Should You Invest In D-Wave Quantum (QBTS) Stock Now?

Table of Contents

Understanding D-Wave Quantum's Business Model and Technology

D-Wave's core technology centers around quantum annealing, a specialized approach to quantum computing designed to solve optimization problems. Unlike gate-based quantum computers (used by competitors like IBM and Google), which operate using qubits to perform universal computations, D-Wave's quantum annealers excel at finding the lowest energy state of a system, a process crucial for complex optimization challenges. These applications span various industries, including logistics, materials science, and financial modeling.

D-Wave's target market comprises organizations needing high-performance computing for complex optimization problems. Their current customer base includes prominent companies and research institutions across various sectors. Key partnerships with industry giants further enhance D-Wave's reach and credibility. However, analyzing D-Wave's revenue streams and financial performance reveals a picture of a company still in its growth phase, facing challenges in achieving profitability. Publicly available financial data should be consulted for the most up-to-date figures.

- Strengths of D-Wave's technology: Superior performance in specific optimization problems; established customer base; ongoing technological advancements.

- Weaknesses of D-Wave's technology: Limited applicability compared to gate-based quantum computers; potential for technological disruption from competitors; dependence on specialized hardware and software.

- Market opportunities and challenges: Growing demand for high-performance computing; competition from gate-based quantum computing; need for wider adoption and standardization.

Evaluating the Current Market Conditions for Quantum Computing Stocks

The quantum computing market is currently characterized by a mix of hype and realistic expectations. While the long-term potential is enormous, we're still in the early stages of development. Major players like IBM, Google, and Rigetti are aggressively pursuing advancements in gate-based quantum computing, creating a competitive landscape. The potential for growth in the quantum computing industry over the next decade is substantial, driven by advancements in algorithm development, hardware improvements, and increasing government and private investment. However, macroeconomic factors such as interest rates, inflation, and overall market sentiment can significantly impact QBTS stock performance, creating additional volatility.

- Key industry trends affecting D-Wave: Increasing competition; growing government funding for quantum computing research; the emergence of hybrid classical-quantum computing approaches.

- Government regulations and their impact: Government policies promoting quantum computing research and development can positively influence the industry; however, regulations concerning data privacy and security could present challenges.

- Potential for disruptive technologies: Breakthroughs in quantum computing could render current approaches obsolete, impacting D-Wave’s market position.

Assessing the Risks and Rewards of Investing in QBTS Stock

Investing in QBTS stock carries significant risks. D-Wave is a relatively young company operating in a highly speculative market. The potential for substantial losses is real, especially given the volatility of the stock market and the uncertainties inherent in the quantum computing industry. High potential returns are possible, but only if D-Wave achieves significant market penetration and overcomes technological challenges. Diversification is crucial for any investor considering QBTS stock, ensuring that a single investment doesn't disproportionately affect your overall portfolio.

Valuation of QBTS stock should be assessed carefully, considering its current financial performance, future projections, and comparison to peers. Long-term investors with a high-risk tolerance might find QBTS attractive, while those seeking lower-risk investments should look elsewhere.

- Risk factors associated with QBTS: Market volatility; technological uncertainty; competition; financial performance; dependence on funding.

- Potential return on investment (ROI) scenarios: High potential returns in the long term, but also significant losses are possible.

- Comparison to other quantum computing investments: QBTS carries higher risk compared to investments in larger, more established companies in the technology sector.

- Long-term vs. short-term investment strategies: A long-term investment horizon is generally recommended for QBTS, given the company's stage of development.

Alternative Investment Options in the Quantum Computing Sector

Investors seeking exposure to the quantum computing sector without the high risk associated with QBTS might consider alternative strategies. Investing in ETFs (Exchange-Traded Funds) that focus on technology or innovation can provide diversified exposure to the broader quantum computing ecosystem without concentrating risk on a single company. Another option involves investing in larger, more established technology companies that are indirectly involved in quantum computing research or development.

- Examples of relevant ETFs: Look for ETFs with a focus on technology or innovation that may include companies involved in quantum computing research or development. (Note: specific ETF recommendations are beyond the scope of this article and require independent research).

- Companies indirectly involved in quantum computing: Many large tech companies are investing in quantum computing research, offering a potentially less risky way to participate in the industry's growth.

Should You Invest in D-Wave Quantum (QBTS) Stock Now? A Final Verdict

Investing in QBTS stock presents a high-risk, high-reward scenario. While D-Wave's unique approach to quantum annealing offers potential advantages, the company faces intense competition and operates in a highly volatile market. The potential for significant financial gains exists, but equally, substantial losses are a real possibility. Therefore, the answer to the question "Should you invest in D-Wave Quantum (QBTS) stock now?" depends entirely on your individual risk tolerance, investment timeline, and diversification strategy.

This article provides an overview and does not constitute financial advice. Before making any investment decisions related to D-Wave Quantum (QBTS) stock or any other quantum computing investments, conduct thorough due diligence, considering all risks involved. Understanding the intricacies of quantum computing and the competitive landscape is crucial. Continue to research the topic of quantum computing investment and monitor D-Wave Quantum's progress closely before making any investment decisions.

Featured Posts

-

Beenie Mans It A Stream Event A New Era In New York Concerts

May 21, 2025

Beenie Mans It A Stream Event A New Era In New York Concerts

May 21, 2025 -

Kerrisdale Capitals Report Triggers D Wave Quantum Qbts Stock Decline

May 21, 2025

Kerrisdale Capitals Report Triggers D Wave Quantum Qbts Stock Decline

May 21, 2025 -

The David Walliams Britains Got Talent Controversy Explained

May 21, 2025

The David Walliams Britains Got Talent Controversy Explained

May 21, 2025 -

The Pursuit Of A New Trans Australia Run World Record

May 21, 2025

The Pursuit Of A New Trans Australia Run World Record

May 21, 2025 -

March 20 2025 Nyt Mini Crossword Solutions And Clues

May 21, 2025

March 20 2025 Nyt Mini Crossword Solutions And Clues

May 21, 2025

Latest Posts

-

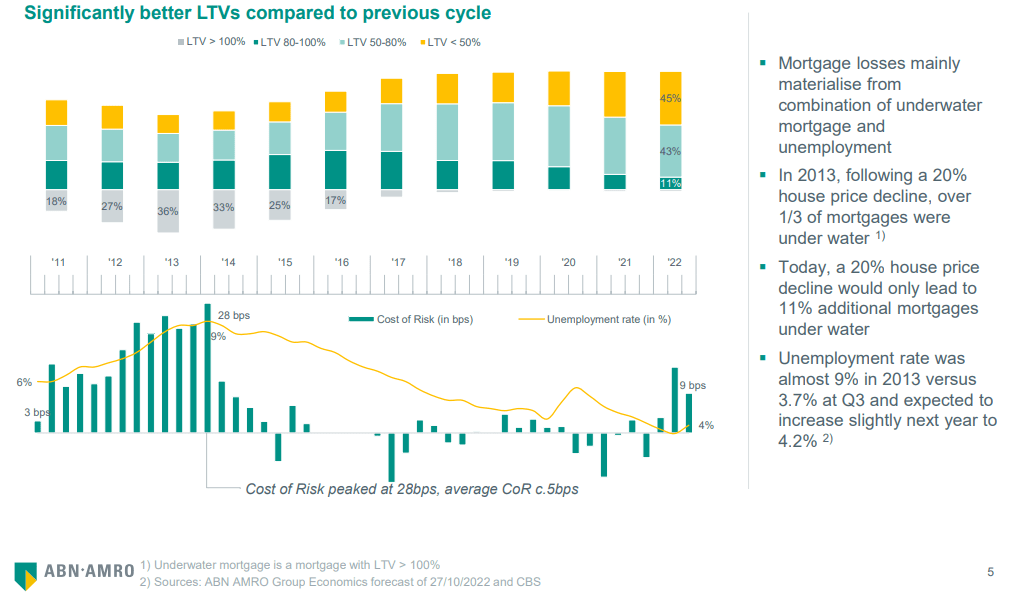

Occasionmarkt Boemt Abn Amro Registreert Forse Toename Verkoop

May 22, 2025

Occasionmarkt Boemt Abn Amro Registreert Forse Toename Verkoop

May 22, 2025 -

Abn Amro Analyse Van De Stijgende Vraag Naar Occasions

May 22, 2025

Abn Amro Analyse Van De Stijgende Vraag Naar Occasions

May 22, 2025 -

Occasionmarkt Bloeit Abn Amro Ziet Verkopen Flink Stijgen

May 22, 2025

Occasionmarkt Bloeit Abn Amro Ziet Verkopen Flink Stijgen

May 22, 2025 -

Impact Invoertarieven Vs Abn Amro Rapporteert Over Halvering Voedselexport

May 22, 2025

Impact Invoertarieven Vs Abn Amro Rapporteert Over Halvering Voedselexport

May 22, 2025 -

Voedselexport Vs Daalt Abn Amro Analyseert Impact Heffingen

May 22, 2025

Voedselexport Vs Daalt Abn Amro Analyseert Impact Heffingen

May 22, 2025