Should I Buy XRP (Ripple) At The Current Price? Investment Risks And Rewards

Table of Contents

Understanding XRP and Ripple's Technology

XRP is the native cryptocurrency of Ripple, a company focused on enabling fast and efficient cross-border payments. RippleNet, Ripple's payment network, utilizes XRP to facilitate transactions between financial institutions. XRP's role within this ecosystem is crucial, acting as a bridge currency to streamline international transfers.

Advantages of XRP:

- Faster transaction speeds: XRP boasts significantly faster transaction times compared to Bitcoin or Ethereum, making it attractive for real-time payments.

- Lower transaction fees: The cost of sending XRP is considerably less than many other cryptocurrencies, increasing its appeal for high-volume transactions.

- Focus on institutional adoption: Ripple actively pursues partnerships with major financial institutions, aiming for widespread adoption within the traditional banking sector.

- Potential for widespread use in international finance: Its speed and efficiency make XRP a potential game-changer in the global financial landscape.

Disadvantages of XRP:

- Centralization concerns: Unlike many cryptocurrencies, Ripple holds a significant portion of XRP, raising concerns about decentralization and potential manipulation. Understanding XRP's tokenomics and Ripple's control is critical.

The SEC Lawsuit and its Impact on XRP Price

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price and overall market sentiment. The SEC alleges that Ripple sold XRP as an unregistered security, a claim Ripple vehemently denies. The outcome of this legal battle is highly uncertain and could dramatically influence XRP's future.

Potential Outcomes and Their Impact:

- SEC Win: A victory for the SEC could severely damage XRP's value, potentially leading to delisting from exchanges and significant price drops.

- Ripple Win: A win for Ripple would likely boost investor confidence and result in a substantial price increase.

- Settlement: A settlement between the two parties could lead to a mixed outcome, with the price potentially reacting moderately depending on the settlement terms.

The legal uncertainty surrounding this case creates significant volatility in XRP's price, making it a high-risk investment.

Market Analysis and Price Prediction (Disclaimer: This is not financial advice)

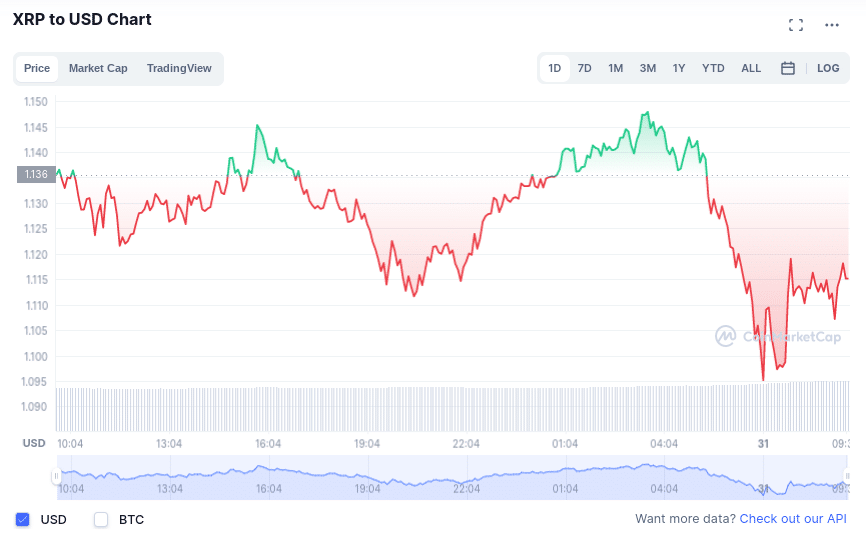

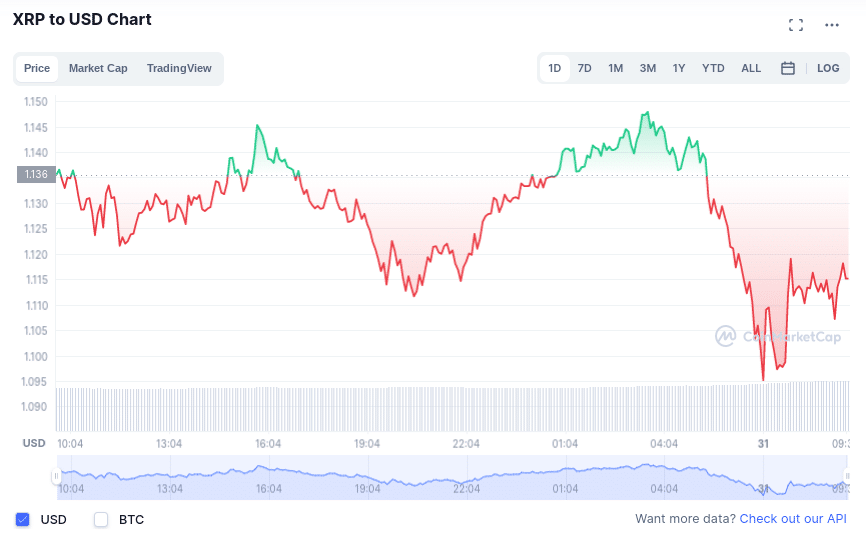

Analyzing XRP's price requires considering various factors, including its adoption rate, regulatory changes, and the overall cryptocurrency market sentiment. While predicting future prices is impossible, examining historical performance and current trends provides context.

Factors Influencing XRP Price:

- Current XRP price and market capitalization: Monitoring these metrics provides an understanding of XRP's current standing in the crypto market.

- Recent price trends: Analyzing charts and graphs can help identify potential patterns and future price movements. (Note: Past performance is not indicative of future results).

- Potential catalysts for price increase or decrease: Positive news, such as successful partnerships or regulatory clarity, can drive prices up, while negative news (like further legal setbacks) can lead to drops.

- Expert opinions: Researching reputable financial analysts' opinions can offer additional perspectives (always critically evaluate the source and their potential biases).

Assessing the Risks of Investing in XRP

Investing in XRP carries substantial risks, primarily due to its inherent volatility and the ongoing legal uncertainty. The cryptocurrency market is known for its dramatic price swings, and XRP's price is particularly sensitive to news related to the SEC lawsuit.

Key Risks:

- High risk of price fluctuations: XRP's price can experience significant and rapid changes.

- Potential for complete loss of investment capital: There's a real possibility of losing your entire investment in XRP.

- Regulatory uncertainty: Future regulations could negatively impact XRP's value and trading.

- Legal risk: The outcome of the SEC lawsuit remains a major risk factor.

Diversification and Risk Management Strategies

To mitigate the risks associated with XRP investment, consider diversifying your portfolio across multiple asset classes. Never invest more than you can afford to lose. Thorough research and understanding of the inherent risks are crucial before making any investment decisions.

Conclusion: Should You Buy XRP Now? A Final Verdict

XRP offers potential benefits such as fast transaction speeds and low fees, positioning it as a player in the cross-border payment sector. However, the ongoing SEC lawsuit creates significant uncertainty, making it a high-risk investment. The market analysis suggests volatility, and the inherent risks, including the potential for complete loss, shouldn't be overlooked. After careful consideration of the technological advantages, legal challenges, market analysis, and inherent risks discussed, is investing in XRP right for you? Remember to conduct thorough research and assess your own risk tolerance before investing in XRP or any other cryptocurrency.

Featured Posts

-

Dragons Den Investment Strategies What Works And What Doesnt

May 01, 2025

Dragons Den Investment Strategies What Works And What Doesnt

May 01, 2025 -

Structurele Problemen Leiden Tot Lange Wachttijden In Tbs Klinieken

May 01, 2025

Structurele Problemen Leiden Tot Lange Wachttijden In Tbs Klinieken

May 01, 2025 -

Agha Syd Rwh Allh Mhdy Bharty Hkwmt Ky Kshmyr Palysy Pr Tnqyd

May 01, 2025

Agha Syd Rwh Allh Mhdy Bharty Hkwmt Ky Kshmyr Palysy Pr Tnqyd

May 01, 2025 -

Rechtszaak Kampen Enexis Gevecht Om Stroomnetaansluiting

May 01, 2025

Rechtszaak Kampen Enexis Gevecht Om Stroomnetaansluiting

May 01, 2025 -

Priscilla Pointer Amy Irvings Mother Dies At 100

May 01, 2025

Priscilla Pointer Amy Irvings Mother Dies At 100

May 01, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Investors Reassurance

May 01, 2025

Stock Market Valuation Concerns Bof A Offers Investors Reassurance

May 01, 2025 -

Pierre Poilievres Election Loss What Went Wrong

May 01, 2025

Pierre Poilievres Election Loss What Went Wrong

May 01, 2025 -

Black Sea Oil Spill 62 Miles Of Beaches Closed In Russia

May 01, 2025

Black Sea Oil Spill 62 Miles Of Beaches Closed In Russia

May 01, 2025 -

Major Oil Spill Prompts Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025

Major Oil Spill Prompts Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025 -

Russias Black Sea Oil Spill Leads To Widespread Beach Closures

May 01, 2025

Russias Black Sea Oil Spill Leads To Widespread Beach Closures

May 01, 2025