Sensex 1400 Points Higher, Nifty 50 Above 23800: Analysis Of Today's Market Rise

Table of Contents

Global Factors Fueling the Indian Market Rally

Several positive global economic indicators contributed significantly to today's impressive market rally. The positive sentiment spilled over into emerging markets, including India, boosting investor confidence.

- Positive Global Economic Data: Recent reports indicate a potential easing of inflation in major economies like the US, fueling optimism about future economic growth. This positive outlook reduces concerns about aggressive interest rate hikes, creating a more favorable environment for investment.

- Foreign Institutional Investor (FII) Inflows: Significant inflows from Foreign Institutional Investors (FIIs) played a crucial role. These investors are injecting capital into the Indian market, driving up demand and pushing prices higher. This reflects a growing confidence in the Indian economy's long-term prospects.

- Strengthening of the Indian Rupee: The appreciation of the Indian Rupee against the US dollar further enhanced the attractiveness of Indian assets for foreign investors. A stronger Rupee makes Indian stocks more affordable for international investors, leading to increased demand.

- Positive Global Sentiment Towards Emerging Markets: A generally positive global sentiment toward emerging markets has benefited India. Investors are increasingly looking towards high-growth economies, and India's strong fundamentals make it an attractive destination. Keywords: Global markets, FII investment, rupee appreciation, emerging markets.

Domestic Factors Driving the Sensex and Nifty 50 Rise

Beyond global factors, positive domestic developments also played a significant part in today's market surge. Stronger-than-expected economic indicators and positive government initiatives boosted investor confidence.

- Positive Corporate Earnings Reports: Several major companies released strong corporate earnings reports, exceeding market expectations. This positive news demonstrates the robust financial health of Indian businesses and reinforces investor confidence.

- Government Policy Announcements: Recent government policy announcements, particularly those focusing on infrastructure development and economic reforms, contributed to the positive market sentiment. Specific examples include [mention specific recent positive government policy announcements here].

- Stronger-than-Expected Macroeconomic Data: Recent macroeconomic data, including [mention specific data points, e.g., GDP growth figures or inflation data], have been better than anticipated, indicating a healthy trajectory for the Indian economy.

- Improved Consumer Sentiment: Positive consumer sentiment reflects a growing confidence in the economy, leading to increased spending and investment. Keywords: Indian economy, corporate earnings, GDP growth, government policies, consumer confidence.

Sector-Specific Performance: Identifying Top Gainers

The market rise wasn't uniform across all sectors. Some sectors outperformed others, significantly contributing to the overall surge.

- Top-Performing Sectors: The IT, banking, and pharmaceutical sectors were among the top gainers today, experiencing significant percentage increases.

- Specific Stock Performance: [Mention specific stocks that showed substantial gains, along with their percentage increases]. This highlights the strong performance of individual companies within these key sectors.

- Data on Percentage Gains: [Provide data on percentage gains for key sectors and stocks, supporting the claims made above]. Keywords: Sectoral performance, top gainers, stock analysis, IT sector, banking sector, pharmaceutical sector.

Technical Analysis: Chart Patterns and Indicators

While a detailed technical analysis is beyond the scope of this article, some key observations can be made.

- Chart Patterns: The market displayed [mention any significant chart patterns observed, e.g., a strong breakout above a resistance level or a bullish engulfing pattern]. These patterns suggest a strong bullish trend.

- Key Technical Indicators: [If using indicators, mention only those easily understood by non-experts and explain their significance simply. For example, a simple explanation of RSI showing overbought conditions could be included, but avoid complex jargon]. Keywords: Technical analysis, chart patterns, trading indicators, bullish trend, market momentum.

Conclusion: Sensex and Nifty 50's Impressive Surge – What's Next?

Today's significant rise in the Sensex and Nifty 50 can be attributed to a combination of positive global and domestic factors, including strong corporate earnings, supportive government policies, positive global economic indicators, and robust FII investment. While this surge is encouraging, it's important to maintain a cautious outlook. Market fluctuations are inherent, and future trends are difficult to predict with certainty. To stay informed about Sensex and Nifty 50 movements and to make well-informed investment decisions, continue following our updates and consider consulting a financial advisor for personalized guidance. Remember that this analysis is for informational purposes only and doesn't constitute financial advice. Stay tuned for further market analysis and updates on the Indian stock market.

Featured Posts

-

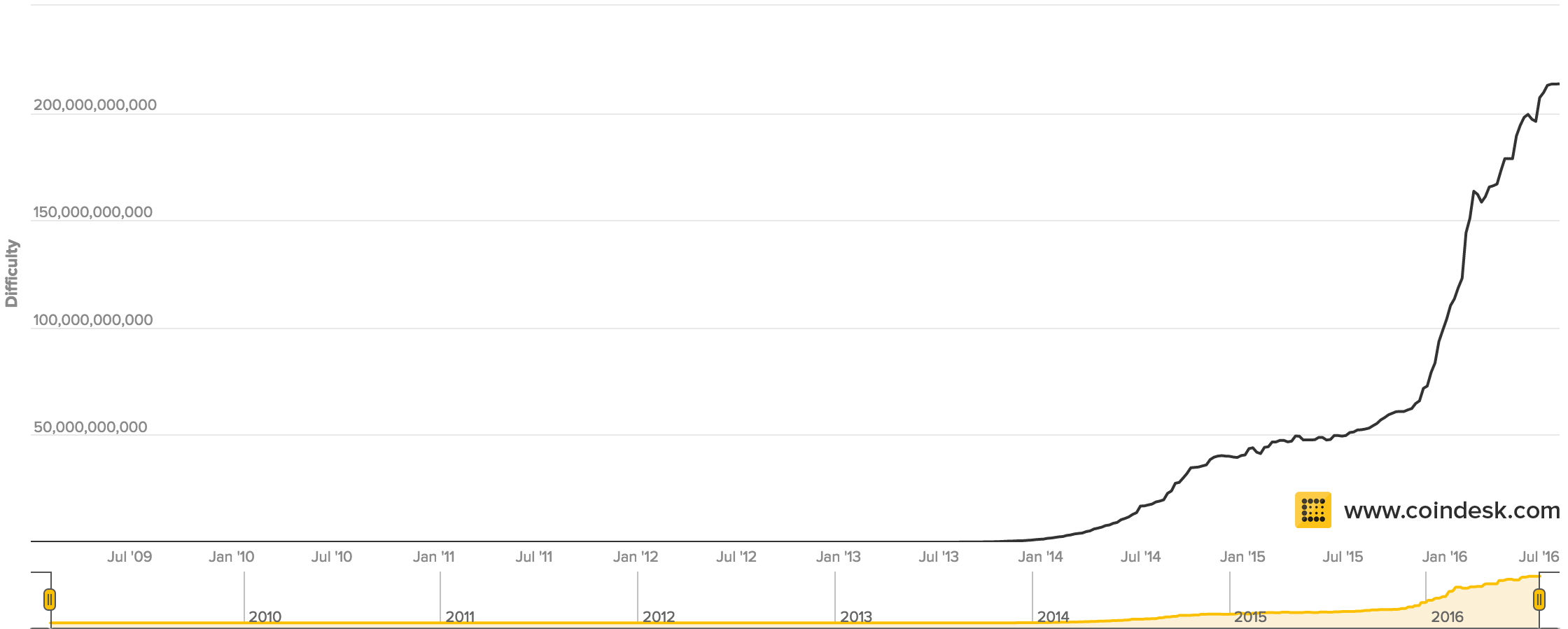

The Reasons Behind The Recent Bitcoin Mining Boom

May 09, 2025

The Reasons Behind The Recent Bitcoin Mining Boom

May 09, 2025 -

Vegas Clinches Playoffs Despite Oilers 3 2 Win

May 09, 2025

Vegas Clinches Playoffs Despite Oilers 3 2 Win

May 09, 2025 -

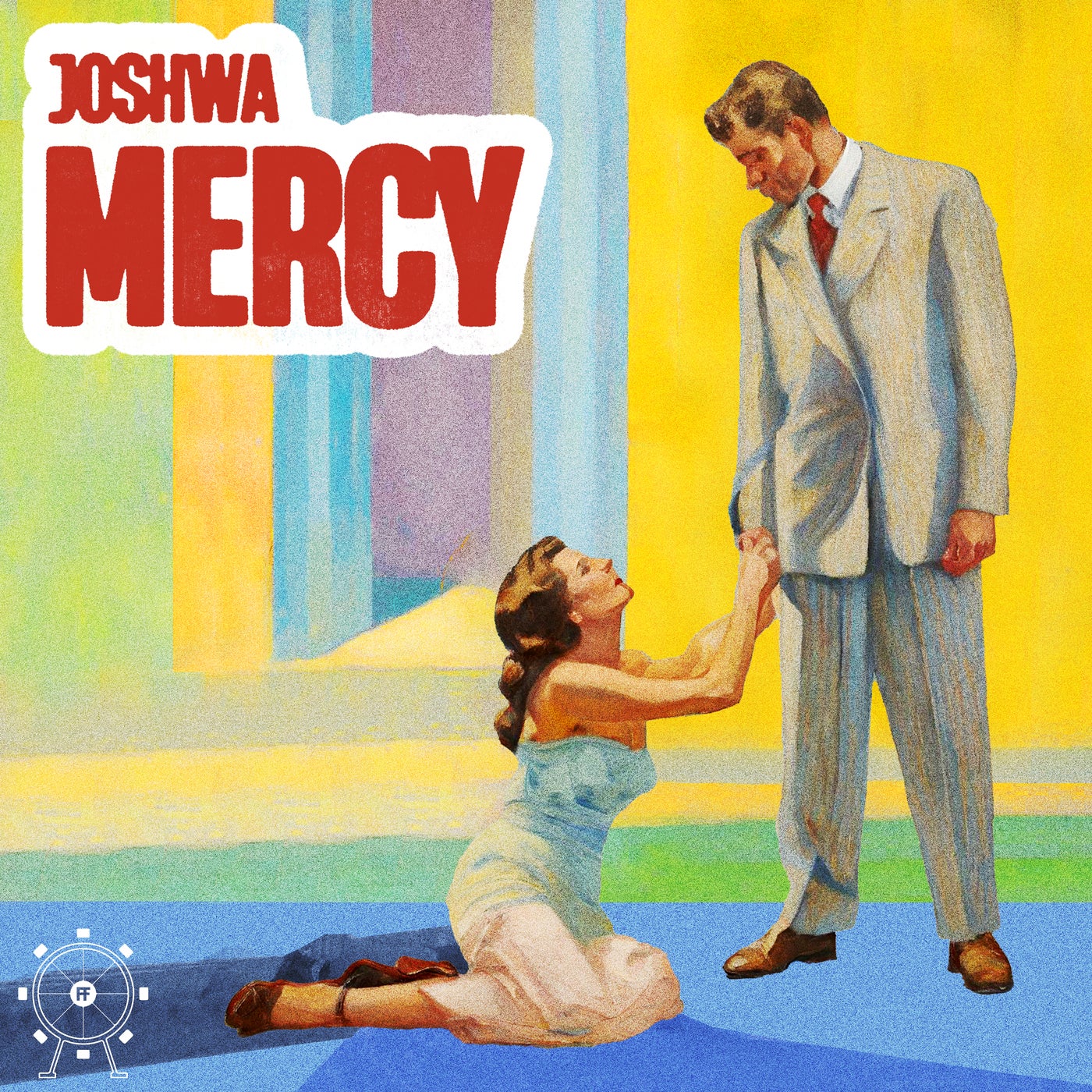

Divine Mercy Extended Religious Life And Gods Compassion In 1889

May 09, 2025

Divine Mercy Extended Religious Life And Gods Compassion In 1889

May 09, 2025 -

Will Dangotes Refinery Affect Nnpcs Petrol Price Control

May 09, 2025

Will Dangotes Refinery Affect Nnpcs Petrol Price Control

May 09, 2025 -

A Familys Tragedy The Horrific Impact Of An Unprovoked Racist Murder

May 09, 2025

A Familys Tragedy The Horrific Impact Of An Unprovoked Racist Murder

May 09, 2025