Should I Buy Palantir Stock Now? 2025 Projections And Risks

Table of Contents

Palantir's 2025 Growth Projections and Financial Performance

Palantir's success hinges on its ability to maintain and accelerate its revenue growth. Understanding its financial trajectory is crucial for any potential investor considering Palantir stock.

Revenue Growth Analysis

Palantir has demonstrated consistent revenue growth in recent years, fueled by increasing demand for its data analytics solutions from both government and commercial sectors. Analyzing historical data and factoring in projected market trends, we can attempt to forecast Palantir revenue. While precise prediction is impossible, several factors point to continued growth:

- Government Sector Growth: Palantir's government contracts are a significant revenue driver. Continued government investment in national security and data analytics suggests sustained growth in this sector. Keywords: Palantir government contracts, Palantir revenue growth, Palantir government sector.

- Commercial Sector Expansion: Palantir is actively expanding its commercial client base. Success in this sector will be key to long-term growth. The increasing adoption of AI and big data analytics across various industries presents significant opportunities. Keywords: Palantir commercial sector, Palantir revenue, Palantir commercial growth.

- AI and Data Analytics: Palantir is heavily invested in artificial intelligence and advanced data analytics. This positions the company well to capitalize on the burgeoning demand for AI-powered solutions. Keywords: Palantir AI, Palantir data analytics, Palantir growth forecast.

While specific numerical projections are speculative and depend on numerous variables, a conservative estimate suggests a continued, albeit possibly slowing, rate of growth over the next few years. Analyzing past performance and comparing it with industry benchmarks helps paint a clearer picture.

Profitability and Margins

While Palantir has shown revenue growth, its profitability and margins are crucial aspects for evaluating Palantir stock. Examining the company's operating margins and net income is essential. Palantir's strategies for improving margins, such as focusing on higher-margin contracts and optimizing operational efficiency, will play a significant role in its future profitability. Keywords: Palantir profit margins, Palantir profitability, Palantir earnings, Palantir operating margin.

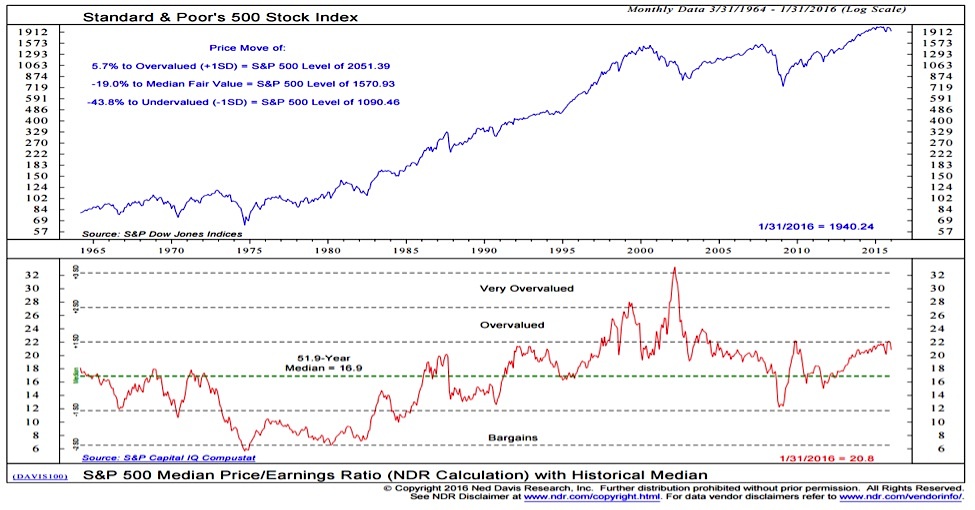

Stock Valuation

Determining whether Palantir stock is undervalued or overvalued requires a thorough valuation analysis. Various methods, such as the Price-to-Earnings (P/E) ratio and Price/Earnings to Growth (PEG) ratio, can be used. Comparing Palantir's valuation metrics to those of its competitors within the data analytics and AI sector provides valuable context. Keywords: Palantir stock valuation, Palantir stock price, Palantir P/E ratio, Palantir PEG ratio.

Competitive Landscape and Market Risks for Palantir Stock

The data analytics and AI market is fiercely competitive. Understanding Palantir's position within this landscape is vital.

Key Competitors

Palantir faces competition from established tech giants like Microsoft, Google, and Amazon, as well as specialized data analytics companies. These competitors possess considerable resources and market share. Analyzing their strengths and weaknesses relative to Palantir is critical for assessing Palantir stock's prospects. Keywords: Palantir competitors, data analytics competition, AI market competition.

Market Saturation and Technological Disruption

The risk of market saturation and the potential for disruptive technologies to emerge are significant concerns. New technologies could render Palantir's current offerings obsolete, impacting its market share and revenue growth. Analyzing market trends and technological advancements is crucial to assess these risks. Keywords: Palantir market risk, technological disruption, data analytics market trends.

Geopolitical and Regulatory Risks

Palantir's business is subject to geopolitical and regulatory risks. Government contracts, which represent a considerable portion of Palantir's revenue, are sensitive to changes in international relations and government policies. Regulatory changes or sanctions could significantly impact Palantir's operations and stock price. Keywords: Palantir regulatory risk, geopolitical risk, Palantir government contracts.

Should You Buy Palantir Stock Now? Weighing the Potential and Risks

Investing in Palantir stock presents both significant potential upside and considerable risks. The company's innovative technology and expanding market presence are positive factors, while the competitive landscape, regulatory hurdles, and market volatility represent potential downsides. A balanced assessment of these factors is crucial for making an informed decision. Keywords: Palantir investment, Palantir stock buy or sell, Palantir risk assessment.

Based on the analysis, a cautious approach might be warranted. While Palantir's long-term prospects are intriguing, the current market conditions and competitive pressures suggest a "hold" or "wait-and-see" strategy may be more prudent than an immediate buy. This recommendation is subject to further market developments and financial analysis.

Conclusion: Making Informed Decisions About Palantir Stock

Investing in Palantir stock involves navigating a complex landscape of growth potential and significant risks. This analysis has highlighted the company’s revenue growth potential, driven by its government and commercial sectors, and the competitive pressures and market risks it faces. Remember, this is not financial advice. Thorough due diligence, including independent research and consultation with a qualified financial advisor, is crucial before investing in any stock, including Palantir stock. Share your thoughts on Palantir stock in the comments below! What are your predictions for Palantir's future?

Featured Posts

-

9 Maya Mezhdunarodnaya Izolyatsiya Zelenskogo

May 10, 2025

9 Maya Mezhdunarodnaya Izolyatsiya Zelenskogo

May 10, 2025 -

Nottingham A And E Records Breach Families Demand Accountability From Nhs

May 10, 2025

Nottingham A And E Records Breach Families Demand Accountability From Nhs

May 10, 2025 -

Understanding High Stock Market Valuations A Bof A Analysis

May 10, 2025

Understanding High Stock Market Valuations A Bof A Analysis

May 10, 2025 -

Vegas Golden Knights Assessing The Impact Of Hertls Absence

May 10, 2025

Vegas Golden Knights Assessing The Impact Of Hertls Absence

May 10, 2025 -

Brutal Racist Killing Shatters Family A Community Mourns

May 10, 2025

Brutal Racist Killing Shatters Family A Community Mourns

May 10, 2025