Should You Invest In D-Wave Quantum (QBTS) Stock?

Table of Contents

Understanding D-Wave Quantum's Business Model and Technology

D-Wave Quantum distinguishes itself in the quantum computing arena by focusing on quantum annealing. Unlike gate-based quantum computers pursued by companies like IBM and Google, D-Wave's approach specializes in solving complex optimization problems. This makes it particularly attractive for industries grappling with logistical challenges, financial modeling, materials science, and artificial intelligence. Their current target market includes businesses needing to optimize processes, analyze large datasets, and improve efficiency.

D-Wave has forged key partnerships with prominent organizations, further solidifying its position in the market. These collaborations enhance the development and application of their quantum annealing technology, proving its real-world potential.

- Strengths of D-Wave's technology: Focus on a specific niche (optimization), established track record of building quantum computers, growing ecosystem of users and developers.

- Limitations and challenges faced by D-Wave: Quantum annealing's limitations compared to universal gate-based quantum computing, competition from other quantum computing companies, the need for continued technological advancements.

- Comparison with other quantum computing companies (e.g., IBM, Google): While IBM and Google pursue more general-purpose quantum computers, D-Wave specializes in a specific type of quantum computation with immediate applications. This focused approach offers both advantages and disadvantages.

- Potential future applications and market growth: The potential market for quantum annealing is vast, encompassing diverse industries and applications beyond current offerings. The expansion into new sectors and increased adoption rates will drive future growth.

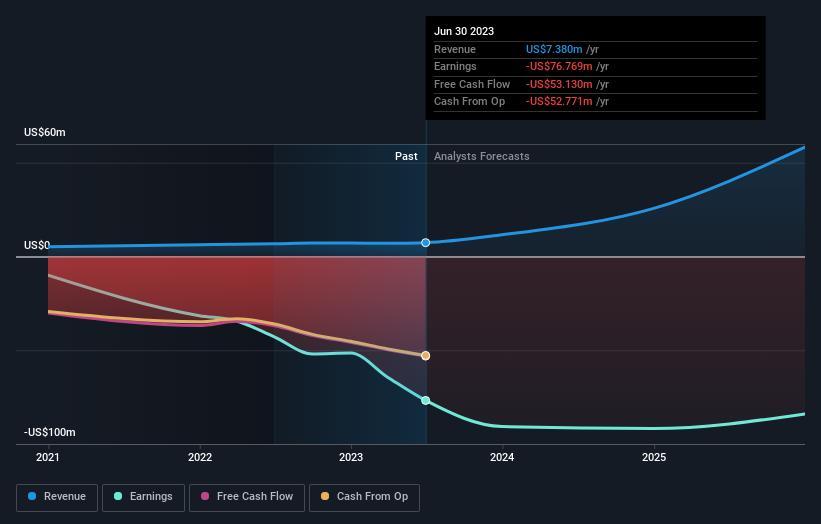

Analyzing D-Wave Quantum's Financial Performance and Future Prospects

Analyzing QBTS stock requires a careful examination of its financial performance, both historical and current. While D-Wave is a relatively new public company, monitoring its revenue streams, profitability, and overall financial health (including debt levels and cash flow) is crucial for assessing its long-term viability. Growth potential, market capitalization, and comparisons with similar tech stocks provide valuable context for investment decisions.

- Key financial ratios and metrics: Closely monitor revenue growth, profitability margins, debt-to-equity ratio, and cash flow to gauge the financial health of the company.

- Risks associated with investing in QBTS stock: Being a relatively new company in a volatile sector, QBTS faces inherent risks, including technological hurdles, competition, and market fluctuations.

- Potential for high returns vs. high risk: The quantum computing sector holds immense potential for high returns, but this is balanced by the high risk inherent in early-stage technology investments.

- Comparison to other tech stocks in the same sector: Benchmark QBTS's performance against other companies in the quantum computing or broader technology sectors to gain a comparative perspective.

Considering the Risks and Rewards of Investing in QBTS

Investing in QBTS requires an understanding of the inherent volatility in the quantum computing sector. This is a long-term investment; substantial returns may not materialize immediately. While the potential for significant gains exists, the possibility of significant losses must also be acknowledged. Diversification is key to mitigating risk.

- Specific risks associated with QBTS: Competition from established tech giants, technological setbacks in development, the slow adoption of quantum computing in mainstream industries.

- Risk tolerance assessment for potential investors: Before investing, carefully assess your personal risk tolerance. QBTS is not suitable for risk-averse investors.

- Diversification strategies for a balanced portfolio: Do not put all your eggs in one basket. Diversify your investment portfolio to reduce risk.

- Alternative investment options in the quantum computing space: Explore alternative investment avenues in the quantum computing space, such as ETFs or other companies in the sector.

How to Invest in D-Wave Quantum (QBTS) Stock

Investing in QBTS involves utilizing brokerage accounts or investment platforms that offer access to the stock market. Thorough research and due diligence are paramount before making any investment decision. Consult with a financial advisor to discuss if QBTS aligns with your investment goals and risk tolerance. Remember, investments in early-stage technology companies are inherently speculative.

- Step-by-step guide to buying QBTS stock: Open a brokerage account, research QBTS, place a buy order through your chosen brokerage.

- Important considerations before investing: Understand your risk tolerance, diversify your portfolio, and perform thorough due diligence.

- Resources for further research on QBTS and quantum computing: Consult financial news sources, company filings, and industry reports for detailed information.

Conclusion: Should You Invest in D-Wave Quantum (QBTS) Stock? A Final Verdict

D-Wave Quantum operates in an exciting but volatile sector. While its unique approach to quantum computing shows promise, investing in QBTS carries significant risk. The potential for substantial long-term returns exists, but significant losses are also possible. Before investing, carefully assess your risk tolerance, investment goals, and diversify your portfolio. Whether or not QBTS aligns with your investment strategy depends entirely on your individual circumstances. Make an informed decision about whether D-Wave Quantum (QBTS) stock aligns with your investment strategy. Start your research today!

Featured Posts

-

Recent D Wave Quantum Qbts Stock Market Activity Explained

May 20, 2025

Recent D Wave Quantum Qbts Stock Market Activity Explained

May 20, 2025 -

Huuhkajien Valmennusuudistus Tavoitteena Mm Kisat

May 20, 2025

Huuhkajien Valmennusuudistus Tavoitteena Mm Kisat

May 20, 2025 -

Pro D2 Colomiers Vs Oyonnax Et Montauban Vs Brive Matchs A Suivre

May 20, 2025

Pro D2 Colomiers Vs Oyonnax Et Montauban Vs Brive Matchs A Suivre

May 20, 2025 -

Druga Vagitnist Dzhennifer Lourens Zavershilasya Narodzhennyam Ditini

May 20, 2025

Druga Vagitnist Dzhennifer Lourens Zavershilasya Narodzhennyam Ditini

May 20, 2025 -

Collins Aerospace Announces Job Cuts In Cedar Rapids

May 20, 2025

Collins Aerospace Announces Job Cuts In Cedar Rapids

May 20, 2025

Latest Posts

-

Southern French Alps Weather Update Late Season Snow And Storms

May 21, 2025

Southern French Alps Weather Update Late Season Snow And Storms

May 21, 2025 -

Southern French Alps Late Snowfall And Stormy Weather

May 21, 2025

Southern French Alps Late Snowfall And Stormy Weather

May 21, 2025 -

Macrons Push For Increased Intra Eu Trade A Challenge To Us Imports

May 21, 2025

Macrons Push For Increased Intra Eu Trade A Challenge To Us Imports

May 21, 2025 -

European Union Trade Policy Macron Advocates For Prioritizing European Products

May 21, 2025

European Union Trade Policy Macron Advocates For Prioritizing European Products

May 21, 2025 -

Macrons Call To Eu Buy European Not American

May 21, 2025

Macrons Call To Eu Buy European Not American

May 21, 2025