Saudi Arabia's ABS Market Transformation: A Rule Change With Global Impact

Table of Contents

Asset-Backed Securities (ABS) are essentially investments backed by a pool of underlying assets, such as mortgages, auto loans, credit card receivables, or other financial assets. They provide a mechanism for investors to participate in the returns generated by these assets, while also offering diversification benefits. This article delves into the specifics of the new regulations, examining their potential to stimulate growth, attract foreign investment, and set a precedent for other emerging markets.

The New Regulations: Key Changes and Their Rationale

The Saudi Arabian government's recent reforms to its ABS market are designed to modernize and streamline the sector, making it more attractive to both domestic and international investors. These changes aim to boost economic diversification, attract foreign capital, and enhance the overall efficiency of the financial system.

Streamlining the Issuance Process

The new regulations significantly simplify and expedite the ABS issuance process. This is achieved through several key changes:

- Reduced Paperwork: The requirements for documentation and approvals have been significantly reduced, minimizing bureaucratic hurdles.

- Faster Approvals: The timeline for regulatory approvals has been shortened, allowing for quicker issuance of ABS.

- Clearer Guidelines: The regulatory framework has been clarified, providing greater certainty and transparency for issuers.

These improvements aim to reduce the time and cost associated with bringing ABS to market, encouraging greater issuance and participation. The Saudi Arabian government's goal is to foster a more dynamic and efficient capital market, supporting economic growth and diversification.

Enhanced Transparency and Disclosure Requirements

The new regulations place a strong emphasis on transparency and disclosure, significantly improving the information available to investors. This includes:

- Detailed Information on Underlying Assets: Issuers are now required to provide more comprehensive information about the underlying assets backing the ABS, including their quality, risk profile, and expected performance.

- Improved Risk Assessment Reporting: More rigorous risk assessment methodologies are mandated, providing investors with a clearer understanding of the potential risks associated with each ABS offering.

Increased transparency is crucial for building investor confidence and attracting foreign capital. By providing more detailed and reliable information, the regulations aim to mitigate information asymmetry and enhance market integrity.

Risk Mitigation and Investor Protection

The reforms also incorporate robust risk mitigation and investor protection measures:

- Improved Risk Management Frameworks: Issuers are required to implement comprehensive risk management frameworks, ensuring that appropriate controls are in place to manage and mitigate potential risks.

- Investor Protection Mechanisms: New mechanisms have been introduced to protect investors' interests, including stricter requirements for due diligence and improved dispute resolution processes.

These measures are designed to build trust and confidence in the Saudi Arabian ABS market, encouraging both domestic and international participation. The goal is to create a stable and reliable environment for investment, attracting a broader range of investors.

Impact on the Saudi Arabian ABS Market

The new regulations are expected to have a profound impact on the Saudi Arabian ABS market, stimulating growth and attracting significant investment.

Increased Domestic Issuance

The streamlined issuance process and enhanced regulatory clarity are expected to lead to a significant increase in domestic ABS issuance. This is likely to manifest across various sectors:

- Mortgages: The growing mortgage market in Saudi Arabia is poised to benefit significantly from increased ABS issuance.

- Auto Loans: Similarly, the auto loan sector is expected to see a surge in ABS-based financing.

- Credit Cards: The expansion of credit card usage in the Kingdom will also drive demand for ABS.

The increased issuance of ABS will have a positive ripple effect on the Saudi Arabian economy, providing access to much-needed capital for businesses and consumers.

Attracting Foreign Investment

The improved regulatory framework, enhanced transparency, and strengthened investor protection mechanisms are expected to attract significant foreign investment into the Saudi Arabian ABS market. The key attractions include:

- Improved Transparency: The increased transparency offers foreign investors greater comfort and confidence in the market.

- Risk Mitigation Measures: The robust risk management and investor protection mechanisms reduce the perceived risk associated with investing in Saudi Arabian ABS.

- Potential for Higher Returns: The relatively underdeveloped nature of the Saudi Arabian ABS market presents attractive potential for higher returns.

This inflow of foreign investment will increase competition, boost market liquidity, and further strengthen the Saudi Arabian financial system.

Global Implications of Saudi Arabia's ABS Market Transformation

The reforms in Saudi Arabia's ABS market have significant global implications, potentially influencing regulatory frameworks and investment flows worldwide.

Setting a Precedent for Emerging Markets

Saudi Arabia's ambitious regulatory overhaul could serve as a model for other emerging markets seeking to develop their ABS markets. Several countries with similar economic structures and aspirations might adopt similar reforms:

- Other GCC Countries: The reforms could inspire similar changes in other Gulf Cooperation Council (GCC) nations.

- Other Emerging Economies: Countries in other regions with developing financial sectors may also draw inspiration from the Saudi Arabian experience.

This potential ripple effect could lead to increased harmonization of regulatory standards and greater integration of global ABS markets.

Shifting Global Investment Flows

The transformation of the Saudi Arabian ABS market is likely to shift global investment flows, diverting capital towards emerging markets:

- Increased Competition with Developed Markets: The improvements in the Saudi Arabian market will increase its competitiveness with established ABS markets in developed economies.

- Redistribution of Capital: This increased attractiveness could lead to a redistribution of investment capital, with a portion flowing from traditional markets to Saudi Arabia and other emerging markets.

In the long term, this shift could significantly alter the global financial landscape, fostering greater diversification and potentially influencing interest rates and capital allocation worldwide.

Conclusion: Saudi Arabia's ABS Market Transformation: A Catalyst for Growth

The recent regulatory changes in Saudi Arabia's ABS market represent a significant step towards modernizing and deepening its financial system. The streamlined issuance process, enhanced transparency, and improved risk mitigation measures are expected to stimulate domestic issuance, attract substantial foreign investment, and set a precedent for other emerging markets. This transformation acts as a catalyst for growth in the Saudi Arabian economy and could significantly influence global investment flows and the broader landscape of the global ABS market. Stay updated on the evolution of Saudi Arabia's ABS market and explore the opportunities presented by this transformative rule change. [Link to relevant resource on Saudi Arabian ABS market].

Featured Posts

-

Did Christina Aguilera Go Too Far Fan Reactions To Her Latest Photoshoot

May 03, 2025

Did Christina Aguilera Go Too Far Fan Reactions To Her Latest Photoshoot

May 03, 2025 -

Ngo Condemns Drone Attack On Gaza Aid Ship

May 03, 2025

Ngo Condemns Drone Attack On Gaza Aid Ship

May 03, 2025 -

Protecting Childrens Mental Health A Call For Investment

May 03, 2025

Protecting Childrens Mental Health A Call For Investment

May 03, 2025 -

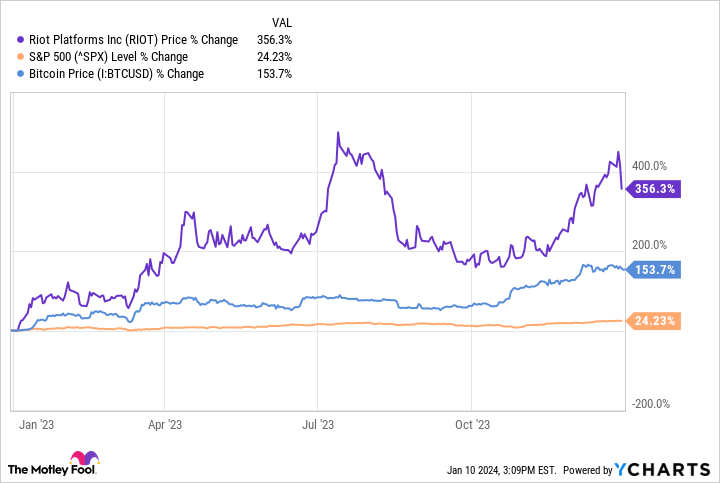

Understanding The Fluctuations In Riot Platforms Riot Stock Price

May 03, 2025

Understanding The Fluctuations In Riot Platforms Riot Stock Price

May 03, 2025 -

Arsenals Havertz A Disappointing Signing Souness Weighs In

May 03, 2025

Arsenals Havertz A Disappointing Signing Souness Weighs In

May 03, 2025

Latest Posts

-

The Australian Election A Litmus Test For Global Opposition To Trumpism

May 04, 2025

The Australian Election A Litmus Test For Global Opposition To Trumpism

May 04, 2025 -

The Allure Of The Special Little Bag Functionality And Style Combined

May 04, 2025

The Allure Of The Special Little Bag Functionality And Style Combined

May 04, 2025 -

Rewatching The Gta Vi Trailer What We Know So Far

May 04, 2025

Rewatching The Gta Vi Trailer What We Know So Far

May 04, 2025 -

53 Year Sentence For Hate Crime Against Palestinian American Boy And Mother

May 04, 2025

53 Year Sentence For Hate Crime Against Palestinian American Boy And Mother

May 04, 2025 -

Kentucky Derby 2024 Bob Bafferts Return And The Sports Ongoing Struggle

May 04, 2025

Kentucky Derby 2024 Bob Bafferts Return And The Sports Ongoing Struggle

May 04, 2025