Should You Buy Apple Stock Now? Analyst's $254 Price Target Explained

Table of Contents

Apple's Current Financial Performance and Future Projections

Apple's continued success hinges on its financial performance and future projections. Let's analyze the key factors driving its growth and potential challenges.

Revenue and Earnings Growth

Apple consistently demonstrates robust financial performance. Recent quarters have shown impressive growth across various segments.

- iPhone Sales: While iPhone sales growth may have slowed slightly year-over-year in [Insert most recent quarter/year], they still represent a significant portion of Apple's overall revenue. [Insert specific revenue figures and percentage changes].

- Services: Apple's services segment, encompassing Apple Music, iCloud, and the App Store, continues to be a significant driver of growth, exhibiting [Insert percentage] year-over-year growth in [Insert most recent quarter/year]. This demonstrates the power of Apple's ecosystem.

- Wearables, Home, and Accessories: This segment continues to experience strong growth, driven by the popularity of the Apple Watch and AirPods. [Insert specific revenue figures and percentage changes].

These positive trends suggest a healthy financial foundation for future growth.

Innovation and New Product Launches

Apple's ability to consistently innovate and launch groundbreaking products is crucial for its long-term success. Speculation surrounds several anticipated product categories:

- iPhone 15 Series: The next generation of iPhones is expected to introduce [mention rumored features, e.g., A17 Bionic chip, improved camera system]. These upgrades could significantly boost sales.

- Apple AR/VR Headset: The much-anticipated mixed-reality headset promises to be a game-changer, potentially opening up new revenue streams. The success of this venture remains to be seen.

- Other Innovations: Apple continues to invest heavily in research and development, suggesting further innovation in areas like electric vehicles, and further advancements in its existing product lines.

Competitive Landscape

While Apple enjoys a dominant position, the competitive landscape is ever-evolving.

- Samsung: Remains a strong competitor, particularly in the Android smartphone market. Samsung's aggressive marketing and innovative features present a challenge to Apple's market share.

- Google: Google's Android operating system and Pixel phones provide robust competition, especially in certain price segments.

- Microsoft: Microsoft competes with Apple in areas like laptops and tablets, posing a threat in the enterprise and productivity sectors.

Apple maintains a strong competitive advantage through its brand loyalty, robust ecosystem, and superior user experience. However, vigilance against the competition remains essential.

The $254 Price Target: What Does It Mean?

The $254 price target for Apple stock, mentioned by [cite source, e.g., Morgan Stanley analysts], reflects a bullish outlook on the company's future performance.

Analyst Rationale

The rationale behind the $254 price target likely includes:

- Projected Revenue Growth: Analysts likely factored in projected growth in iPhone sales, services, and other product categories.

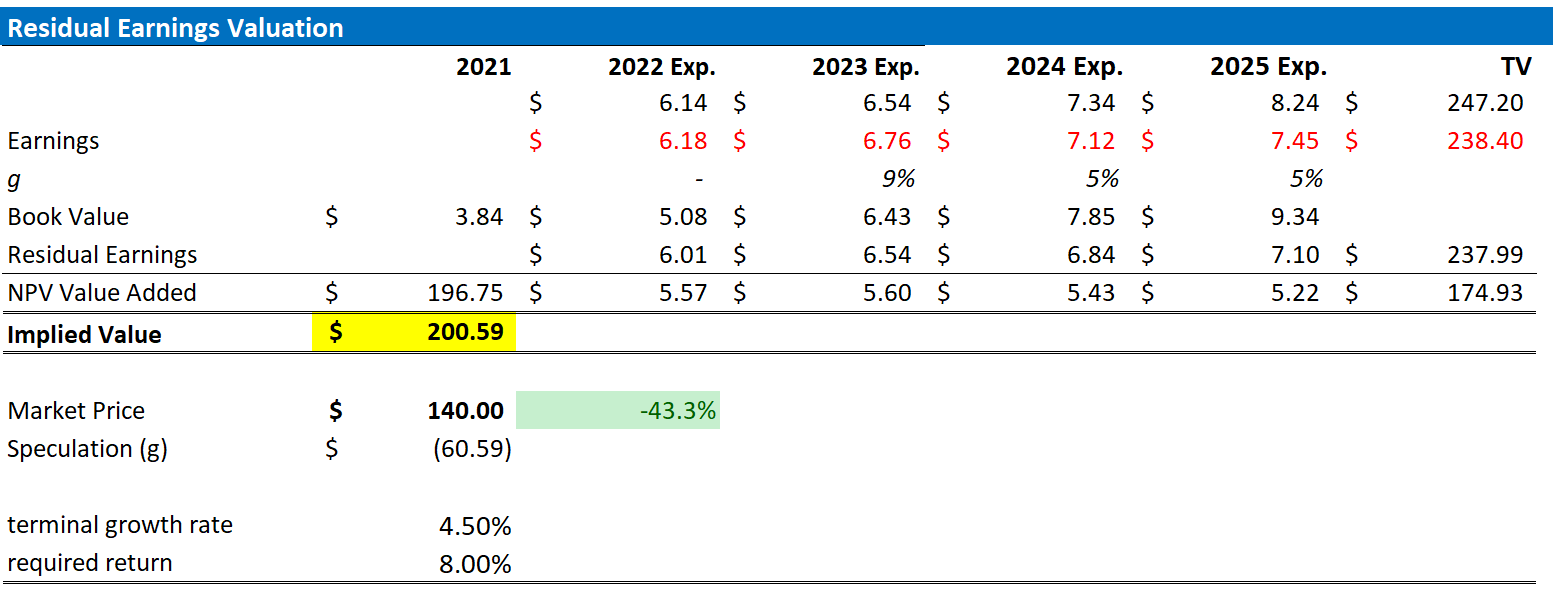

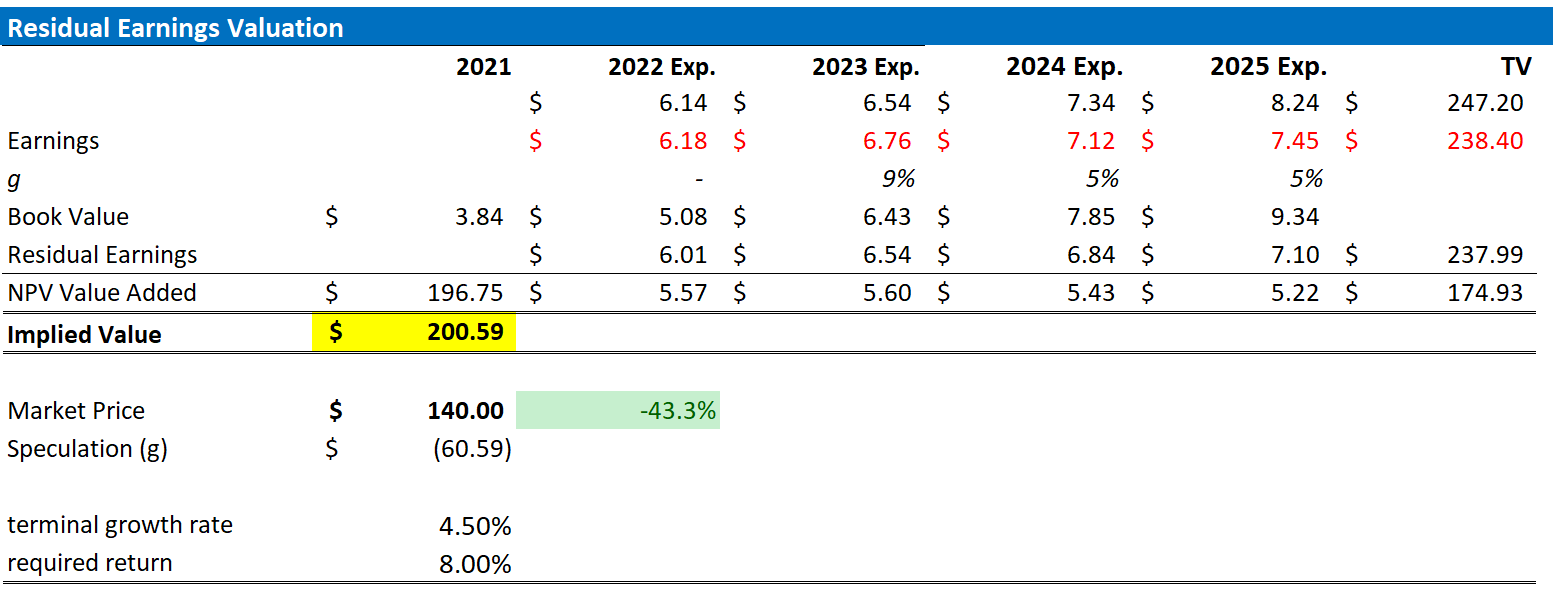

- Market Valuation: The target may be based on various valuation models, such as discounted cash flow analysis, taking into account Apple's future earnings potential and market capitalization.

- Economic Factors: The analysts probably also considered macroeconomic factors that could influence Apple's performance.

Potential Upside and Downside

While the $254 price target suggests significant upside potential, several factors could influence the actual stock price.

- Positive Factors: Exceeding revenue projections, successful new product launches, and strong consumer demand could push the stock price higher.

- Negative Factors: Economic recession, supply chain disruptions, increased competition, or negative regulatory changes could negatively impact the stock price and prevent it from reaching the $254 target.

Risks Associated with Investing in Apple Stock

Investing in any stock carries inherent risks. Investing in Apple stock is no exception.

Market Volatility

The tech sector is known for its volatility. External factors can significantly impact Apple's stock price.

- Economic Downturns: Economic recessions generally lead to decreased consumer spending, affecting demand for Apple products.

- Geopolitical Events: Global instability can impact supply chains and consumer confidence, negatively influencing Apple's stock performance.

Competition and Disruption

Emerging technologies and competitors could disrupt Apple's market dominance.

- Technological Disruption: New innovations in areas like AR/VR or foldable smartphones could challenge Apple's leadership position.

- Competitive Innovation: Competitors continually strive to improve their products and services, potentially eroding Apple's market share.

Valuation

Assessing Apple's valuation is crucial for determining whether its stock is currently overvalued or undervalued.

- P/E Ratio: Comparing Apple's P/E ratio to its competitors and historical averages can provide insight into its valuation. [Insert data and analysis if available]

- Other Metrics: Other relevant metrics such as Price-to-Sales ratio and PEG ratio should also be considered.

Conclusion: Should You Invest in Apple Stock Right Now?

Considering the $254 price target, Apple's strong financial performance, and its innovative capabilities, investing in Apple stock presents potential for significant returns. However, market volatility, competition, and valuation risks must be carefully weighed. The recommendation is not a definitive "buy" or "sell" but rather a suggestion to carefully assess your risk tolerance and investment goals before making any decisions. Remember, this analysis is not financial advice.

Should you buy Apple stock now? The answer depends on your individual circumstances and risk appetite. Conduct thorough due diligence, consult with a financial advisor, and consider your personal financial situation before making any investment decisions related to Apple stock or any other stock. Informed investing is key to achieving your financial goals.

Featured Posts

-

Former French Premier Expresses Reservations About Macrons Actions

May 24, 2025

Former French Premier Expresses Reservations About Macrons Actions

May 24, 2025 -

Kudi Podilisya Peremozhtsi Yevrobachennya Za Ostannye Desyatilittya

May 24, 2025

Kudi Podilisya Peremozhtsi Yevrobachennya Za Ostannye Desyatilittya

May 24, 2025 -

Darwin Robbery Teenager Arrested For Fatal Stabbing In Nightcliff

May 24, 2025

Darwin Robbery Teenager Arrested For Fatal Stabbing In Nightcliff

May 24, 2025 -

Los Angeles Renters Face Price Gouging After Recent Fires

May 24, 2025

Los Angeles Renters Face Price Gouging After Recent Fires

May 24, 2025 -

Glastonbury 2025 Charli Xcx Neil Young And The Unmissable Acts

May 24, 2025

Glastonbury 2025 Charli Xcx Neil Young And The Unmissable Acts

May 24, 2025

Latest Posts

-

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025