Should You Buy Palantir Stock? Wall Street's Consensus And Your Investment Strategy

Table of Contents

Palantir Technologies (PLTR) has captivated investors, sparking heated debate: should you buy Palantir stock? This article dives into Wall Street's current consensus on Palantir's stock, analyzing its performance, growth potential, and risks to guide your investment strategy. We'll examine factors influencing its share price and offer insights into whether this data analytics giant is a worthwhile addition to your portfolio. Understanding the Palantir stock price trajectory requires a nuanced look at the company's financials and market positioning.

H2: Palantir's Business Model and Current Performance:

H3: Understanding Palantir's Offerings:

Palantir offers two primary platforms: Gotham and Foundry. Gotham caters primarily to government agencies, assisting in counter-terrorism, intelligence gathering, and law enforcement through advanced data analytics. Foundry, on the other hand, targets commercial clients, providing them with a platform to integrate and analyze massive datasets for operational efficiency and improved decision-making. Both leverage big data and advanced data analytics techniques.

- Gotham Strengths: Strong presence in government contracts, proven track record with high-profile clients, specialized tools for national security applications.

- Gotham Weaknesses: Reliance on government contracts, potential for budget constraints impacting future revenue.

- Foundry Strengths: Scalable platform applicable across various industries, potential for significant growth in the commercial sector.

- Foundry Weaknesses: Competition from established players in the commercial data analytics market, longer sales cycles compared to Gotham.

- Recent Contract Wins/Losses: [Insert recent news about significant contract wins and losses, citing sources]. Analyzing these developments is crucial to understanding the near-term Palantir stock price outlook.

H3: Analyzing Palantir's Financial Performance:

Palantir's recent financial reports showcase a mixed bag. While revenue growth has been impressive, sustained profitability remains elusive. Key financial metrics such as operating margin and earnings per share (EPS) need close scrutiny. Cash flow, however, provides a positive indicator of the company's financial health.

- Positive Trends: Strong revenue growth, increasing adoption of Foundry, expansion into new commercial markets.

- Negative Trends: Negative or low operating margins, high R&D spending impacting profitability, dependence on a few large government contracts.

- Comparison to Competitors: [Compare Palantir's key financial metrics to competitors such as Snowflake, Databricks, or similar companies. Cite sources for data]. This comparative analysis helps determine Palantir's competitive positioning and its relative valuation.

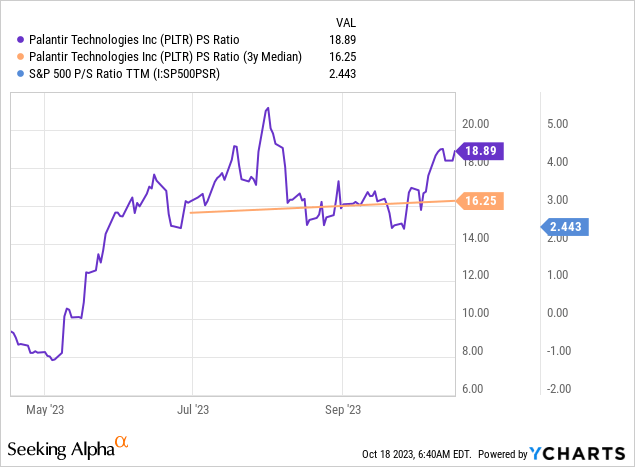

H3: Current Palantir Stock Price and Valuation:

Palantir's market capitalization, P/E ratio, and price-to-sales ratio are crucial for understanding its valuation. The current market capitalization reflects investor sentiment towards the company's future growth prospects.

- Key Valuation Metrics: [Provide current market cap, P/E ratio, and price-to-sales ratio. Source the data].

- Comparison to Peers: [Compare these metrics to competitors to assess whether Palantir is overvalued or undervalued. Cite sources]. Analyzing this data provides a more informed perspective on the Palantir share price.

- Recent Price Fluctuations: [Discuss recent price movements and their underlying causes, connecting them to news events, earnings reports, or market sentiment]. Understanding these fluctuations is key to any Palantir investment strategy.

H2: Wall Street's Consensus on Palantir Stock:

H3: Analyst Ratings and Price Targets:

Analyst ratings on Palantir stock are varied, reflecting the inherent risks and growth potential of the company. The average price target provides a range of potential future prices.

- Analyst Ratings Summary: [Summarize buy, hold, and sell ratings from major analysts, citing sources].

- Rationale Behind Ratings: [Explain the reasons behind the different ratings, focusing on their perspectives regarding growth potential, profitability, and risks].

H3: Institutional Investment in Palantir:

Significant institutional investment provides an indication of confidence in Palantir's long-term prospects. Monitoring changes in institutional holdings can offer insights into market sentiment.

- Key Institutional Investors: [List major institutional investors, citing sources where available].

- Investment Strategies: [Discuss the likely investment strategies driving institutional involvement in Palantir].

H3: Factors Influencing Wall Street's Opinion:

Various factors, including macroeconomic conditions, industry trends, and company-specific events, significantly influence Wall Street's perception of Palantir.

- Market Sentiment: [Discuss overall market sentiment towards technology stocks and the impact on Palantir’s valuation].

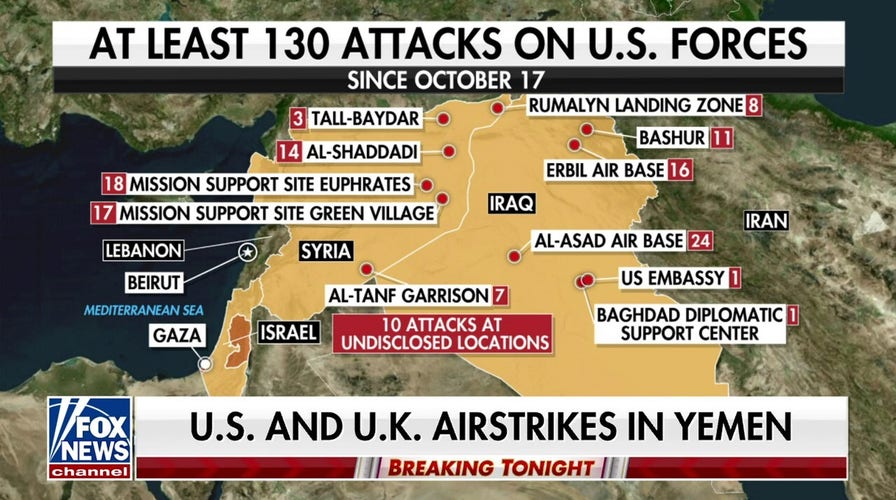

- Geopolitical Risks: [Analyze geopolitical events and their potential impact on Palantir’s government contracts and commercial growth].

- Competition: [Evaluate the competitive landscape and potential threats from other data analytics companies].

- Regulatory Changes: [Assess potential regulatory changes that could impact Palantir’s operations or growth].

H2: Assessing the Risks and Rewards of Investing in Palantir:

H3: Potential Upside:

Palantir's potential for growth lies in several areas: expansion into new commercial markets, deeper penetration into existing government and commercial sectors, and continued innovation in data analytics.

- Growth Drivers: [Detail the factors likely to drive future revenue growth, such as new product launches, strategic partnerships, and market expansion]. This long-term growth potential is a major factor influencing Palantir stock price predictions.

H3: Potential Downsides:

Investing in Palantir entails significant risks: intense competition in the data analytics market, dependence on government contracts, and valuation concerns.

- Key Risks: [Highlight the potential downsides, such as intense competition, slow adoption of Foundry, budget cuts by government clients, and the risk of overvaluation]. Addressing these risks is crucial for any prospective Palantir investor.

Conclusion:

This Palantir Technologies analysis and overview of Wall Street's opinion provides a framework for assessing whether Palantir stock is right for you. While Palantir shows substantial growth potential in the lucrative data analytics sector, investors must carefully weigh the risks associated with its valuation and dependence on government contracts. Thorough research and consideration of your risk tolerance are crucial before investing in Palantir shares. Consult a financial advisor for personalized guidance before making any investment decisions regarding Palantir stock. Ultimately, the decision of whether to buy Palantir stock depends on your individual investment strategy and risk appetite.

Featured Posts

-

Top Live Music And Events Happening In Lake Charles This Easter

May 10, 2025

Top Live Music And Events Happening In Lake Charles This Easter

May 10, 2025 -

2025 Hurun Global Rich List Elon Musks Position Remains Unchallenged Despite 100 Billion Drop

May 10, 2025

2025 Hurun Global Rich List Elon Musks Position Remains Unchallenged Despite 100 Billion Drop

May 10, 2025 -

Skepticism Remains Analyzing The Impact Of Trumps Houthi Truce On Shipping

May 10, 2025

Skepticism Remains Analyzing The Impact Of Trumps Houthi Truce On Shipping

May 10, 2025 -

Unveiling Jeanine Pirro Behind The Scenes Insights From Fox News

May 10, 2025

Unveiling Jeanine Pirro Behind The Scenes Insights From Fox News

May 10, 2025 -

Pam Bondi Announces Unprecedented Fentanyl Bust Details Inside

May 10, 2025

Pam Bondi Announces Unprecedented Fentanyl Bust Details Inside

May 10, 2025