Sensex & Nifty Today: Market Trends & Analysis, 100 Point Gain

Table of Contents

H2: Sensex and Nifty's 100-Point Rally: A Deep Dive

The Sensex and Nifty's impressive 100-point rally wasn't a random event; several key factors contributed to this significant upward movement. Let's break down the contributing elements:

-

Impact of Global Market Trends: Positive cues from global markets played a crucial role. While the US Federal Reserve's rate hike expectations still loom large, recent data suggesting a potential slowdown in inflation offered some relief, boosting investor confidence globally. This positive sentiment spilled over into the Indian market.

-

Influence of Domestic Factors: Domestically, positive corporate earnings reports from several key sectors infused optimism. Government initiatives aimed at boosting infrastructure and economic growth also contributed to the positive market sentiment. The recent announcement of [insert specific recent positive government policy or news here] further bolstered investor confidence.

-

Sector-wise Performance: The IT sector led the charge, with several major IT companies posting strong gains. The Banking and FMCG sectors also saw substantial growth, indicating broad-based market strength. Specifically, [mention 2-3 specific stocks and their percentage gains].

-

Specific Stocks Driving the Surge: [Name a few specific stocks that contributed significantly to the Sensex and Nifty's rise, along with their percentage increase]. These stocks benefited from positive news, strong earnings reports, or positive investor sentiment.

H2: Analyzing the Market Sentiment and Volatility

Today's market displayed a predominantly bullish sentiment. While some volatility was observed throughout the day, the overall trend remained positive. The VIX index, a measure of market volatility, showed [insert VIX data or a description of its trend – e.g., a slight decrease, indicating reduced volatility].

-

Market Volatility: The market experienced [describe the level of volatility – e.g., moderate volatility in the morning session followed by a calmer afternoon]. This could be attributed to [mention potential causes, e.g., profit-booking after recent gains, or anticipation of upcoming economic data].

-

Trading Volume: Trading volume was [high/moderate/low], suggesting [interpret the implication of the trading volume – e.g., strong investor participation/cautious approach].

-

Significant News Events: [Mention any significant news events or announcements—economic data releases, policy changes, or corporate news—that impacted market sentiment].

H2: Key Indicators and Technical Analysis

Technical indicators provided further support for the positive market trend. The RSI (Relative Strength Index) indicated [mention RSI level and interpretation - e.g., a reading above 50 suggests bullish momentum]. The MACD (Moving Average Convergence Divergence) showed [mention MACD signal and interpretation – e.g., a bullish crossover, signaling a potential upward trend].

-

Technical Chart Analysis: The Sensex and Nifty's technical charts showed [describe the charts – e.g., sustained movement above crucial support levels, suggesting further upside potential].

-

Support and Resistance Levels: Key support levels were successfully defended, while resistance levels were breached, opening the way for further gains. [Specify the support and resistance levels].

-

Potential Future Trends: Based on the current technical analysis, the market outlook remains [bullish/neutral/bearish], with potential for further gains/consolidation/correction. However, external factors and unforeseen events can always influence the market.

H2: Investor Strategies and Recommendations

The 100-point gain in Sensex and Nifty presents both opportunities and challenges for investors. Here are some considerations:

-

Long-term Investors: Long-term investors should maintain a disciplined approach, focusing on their investment goals and risk tolerance. This market movement shouldn't significantly alter their long-term investment strategies.

-

Short-term Traders: Short-term traders should carefully monitor market movements and adjust their strategies accordingly, taking advantage of potential short-term opportunities while managing risk.

-

Risk Management Strategies: Regardless of investment timeframe, risk management remains crucial. Diversification, stop-loss orders, and careful position sizing can help mitigate potential losses.

-

Consult a Financial Advisor: Before making any investment decisions, it’s highly recommended to consult a qualified financial advisor who can tailor advice to your specific financial situation and goals.

3. Conclusion:

Today’s Sensex and Nifty analysis reveals a strong 100-point surge, driven by a combination of positive global and domestic factors. The market displayed bullish sentiment, with technical indicators supporting the upward trend. However, investors should remain vigilant and manage risk effectively. While the outlook appears positive, unforeseen events can always impact the market. Stay updated on Sensex and Nifty movements by following our daily analysis. Monitor the Indian stock market with our expert insights and check back tomorrow for the latest Sensex and Nifty trends.

Featured Posts

-

Deciphering The Nyt Strands April 12 2025 Spangram And Hints

May 10, 2025

Deciphering The Nyt Strands April 12 2025 Spangram And Hints

May 10, 2025 -

Alexandria Ocasio Cortez Slams Pro Trump Fox News Commentary

May 10, 2025

Alexandria Ocasio Cortez Slams Pro Trump Fox News Commentary

May 10, 2025 -

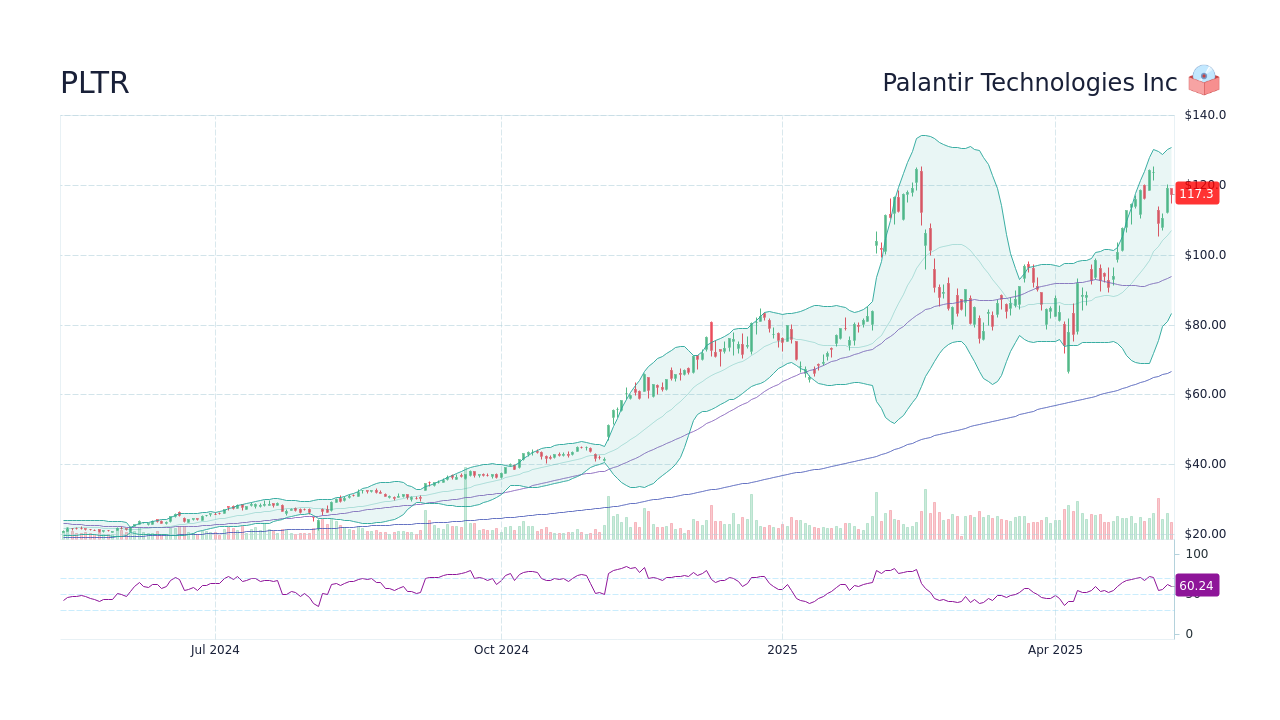

Palantir Technologies Stock Should You Invest Before May 5th Expert Analysis

May 10, 2025

Palantir Technologies Stock Should You Invest Before May 5th Expert Analysis

May 10, 2025 -

North Idaho Event Conservative Commentator Jeanine Pirro

May 10, 2025

North Idaho Event Conservative Commentator Jeanine Pirro

May 10, 2025 -

France Et Europe Un Bouclier Nucleaire Partage

May 10, 2025

France Et Europe Un Bouclier Nucleaire Partage

May 10, 2025