02, 2025

Shhr Glbn Kb Tk Khnjr Ka Nshanh Ayksprys Ardw Ky Rpwrt

May 02, 2025

Latest Posts

-

Guevenlik Goerevlileri Ile Esir Aileleri Arasindaki Olay Israil Meclisi Nde Gerilim Tirmaniyor

May 02, 2025

Guevenlik Goerevlileri Ile Esir Aileleri Arasindaki Olay Israil Meclisi Nde Gerilim Tirmaniyor

May 02, 2025 -

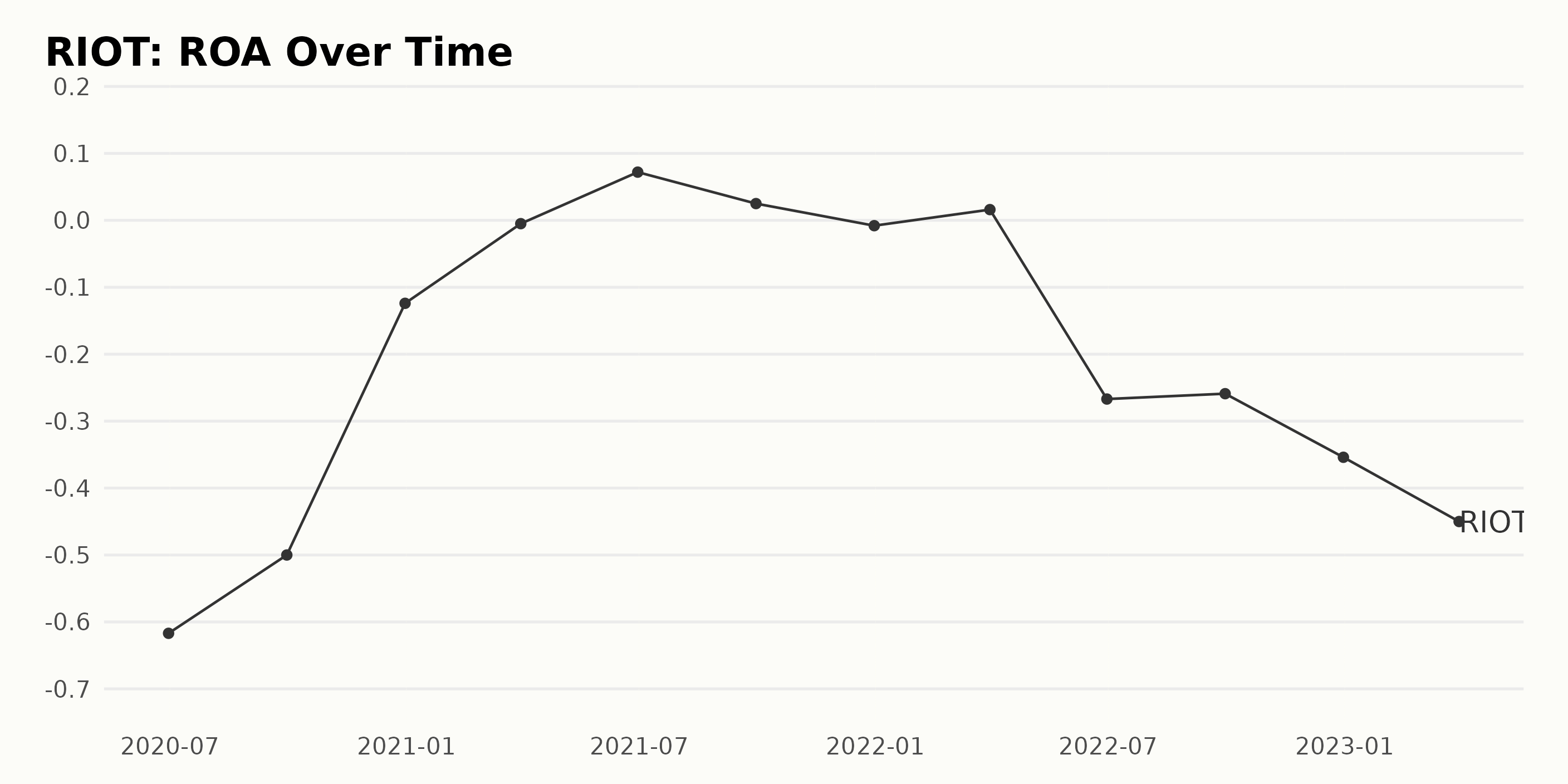

Is Riot Platforms Stock Riot A Good Investment Analyzing Riot And Coin

May 02, 2025

Is Riot Platforms Stock Riot A Good Investment Analyzing Riot And Coin

May 02, 2025 -

Israil Meclisi Esir Yakinlari Ile Guevenlik Guecleri Arasindaki Catisma

May 02, 2025

Israil Meclisi Esir Yakinlari Ile Guevenlik Guecleri Arasindaki Catisma

May 02, 2025 -

Riot Platforms Stock Riot A Deep Dive Into Recent Performance

May 02, 2025

Riot Platforms Stock Riot A Deep Dive Into Recent Performance

May 02, 2025 -

Understanding The Riot Platforms Inc Irrevocable Proxy And Waiver

May 02, 2025

Understanding The Riot Platforms Inc Irrevocable Proxy And Waiver

May 02, 2025