Shein's Stalled London IPO: US Tariffs Cast A Shadow

Table of Contents

H2: The Impact of US Tariffs on Shein's Financial Performance

The imposition of US tariffs on imported goods has dealt a significant blow to Shein's financial performance, directly impacting its profitability and, consequently, its attractiveness to potential investors. This is a crucial factor in the stalled Shein IPO.

H3: Increased Production Costs

US tariffs have dramatically increased Shein's production costs. This is because a large portion of its inventory is manufactured overseas and imported into the US market.

- Increased import duties: Higher tariffs translate directly into increased costs for every garment Shein imports.

- Reduced profit margins: These increased costs inevitably squeeze Shein's already slim profit margins, making the business less appealing to investors eyeing a return on their investment in a Shein Stock Market listing.

- Potential price increases for consumers: To offset rising costs, Shein may be forced to increase prices, potentially impacting sales volume and consumer loyalty.

The mechanism is straightforward: higher tariffs mean Shein pays more to bring its goods into the US, directly affecting its bottom line. This increased cost burden severely undermines the company's profitability, a key concern for investors considering participation in the Shein IPO.

H3: Shifting Production Strategies

In response to the tariffs, Shein is likely exploring several strategies to mitigate the increased costs. These strategic shifts are complex and costly, further delaying any potential Shein London IPO.

- Increased investment in non-US manufacturing: Shein may be shifting a greater portion of its manufacturing to countries outside the US to avoid tariffs.

- Potential relocation of factories: This involves significant investment and logistical challenges, potentially impacting production timelines and supply chain efficiency.

- Impact on labor costs: Shifting production to different regions will necessitate navigating varying labor costs and regulations, adding another layer of complexity.

Reshoring or nearshoring production presents significant challenges. Finding suitable facilities, establishing new supply chains, and training workers in new locations require considerable time and financial investment – factors that contribute to the delay of the Shein IPO.

H2: Growing Scrutiny and Regulatory Concerns

Beyond the financial hurdles, Shein faces increasing scrutiny regarding its business practices. These concerns are impacting investor confidence and significantly affecting the timing of the Shein IPO.

H3: Environmental and Labor Practices

Shein's rapid growth model has drawn criticism regarding its environmental impact and labor practices.

- Sustainable fashion criticisms: The company faces criticism for its contribution to textile waste and its reliance on unsustainable materials.

- Allegations of unethical labor practices: Reports of poor working conditions and low wages in Shein's supply chain have damaged its public image.

- Potential boycotts and negative publicity: Negative press and potential consumer boycotts negatively impact investor confidence and the likelihood of a successful Shein Stock Market entry.

Specific examples of negative media coverage and reports on Shein's operational practices have fueled public concern and contributed to investor hesitancy surrounding the Shein IPO.

H3: Intellectual Property Issues

Shein is also embroiled in several legal battles concerning intellectual property infringement.

- Design copying allegations: The company has been accused of copying designs from other brands, leading to numerous lawsuits.

- Ongoing lawsuits: These legal challenges create uncertainty and financial risk, impacting investor confidence in a Shein London IPO.

- Potential fines and settlements: Significant financial penalties from these lawsuits could severely impact Shein's financial health.

The legal risks associated with these allegations are substantial. The uncertainty surrounding potential fines and settlements significantly impacts the attractiveness of the company to potential investors, further contributing to the delay of the Shein IPO.

H2: Alternative Market Strategies for Shein's Growth

While the Shein IPO is currently on hold, the company is likely exploring alternative strategies to fuel its growth.

H3: Focus on Direct-to-Consumer Sales

Shein's direct-to-consumer model offers a key advantage.

- Strengthening app engagement: Improving the user experience and expanding app features can enhance customer loyalty and drive sales.

- Improving customer loyalty programs: Rewarding repeat customers strengthens brand loyalty and reduces reliance on external factors.

- Exploring new marketing strategies: Adapting to changing market trends and exploring innovative marketing techniques can drive growth.

By focusing on its direct-to-consumer channels, Shein can reduce its dependence on external factors and potentially navigate the current challenges more effectively, even without a near-term Shein IPO.

H3: Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions offer potential avenues for growth.

- Collaborations with sustainable material suppliers: Partnering with ethical and sustainable suppliers could address environmental concerns and improve the company's image.

- Acquisitions of smaller brands: Acquiring smaller, more established brands could expand Shein's product range and market reach.

- Expansion into new markets: Entering new geographical markets could diversify revenue streams and reduce reliance on specific regions.

These strategic moves could potentially enhance Shein's position within the fast fashion industry and enhance its long-term prospects, independent of any immediate Shein IPO.

3. Conclusion:

The postponement of Shein's London IPO underscores the complex challenges faced by even the most successful fast-fashion companies. The combined pressures of US tariffs, regulatory scrutiny, and ethical concerns create significant hurdles. While the current market conditions pose difficulties, Shein's immense customer base and its robust direct-to-consumer model provide a solid foundation for future growth. However, proactively addressing ethical sourcing, environmental sustainability, and intellectual property rights is critical for Shein's long-term success and any future attempts at a successful Shein IPO. The company must demonstrate a commitment to resolving these issues to regain investor confidence and navigate the complexities of the global fashion industry. The future of the Shein IPO remains uncertain, but the company's decisive actions in addressing these challenges will ultimately shape its trajectory. Will Shein successfully overcome these hurdles and eventually achieve its Shein IPO ambitions? Only time will tell.

Featured Posts

-

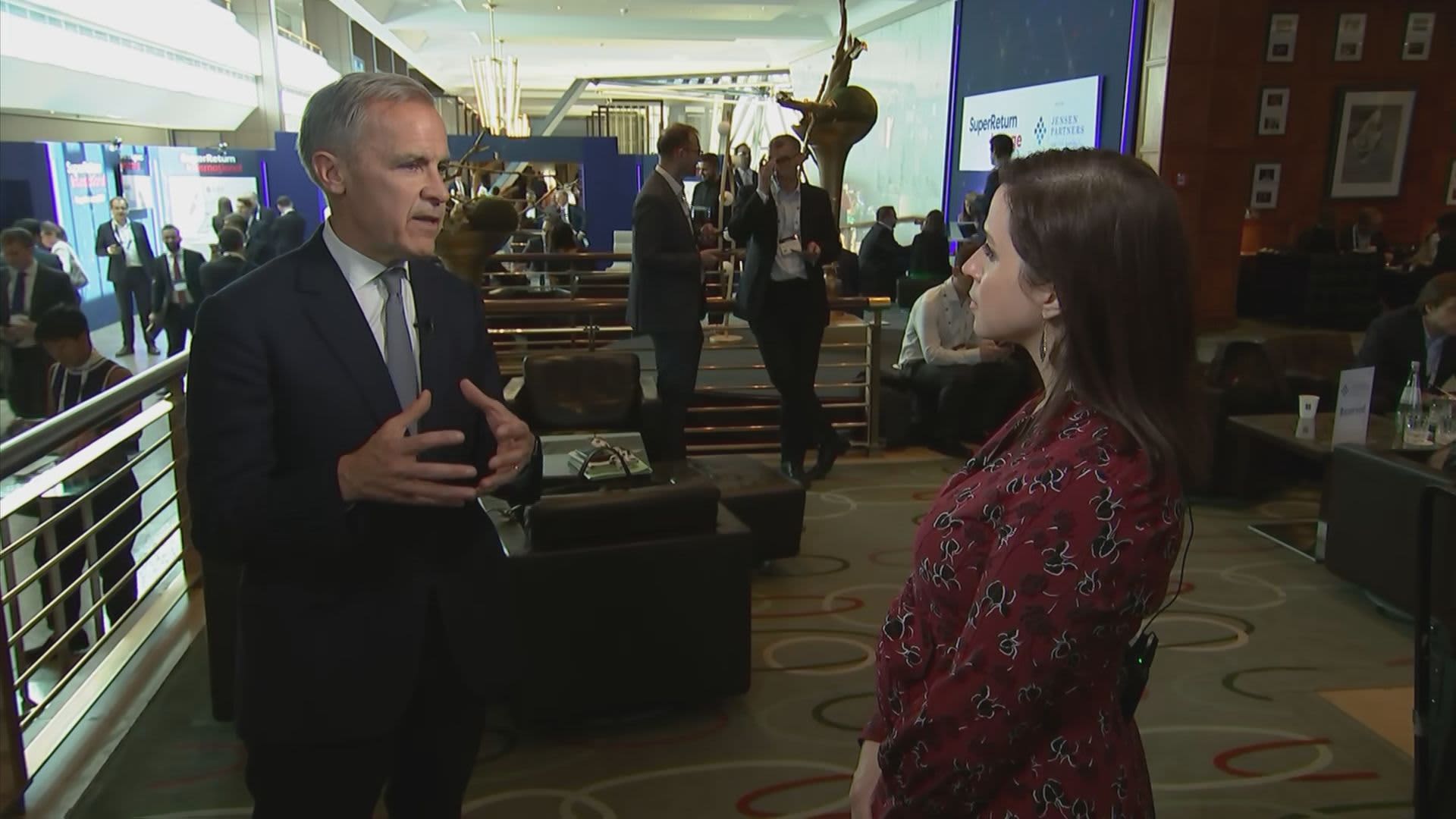

Mark Carneys Upcoming Meeting With President Trump At The White House

May 05, 2025

Mark Carneys Upcoming Meeting With President Trump At The White House

May 05, 2025 -

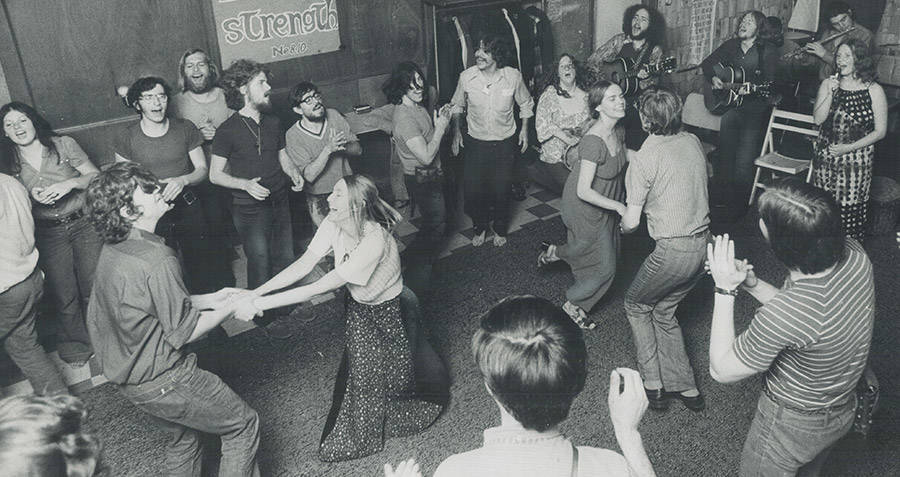

A Wild Crypto Party Two Days Of Excess

May 05, 2025

A Wild Crypto Party Two Days Of Excess

May 05, 2025 -

I Emma Stooyn Kai I Tolmiri Epilogi Tis Mia Anatreptiki Emfanisi

May 05, 2025

I Emma Stooyn Kai I Tolmiri Epilogi Tis Mia Anatreptiki Emfanisi

May 05, 2025 -

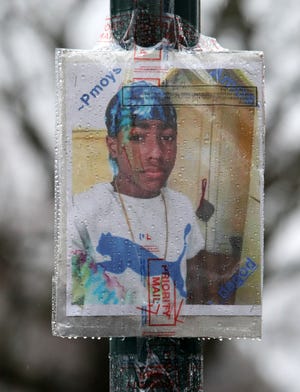

Months Long Lingering Of Toxic Chemicals In Buildings After Ohio Train Derailment

May 05, 2025

Months Long Lingering Of Toxic Chemicals In Buildings After Ohio Train Derailment

May 05, 2025 -

Will Chinas Electric Vehicle Revolution Leave America Behind

May 05, 2025

Will Chinas Electric Vehicle Revolution Leave America Behind

May 05, 2025

Latest Posts

-

Cult Members Jailed For Child Endangerment Through Gambling

May 05, 2025

Cult Members Jailed For Child Endangerment Through Gambling

May 05, 2025 -

Alleged Torture Starvation And Beatings Stepfather Charged In 16 Year Old Stepsons Death

May 05, 2025

Alleged Torture Starvation And Beatings Stepfather Charged In 16 Year Old Stepsons Death

May 05, 2025 -

16 Year Old Stepsons Murder Stepfather Faces Charges Of Torture Starvation And Abuse

May 05, 2025

16 Year Old Stepsons Murder Stepfather Faces Charges Of Torture Starvation And Abuse

May 05, 2025 -

Convicted Paedophile Receives Significant Prison Term Following Multi Agency Operation

May 05, 2025

Convicted Paedophile Receives Significant Prison Term Following Multi Agency Operation

May 05, 2025 -

Cult Members Jailed For Childs Disturbing Death

May 05, 2025

Cult Members Jailed For Childs Disturbing Death

May 05, 2025