Sharp Decline In Amsterdam Stock Index: Lowest Point In Over A Year

Table of Contents

Factors Contributing to the Amsterdam Stock Index Decline

Several interconnected factors have contributed to the recent sharp decline in the Amsterdam Stock Index. Understanding these factors is crucial for navigating the current market volatility.

Global Economic Uncertainty

The current global economic climate significantly impacts the AEX. Rising inflation rates in many countries, coupled with aggressive interest rate hikes by central banks aiming to curb inflation, have created a challenging environment for businesses and investors. Geopolitical instability, particularly the ongoing war in Ukraine and its ripple effects on energy prices and supply chains, further exacerbates this uncertainty.

- Weakening Euro: The weakening Euro against the US dollar increases import costs for Dutch businesses, impacting profitability and potentially dampening investor confidence in the AEX.

- Supply Chain Disruptions: Continued disruptions to global supply chains, stemming from the pandemic and geopolitical events, have led to increased production costs and shortages of essential goods, negatively impacting many sectors within the AEX.

- Energy Crisis: Europe's energy crisis, largely fueled by the war in Ukraine, has significantly increased energy costs for businesses across all sectors, impacting profit margins and depressing economic growth. The Netherlands, like many European countries, is particularly vulnerable to these energy price shocks.

- War in Ukraine: The ongoing conflict in Ukraine has created significant uncertainty in global markets, causing investors to seek safer havens and leading to a sell-off in riskier assets, including those listed on the AEX. For example, the Technology sector of the AEX experienced a 15% drop in the last quarter, largely attributed to investor concerns about geopolitical instability.

Performance of Specific Sectors

The decline in the AEX is not uniform across all sectors. While some sectors have been disproportionately affected, others show relative resilience.

- Technology: The technology sector, often considered more sensitive to economic downturns and interest rate hikes, has seen some of the steepest declines. Increased borrowing costs make expansion more challenging for technology companies, impacting their valuations.

- Financials: The financial sector, while exhibiting some resilience, is also vulnerable to rising interest rates, which can affect lending profitability. However, increased borrowing costs can lead to greater profits on savings accounts and bank deposits for the time being.

- Energy: The energy sector presents a mixed picture. While high energy prices initially boosted the sector's profits, the uncertainty surrounding future energy supplies and the potential impact of government regulations creates volatility.

- Consumer Staples: Companies offering essential goods and services such as food and healthcare, have performed relatively better compared to other sectors, exhibiting the expected stability that usually accompanies such products.

Investor Sentiment and Market Volatility

Investor sentiment plays a significant role in driving market movements. The current negative news headlines surrounding inflation, interest rates, and geopolitical instability have eroded investor confidence. This has led to increased selling pressure in the AEX, resulting in increased market volatility.

- Increased Selling Pressure: As investors become more risk-averse, they are selling off assets, putting downward pressure on the AEX.

- Flight to Safety: Investors often seek safer investments during times of uncertainty, leading to capital flowing out of riskier assets like equities listed on the AEX, into government bonds or other safe-haven assets.

- Impact of Negative News Headlines: Continuous negative news about the global and European economy directly impacts investor confidence and can trigger further sell-offs.

Potential Consequences of the Amsterdam Stock Index Drop

The decline in the Amsterdam Stock Index has significant consequences for both the Dutch economy and investors.

Impact on the Dutch Economy

A prolonged decline in the AEX can have far-reaching implications for the Dutch economy.

- Reduced Consumer Spending: Lower stock market valuations can impact consumer confidence, leading to reduced spending and slower economic growth.

- Decreased Business Investment: Businesses may postpone or cancel investment plans in response to economic uncertainty, potentially impacting job creation and economic expansion.

- Potential Job Losses: If economic slowdown persists, businesses may be forced to reduce their workforce, leading to job losses and further dampening consumer confidence.

- Weakening of the Dutch Guilder: The overall impact of a weakening stock market and economy might negatively influence the value of the Dutch currency in relation to other currencies.

Implications for Investors

The AEX decline has significant implications for investors, regardless of their investment timeline.

- Long-term Investors: Long-term investors may need to reassess their portfolios' risk profiles, considering diversification strategies to mitigate potential losses.

- Short-term Investors: Short-term investors are particularly vulnerable to market volatility and might need to adopt more cautious strategies, potentially using hedging instruments to protect against potential further losses.

- Portfolio Diversification: Diversification is crucial for mitigating risk in the current environment. Investors should consider spreading investments across different asset classes and geographical regions.

- Risk Management Strategies: Implementing appropriate risk management strategies, such as stop-loss orders, can help limit potential losses.

Looking Ahead: Potential Recovery and Future Outlook for the Amsterdam Stock Index

While the current outlook is challenging, several factors could contribute to a recovery in the AEX.

Factors that Could Drive a Recovery

Several potential catalysts could trigger a rebound in the AEX:

- Government Intervention: Government policies aimed at boosting economic growth, such as infrastructure spending or tax cuts, could improve investor sentiment and encourage investment.

- Improved Economic Data: Positive economic indicators, such as lower inflation rates or stronger employment figures, could restore investor confidence.

- Shifts in Global Market Sentiment: A shift in global market sentiment towards greater optimism could lead to increased capital flows into the AEX.

- Technological Advancements: New technological innovations and their adoption within the Dutch economy could have a positively stimulating effect on the market.

Long-Term Predictions and Investment Strategies

The long-term outlook for the AEX remains uncertain but depends heavily on global economic developments and developments in the Dutch economy.

- Potential for Growth in Specific Sectors: Certain sectors, such as renewable energy and technology, may offer long-term growth potential, despite the current downturn.

- Opportunities for Strategic Investment: The current downturn presents opportunities for strategic investors to acquire assets at discounted prices, potentially generating higher returns in the long run.

It is crucial to remember that investing involves risk. The information provided here is for informational purposes only and should not be considered financial advice. Before making any investment decisions, consult with a qualified financial advisor to assess your risk tolerance and develop a personalized investment strategy.

Conclusion

The sharp decline in the Amsterdam Stock Index represents a significant challenge for the Dutch economy and investors. Factors such as global economic uncertainty, the performance of specific sectors within the AEX, and overall investor sentiment have contributed to this downturn. The potential consequences are considerable, ranging from reduced consumer spending and decreased business investment to potential job losses. However, potential catalysts for recovery exist, including government intervention, improved economic data, and shifts in global market sentiment. Understanding the dynamics of the AEX and the factors impacting it is crucial for making informed investment decisions. Stay informed about fluctuations in the Amsterdam Stock Index and consider consulting a financial advisor for personalized guidance regarding your investment portfolio in light of the recent AEX decline.

Featured Posts

-

Euronext Amsterdam Experiences 8 Stock Market Increase After Trumps Tariff Announcement

May 25, 2025

Euronext Amsterdam Experiences 8 Stock Market Increase After Trumps Tariff Announcement

May 25, 2025 -

Amsterdam Stock Market Suffers 2 Drop Trump Tariff Fallout

May 25, 2025

Amsterdam Stock Market Suffers 2 Drop Trump Tariff Fallout

May 25, 2025 -

Escape To The Countryside Homes Land And Lifestyle Choices

May 25, 2025

Escape To The Countryside Homes Land And Lifestyle Choices

May 25, 2025 -

8 Stock Market Rally On Euronext Amsterdam Trumps Tariff Impact

May 25, 2025

8 Stock Market Rally On Euronext Amsterdam Trumps Tariff Impact

May 25, 2025 -

Jorja Smith Biffy Clyro Blossoms At Bbc Radio 1 Big Weekend Complete Artist Lineup

May 25, 2025

Jorja Smith Biffy Clyro Blossoms At Bbc Radio 1 Big Weekend Complete Artist Lineup

May 25, 2025

Latest Posts

-

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025 -

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025 -

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025 -

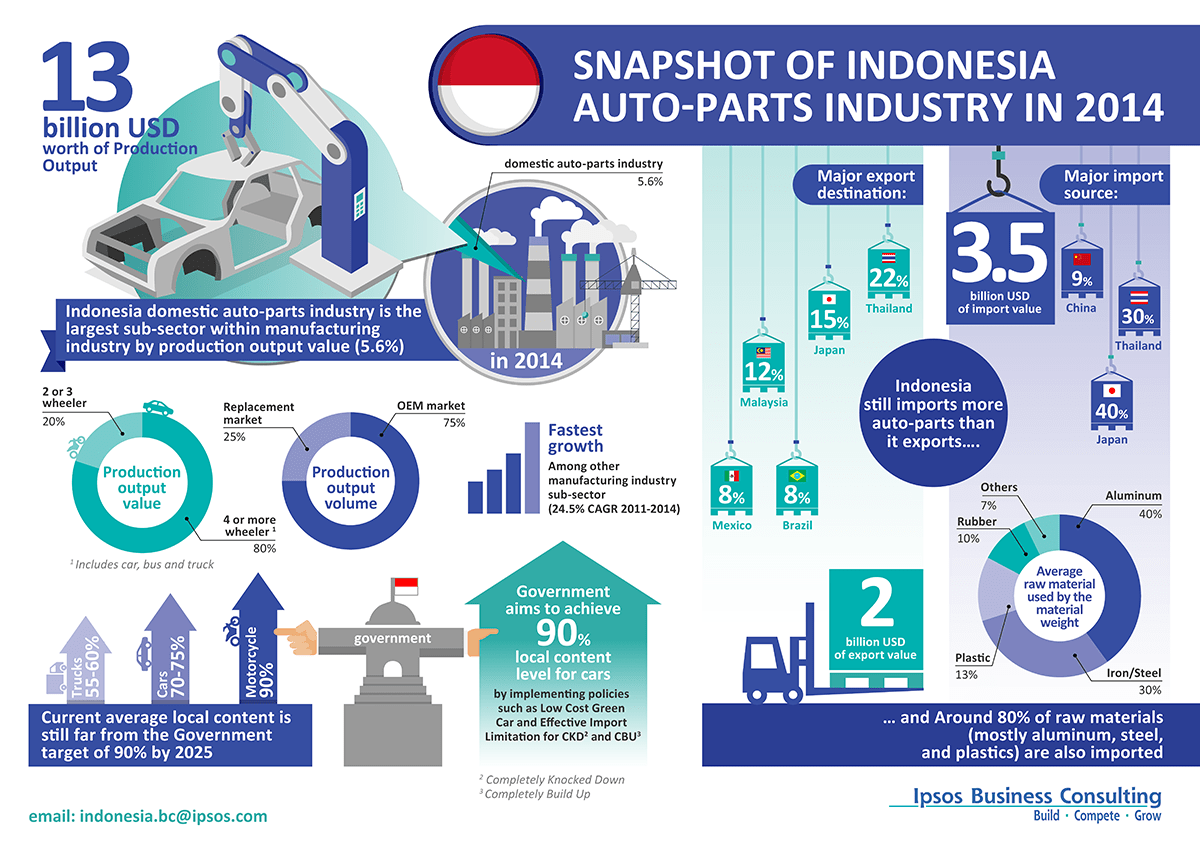

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025